ATV Insurance

So you can protect yourself and your vehicle for many joyrides to come.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Owning and riding a four-wheeler across all types of terrain can bring great freedom and joy. Unfortunately, it can also bring severe risks like injury and property damage. That's why it's critical to consider getting ATV insurance before you ride.

Our independent insurance agents can help you get your ride equipped with the proper ATV insurance before an incident ever occurs. But first, here's a behind-the-scenes look at ATV insurance and what it covers.

Do I Need ATV Insurance?

You might need ATV insurance depending on where you live. Each state has its own set of minimum coverage requirements for owning a four-wheeler. Your state might require you to have liability coverage if you'll be riding your ATV on public land.

You might be required to have insurance no matter where you operate your ATV, though. Further, if you lease or finance your ATV, the bank you have your loan through could very well require you to have insurance. It's always a safe bet to have ATV insurance, especially if you couldn't afford to replace your vehicle out of pocket after an accident.

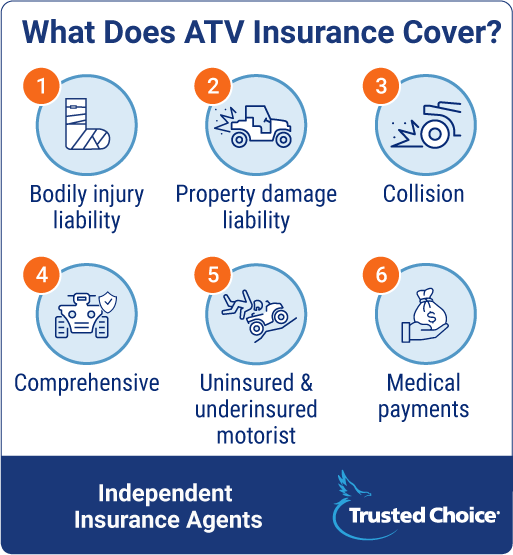

What Does ATV Insurance Cover?

ATV insurance provides the coverage you need to protect you from damage or injuries related to an ATV accident. Your homeowners insurance and auto insurance policies likely exclude coverage for ATVs. Double-check your specific policies with the help of your independent insurance agent to be sure.

ATV insurance usually includes the following:

- Collision coverage: Pays for structural damage to your vehicle if you hit another ATV, or a rock, tree, or other object.

- Comprehensive coverage: Pays for damage that results from lightning, vandalism, animals, theft, etc.

- Liability coverage: Bodily injury and property damage liability cover damage and legal defense if you cause an accident that harms another person or their property.

- Uninsured/underinsured motorist coverage: Covers if you or your property are harmed by someone who isn’t properly covered to pay for the losses and damage.

An independent insurance agent can help you find the right ATV insurance for your needs.

Additional ATV Insurance Coverages to Consider

Your basic ATV insurance policy might not provide you with enough coverage. Here are some common additional coverages you might want to add to your policy.

- Medical payments coverage: Pays for medical treatments for injuries to you or your passengers after an accident.

- OEM coverage: Pays for original equipment manufacturer parts for your ATV if it needs repairs.

- Trailer coverage: Pays for repairs to the trailer that you use to transport your ATV if it gets damaged.

- Equipment coverage: Pays for damage, repair, or replacement of your ATV's equipment if you purchased both collision coverage and comprehensive coverage already.

- Trip interruption coverage: Pays for food and lodging costs if you get stranded away from home while out on a ride.

- Roadside assistance coverage: Pays for a tow of your ATV if it breaks down 100 feet or less from the main road.

Your independent insurance agent can help you determine if any of these additional ATV insurance coverages are important to add to your policy.

How Much Is ATV Insurance?

ATVs' insurance rates can range from a few hundred dollars annually to well over one thousand dollars per year. ATV insurance costs depend on the coverage you select, your state's requirements, and a few other factors, like:

- Your driving history: Drivers with traffic violations and accidents on their record are considered a larger risk and often pay higher rates.

- Your ATV make and model: The make, model, and engine of your ATV along with whether it's classified as an on-road or off-road vehicle, affect your ATV insurance cost.

- Your driving habits: The more you use your ATV, the more you're likely to pay for your coverage. Also, if you use your ATV for more dangerous activities like sporting events or jumping risky obstacles, you'll likely pay more for coverage than someone who uses it for an occasional joyride over calm terrain.

- Any additional riders: The number of riders using the ATV and their ages and driving habits can influence the cost of your coverage, as well.

If you get just liability insurance for your ATV, you could pay less than $100 per year for your coverage, whereas you can pay nearly $1,600 annually if you purchase every available coverage. An independent insurance agent can help you find an exact ATV insurance quote for your area.

Does Homeowners Insurance Cover ATV Theft?

Most likely your homeowners insurance won't cover theft of your ATV. With very few exceptions, most homeowners insurance policies exclude damage to or theft of ATVs and other similar vehicles. Theft of your ATV won't be covered by an auto insurance policy, either, which is why it's so important to have an actual ATV insurance policy.

How Much Does ATV Liability Insurance Cost?

The cost of the liability coverage portion of your ATV insurance can vary depending on how much coverage you need. But an average figure is $99 annually for just the liability coverage in your ATV insurance policy. Such an affordable rate makes having enough liability coverage for your ATV more accessible and even more attractive to consider.

Finding and Comparing ATV Insurance Quotes

Our independent insurance agents will review your needs and help you evaluate the ATV coverage that makes the most sense. They’ll also compare insurance policies and quotes from multiple carriers to make sure you have the right protection in place. Independent insurance agents help get you matched with the right policy from the right carrier for you.

Why Choose an Independent Insurance Agent?

It’s simple. Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best ATV insurance coverage, accessibility, and competitive pricing while working for you.

mn.gov/commerce/consumers/your-vehicle/atvs-boats-motorcycles.jsp