Liability-Only Car Insurance

(And how you can get started today)

Even if you’re the safest driver on the road, there are a number of distractions that can put you at fault for an accident. Just the act of looking at a cell phone causes 70,000 drivers to have accidents every year.

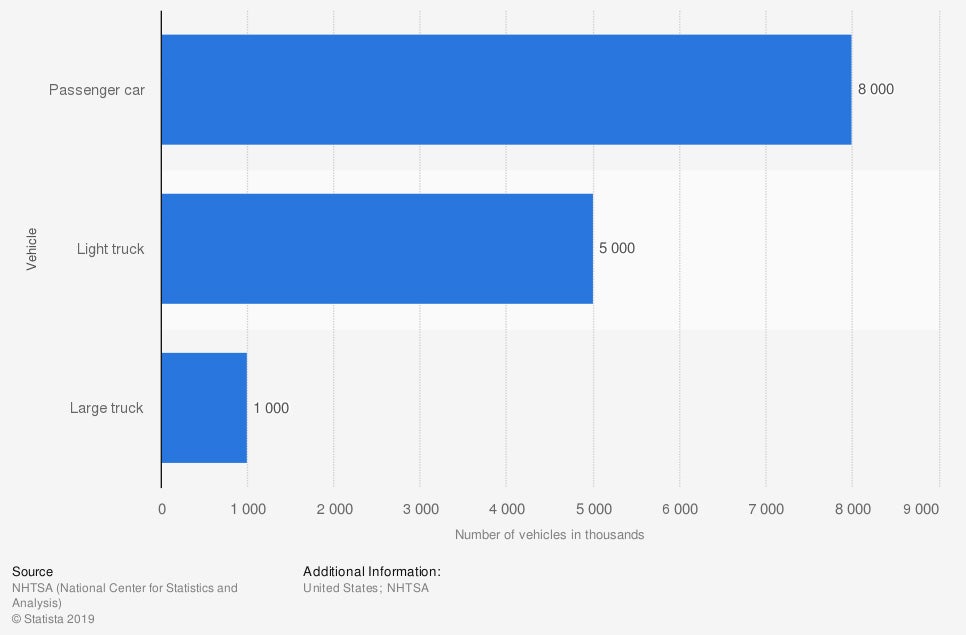

Number of vehicles involved in traffic accidents

Motor vehicle crashes are among the leading causes of death among those under the age of 55 in the United States.

Not only do you need liability coverage to protect you against crashes caused by the unexpected, but you also need it because it’s the law. An independent agent Is ready to walk you through your options and help you find the right coverage to keep you secure so you can feel safe behind the wheel.

What Is Liability-Only Car insurance?

At its bare bones, it's a policy that you’re legally required to have that covers injuries to other drivers or damage during an accident you’re found at fault for. Unfortunately it offers zero protection for any of your own medical bills or vehicle repairs, so you’ll need an additional policy for that.

Why Do I Need Liability Insurance?

The big reason is that it’s illegal to drive without it. Another reason is that it has the potential to save you from financial ruin if the accident is your fault.

Medical expenses and repairs can be costly, and since liability premiums are typically low, it’s more than worth the cost. The whole legally-required-to-have-it part should make this a pretty easy decision.

What Does Liability Insurance Cover?

Car liability insurance is pretty straightforward, with two types of coverage included in your basic policy. They only protect those in the other vehicle, so you’re on the hook for whatever expenses you may incur as a result of your accident.

The two forms of coverage include:

- Bodily injury liability: This helps pay medical expenses for anyone in the other vehicle who is injured. If they decide to file a lawsuit, it will also help to pay for legal defense and any settlements as a result of the claim.

This type of coverage is written with two limits:

- The amount your insurer will pay for each person (not you) injured in the accident.

- The total cost of injuries as a result of the accident.

- Property damage liability: This will help pay for any damage to the other driver’s vehicle or property as a result of the accident. It will also help pay to repair other property involved, like fences, garage doors, or even landscaping. The single coverage limit for this is typically $50,000.

- Example: Typical liability coverage has limits of 100/300/50, meaning that your insurer will pay up to $100,000 for one person’s bodily injury costs, up to $300,000 for all bodily injuries claimed as a result of the accident, and up to $50,000 to cover property damage.

Is Liability Insurance Required in Every State?

Yes. Each state may have different specifics on coverage, but liability is the minimum requirement. At the very least you’ll be getting a ticket if you don't have it, but you’re more likely to have your license suspended until you have proof of insurance.

In some states, your vehicle may also be impounded, meaning you’ll accrue even more out-of-pocket expenses. So coverage is kind of a no-brainer.

How Much Liability-Only Coverage Should I Have?

Each state has its own minimum requirement, but they are all typically low and never recommended. Take Pennsylvania, for instance. The minimum liability coverage is 15/30/5 which breaks down like this:

- $15,000 to cover injuries of one person

- $30,000 to cover all bodily injuries

- $5,000 for property damage

If you've been to a hospital lately then you know that those coverages may be enough for an ambulance ride, one X-ray, and an aspirin. But if any type of surgical procedure is needed, you'll be facing some big bills.

There is a positive to having more coverage, especially if you own a home or have assets which could be at risk if you’re at fault for a serious accident. Most experts will advise a 100/300/50 policy or higher. Those numbers should be able to take care of all injuries and property damage.

When Should I Switch to Liability-Only?

There are some situations where you should definitely consider switching to liability-only coverage. Here are two instances to keep in mind when considering the big switch:

- Driving an old car: Old beaters that aren’t worth the cost of repairing, or maybe couldn’t be repaired if damaged, typically aren’t worth spending more money on extra coverage.

- Having a teen driver: Teen drivers are typically more inexperienced, meaning they will often be too expensive to insure on a new vehicle. If your teen is driving an old vehicle, it may be a good idea to look into liability-only for cheaper coverage.

Should I Consider an Umbrella Policy?

Umbrella policies are there to provide additional coverage above and beyond liability-only coverage. Once you reach your coverage limit for an accident, the umbrella policy steps in to cover the remaining expenses.

The best thing about umbrella coverage, besides it significantly increasing your coverage, is that it can come fairly cheap. A typical coverage of $1 million can usually be bought for $150 to $300 a year.

How Do I Find Liability-Only Car Insurance?

Finding the best policy for you and your bank account is not always easy, and it’s sometimes not even an option. If you have a loan out for your vehicle or are leasing it, your lender will require full coverage.

Our independent agents can help you decide how much coverage is best to ensure your assets are fully protected. If you’re interested in purchasing extra coverage under an umbrella policy, they can also help you determine how much is best for your specific situation.

How Much Does Liability Insurance Cost?

The cost depends on the amount of coverage and a variety of factors like age, where you live, the car you drive, and your driving record. In 2019, the national average was $538 annually for liability insurance.

However, taking into consideration all of the factors above, monthly premiums can range anywhere from less than $50 a month to couple hundred dollars a month.

The Awesome Benefits of an Independent Agent

Your car is one of your most important assets — don’t let mistakes and misunderstandings get between you and the coverage you need. Independent agents simplify the process by comparing insurance quotes for you. They’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Most importantly, they’ll be there to help you and your family in case of an accident. They’re experts at handling claims and helping you maximize the benefits of your insurance.

The 411 on Online Liability-Only Car Insurance Quotes

Instant online insurance quotes are nice, but algorithms are designed for the lowest common denominator and can miss important details. Our insurance agents do the hard work behind the scenes so you can enjoy a policy that strikes the perfect balance of meeting your needs and saving you money.