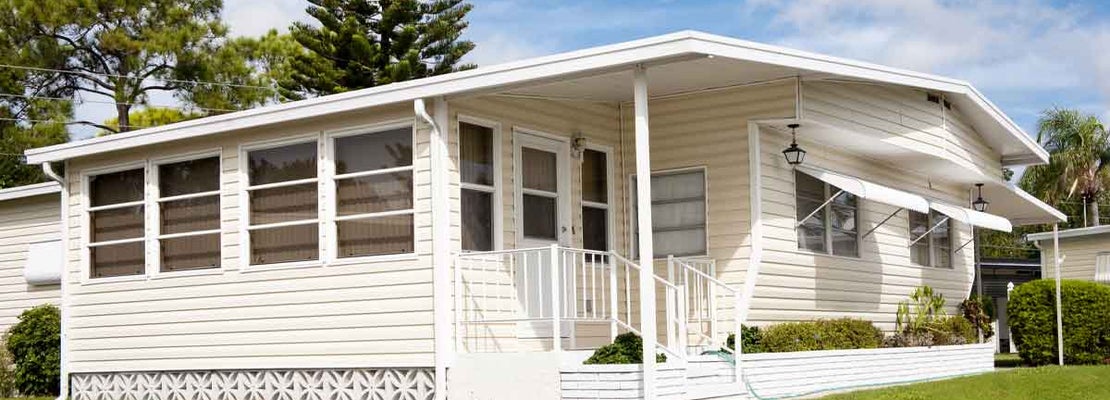

Wisconsin Mobile Home Insurance

Independent agents in Wisconsin shop multiple companies to get you the best price on mobile home insurance.

Buying a mobile home in Wisconsin has many advantages. Not only are the homes a great value, but they also offer an attractive lifestyle to those who want to live large on a small budget. In the past, mobile homes were limited to a small number of models and amenities. Today, mobile homes, otherwise known as manufactured homes, have come a long way. You can even purchase multi-story homes that arrive on your land ready to be made a home. The next step is purchasing Wisconsin mobile home insurance.

Use our independent agent matching system to find the best insurance plan in your area. You tell us what you’re looking for, and our search engine will recommend the best agents for you. Any information you provide will be sent to only the agents you pick. We do not sell to third parties.

Wisconsin Mobile Home Statistics

- Average price of pre-owned home: $38,280

- Average model year of pre-owned home: 1994

- Average pre-owned homes size in square feet: 1,144

- Average sites in a mobile home community: 92

- Average year a community was developed: 1974

- Number of age-restricted communities: 24

- Number of all-age communities: 457

What Is Wisconsin Mobile Home Insurance?

This is a type of insurance that will protect your home against the cost of structural damage or loss, as well as your personal belongings. Covered events usually include fire, tornado, hail, lightning, burglary, and vandalism. Wisconsin mobile home insurance also comes with a liability portion that will protect you in case you’re involved in a lawsuit related to an accident that occurs in or near your home. It can pay for legal fees and any settlements that you’re ordered to pay, up to the policy limits.

While a standard homeowners policy is made for a house built with traditional methods, a mobile home insurance policy is specifically tailored to meet your unique needs as a mobile home owner. The lightweight materials used in the construction of mobile homes makes them more vulnerable to weather damage and break-ins. These added risks mean that mobile home insurance can sometimes cost a bit more than coverage for a site-built home of the same monetary value. However, since the cost of a mobile home is generally lower, rates tend to be affordable.

Modular homes differ from mobile or manufactured homes. Modular homes are assembled into smaller pieces at the factory, and built onto a foundation at the home site. They resemble a traditional site-built home, more than a mobile home, and are usually insured with standard homeowners insurance.

Finding Wisconsin Mobile Home Coverage

Not all policies are the same. Different insurance companies offer different mobile home insurance products. There are two major types of policies that you can purchase:

- Named peril policy: This will cover your manufactured home and personal belongings only during certain circumstances, like fire, lightning, riot or windstorm.

- Comprehensive policy: This policy will cover all damages as long as you can prove that two conditions are met. The cause of the damage should be direct and accidental, and the cause of the damage must not be excluded from your policy.

Typical coverage policies include personal property, personal liability, and medical payments. You may also consider adding optional policies like additional living expenses, emergency removal expense coverage, and consent to move coverage. If you want to know more about the advantages of these different types of coverages, speak with a local agent.

Get the Right Wisconsin Mobile Home Insurance

An independent agent can help you analyze different insurance products, from many companies, and search through various policies to find a comprehensive plan that suits your unique needs. It only takes a few moments to locate a TrustedChoice.com independent agent right in your neighborhood to get the information you need.

A Trusted Choice agent can help you get the coverage that matches your lifestyle and your budget. An independent agent can show you several Wisconsin manufactured home insurance quotes to compare before you buy. Talk with an independent agent right in your ZIP code to get started.