Compare Permanent Life Insurance

(And how you can get started today)

If you insure your house and car, it only makes sense to invest in life insurance so that your loved ones will be taken care of after your death.

Once you know you want to provide benefits to your family upon your passing, and you have chosen to buy a permanent life insurance policy, the next decision you need to make is which type of permanent life insurance best suits your needs.

There are a number of factors to consider, and it is a good idea to do some research. If you aren’t sure to where to start, contact an independent agent in our network who specializes in life insurance.

Your agent can help you sort through all the information and help you compare policies and rates from several insurance companies. Contact a local agent today to get started.

Trusted Choice vs. Big Brands

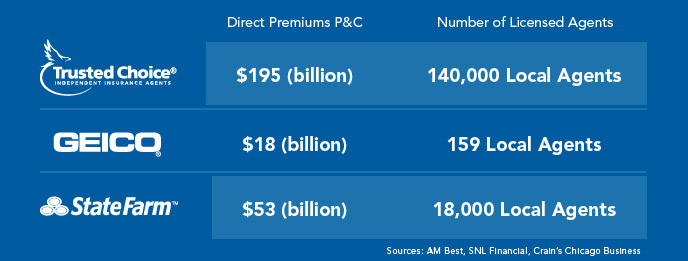

The Trusted Choice brand is built on the customer-focused integrity of more than 300,000 business owners, agents and employees nationwide. With more local insurance agents than State Farm and GEICO, this network of agencies serves more consumers and pays out more claims

Important Life Insurance Terms

These are some terms you will hear no matter which policy you choose to buy.

- Beneficiary: The person(s) who receives the death benefits of the insurance policy

- Policyholder: The person who owns the policy, and chooses the beneficiaries of the death benefits

- Riders: Add-on purchase options that allow the insured to purchase additional coverage or make specific choices about the policy

- Waiver of premium: Suspends your premium, but not your life insurance benefits, if you become totally disabled

Which Permanent Life Insurance Is Right for You?

There are three main types of permanent life insurance: whole life, universal life, and variable life. Each of these policies has features and benefits that are specific to that policy type.

- Whole life: If you prefer a fixed monthly rate, standard expense charges, and a guaranteed rate of return on your investment, whole life insurance may be the best permanent life insurance for you. Generally, the insurance company assumes all the risk.

- Universal life: If you prefer flexibility and more control over your account, you might want to look at universal life insurance. Your costs can vary based on the insurance company or changes you make to the policy. There is a cap on the maximum premium limit. As for cash value, it reflects market activity but will still have a minimum rate of gain.

- Variable life: Variable life insurance is less common and the riskiest investment. If you are truly interested in securing death benefits for your loved ones, a variable policy may not be the best permanent life insurance. Your premium is invested in options of your choice, and death benefits and cash value depend on performance.

When you compare permanent life insurance policies, it is wise to make sure you know how your coverage, premiums and beneficiaries are affected long term.

How to Compare Whole Life vs. Universal Life Insurance

If you’ve ruled out any chance of variable life insurance, there are only two policies left to consider: universal and whole life insurance. Both types are going to provide you with life insurance coverage, but you need to set your expectations for the policies by performing a permanent life insurance comparison.

While whole life may seem like a safer route because your rates are guaranteed, very little of your premium is invested and you cannot contribute more. Think about whether you may want to contribute more money to your life insurance investment.

You may want to do so, for example, because the bigger your investment, the bigger your dividend payment. You can choose to use your dividend income to pay any premiums, buy extra insurance, or be re-invested.

Just know that your investment is only growing at a guaranteed rate of return, so no matter the market performance, you’re locked into a growth percentage.

As with all financial investments, this can good or bad. If you’re looking for a set premium because you have a budget or don’t trust yourself to invest wisely, whole life may be the best permanent life insurance policy for you.

On the other hand, if you need life insurance and also want a strong investment tool, universal is more likely to be a fit for your needs. The premiums you pay for universal are not going to fluctuate at an unreasonable rate.

You will pay a set amount for a certain time period but at any time, you can contribute more to the investment portion of your policy.

You can also choose how your money is invested. If you’re savvy with your money, your premium can be paid with the dividends earned from your investment so your out-of-pocket cost eventually disappears.

At that point, you have tax free growth happening with minimal effort.

How to Do a Universal Life Insurance Comparison

If you’ve decided to purchase a universal life insurance policy, you need to find the best provider and policy for you. This can be confusing because there are many options, and costs vary among insurance companies.

With a universal life insurance policy, focus on the options that offer you flexibility. Ideally, you want low costs combined a high yield on cash value. Some things you want to ask your life insurance sales representative or agent include:

- How taxes will affect any account transaction

- The minimum premium limits and if they can be suspended

- Average investment returns

Additionally, read the fine print and check the company’s rating at non-partisan resources like AM Best to find a provider that is best for you.

How to Do a Whole Life Insurance Comparison

If you’re conducting a whole life insurance comparison, you probably are most interested in the guarantees the policy offers. Compare premiums from several companies based on the amount of insurance offered as well as the potential dividends.

Similar to seeking a universal policy, you want the lowest costs for a reasonable rate of return on investment.

This is especially true for whole life because you will be locked into the rates. Examine policy time limits and any other restrictions placed on your policy. Look at how the amount of premiums paid has contributed to the current cash value and make sure your company is in good credit standing.

An independent agent in our network who specializes in life insurance can help you with these assessments.

Making the Best Permanent Life Insurance Choice for You

Many people are torn over the idea of buying permanent life insurance, whether it’s a whole life or universal life insurance plan. A Trusted Choice member agent can provide unbiased information on your options for permanent life insurance.

You will feel more confident about your insurance coverage when you have guidance and all of the information you need to make the best decision for you.

If you’ve made the decision to purchase life insurance, work with a local independent agent who will get to know you and help you find the best permanent life insurance for your specific needs. Contact an agent today and get the personalized assistance and guidance you need to make an informed decision.