Fixed Annuities vs Other Investments

(The whys and the why nots)

Why do people invest their hard-earned money? The answer, of course, is to make more money. Like most things in life, the basics are pretty simple. It's the details that get you into trouble.

There are a dizzying number of investments to choose from and ways to buy them, but they all fit into a few categories.

If you're thinking about buying a fixed annuity (you probably are because you're here), a good question to ask is how do they compare against other investments?

Independent insurance agents are there to make things simpler for you. They’ll help guide you through all your options, weigh the good and the bad, and even see you through it all from start to signature. See, easy, isn’t it?

What Can You Invest in?

The answer here is way simpler than you probably think it is. You can only invest in two things, property, and securities. Property investments are physical, real estate, commodities, art, coins, etc., even Beanie Babies and baseball cards. Securities are intangible. They're representations of ownership, or an obligation. Securities have three basic categories called asset classes.

Equity means ownership. The most common equity securities are stocks, which are measured in shares.

Debt means an obligation to repay a loan with interest. The most common form of debt investment for most people is a bond. Bonds are measured in par value which represents the original loan.

Cash and cash equivalents are bank products, money market funds, and treasury bills.

Most people invest in stocks or bonds that are publicly traded on an exchange, like the New York Stock Exchange. Investing in publicly traded stocks and bonds assures that there is a buyer in the event you want to sell.

There are other types of securities, but these are the basics.

Investment Risk

Investment risk measures uncertainty. Securities with higher risk will have greater swings in value than securities with lower risk. Securities with higher risks have higher potential for gain as well as higher potential for loss, including loss of principal.

Over longer periods of time, securities with higher risk, like stocks, tend to perform better than securities with less uncertainty, like bonds.

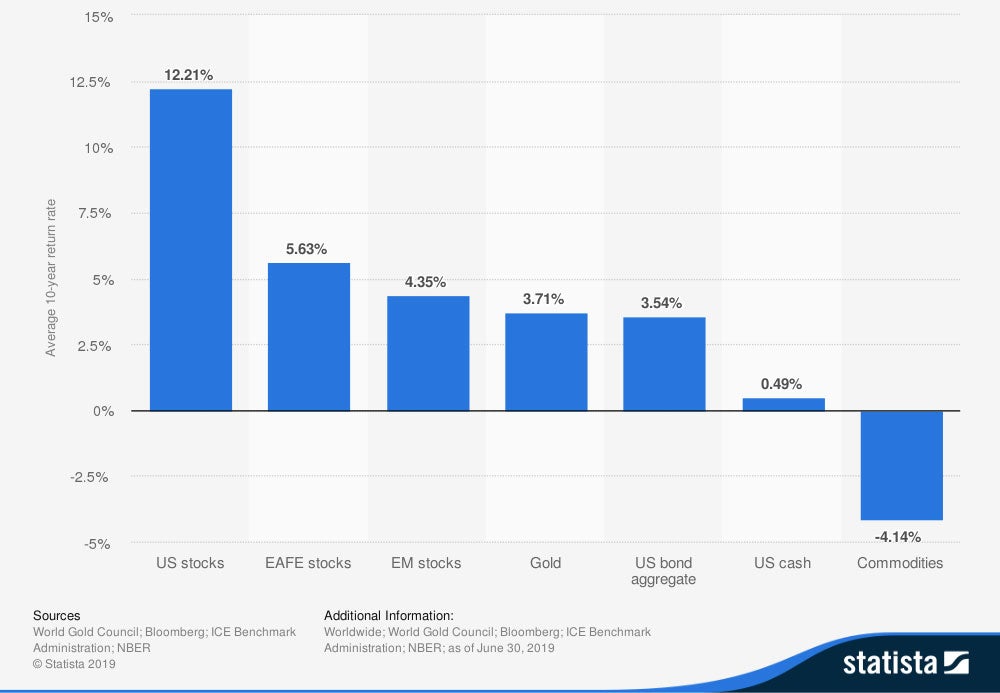

10-year average return of gold and other assets worldwide as of June, 2019

Over shorter periods of time, though, securities with higher risk can be very painful. Think 2008-2009 when stocks lost more than 50% of their value.

Some securities have little or no exposure to risk. Certificates of deposit, for example, pay a fixed rate of interest. The principal is guaranteed by the FDIC up to $250,000.

Investors come in all shapes and sizes when it comes to taking risk. It's not surprising, though, that appetite for investment risk changes as we get older.

Ways to Invest Your Money

Now that you know what you can invest in, how do you go about it? Here are the most common investment vehicles.

- Individual stocks and bonds

- Mutual funds

- Exchange traded funds (ETFs)

- Managed accounts

- Bank products

- Variable annuities

- Fixed annuities

All of these investment vehicles are a way to invest in the security asset classes. Let's take a brief look at each one.

Bank Products

Checking accounts, savings accounts, and CDs are all guaranteed up to $250,000 per account by the Federal Deposit Insurance Company. As of February 10, 2020, the FDIC national average rate on a 5-year CD is .97%.

Individual Stocks and Bonds

Individual stocks and bonds are typically purchased through a brokerage firm account, or retirement plan account. The stocks and bonds are technically owned either by the brokerage firm, or the retirement plan on behalf of the investor.

If you take a "stock picking" approach to individual stocks, you're betting that you're smarter than the market. For example, if you bought Apple or Amazon, you were right. If, on the other hand, you bought Enron ... well, we all know how that turned out.

Mutual Funds

Mutual funds are a way for the average investor to buy a portfolio of professionally managed stocks and bonds based on an investment objective. Investment objectives can be conservative, moderate, or aggressive. Shares of a mutual fund represent shares in an investment company that owns the securities.

Mutual funds are purchased directly from the investment company through a brokerage firm account or a retirement plan. Mutual fund shares are only bought from and redeemed by the mutual fund. The share price is the value of all the securities divided by the number of shares at the end of each day.

Exchange Traded Funds

ETFs are a portfolio of securities that are publicly traded. ETFs are a way for the average investor to buy a portfolio of professionally managed securities based on an investment objective.

ETFs differ from mutual funds because the share price can be higher or lower than the value of all of the securities. ETFs trade all day long at the market price, rather than once per day at a predetermined value like mutual funds. ETFs are purchased through a brokerage firm or retirement account.

Managed Accounts

Managed accounts are a professionally managed portfolio of stocks and bonds that are individually owned by the investor rather than an investment company. Managed accounts generally have high minimums and are designed for wealthier investors. Managed accounts are purchased through special types of brokerage accounts and retirement accounts.

Variable Annuities

Variable annuities are policies issued by insurance companies. Investors have access to a broad selection of investments similar to mutual funds called subaccounts funds. Variable annuities offer death benefit protections, lifetime income options, tax deferral, and creditor protections. Variable annuities are purchased through a brokerage or retirement account.

Fixed Annuities

Fixed annuities are a way to accumulate money and create income for retirement with little or no risk. The insurance company guarantees principal, payments, and a minimum rate of interest. Interest is credited each year to the account value. Once the interest is credited, it cannot be reduced or taken away.

When you contribute to a fixed annuity, the insurance company puts the money into its general account. The general account is largely a portfolio of corporate and government bonds. The interest the insurance company pays to you is based on what they earn from the portfolio. Here's why that's important.

When you invest in bonds, the value can change up or down depending on interest rates. The insurance company guarantees your fixed annuity account value and rate of interest regardless of how their bond portfolio performs. What that means is when you purchase a fixed annuity, you are getting the benefits of a large professionally managed bond portfolio without any investment risk. Insurance companies take some additional steps for indexed annuities, but the basic concept is the same.

The bad news? If the insurance company goes bankrupt, your money can go with it. That's why it's important to buy a fixed annuity from a reputable and financially strong insurance company.

Fixed annuities are purchased from a licensed insurance agent.

Fixed Annuities vs. Other Investment Vehicles

With the exception of bank products, every other investment vehicle has some investment risk based on the asset class. Stocks have a higher level of uncertainty, and prices can be influenced by politics, news, technology and skittish investors. Bond values are influenced by rising and falling interest rates.

Fixed annuities are unique vs. other investment vehicles in that:

- Fixed annuities have very little risk to principal.

- Fixed annuities (and variable annuities) have protections from creditors in each state. This can be a valuable feature for investors who may be in occupations with higher risk of lawsuits, like doctors and corporate executives. Other investments only receive creditor protections if they are in a retirement account.

- Interest payments are tax-deferred. The only other tax-deferred investment vehicle is a variable annuity. Unlike other investments, there is no tax benefit to buying an annuity through a retirement account.

- Interest rates and account values are guaranteed by the insurance company.

- Interest rates offered by the insurance company are typically higher than CD rates.

Thinking of a Fixed Annuity?

Fixed annuities offer a low risk alternative to CDs. They can work very well if you are nearing retirement and have concerns about losses in the market.

Fixed annuities are guaranteed by the insurance company. Be sure the company is reputable and financially strong. A.M. Best, Moody's, S&P, and Fitch all publish financial strength ratings for insurance companies. Financial strength ratings are a measure of the company’s ability to meet policyholder obligations.

Inflation has a higher impact on fixed annuities and other low risk investments. Over long periods of time, inflation can significantly reduce purchasing power.

Fixed annuities have surrender charges and tax penalties for withdrawals before age 59 1/2. They are not a good choice if you need immediate access to the money.

What's So Great about Independent Insurance Agents?

Fixed annuities can be an important part of your retirement plan. While they have many features and benefits, they are not for everyone. Annuities are complex, and searching through options can be confusing, time-consuming, and frustrating. An independent insurance agent's role is to simplify the process. Talk to an independent insurance agent. They can help you decide if a fixed annuity is right for you.

World Gold Council

Fundamentals Of Investments Wilson And Hopkins

Investor.Gov