Fixed Annuities Pros & Cons

(Because it's important to pick the right tool for any job. And especially this one.)

The Pennsylvania Department of Labor gives some great advice about how to avoid injuries: "Use the right tool for the job. Don’t use your wrench as a hammer. Don’t use a screwdriver as a chisel, etc. Go back to the tool cache and get the right tool in the right size for the job."

Want to avoid financial injury? One way is to use the right "financial tools" to accomplish your goals. There are plenty of investment choices to accumulate wealth and create retirement income. When would you use a fixed annuity instead of other financial tools? That depends on your goal.

Independent insurance agents are experts when it comes to helping you pick the right tool for the job. After all, who wants to make life more complicated?

Fixed Annuities and Accumulating Wealth

Fixed annuities are insurance products designed to accumulate money. Some fixed annuities can accept regular contributions, while others accept only one. Fixed annuities have guaranteed rates of interest and guaranteed principal. These are features that are similar to bank products like CDs. So what's the difference?

Fixed annuities are tax-deferred. The interest that is paid by the insurance company is not taxable until the money is withdrawn. That means the money you would have paid to Uncle Sam stays in the annuity and grows until you take it out. The interest on CDs is taxed every year. By the way, both fixed annuities and CDs are taxed at ordinary rates, not the more favorable capital gains rate. The higher your tax bracket, the bigger benefit you get from tax deferral.

Fixed annuities often pay higher rates of interest than CDs. That's because the way the insurance company can offer a rate tends to be more favorable than what the bank can do. The big difference is that your CD money is guaranteed by the FDIC, an agency of the federal government. Annuities are guaranteed by the insurance company. If the insurance company fails, your money may be at risk.

Fixed Annuities and Retirement Income

There are a number of ways to create retirement income. Some people have pension benefits that pay income for the rest of their lives. These days, however, traditional pension benefits are mainly available to public employees. Social Security represents an important source of retirement income for most people, but even at the maximum, it’s not enough.

Retirement income can be created using stock dividends and interest payments from bonds, either individually or using mutual funds, exchange-traded funds, and real estate investment trusts. The value of these investment options and the income they produce can change based on market conditions.

Fixed annuities create a guaranteed income for life. It's similar to having a traditional pension benefit. The income can be structured for a single lifetime, or as joint and survivor for two lives.

The downside? The purchasing power of fixed annuity payments declines with inflation, and the guarantee is only as good as the financials of the insurance company.

Access to Your Money

If you need access to your money for emergencies or other short-term needs, fixed annuities are not a good choice.

Fixed annuities have:

Surrender penalties . Fixed annuities have surrender penalties, typically for 3 to 10 years. And they can be significant, as much as 10% of the money withdrawn. Fixed annuities allow a penalty-free withdrawal, usually 10% of the account value.

Tax penalties. If you withdraw money before age 59-1/2, you may be subject to a 10% penalty on the taxable portion.

How Much Time Do You Have?

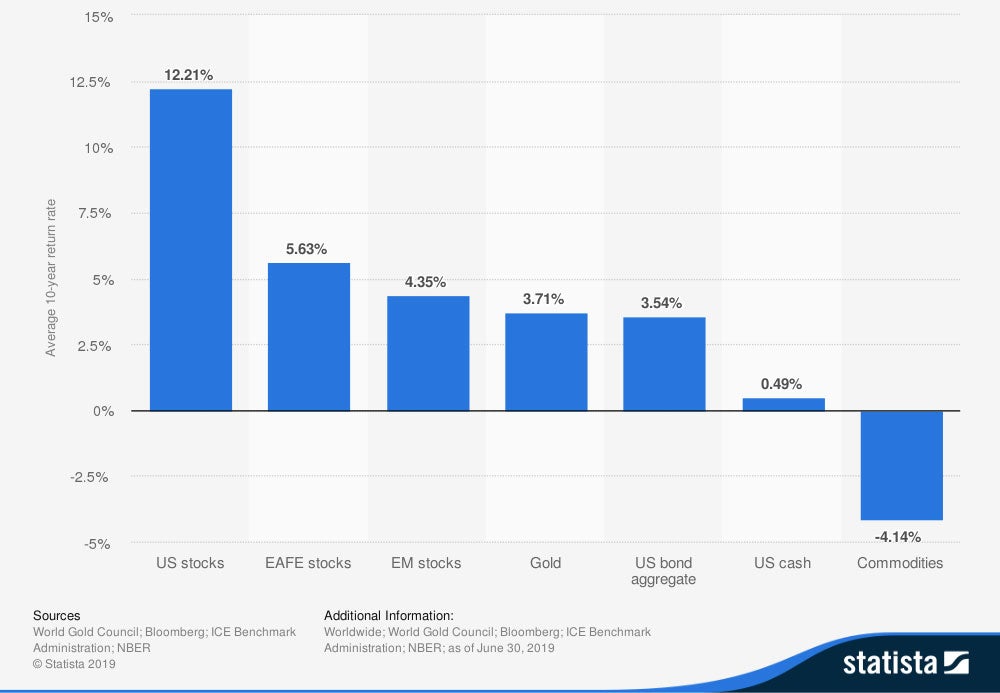

The length of time you have to accumulate wealth should be a consideration for what tools you use. Investments that have higher risk of loss also have higher potential for gain. And over the long term, they tend to perform better than lower-risk investments. The chart below shows how different types of investments performed from 2009 to 2019.

10-Year Average Return of Gold and Other Assets Worldwide 2019

In the short term, higher-risk investments can be very painful. Think 2008 -2009, when stocks lost 50% of their value.

| Reward Interest, Dividend, Capital Gain |

Financial Asset | Risk Default, Capital Loss, Inflation Liquidity |

| Interest | Treasury Bonds, Bills, Notes | Inflation (if not indexed) |

| Interest | Certificates of Deposit | Inflation |

| Interest | Fixed Annuities | Inflation, Liquidity, Default |

| Interest, Capital Gain | Corporate Bonds | Inflation, Liquidity, Capital Loss |

| Dividends | Real Estate Investment Trusts (REITs) | Inflation, Capital Loss |

| Capital Gains, Dividends | Mutual Funds, Exchange-Traded Funds | Inflation, Capital Loss |

| Capital Gains, Dividends | Stocks | Inflation, Capital Loss |

| Capital Gains | Collectibles | Liquidity, Capital Loss |

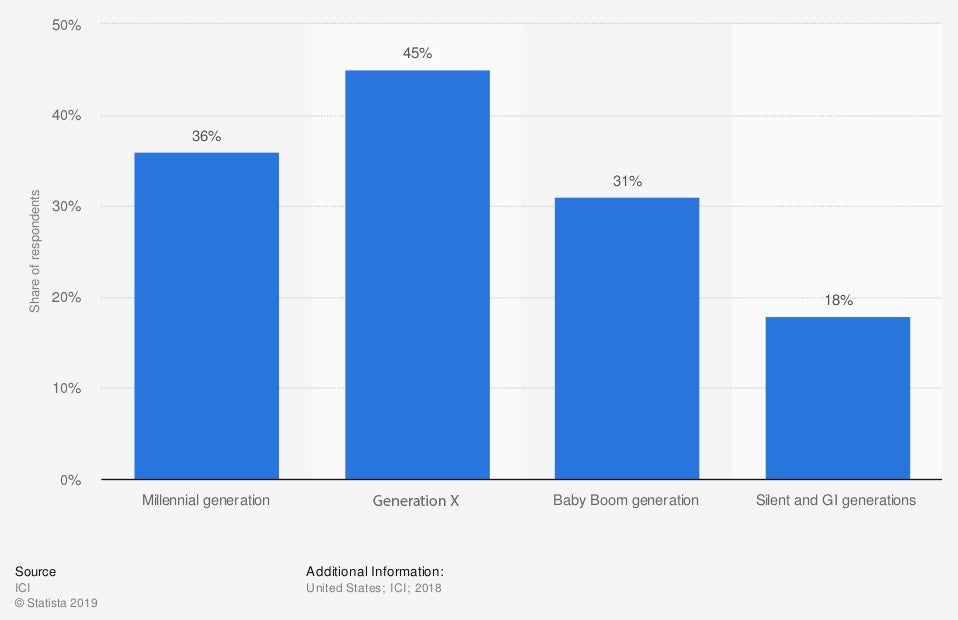

If your time horizon is 10 years, you may be willing to take more risk to get more return. The chart below illustrates attitudes toward investments as people age.

Willingness To Take Investment Risks in the US 2018 by Age of Household

Fixed annuities can make sense for pre-retirees who want low-risk investments.

What Other Options Are Available to You?

Consider all of the alternatives available, especially if your goal is to accumulate retirement money. Employer-sponsored plans are often the most effective choice. IRAs and Roth IRAs are a good option as well, but there are limits on the tax deductions and contribution levels based on your income.

Fixed annuities can be used in IRAs and some types of qualified plans, but they don't provide any additional tax benefits. Fixed annuities can be a good choice for folks who have maxed out their retirement plan contributions and want a predictable low-risk investment.

Protecting Your Money

Fixed annuities can protect your money in several ways that most investment options don't. The first, of course, is the guarantees of the insurance company. Life insurance companies are regulated and monitored by the state insurance department of each state they do business in. Life insurance companies have to maintain sufficient reserves to meet policyholder obligations. They also have to meet other financial standards set by the state insurance commissioner. Most states use the standards recommended by the National Association of Insurance Commissioners. Each state has a guarantee fund to reimburse policyholders if the life insurance company fails. The limits are different for each state.

The guarantees, of course, are only as good as the insurance company's ability to make good on them. Financial strength ratings of insurance companies are available from A.M. Best, Fitch, Moody’s and Standard & Poor.

Fixed annuities can be protected from lawsuit judgments or bankruptcy. For some people who may be more likely to be sued (think doctors, corporate executives, etc.), protecting their assets from creditors can be a very important reason to buy an annuity.

Most states offer annuities some form of creditor protection. Some states protect all of the annuity proceeds from creditors, where others just protect the beneficiary's interest.

Should You Buy a Fixed Annuity?

Fixed annuities are a predictable, low-risk way to accumulate money and create guaranteed income that you can't outlive. They can work especially well for people in higher tax brackets with time horizons of 3 to 5 years.

Financial goals and preferences are as individual as you are. And there are a lot of ways to get to where you want to go.

Annuities are complicated, no getting around it. Why not make it easier? Independent insurance agents can help, they're professionals. Their job is to help you understand your options, and simplify the process from start to signature.

PA Dept Of Labor Hand Tool Safety

Dallas Fed Education Saving And Investing

Statista