Retirement Annuities

(How to retire with income for life)

Neel Lane is an independent contract paralegal who specializes in Medicaid and VA benefits. He helps people access and maximize the benefits that they're entitled to. He has over 30 years of experience in this area.

These days, someone retiring at 65 can expect to live about 20 years. In fact, about a third of retirees can expect to live to age 90. Unfortunately, fewer people have traditional pensions that pay an income every year. Buying a retirement annuity is like buying a pension for yourself.

You can click here to use an independent agent matching tool to find the best insurance solution in your area. Provide a few details about what you're looking for, and the tool will recommend the best agents for you. Any information you provide will only be sent to the agent you pick.

What Is a Retirement Annuity?

Retirement annuities are also known as income or immediate annuities. That's because the insurance company begins to pay an income immediately after receiving a purchase payment, or premium. Immediate annuities have several options for income:

Life-only: A payment is guaranteed for the lifetime of the annuitant. No payments are made after the annuitant's death. Life-only options will pay out a higher monthly or annual income than the other options. Joint and survivor life only is available for the longer of two lives, usually spouses.

Life and period certain: A payment is guaranteed for the lifetime of the annuitant. The payments are made for at least a "certain" number of years, regardless of when the annuitant dies. The certain year options are usually 10 and 20. Joint and survivor options are available for life and period certain.

Fixed period: Payments are made for a specified number of years, regardless of when the annuitant dies.

Insurance companies calculate the payout for life-only and life and period certain using an annuity rate. Fixed period payouts are based strictly on interest rates.

How Much Income Do You Get?

Retirement annuity rates for each income option are calculated from the age and gender of the annuitant, based on an interest rate the insurance company chooses. The interest rate changes with market conditions. That means the retirement annuity rates change frequently. The longer the insurance company predicts that you will live, the lower the payout.

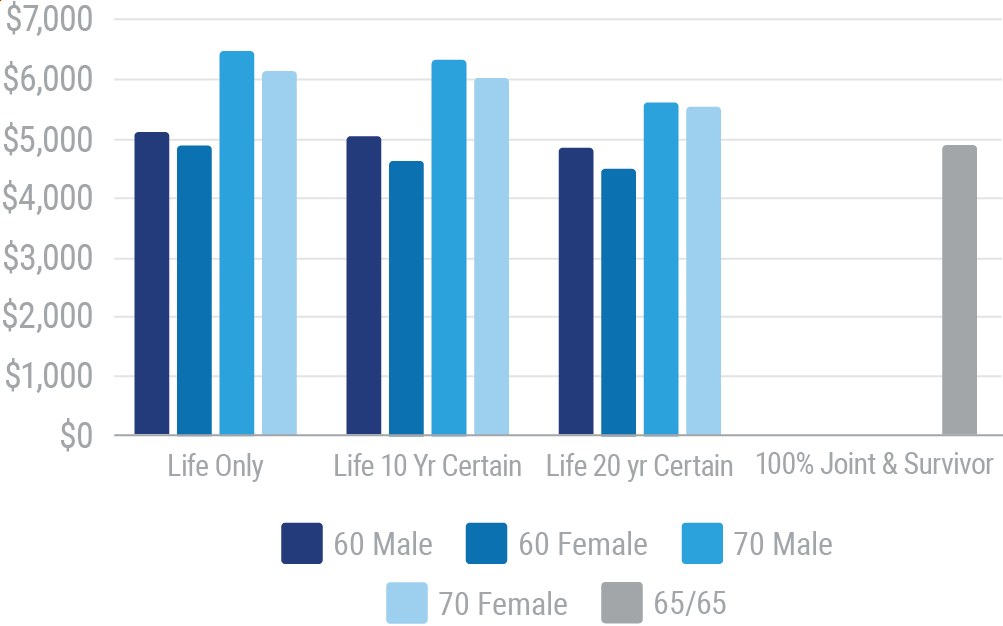

The chart below compares immediate annuity payouts at different ages for a $100,000 purchase payment.

Immediate Annuity Annual Payouts at Selected Ages

$100,000 Purchase Payment

The life-only option is always the highest rate.

Annuity Inflation Riders

Some retirement annuities have optional inflation riders. There are two types of inflation riders, consumer price index (CPI) and cost-of-living adjustment (C.O.L.A.) Both riders increase the annuity payment each year, but they are calculated differently. CPI riders are based on the consumer price index, much like Social Security benefits. CPI inflation riders, however, are not widely available, if at all. C.O.L.A. riders increase the annuity payment by a fixed percentage. The options are usually 2%, 3%, or 4%.

The initial payout with an inflation rider is lower than the initial payout without one.

Variable Retirement Annuities

Variable retirement annuities are based on how the market performs. So the income in some years could be higher than in others. The assumed rate of interest is what insurance companies use to calculate the initial variable income payments from an annuity.

The initial payment is calculated based on your age, sex, the assumed rate of interest, and the accumulated value of your variable annuity.

If the investments that you selected perform better than the assumed interest rate, your payment will be higher. If the performance of investments that you selected are lower than the assumed interest rate, your payments will be lower.

Retirement Annuity Rates of Return

Immediate annuities are different from other investments because you are exchanging principal for income. Once the income begins, you generally have no access to the money. On the other hand, the income is higher than you would receive on other "low-risk" investments.

Here's why. Insurance companies know that a certain percentage of annuitants will die before their life expectancy. A portion of that money, called mortality credits, is used to fund higher payouts for everyone else. In the earlier example, a $100,000 premium created $5,120 of income per year for a 60-year-old male. While the rate of income is 5.12%, the actual rate of return is considerably lower. Assuming the 60-year-old received payments for 25 years, the rate of return is 2.0%. If he lives to 95, the rate of return is 3.7%.

What Happens to the Money When You Die?

The insurance company calculates annuity payments based on a certain number of people dying. While it's unfortunate if you happen to be "the statistic," it’s good news for the rest of the annuitants. The "mortality credits" result in higher payments to everyone else.

The income option you selected determines what your beneficiary receives. Certain options guarantee that a minimum number of payments will be made. Joint and survivor options continue to pay the survivor for the rest of their life. Life-only options pay nothing to beneficiaries.

The Pros of Retirement Annuities

After you have spent your working life accumulating money for retirement, how do you create a paycheck? These days fewer people have traditional pensions that pay an income every year for life. Buying a retirement annuity is a simple way to create guaranteed lifetime income for yourself. Retirement annuities can also help you plan lifetime income for two people. Joint and survivor life expectancy can be much longer than for each individual.

Retirement annuities produce a higher income than you would get for a similar low-risk investment. A portion of the income is excluded from taxes because it is considered principal.

Finally, as people get older, it becomes more difficult to manage day-to-day finances. Retirement annuities offer a predictable long-term alternative that doesn't require hands-on attention.

The Cons of Retirement Annuities

When you purchase a retirement annuity you give up access to the principal. In doing so, you give up the opportunity for other investments in the future. Here's why that can be a problem. Interest and inflation rates change. In January 2000 you could get a 6-month CD at 6.15%. Today? A 6-month CD pays 0.60%. In 1980, inflation was running at 12%, today it is 2%. The point is that retirement annuities are long-term arrangements. Changes in the economic environment can make them more or less effective.

While retirement annuities do produce a higher rate of income, it takes a long time to get your principal back. In the chart above, the 60-year-old female is 82 before she recaptures her original $100,000.

What to Look for in a Retirement Annuity

The first concern for any type of annuity is the financial condition of the insurance company. The primary rating services that cover insurance companies are A.M. Best, Moody’s, Standard & Poor, and Fitch. Each has differences in their methodologies and rating designations.

The rating each service assigns reflects their opinion about the insurance company's ability to pay claims. The chart below summarizes the financial strength ratings of the different services.

| Highest Ability To Meet Obligations |

Medium Ability To Meet Obligations |

Lowest Ability To Meet Obligations |

|

| A.M. Best | A++ to A- | B++ to B- | C++ to C- |

| Moody’s | Aaa to Aa | A to Baa | Ba to Caa |

| S&P | AAA to A | BBB to B | CCC to C |

| Fitch | AAA to AA- | A+ to BBB- | BB+ to CC |

Shop around, there can be a big difference in what the insurance companies are offering. If you are in less-than-perfect health, some insurance companies sell medically underwritten income annuities with higher payouts.

What Next?

Retirement annuities can be an important part of your retirement plan. While they have many features and benefits, they are not for everyone. Talk to your independent insurance agent. They can help you decide if a retirement annuity is right for you.

Advisors Guide To Annuities John Olsen

Fundamentals of Investments Wilson & Hopkins

SSA.gov

IRS PUB 575

IRS PUB 410

Fitch Ratings Definitions

Moody’s Moody’s rating scale and definition

S&P Global Understanding Ratings

A.M. Best Why An A.M. Best Financial Rating Is Important