Business Insurance Discounts

(See if you qualify for cheaper coverage)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Your business isn’t just your passion—it’s your everything. When the clock strikes 5 and others leave their work behind, you tuck it into bed right next to you, snug as a bug.

But you don’t have to let your insurance premiums weigh you down. There’s a whole world of discounts for business insurance out there, and getting them can be pretty simple.

In fact, everything from a fleet of standing desks to a really nice paint job could qualify you for big savings on your premiums.

Our independent insurance agents can help you figure out if you’re leaving money on the conference table, cut your bills, and maximize your profits. But first, we want to talk a little bit about insurance discounts. So here we go.

What Are Business Insurance Discounts?

When you insure your business, you're signing up to pay premiums (monthly, quarterly or yearly) in exchange for coverage. If disaster strikes your business, your insurance company promises to pay as long as certain conditions are met.

Business insurance discounts simply mean lower insurance premiums. But most insurance discounts don’t work quite like coupons. They’re more like a giant math problem that the insurance company uses to calculate how likely your business is to be in harm’s way.

DID YOU KNOW?

The more you do to promote a safe, healthy, and secure business operation, the less you’ll pay.

Things that go into the formula include your business's industry, safety features, vulnerability to natural disaster, and whether you work with flammable materials.

Another factor in business insurance discounts is the size of your deductible. A deductible is the amount of money for damage you agree to pay before your insurance coverage kicks in.

The higher your deductible is, the lower your premiums will be, since the insurance company is on the hook for less money and they pass those savings on to you.

Finally, finding that “just right” amount of business insurance coverage will also help you get the maximum number of discounts. Paying for coverage you don't need is a drag.

Zeroing in on what you most need to insure — whether it’s your property, your employees, or your inventory — will help you save big bucks.

There are four major types of business insurance you need to know:

- Commercial property insurance: This protects the physical property that makes up your business, including inventory, equipment, and buildings. Business insurance policies can be written to cover specific types of property while excluding others.

- Commercial auto insurance: This covers both vehicles owned by your business and personal vehicles (yours or your employees') that are used to conduct business.

- Workers' compensation: Workers' comp (for short) pays out money to employees who get injured on the job.

- Liability insurance: Liability insurance covers any legal expenses your company might face. Liability insurance will pay for a lawyer, court costs, and even damages if you're found liable in court.

If you're just starting your business, you probably won't need all four types. Liability is typically the most important, followed by property.

You may choose to get minimal coverage in order to save on premiums while you build your business. Shopping smart and getting the right kind of insurance is a kind of business insurance discount.

It’s important to remember that not all discounts will be spelled out in your policy, even if they’re still saving you money.

You're likely to know if you’re getting a discount for your sprinkler system, but you might not realize you’re getting a discount for keeping the lawn trimmed, too. It’s all part of the math problem. And, ugh, math, right?

Insurance companies (also called insurance carriers) don't like to share their exact formulas with customers. It's key to their bottom line, so they consider it proprietary information.

Luckily, we've got insider knowledge. Here's what carriers are really thinking when they offer you savings on your business insurance.

What Business Insurance Discounts Are Available?

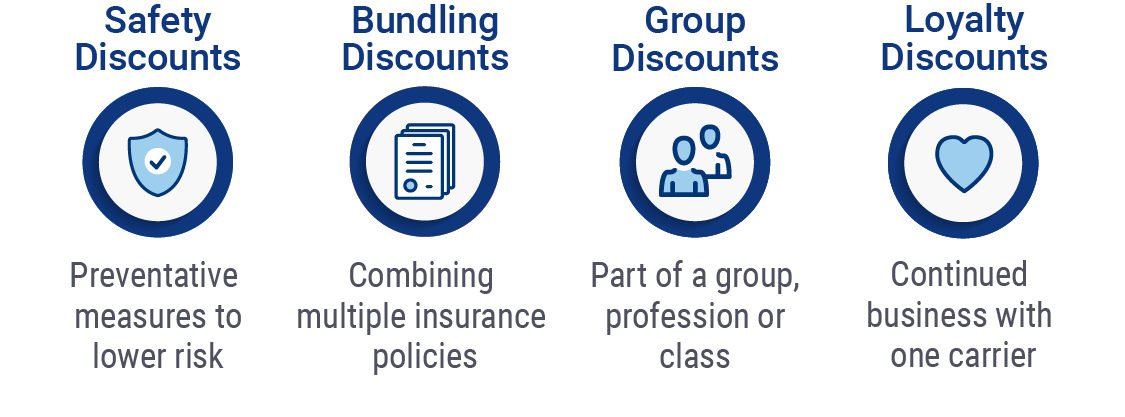

There are almost as many business insurance discounts available as there are business insurance companies, but they can all be divided into four major types. So let’s meet them:

4 Major Types of Discounts

- Safety discounts: These are applied if the insurance company sees that you take good care of your commercial property, or if your business has special features that keep your assets safe. This includes installing burglar alarms, sprinklers, a high-quality roof, and loads more.

- Sometimes safety discounts aren’t obvious. When an insurance inspector visits your property, they’ll probably take notes on how it looks. Things like nice landscaping and fresh paint can actually drive insurance costs down, even if they don’t spell it out in your policy.

- Workers' compensation can be an expensive portion of your business insurance, so providing a safe environment for your employees can really save you money. That includes things like ergonomic desks and high-quality personal protective equipment.

- Bundling discounts: These are discounts you can get if you buy multiple types of insurance with the same company. Say you need to insure your personal car as well as your business. If you get both with the same company, they are likely to cut you a deal. Ditto if you insure multiple properties with the same company.

- Group discounts: These are discounts you can get based on your business sector. It’s common for an insurance company to specialize in a business niche, like farms or grocery stores. That insurance company will often offer special discounts to that type of business.

- Loyalty discounts: These are self-explanatory: Insurers reward customers who stick around. You might also get discounts for referring friends, family, and colleagues to your insurance company.

When it comes to business insurance discounts, they all boil down to the likelihood of a disaster or lawsuit for your business. If you operate in a risky industry, it's simply going to be harder to find discounts.

That doesn't mean you can't offset some of those costs, though. You just need to run a tight ship.

Here are the biggest factors going through an insurance carrier's mind when they're deciding what to charge in premiums:

- Fire: The lower your fire risk, the lower your premiums. The calculation includes the potential flammability of your property and inventory, as well as whether you have proper safety features like extinguishers and sprinklers.

- Theft: If your business deals with valuable items that are a target for thieves, or you're located in a high-crime area, your premiums will go up. You can offset this with things like security cameras and guards.

- Natural disaster: Earthquakes, hurricanes, floods, hailstorms, windstorms, wildfires, and tornadoes will all affect your insurance costs. This is especially true if your business is vulnerable to the elements, like if it's housed in a mobile trailer or beach shack. Reinforcing your buildings or relocating to a safer area will lower your cost.

- Hacking: Your business's cyber security is just as important as the real world kind. Keeping your servers secure and taking proper precautions with customer data can net you insurance discounts.

- Legal liability: Industries like food service, cosmetics, and travel are particularly vulnerable to lawsuits, so their legal coverage costs more. Making sure waivers and similar paperwork are in order will help offset costs.

- Employee injury: Dangerous employee conditions raise insurance costs, especially liability and workers' comp. Providing proper safety equipment and implementing crystal-clear safety and evacuation procedures lowers those costs.

- White collar and retail businesses aren't as safe as you might think. Providing ergonomic equipment and taking steps to prevent repetitive motion injuries will help lower these costs in those sectors.

- Customer injury: Do you offer risky experiences like skydives and trail rides to your customers? Those risks raise premiums. Making sure your safety procedures are airtight, like enforcing helmet and health requirements, can lower these costs.

- Even everyday businesses in food service, cosmetics, and similar sectors need to protect their customers against food poisoning and contamination through cleanliness and proper training.

- Equipment: If your business's equipment is expensive, dangerous, or difficult to replace, that raises premiums. Well-maintained equipment and clear safety procedures lowers them.

- Lost or damaged property: If customers trust you with their valuable property (at hotels, for example), then your premiums will be higher to reflect that extra risk. Setting yourself up with safes and security cameras can lower costs.

- Replacement costs: Owning rare or defunct equipment, items, blueprints, vehicles, or buildings can all dramatically raise business insurance costs.

- Appearance and maintenance of the property: Keeping your building and property looking spiffy when an insurance adjuster visits can lower your premiums. It shows that you're conscientious about maintenance, something carriers love to see.

- Training: Some business insurance carriers offer special safety training for business owners and their employees. Take them up on it and you'll get a discount.

Bonus round: high deductible discounts. If you agree to pay a higher deductible when you file a claim, your premiums will be lower. The insurance company will owe less in case of an accident or lawsuit, so they pass those savings on to you. Choosing a high deductible makes sense if you have enough assets to cover minor damage.

Commercial Auto Insurance Discounts

Your regular auto insurance may not cover you if you're using your car for business tasks like moving inventory. It definitely won't cover commercial vehicles like catering trucks and cleaning service vans. Bummer! Luckily, commercial auto insurance discounts are easy to spot.

Here's what an insurance carrier considers when they're deciding how much to charge in commercial auto insurance premiums:

- Value: The cheaper the vehicle, the cheaper the premiums.

- Safety: New features like rear cameras, pedestrian detection, and emergency braking can lower premiums.

- Cost of repairs: If a vehicle costs a lot to repair, it'll up your premiums (because your carrier wants to break even).

- Attractiveness to thieves: If a vehicle is at higher risk of being stolen, it'll also up your premiums (same deal as above: your carrier needs to cover their costs).

- Engine size/power: The more powerful the vehicle, the worse an accident could be, so a large engine ups your premiums.

- Value of inventory and equipment: If a commercial vehicle regularly carries valuable inventory or business equipment, it'll need extra insurance to cover that value, raising premiums.

Taxi and other ride-for-hire companies require special commercial auto insurance called livery insurance. If you're an independent contractor for rideshare companies like Lyft and Uber, you’re covered by their livery insurance while you're clocked into their app.

If you own a business that delivers to customers, like a pizza parlor or florist, you need to carry commercial auto insurance for your delivery employees' vehicles, even if they're also personal vehicles. Commercial auto insurance covers employees' cars while they're on the clock.

What about Home-Based Businesses?

If you're running a business out of your home, you shouldn't count on your homeowners insurance to cover everything if disaster strikes. In fact, some home insurance policies specifically exclude home-based businesses.

Luckily, this type of business insurance is easy to find discounts for, since your risks at home are typically lower than, say, a sawmill or oil rig. (At least, we hope so.)

It may feel like overkill to install a bunch of fancy safety features in your own home, but if your business makes up a big chunk of your income, it pays to be cautious. Installing a fire extinguisher and a security system is an easy way to get discounts on home-based business insurance.

These items show insurance carriers that you're serious about protecting your inventory from fire and theft, two of the biggest causes of business insurance claims.

How Hard Is It to Get Business Insurance Discounts?

The short answer is that it’s pretty doggone easy. The slightly longer answer is that getting discounts sometimes depends on things you can’t control, like your business sector and location. If you’re in a dangerous industry or area, sometimes you have to settle for less-than-ideal discounts.

It can also be hard to tell exactly when you're getting a discount. Some carriers will advertise their discount programs, especially big-ticket discounts like those for veteran-owned businesses. Others quietly slip savings into the final deal without explaining what discounts they offered you and why.

There are hundreds of insurance carriers in the United States. Each has a different focus and formula, which means that each offers slightly different discounts.

This is especially true in business insurance, where insurance carriers are usually specialized. Real-life examples include carriers who specialize in insuring nothing but forestry businesses or RV dealerships.

Specialized carriers are good news for business owners. The more industry expertise your carrier has, the more they can tailor your insurance to your business. The more tailoring, the more discounts.

Finding an agent who specializes in your industry is also important to getting discounts. They’ll know the ins and outs of relevant carriers and discount opportunities, minimizing your costs.

They might not be able to get you out of paying a premium to insure flammable inventory, but they will know all the finer points of your carrier's safety wish list, helping you check off as many items as you can to score discounts.

How Do I Get Business Insurance Discounts?

First of all, don’t go it alone — talk to an expert independent insurance agent. They have a huge advantage over agents who work with only one company: They can comparison shop between dozens of companies to find the best rate for you.

Your agent will help evaluate what coverage you need and the best way to get it. You'll usually start by filling out a questionnaire, followed by a face-to-face or phone conversation.

Your agent needs to know:

- What you do and what population you serve

- The age of your business

- How many employees you have

- About how many customers you have

- What kind of training and safety equipment you provide

- Details about your property: buildings, vehicles, equipment, inventory, etc.

- Your relevant work history, for example, if you worked in this industry before you started your business

- Whether you're a veteran, especially if you're part of the government's official veteran-owned business program

After the getting-to-know-you part, your agent will get to work finding you insurance quotes. The quotes represent the rate each insurance carrier is willing to offer you, including the discounts you’ve been looking for.

Your agent will help you comparison shop to find the right amount of coverage for the lowest price.

Getting discounts on your business insurance shouldn't stop when you select a quote and seal the deal. You should continue to work with your agent as your business grows, expanding coverage where you need it and finding extra savings as you bundle coverage and reduce risks.

Plus, the longer you stay with a carrier, the more loyalty and bundling discounts you're likely to get down the road.

The Benefits of an Independent Insurance Agent

Now you know how discounts work, but your time is valuable. Why do the hard work yourself? Our independent insurance agents stay on top of the industry and all the latest discounts so you don’t have to. That means they’ll help you find the right coverage for you at the right price.

They’re not just there at the beginning, either. If disaster strikes and you need to file a claim, they’ll be with you every step of the way, helping you meet deadlines and maximize your benefits—and how can you beat that?