Employment Practices Liability Insurance

Because even the most careful and responsible employers get sued sometimes.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

As an employer, unfortunately there's a good chance that one of your employees will sue your business. Even if you run the most successful business around, your employees can sue you for many disasters, and lawsuits can be more than just an inconvenience. That’s why having employment practices liability insurance is so important.

Employee lawsuits are also becoming more common over time, which makes employment practices liability insurance (EPLI) a critical option for all businesses. Fortunately independent insurance agents can help you find the best EPLI coverage in your area. But first, here's a deep dive into this crucial coverage.

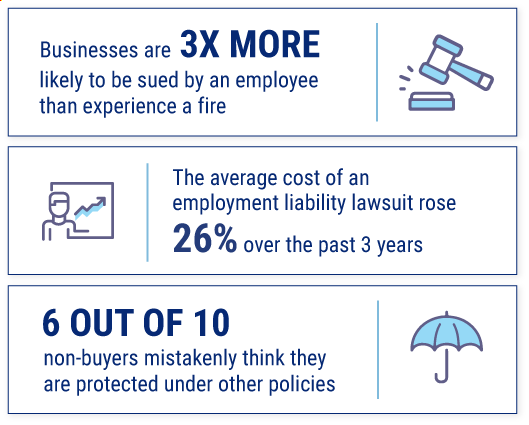

Over the last 20 years, employee lawsuits have risen roughly 400%, with wrongful termination suits jumping up more than 260%. Oddly enough, you're more likely to be sued by an employee today than you are to have a fire at your business.

And it’s not just large corporations that are being hit. Roughly 41.5% of employee lawsuits are brought against private companies with less than 100 employees. The cost of settling out of court averages $75,000, and the average court settlement fee is $217,000 if lose the case.

Beyond wrongful termination cases, your business can be sued for many other reasons. Still, roughly 7 out of 10 businesses don’t carry EPLI insurance. This can be an extremely costly mistake, in more ways than one.

What Is Employment Practices Liability Insurance?

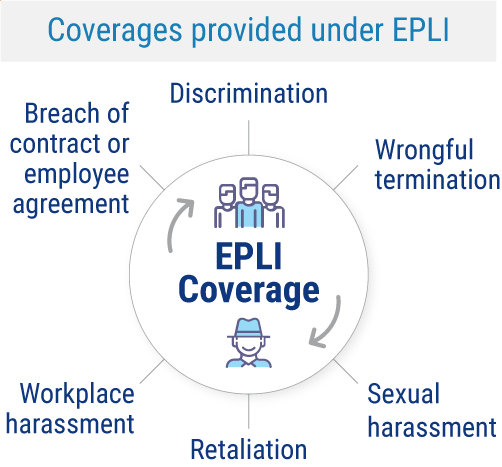

Employment practices liability insurance, or EPLI insurance, protects employers from lawsuits brought by employees. It provides coverage for many situations that general liability insurance doesn't. Even lawsuits that are won by your company can be expensive, due to the high cost of legal defense. EPLI coverage provides important financial protection for your business.

Coverage can protect your business against various lawsuits, ranging from harassment to discrimination. These types of claims are becoming more common as time goes on. Fortunately an independent insurance agent can easily help you find the appropriate EPLI coverage for your unique business's needs.

What Does Employment Practices Liability Insurance Cover?

Your business may not be able to sustain a lengthy legal battle without the proper coverage. EPLI helps pay for court, settlement, and defense costs.

EPLI coverage can be purchased as a stand-alone policy, but can also be found inside a management liability insurance package. These packages combine EPLI coverage with directors and officers liability and fiduciary liability insurance.

Stand-alone EPLI provides coverage for legal expenses arising from the following claims:

- Sexual harassment

- Wrongful termination

- Breach of an employment contract

- Discrimination

- Negligent HR decisions

- Inaccurate employee evaluations

- Violation of local and federal employment laws

- Infliction of emotional distress or mental anguish

- Failure to employ or promote

- Wrongful discipline or demotion

- Mismanagement of employee benefits

- Defamation of character

- Privacy violations

An independent insurance agent can further explain the coverage provided by EPLI policies in your area.

Who Sells Employment Practices Liability Insurance?

Employment practices liability insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. Independent insurance agents know which insurance companies to recommend to meet your needs, and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies could provide employment practices liability insurance for you, finding coverage could also depend on the area you live in. Here are a few of our top picks for employment practices liability insurance.

| Top EPLI Insurance Companies | Star Rating |

| Nationwide |

|

| The Hartford |

|

| Travelers |

|

| Acuity |

|

| Allstate |

|

One employment practices liability insurance company outshines its competitors.

- Best overall employment practices liability insurance company: The Hartford

The Hartford provides comprehensive ELPI coverage for the following:

- Discrimination

- Harassment

- Retaliation

- Violation of the Family and Medical Leave Act

- Wrongful discipline

- Wrongful failure to promote

- Wrongful termination

With quality coverage from an outstanding carrier overall, The Hartford easily earns our recommendation as the top choice for ELPI coverage.

What Doesn't Employment Practices Liability Insurance Cover?

Though employment practices liability insurance provides a ton of critical protection for businesses everywhere, it can’t cover everything. These are a few of the most common coverage exclusions:

- Data breaches

- Criminal fines

- Unpaid employee wages

- Bodily injury

- Intentional or malicious acts

- Unemployment benefits

- Workers' comp incidents

- Property damage

If you have further questions about which exclusions apply to your specific EPLI policy, an independent insurance agent can help you review your coverage.

Who Is Covered by Employment Practices Liability Insurance?

Your employees are covered against various claims under EPLI, along with the business owner, directors, officers, and management staff. You may also be protected against claims filed by third-parties. Your business needs to be equipped with this critical coverage before it ever opens its doors. Having the proper protection can mean the difference between success and failure.

Do I Need Employment Practices Liability Insurance?

Though coverage may not be required by law, it's really important to have it. Especially if your business does any of the following:

- Hires employees

- Performs evaluations for its employees

- Promotes or fires employees

- Distributes information about its employees

- Allows employee interaction with coworkers, customers, or other third-parties

- Provides employee benefits

Your business can be sued for any of these routine operations by its employees. An independent insurance agent can provide you with even more examples of why having EPLI coverage is a good idea for your business.

How Much Does Employment Practices Liability Insurance Cost?

Carriers use personal data and outside elements to figure your costs. Depending on your location, you might pay less than $1,500 per year for $1 million in coverage, if you have five or fewer employees.

Like any other business insurance out there, pricing is customized to your policy's specifics. Employment practices liability premiums are often rated on the following factors:

- Your experience level

- The safety practices you have in place

- If you have a human resources department

- How you deal with hiring

- How you deal with termination

- Prior claims reported

An independent insurance agent can provide you with exact quotes for coverage available in your area.

What Are the Limits on an EPLI Policy?

Commonly, EPLI coverage comes with limits between $1 million and $25 million. It's important to work together with an independent insurance agent to choose the right amount of coverage for your business to cover possible attorney, court, and settlement costs in case of a lawsuit.

EPLI insurance often works on a claims-made basis, which means that coverage kicks in when the following criteria are both met:

- The incident the employee claims occurred when the policy was active

- Charges are pressed against the business for the claim while the policy is active

An independent insurance agent can further help you understand the coverage limits and terms under EPLI.

What to Look for in an EPLI Policy

To find the best coverage for your business, work with an independent insurance agent to select an EPLI policy with the following protections:

- Sexual harassment

- Retaliation

- Defamation

- Mismanagement of employee benefits

- Failure to promote

- Mental or emotional distress

- Invasion of privacy

- Discrimination

- Negligent evaluation or supervision

- Wrongful demotion, termination, or disciplining of an employee

When you select the most comprehensive EPLI policy for your business, it can seriously help you maintain smooth operations and employee relationships for years to come.

Frequently Asked Questions about Employment Practices Liability Insurance

To determine how much EPLI coverage your business needs, you'll need to work with an independent insurance agent. Together, you'll discuss your business's operations and risks, and from there, be able to pinpoint the exact amount of coverage necessary to protect you.

Employers liability insurance is similar to EPLI, but its scale is more limited. This coverage protects businesses against employee claims of injury or illness that stemmed from the business's negligence. Employer's liability insurance also covers legal fees, such as attorney, court, and settlement costs.

EPLI insurance protects employers from lawsuits brought by employees. It provides coverage for many situations that general liability insurance doesn't, such as harassment or wrongful termination. EPLI coverage provides important financial protection for your business against costly (and frequent) employee lawsuits.

EPLI protects your business from numerous employee lawsuits, for claims of sexual harassment, wrongful termination, breach of contract, discrimination, failure to promote, invasion of privacy, and much more.

The Benefits of an Independent Insurance Agent

When it comes to helping insurance customers find the absolute best employment practices liability coverage, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who sell EPLI, deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

https://www.thehartford.com/employment-practices-insurance

https://www.iii.org/article/what-employment-practices-liability-insurance-epli

https://www.irmi.com/term/insurance-definitions/employment-practices-liability-insurance