Errors and Omissions Insurance

If your professional advice or service costs your client money and you’re sued, E&O insurance will cover you.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Many people pay experienced professionals to give them trustworthy advice on things such as buying a home, legal issues, tax preparation, investing, and more. Most of the time, these professionals give sound advice that can help them with their goals. But what happens if they give inaccurate or faulty information to a client?

Besides potentially costing money, this could result in a lawsuit. Fortunately, for professionals who are brought into those lawsuits, there is insurance that can cover them. This type of insurance is called errors & omissions, or E&O, insurance. It’s also sometimes referred to as professional liability insurance. E&O insurance is always a separate insurance policy that’s bought in addition to a standard general liability insurance policy.

The Best Errors and Omissions Insurance Companies

Most insurance companies will want to provide the rest of your business’s insurance in order to offer errors and omissions coverage as well. Meaning, they’ll want to insure your commercial property and general liability first, and then they will be willing to offer errors and omissions insurance. These companies won’t offer E&O insurance by itself, without at least general liability insurance to go along with it.

There are some companies that offer errors and omissions insurance by itself, as long as the business has a general liability policy with another company. Generally, these companies are the larger insurance companies, though there are also specialty companies that offer E&O insurance.

| Errors and Omissions Insurance Companies | Star Rating |

| Travelers |

|

| Liberty Mutual |

|

| Cincinnati |

|

| Westfield |

|

| Selective |

|

| Philadelphia Insurance |

|

| State Auto |

|

| Nationwide |

|

| Central Insurance Companies |

|

| Progressive |

|

Who Sells E&O Insurance?

The best way to find E&O insurance is through an independent insurance agent. If you already have commercial insurance, such as general liability and commercial property insurance, you’re likely to be able to add an E&O insurance policy to your existing commercial insurance package through your current insurance company.

Most insurance companies that offer commercial insurance will also offer errors and omissions insurance. And most businesses will buy an E&O policy through the same insurance company that has the rest of their business insurance.

However, certain professions, such as real estate agents, are seen as being at higher risk for E&O claims than others. Some insurance companies won’t offer errors and omissions coverage to businesses in these professions, and the ones that do will often charge higher rates due to the higher chance of these businesses having a claim.

Does Your Small Business Need Errors and Omissions Insurance?

Businesses that offer any type of professional advice or provide services to clients are good candidates for E&O insurance. To help determine if your business needs errors and omissions insurance, it’s important to understand what your standard commercial general liability insurance doesn’t cover you for.

General liability is the type of liability that almost all businesses have if they have business insurance. It covers your business for lawsuits if you’re found negligent for somebody else’s injuries or property damage, such as a slip-and-fall injury or having a faulty product that caused somebody injury. General liability specifically does not cover (excludes in insurance-speak) professional advice and services.

Typically, insurance companies have specific errors and omissions coverage forms that apply to each industry.

Common professions that use errors and omissions coverage include:

- Lawyers

- Accountants

- Financial advisers

- Barbers and beauticians

- Cemetery professionals

- Contractors

- Architects

- Engineers

- Social services

- Teachers or tutors

- Funeral directors

- Wedding planners

- Fitness trainers

- Veterinarians

- Doctors

- Dentists

- Insurance agents

- Counselors

- IT services

- Marketing firms

If your business is based on your professional expertise and you’re providing advice and recommendations to clients, then be sure to speak with an independent insurance agent about errors and omissions insurance coverage.

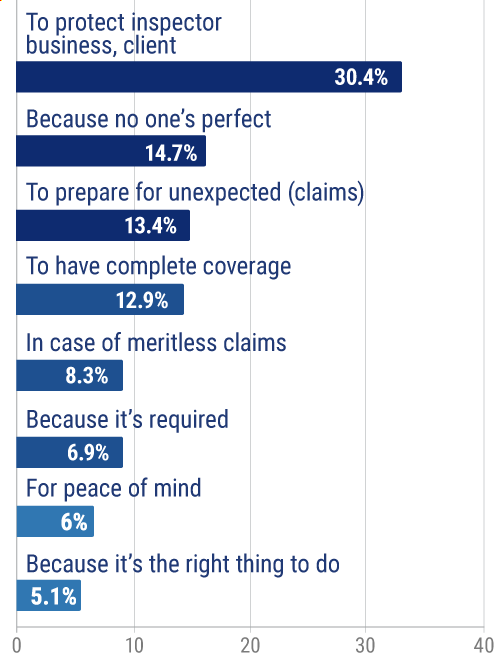

Why carry E&O Insurance?

Do Clients Require Errors and Omissions Insurance Coverage?

Yes, some clients may require your business to have errors and omissions insurance coverage before they conduct business with you.

The reason for this is because they want to know that if there’s a claim related to your professional services or advice, both you and the client are protected financially, since your insurance will pay for the claim. The client doesn’t want you to sue them if you’re brought into a lawsuit, so having the proper insurance coverage takes care of those possibilities and allows all parties to focus on the job at hand.

How Does Errors and Omissions Insurance Protect Certain Professions?

Errors and omissions insurance protects businesses that offer professional advice or services, where a mistake could potentially cost a client a lot of money. These types of claim could happen in a wide variety of professions. Here are some of the most common.

Insurance agents

Insurance agents are responsible for making sure their clients have adequate insurance coverage. Ideally, insurance agents speak with their clients about their financial assets, explain what type of claims could happen to them, and then offer the appropriate coverage. Sometimes things go awry.

Clients can sue insurance agents if they feel they weren’t offered high enough insurance limits. This typically happens after a claim when the payout is higher than the client had insurance for, meaning the client has to pay out of pocket. Even if the insurance agent says that they did in fact offer higher limits or the appropriate insurance policy and the client didn’t want it, then agents often don’t get the client’s signature stating they were offered a certain type of coverage but decided to reject it.

DID YOU KNOW?

If a client had water damage in their house and didn’t have water back-up coverage, the client could sue the insurance agent for not fully explaining what water back-up coverage was. Errors and omissions insurance would cover the insurance agent in this lawsuit.

Real estate agents

Real estate agents are one of the most common professions that buys errors and omissions insurance because of the high potential for claims. Many insurance companies are even hesitant to offer errors and omissions insurance for realtors, while others may charge higher rates.

Real estate agents make recommendations to their clients on the types of houses or buildings they can buy. They show them the buildings and ultimately broker the sales. If a client then has a problem with the house, even if it had nothing to do with the realtor, the client can sue the real estate agent for misleading them about the condition of the house or building.

DID YOU KNOW?

If a client buys a house from a real estate agent and then a month later has a fire or a leaky pipe, the client could sue the real estate agent for not pointing out the poor condition of the house.

Remember, it doesn’t matter if the lawsuit has any basis or if the real estate agent was actually at fault. The client can still sue and incur legal fees and defense costs for the real estate agent. Errors and omissions insurance would pay for these costs and the insurance company would fight this lawsuit on the realtor’s behalf.

Financial advisers

Financial advisers make recommendations about where clients should put their money, whether it's a retirement account like an IRA, saving to pay for their children’s college education, or just a personal investment account.

Most financial advisers have clients sign disclaimers saying that the advisers aren’t responsible for the ups and downs of the market, and that anything can happen with investment money. While these disclaimers do provide some form of protection for financial advisers, they don’t necessarily prevent lawsuits from being brought against them.

If a client loses thousands of dollars or more because their mutual funds tanked and they are out of retirement money, chances are pretty good that they will sue. A financial adviser's errors and omissions insurance policy will cover this.

Tax preparers

Tax preparers and accountants also handle people’s hard-earned money. While they may make fewer financial recommendations than financial advisers, they are still responsible for making sure that the client’s taxes are properly paid. If there’s a mistake and potentially an audit by the IRS, you can bet the client will be very unhappy and will probably sue the accountant.

A tax preparer or accountant without errors and omissions insurance might have to owe a client a lot of money if they make a mistake, which could potentially put them out of business.

IT professionals

IT professionals could also be at risk of E&O claims because an increase in the number of cyberattacks experienced by businesses across the country. Businesses trust IT professionals to adequately protect their business’s networks, online capabilities, and even their clients’ personal and financial information.

If a business has a cyberattack and is responsible for paying for the damage, which could be in the tens of thousands of dollars or more, they could sue the IT professional for not doing a good enough job protecting them. Hopefully, the business would also have cyber insurance to be able to cover the cost of the cyberattack, but they will also probably sue the IT security firm.

Types of Errors and Omissions Insurance Coverage

Errors and omissions insurance is a very specific type of liability insurance coverage. It doesn’t cover property, autos, or other types of liability exposures, such as the sale of alcohol (liquor liability). Sometimes, the distinction between E&O insurance and general liability insurance is a little blurry.

These blurry lines always exist in commercial insurance, which is why it’s important to have both types of policies, ideally with the same company. If you have both general liability and errors and omissions insurance with the same company, they will definitely pay the claim. If you only have one policy and a claim happens in a gray area, or if you have your policies with two different companies, each company may try to deny the claim, hoping that the other one will pay instead.

What E&O insurance covers

Errors and omissions insurance covers your business for liability claims related to professional negligence, professional errors, omitting important facts or services from the work you performed, and/or malpractice of your professional services. It covers claims that are a direct result of your professional work, whereas general liability insurance is more for accidents that could happen at your workplace or from using products that you’ve produced.

| E&O coverage levels | Covered | Not Covered |

| Mistakes made at work |

|

|

| Services not performed |

|

|

| Breach of contract |

|

|

| Missing contract deadlines |

|

|

| Professional negligence |

|

|

| Occurrence/Tail |

|

|

| General liability |

|

|

| Workers' compensation |

|

|

| Commercial property |

|

|

| Employment practices liability |

|

|

| Commercial auto |

|

|

In general, E&O insurance covers you for:

- Mistakes you make at work. Failing to submit the right tax forms as an accountant, Your IT firm failing to secure your business’s network, or prescribing the wrong medicine as a doctor or veterinarian are examples of mistakes that could happen at work.

- Services that weren’t performed. Not delivering a service that was paid for and agreed upon could result in a lawsuit.

- Breach of contract. If your business breaks its contract with a client or another business for no legitimate reason, this could result in an E&O claim.

- Missing a contract deadline. Contracts generally have strict deadlines, and not meeting those deadlines can cost a lot of money, which could also result in an E&O claim.

- Professional negligence. This is the broad term that applies to professionals that are held to a higher standard of service, such as lawyers, doctors, insurance agents, and other professionals. Failing to meet these professional standards could result in an E&O claim.

What E&O insurance doesn't cover

An errors and omissions insurance policy isn’t designed to cover your business for everything. Rather, it’s fairly specific. You can get coverage for the things that an E&O policy doesn’t cover by buying additional business insurance policies.

- Workers' compensation

- General liability

- Commercial property

- Employment practices liability insurance

- Commercial auto insurance

Finding Discounts and Savings on Errors and Omissions Insurance

As with many types of specialized commercial insurance policies, there aren’t really any discounts that you can find to save money on errors and omissions insurance. On most commercial insurance policies, you’ll be able to save money if the insurance company agrees to put credit on your policy, which could result in significant savings.

However, credit is rarely put on specialized commercial policies such as errors and omissions. Your errors and omissions premium will largely be based on the following factors, some of which you can control to reduce your premiums:

- Your profession. Real estate agents are likely to pay higher premiums than beauty salons, but it largely depends on each profession’s claims history with that particular insurance company in the last few years.

- The size of your business. Larger businesses have a greater chance of having an E&O claim, simply because of the larger number of clients they work with.

- Claims history. If you’ve had an E&O claim in the last 5 years, you’ll pay a significantly higher premium. E&O claims generally aren’t cheap, so the insurance company will raise your rates because of the higher chance that you’ll have another claim.

- Deductible. You’ll be able to choose your own deductible on your E&O claim. Deductible options will vary among companies, but a $10,000 deductible is fairly standard for small to medium businesses. The higher the deductible you choose, the lower your rates will be. The E&O deductible is generally higher because an E&O insurance policy is mainly there in case of a worst-case scenario type claim, such as an E&O claim involving a death or serious injury. It’s not designed to respond to small claims where the client is upset over $500 dollars.

Comparing Errors and Omissions Insurance Plans

Since errors and omissions insurance is a specialized policy, it’s strongly advised that you get the help of an independent insurance agent before buying your policy. They’ll be able to make recommendations about whether your business needs an E&O policy and can look at your existing commercial insurance package to determine which company is best for you.

A local independent insurance agent can also fully explain what errors and omissions insurance covers your business for and how you can take steps to prevent E&O claims. Each profession is different and faces different E&O risks, so it’s important to have a trusted adviser who knows the ins and outs of commercial insurance to help protect your business.

If you do have an E&O claim, it’s likely to involve a difficult claims process that will require a lot of paperwork and may take some time to settle. You’ll want to have a knowledgeable agent on your side who can monitor how the claim is going and help you with the appropriate paperwork. This could make all the difference in the world in whether you have a good claims experience or one that could potentially drive you out of business.

Frequently Asked Questions about Errors and Omissions Insurance

Errors and omissions insurance is a specific type of commercial liability policy that protects your business from claims and lawsuits related to your professional work. It’s mainly designed for professional businesses that offer specialized services and covers claims related to mistakes, errors, or malpractice in those jobs.

Technically, there is no difference between E&O insurance and professional liability insurance. The two are interchangeable terms used in the insurance industry. One company might offer an errors and omissions policy, while another might offer professional liability. But the policies are going to cover the same thing .There might be differences in coverages between companies, but the two words mean the same thing.

Errors and omissions is a liability policy, which means it will pay for injuries or damages that your business is held legally responsible for. Even if you’re not found to be responsible, there will still be defense costs to get to that point, which your E&O policy will pay for. Your insurance company will pay defense costs, settlements, and amounts that you’re legally found to owe to the injured party, up to your policy’s limits.

If you already have a commercial insurance policy, you can first check with your current insurance agent or company to see if they offer E&O insurance. If you’re with a trusted independent insurance agent already, they’ll be able to make recommendations about which E&O insurance companies are best suited to your business.

This is something that you can discuss in greater detail with your independent insurance agent, but an errors and omissions insurance policy is typically called a claims-made policy. This is different from your general liability insurance, which is typically an occurrence-based policy. Occurrence-based policies are the easier of the two to understand, since they cover claims that happened during the policy period, which is typically one year. Claims-made policies need to be in force when the claim is first made, which may be in a different year than when it actually happened.

| General liability is designed primarily to cover bodily injury or property damage that happen as a result of your business operations. This could include a client slip and fall, a roofing contractor dropping a shingle on somebody, or a manufactured toy causing harm to a child. It does not cover professional services, such as giving the wrong advice to a client, which is what E&O insurance is for. |

https://www.iii.org/article/professional-liability-insurance

https://www.iii.org/publications/commercial-insurance/rankings

statista.com