Student Health Insurance 101

Grant is the founder of Stewardship (in Gilbert, AZ) and was named a top entrepreneur before he reached the age of thirty-five.

Most college students are figuring out how to navigate life on their own. One of the items you may be wondering about is student health insurance.

TrustedChoice.com has partnered with Grant Botma and his Stewardship team to put you on the right track. Independent insurance agents are easy to connect with through our find-an-agent tool.

Health Insurance for College Students

There are a few different routes you can take when obtaining student health insurance. Botma explains what each option is, so you can make the right decision for your future.

Student health insurance options:

1. The most common is to stay on your parent's policy, says Botma. You are legally allowed to be included on their plan until age 26. This is assuming you can still be claimed as a dependent by your parents.

2. If you live in a different state, then Botma suggests applying to still be on your parent's plan or go on your own.

3. The final option is to use the university's group plan. Botma states, "What's really great about these school group plans is they can often be included in your tuition loan payments instead of being a separate charge."

How Many College Students Have Health Insurance?

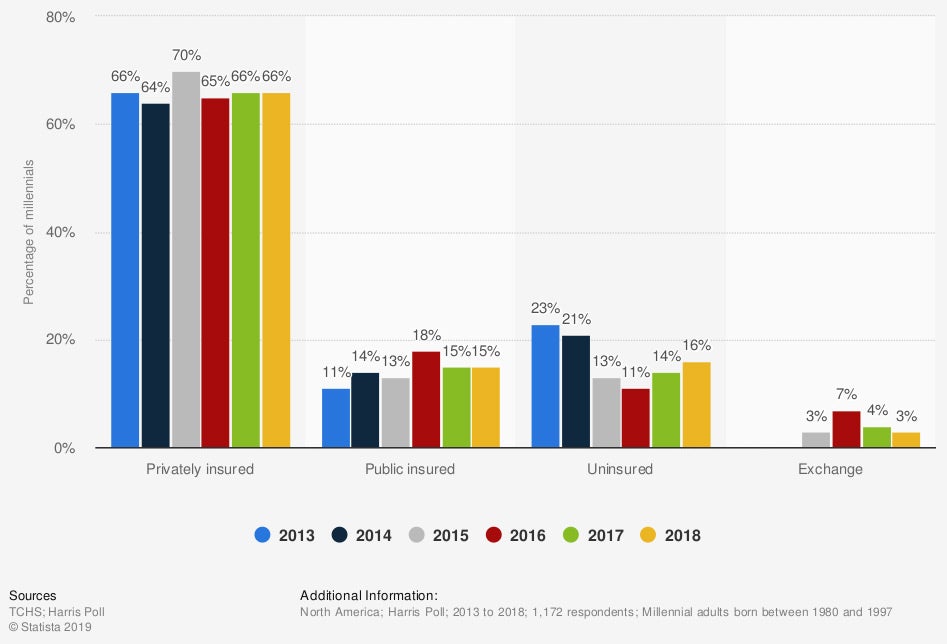

A survey done in 2019 showed millennials who had health insurance. According to the survey, 66% of this younger generation obtained private health insurance, with 16% being uninsured altogether.

Health insurance status of millennials in the US from 2013 to 2018

As you can see, the majority of college students have health insurance. Chances are you're in the group that has health insurance. Each insurance company has a rating similar to your financial institution. You'll want to make sure the carriers that your agent is running insurance with are A-rated or better. AM Best is the rating company that you want to look for when choosing an insurance company. Check out the guide below for clarification.

| Guide to AM Best's financial strength ratings: | |

| A+ to A++ rating: | Excellent |

| B+ to B++ rating: | Good |

| B to B- rating: | Fair |

| C+ to C++ rating: | Marginal |

| C to C- rating: | Weak |

| D rating: | Poor |

Do College Students Have to Have Health Insurance?

According to Botma, no. College students are no more obligated to have health insurance than any other age demographic. However, it's always a good idea to have the proper coverage, especially when it comes to your health. Botma states that there are a few options you should be aware of when choosing health insurance as a college student.

Student health insurance breakdown:

- You'll have your two individual options, which are obtaining insurance through the marketplace, or you can go to an independent insurance agent. Botma says the difference in pricing is zero dollars, but the expertise is priceless.

- The other option is through a medical bill sharing program. Botma clarifies that medical bill sharing is not insurance. However, it works similarly: You would have an annual household portion (AHP) that works like a deductible. Everything above and beyond that AHP would be covered or "shared" based on the company's guidelines.

According to Botma, a knowledgeable and trusted adviser will be able to explain all the options you have to choose from, putting your needs first.

How Much Does Health Insurance Cost for a College Student?

"The premium amount paid on health insurance for a college student is different for everyone," says Botma. While there is no real way to know what your exact cost, or even a ballpark premium amount, could be, he knows which route would save you the most.

Botma suggests, "If possible, stay on your parent's plan as long as possible." Your parent's health insurance plan will be the cheapest option, and your parents may even offer to pay for your portion.

If you don't have the luxury of being on your parent's plan, then the marketplace or medical bill sharing are your next best choices, according to Botma.

Best practices to get lower health insurance premiums:

1.) Go to the doctor regularly - If you keep up to date with your yearly exams, the carriers will see that you take your health seriously and may have better rates.

2.) Stay within your Body Mass Index (BMI) - Your BMI is the measurement that the government and healthcare facilities use to determine an average weight each individual should be within. Your BMI takes into account your height and weight as well.

3.) Don't go untreated - If your last visit to the doctor revealed a treatment plan that was recommended to resolve an illness or injury, be sure to resolve it. If an illness or injury goes untreated insurance companies, including life insurance, will determine that you may still be sick or injured.

4.) Stay active - A body in motion stays in motion sounds simple enough. The more active you are by working out or getting involved in extracurricular activities, will keep you younger and in shape longer.

How to Get Health Insurance as a College Student

You know what your options are for student health insurance, now where do you go to get it? Botma suggests going through an independent insurance agent. They will have your best interests in mind and know all your options.

According to Botma, "You can go at it alone and navigate the marketplace yourself, or you can pay zero dollars and have an expert do the work for you."

The benefits of working with an independent health agent:

- Advice from an expert without paying a penny. An independent agent gets paid by the insurance carriers so the cost doesn't come out of your pocket.

- Your independent agent does the work. An agent will take your information to their carriers and do the price shopping and coverage comparing for you. This saves you time and money.

- They work for you. An independent insurance agent works on your behalf and is a third party, non-biased adviser. It really is a win-win.

- An independent agent is efficient. If you are needing the most value for your money, and agent can get you quote options from multiple carriers fast. They have management tools that quote dozens of companies at one time so you don't have to wait.

Can College Students Get Free Health Insurance?

Unfortunately, there's no such thing as free when it comes to most insurance. However, Botma says if your parents are willing to foot the bill while you're on their plan, you might as well take advantage.

The marketplace will go off your adjusted gross annual income. This is where being a broke college student could actually benefit you. The lower your income, the more credit the government will allow you on your health insurance through the marketplace. As long as your adjusted gross annual income is the same as your annual tax returns, your credit is in good standing.

Connect with an Independent Insurance Agent

The first step on your road to student health insurance is connecting with a local independent agent. An independent agent can find you the best pricing and coverage through their extended network. They work with a variety of carriers, giving you the choices you need to make the right decision.

Statista

AM Best Company