Essential Things to Know About Choosing a Structure for Your New Business

Coming up with a great business idea can be tricky, but that’s only the first step. The legal structure you choose for your business can be a very confusing decision, as it determines several of the requirements for operating and sustaining your enterprise in the future. Laws and regulations at both the federal and state levels vary depending on your choice, so it is essential to pick the one that is most appropriate for your needs.

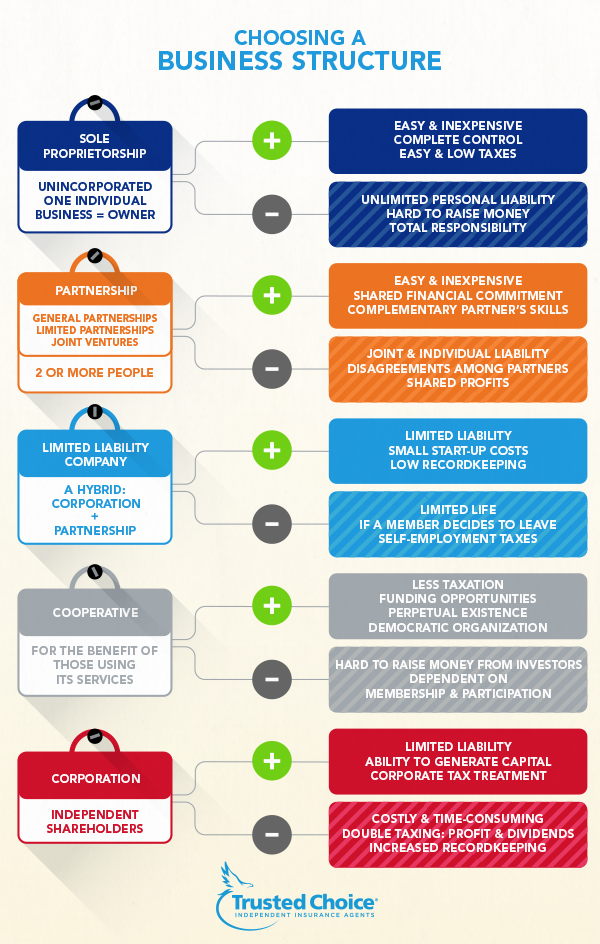

When choosing a structure for your business, you should consider the advantages and disadvantages of each option in order to get the perfect fit:

Sole Proprietorship

If you’re looking for an uncomplicated way to start your business, a sole proprietorship is the way to go. This is a popular choice because it’s easy to create and to operate.

Forming a sole proprietorship is a straightforward process. You’ll probably need to fill out some simple state forms, and possibly some federal forms as well, but licensing and annual renewal fees are generally much cheaper than other alternatives. Once this is done, you’re technically a sole proprietor once you begin business activities. You have control over every aspect of the business with the authority to make whatever decisions you deem necessary.

Having a business that operates as an extension of you has both positive and negative effects. Because a sole proprietorship is legally tied to you, all profits are yours, but similarly, so are debts and liability. Taxes are simply done along with your personal taxes with the use of additional IRS forms, which doesn’t present a problem for businesses without much risk.

Partnership

If you’re starting your business with someone else or with a number of people, you will probably consider a partnership. Although many people view partnerships as exactly the same arrangement as a sole proprietorship but with multiple people, that is not really the case. There are actually multiple types of partnership agreements to choose from, but the basic concept is similar: all partners are responsible for the profit and loss of the business.

It’s strongly recommended that all parties enter a partnership agreement that outlines the optimal decision-making process. In general partnerships, profit, liabilities, and management are all divided equally, while in limited partnerships, certain partners may have a lesser share in an area. Joint ventures may also be utilized. Although they are set up like general partnerships, they are only intended for shorter periods.

Although easy to create legally, partnerships do have additional taxes that aren’t required of owners of sole proprietorships, and the partners are held personally responsible for the actions of other partners in the business.

Limited Liability Company

A limited liability company, or LLC, is an option when you want the liability protection of a corporation but the flexibility of a partnership. This benefit is very attractive for many, because if the company is ever in debt or sued, personal assets are protected. Also, because there are fewer restrictions than on a corporation, the owners or “members” of an LLC have the autonomy to distribute profits as they like.

Creating an LLC generally requires higher filing fees and expenses than a sole proprietorship or partnership. To create an LLC, an owner (or owners) must file articles of incorporation with the state. Some states also require additional actions, such as creating an operating agreement that describes the business’s financial and functional decisions or publishing a statement in local newspapers to announce that the LLC has been formed.

Cooperative

Just as the name implies, a cooperative is a business that is created to collectively help its members. It’s popular in the health care, retail, agriculture, art and restaurant industries. It is formed very differently from other arrangements and consists of a collective agreement on a certain strategy. Cooperatives don’t have to be incorporated, and unlike other structures, they aren’t subject to federal business taxes. But members pay both federal and state taxes on the cooperative’s profits along with their personal income tax.

Corporation

For larger companies that will operate independently and have shareholders, a corporation is a good choice. There is limited liability and owners only pay taxes on salaries, bonuses, and dividends. However, corporations are complex entities that are also costly, with high administrative and legal fees. Tax requirements can also be complicated, but some corporations are able to find some relief if they can be designated S corporations.

The difference between a traditional corporation (referred to as a C corporation) and an S corporation is solely how it is taxed. If a company is eligible to be classified as an S corporation, it can avoid double taxing (where a company is first taxed when it makes a profit and then again when shareholders are paid), but there are regulations on what shareholders can pay themselves as employees.

Starting a new business is an exciting time, but also a time filled with important choices to make. How you structure your business can make a huge difference in the functionality and success of your venture, so going into the decision with your eyes open and aware of the pros and cons of each option can make all the difference.