6 Smart Strategies to Start Flipping Houses for Profit

Flipping shows make flipping houses—purchasing property for renovation and future resale, preferably at a significant profit—look fun, profitable and easy, right? In reality, flipping is a business and it can be risky. There are no consumer protections for flippers (like for their buyers) because it’s a business. If you don’t handle flipping like a professional, you’ll fail.

While you can’t avoid risk entirely in this business, you can mitigate it by learning to flip homes the smart way. Following are some solid tips for doing that.

1. Having What It Takes to Flip

Flipping isn’t easy and not everyone is ideal for this business. Before you start flipping properties, you need the right mind-set. Moreover, some key personal and professional characteristics are required for successful flippers. One is the ability to accept and manage risk; you have to be willing to put everything you have on the line for each flip. You must be organized, and you must have perseverance, focus and willingness to work hard. Being able to handle mishaps and mistakes well and move forward quickly while effectively managing money and people are key. You need to be a strong, objective negotiator who’s willing to keep emotion in check and walk away.

But one trait is absolutely critical to profiting as a flipper. “You have to be a fast learner,” says Kyle Alfriend of The Alfriend Group of Dublin, OH, who sees every home as a flip. “Having knowledge and experience starting out isn’t as important as learning what works today.” He has bought and sold 126 homes, living in 18 of them, and represented buyers and investors in more than 1,500 home-buying transactions in the past 26 years. But he says that even an expert like him doesn’t have an advantage over novices. “Just be a quick learner, be flexible and be able to adjust to the markets quickly,” he continues.

Another important trait is vision. “Most residential buyers can’t see past an ugly kitchen or unappealing paint colors and reject deals based on those factors,” explains Mindy Jensen, a licensed real estate agent who has lived in and flipped eight homes. “Being able to see past the ‘ugly’ to the possibilities will make you a great flipper,” she adds. Jensen is also community manager for BiggerPockets.com, a real estate investors’ social media community.

2. Understand Your Market and Know the Numbers

You probably already know that, as a flipper, you make money when you buy. Because your goal is to make a profit on each flip, you decide on your ideal resale price before closing. Doing that effectively starts with knowing your market and performing due diligence on each deal.

The most successful flippers do their research carefully and pick a market (a neighborhood, community or area of a state) and a price range in that market and get to know that market completely. Then they commit to buying primarily in that market. “The master of this business is the marketplace; you have to know the market and adjust yourself and your business decisions accordingly,” explains Alfriend.

By specializing in a market, you’ll know the buyer expectations are for your flips and meet them. “If you know the average price of homes sold in your market, you know before closing what the house will be worth at resale,” says Alfriend. “Regardless of how much you renovate or what number you want, you’ll only get the average market price,” he continues.

To buy accordingly, you’ll also need to know the highest price you’ll pay for your flip and never go above that. Moreover, going in, professional flippers know their carrying costs—the amount they will have to pay each month to keep the house before resale.

These costs are added to those for rehab or renovation, which you’ll also need to know before closing. Closing costs include mortgages or loans, interest payments, taxes and utilities.

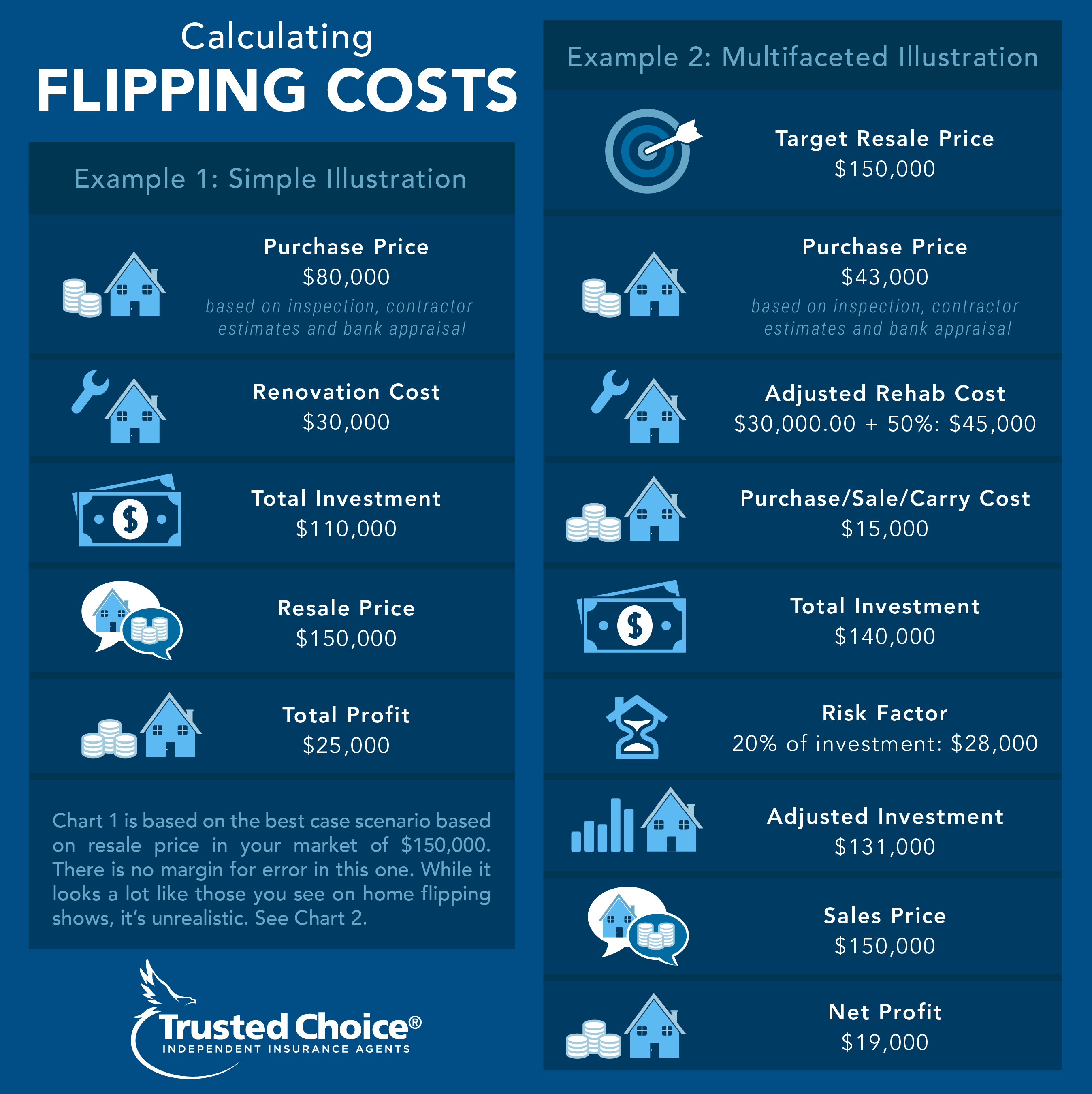

In the two charts below Alfriend illustrates how these costs can be calculated with a simple and a multifaceted illustration. The second chart reflects flipping reality.

Alfriend defines "risk factor" and "error factor" as follows:

Risk Factor: The calculation of the flipper's money at risk including cash, mortgage and rehab costs. It considers market shifts and holding the house between 4-6 months. Precentages for shorter or longer flip projects can be adjusted accordingly.

Error Factor: Calculates unexpected costs of rehab once walls, floors and ceilings are removed during rnovation. *The chart above adds 50% for typical pre-sale calculation errors. You can reduce the percentage accordingly for simpler (cosmetic) rehabs and increase accordingly if ther ar sturctural changes required.

According to Alfriend, “The second chart accounts for any mistakes you make in calculating costs or during the flip or if the market shifts on you. These numbers have the margin to still allow for a fire sale at a profit. They also allow you to sell at an aggressive price and bring multiple offers so you can choose the best transaction terms.”

The key to this cost calculating strategy is to do it before you make the offer so you know what offer price you’re making and what your target sales price is. You can use an Excel speadsheet or other spreadsheet program to calculate those costs (which a qualified real estate professional can help you with creating). But, avoid using online forms for this process for anything other than formatting because they won’t be customized enough for your specific market and type of properties.

3. Know the Source of Your Financing and Be Ready to Act

Professional flippers have a proper understanding of flip financing. No matter what you’ve heard, you can rarely flip with none of your own money down and poor credit. Both experts agree you have to have one or both, depending on the flip. Says Jensen, “You can buy flips with none of your own money but can’t complete them entirely without your own money.” In addition to carrying costs, Jensen reminds flippers, “Your own money for rehab costs will probably come from credit cards or other lines of credit.”

However, you can obtain “hard money” from commercial lenders for the entire property purchase price, but those risky loans have short repayment time frames and extraordinarily high interest rates. It’s best to get financing from cheaper sources, especially when you’re starting out and you can’t accurately predict flip completion timelines. Conventional home mortgages, home equity loans, family or private loans (from private citizens with disposable income) and partnering with other investors are cheaper financing sources with better terms. Most require strong credit, however.

Alfriend prefers to have the cash on hand to buy flips. He says, “Flippers should become able to do all-cash deals as soon as they can.” Jensen lives in her flips, so she gets conventional residential mortgages.

Know which financing type you’ll get and be ready to make the offer.

4. Choosing the Right Properties

After you understand the basics of flipping, you can find flips in your market using MLS or the many websites that list them. Also, driving through neighborhoods or finding estate sales are ways to find flips. “Don’t overlook ugly houses,” says Jensen.

However, it’s best for new flippers to use licensed real estate agents who are knowledgeable about selecting flips, conducting due diligence on them and costing them out, including the projected offer, rehab costs, carrying costs and final resale prices. They should be experts in your market who can show you deals they’ve done and negotiate good deals for you.

Remember, flips are products for resale, so be all business. Only buy flips that you can renovate properly and still make a profit at resale. Any others are bad deals.

5. Avoid Big Mistakes

The biggest flipper mistake Jensen sees is buying more house than they have time to rehab and get back on the market. “Know the scope of the project you can do and don’t get in over your head,” she says. “Know what rehab skills you have and buy a flip that you can do well on your own, or hire good help to do the work.” You can avoid that mistake with due diligence and following the steps above.

For Alfriend, getting greedy is the biggest flipper blunder he witnesses. “Flippers have a top price they’ll spend and don’t go over it. They don’t get into bidding wars and they don’t think one house is going to make them rich.” Besides failing to complete due diligence and not knowing the market, greed causes flippers to make costly mistakes, like paying too much for a house to make a profit or overlooking major, costly problems with properties.

In addition to your rehab budget, have a formal rehab timeline and stick to it or it may cost you. Jensen reminds flippers, “Factor in the unexpected things you find in every single flip when you start removing walls, for example, and add 10% to 20% to your initial budget for contingencies.”

Be careful using information from expensive “how to flip” and “learn flipping” programs. Don’t waste money on them. Be wary of online forums, too. Both experts said that after you learn the key information, you learn by doing flips. The expensive programs and seminars make their sellers money but teach little you need to know to flip successfully. Using them can lead to mistakes, too.

You don’t need these programs to learn the basics, which are, according to Jensen, “Know the market; know what houses sell for; know what a good deal is; and when you see one, be ready to take action.”

6. Choose the Right Team and Be in It for the Long Haul

Your team is pivotal to your success. To start flipping the smart way, you’ll need a strong team, starting with the right real estate agent and lawyer as well as solid financing sources. You’ll also need a good home inspector or structural engineer, and reliable and expert flip contractors.

Finally, know that it takes time to become successful as a flipper, especially since you’ll likely start by doing one or two smaller flips a year. Because the market drives resales and can change overnight, Alfriend says, “Be in this for the long haul. Be prepared to carry a flip longer than expected or to rent it out until you can get your price.”