HO6 Condo Insurance

Hint: Because you've got to protect your home

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

Living in a condo brings pretty much the same concerns as living in a house, and maybe even a few more. You've got to keep your home protected against threats from vandalism to fire and beyond. That's why having a special type of homeowners insurance, called HO6 insurance, is so important.

Luckily an independent insurance agent can help you find the right HO6 insurance for your needs. Even better, they'll get you set up with coverage long before you need to file a claim. But first, here's a deep dive into HO6 insurance and why it's important.

What Is HO6 Insurance?

HO6 insurance is a special form of homeowners insurance designed for condo or co-op owners. It protects the parts of your condo unit that the condo association’s master policy doesn't. Really, an HO6 plan is meant to cover everything inside the walls of your home, along with liability, while the association’s policy will cover everything outside of your unit’s walls.

HO6 condo owner coverage takes care of stuff inside the unit, such as the following.

- Fixtures

- Carpets

- Appliances

- Electronics

- Personal belongings (e.g., clothing, sports gear, jewelry)

A condo association’s master policy covers anything going on outside the units, such as the following.

- Elevators

- Basements

- Hallways

- Roof

- Boilers

- Walkways

Most mortgage companies and financial lenders require condo owners to buy an HO6 insurance policy. This protects both the condo owner and the lender.

Why Is HO6 Insurance Important?

HO6 insurance provides crucial protection for condos from a physical perspective, and offers liability coverage for the owner as well as temporary living expenses if the condo becomes uninhabitable due to a covered disaster. Sometimes HO6 policies are called "walls-in" coverage since they're designed to protect your unit only. Common areas in the building are protected by the condo association's policy.

Who Sells HO6 Insurance?

HO6 insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. They know which insurance companies to recommend to meet your needs, and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies could create an HO6 insurance policy for you, finding coverage could also depend on the area you live in. Here are a few of our top picks for HO6 coverage.

| Top HO6 condo insurance companies | Star rating |

| Progressive |

|

| Liberty Mutual |

|

| Allstate |

|

| Farmers Insurance |

|

One HO6 insurance company outshines its competitors.

- Best overall HO6 insurance company: Liberty Mutual

Liberty Mutual has been in the insurance industry since 1912, and is rated "A+" by the Better Business Bureau and "A" by AM Best. This Fortune 500 company also offers one of the best HO6 products available on the market. Their HO6 coverage includes the following.

- Personal property coverage

- Liability coverage

- Dwelling coverage

- Blanket jewelry coverage

Liberty Mutual also offers a few discounts on their HO6 coverage. An independent insurance agent can help you decide if Liberty Mutual is the right carrier for your coverage needs.

What Does an HO6 Insurance Policy Cover?

HO6 insurance provides a lot of critical protections for condo owners. While your policy may vary depending on your insurance company, there are a few standard coverages included in most policies.

Coverage type/definition

| Coverage type | Definition |

| Dwelling | Covers the structures of your condo like the floor, windows, and walls. |

| Personal property | Covers belongings inside your condo like furniture, clothing, appliances, and sports gear. |

| Loss of use/temporary expense | Covers expenses for staying at a hotel or relocating while your condo unit is being fixed. This only applies if your home is unlivable because of a covered risk. |

| Liability | Covers the legal fees if someone gets physically injured on your property or has their personal items damaged. Covered costs include the other party’s medical bills, repairs to their property, and your legal defense if you get sued. |

| Medical payments | Covers medical bills for someone who’s hurt on your property regardless of who's at fault. |

An independent insurance agent can further explain the important protections provided by an HO6 insurance policy and how they can benefit you.

A Breakdown of HO6 Insurance's Covered Perils

| Usually covered | Usually not covered |

| Fire and smoke | Earthquakes |

| Explosions | Floods |

| Wind and hail | Intentional injuries to others |

| Theft | Nuclear hazards |

| Vandalism | Damage from birds, rodents and insects |

| Lightning | Wear and tear |

| Burst pipe | Damage from underground water (such as sewer backups) |

If you're concerned or confused about what's covered or not covered by your specific HO6 insurance policy, ask your independent insurance agent to review it with you.

What Does the Condo Association’s Master Insurance Policy Cover?

The fees you pay for owning your condo help fund the building's master policy. This policy covers the following.

- The building's exterior: Damage caused by storms

- Common areas: Damage to lobbies, elevators, hallways, outdoor areas, etc.

- Injuries on the premises: Slips and falls in the lobby, hallways, or other common areas, or even outside

An independent insurance agent can further explain what the condo association's master policy covers versus what your HO6 policy covers.

What’s the Difference between HO6 Insurance and Condo Insurance?

Condo insurance is often used interchangeably with HO6 insurance. The key difference with HO6 insurance is that it's used for both condo insurance and co-op insurance. It's a specific form of homeowners coverage customized for these living situations only.

What's the Difference between H06 Insurance and Homeowners Insurance?

Homeowners who live in a stand-alone house are responsible for their entire property, from the interior to fencing and garages outside. Condo owners are only responsible for the walls and interior of their specific unit.

Condo insurance or HO6 insurance doesn't need to provide coverage for common areas of the building or the outdoors, since the condo association's master policy does that. So, an incident that happens outside of a house would be covered by homeowners insurance, whereas if it happened at a condo, you wouldn't be held liable either way.

What Are Some Other Benefits of HO6 Condo Insurance?

Besides all the great protections HO6 condo insurance gives you, there are a few other benefits to getting such a policy. Some of these include the following.

- HO6 condo coverage takes into account any upgrades, improvements, or alterations within your unit.

- Condo policies are usually pretty affordable and often have small deductibles.

- Coverage for special belongings (e.g., fur coats or heirlooms) can be added to an HO6 for a minimal fee.

- Coverage for natural disasters not included on the standard HO6 can also be added for a minimal fee, like for earthquakes, storms, and flooding.

- HO6 condo plans have to, by law, cover at least 20% of the condo unit’s estimated value.

- Some insurers will cover your condo if it’s being rented for less than two nights, like through an Airbnb.

- HO6 insurance is meant to provide coverage where the condo association’s master policy ends, for personal property and liability.

Is HO6 Insurance Required?

Often, it is. Mortgage lenders usually require condo owners to get at least minimal HO6 coverage for their unit. So, while coverage isn't technically required by law, you're still likely going to be required to have it before you move in.

The type of coverage you need depends on your building's master policy. If the master policy is what's called bare walls-in, the mortgage lender will probably require tenants to have coverage that can replace the full interior structure after damage or destruction. If the building's policy is all-in, you're probably only going to be asked to have coverage for improvements or renovations.

What Isn’t Covered by an H06 Policy?

Just like any other type of coverage, HO6 insurance comes with its own set of exclusions. Your policy may vary, but here are some of the most common exclusions.

- Flood damage

- Earthquake damage

- Insect infestations

- Routine maintenance

- Wear and tear damage

- Intentionally malicious acts

An independent insurance agent can help you address any concerns about coverage gaps in your policy. If you live in an area prone to hurricanes and other disasters, they may recommend adding a separate flood insurance policy.

How to Buy HO6 Insurance

- Check your association's master policy to find out if it’s an all-in, bare walls, or single entity policy.

- Determine your personal liability coverage needs as a tenant.

- Calculate the value of your personal property to determine if you need additional floaters.

- Select replacement value or actual cash value reimbursement coverage.

- Decide if you want to add flood, earthquake, or sewer backup coverage to your policy.

- Check your condo documentation. If necessary, add extra master policy deductible and special assessment coverage.

- Finalize the list of coverages you need and shop top-recommended insurance companies. An independent insurance agent can help with this.

How Much Does HO6 Insurance Cost?

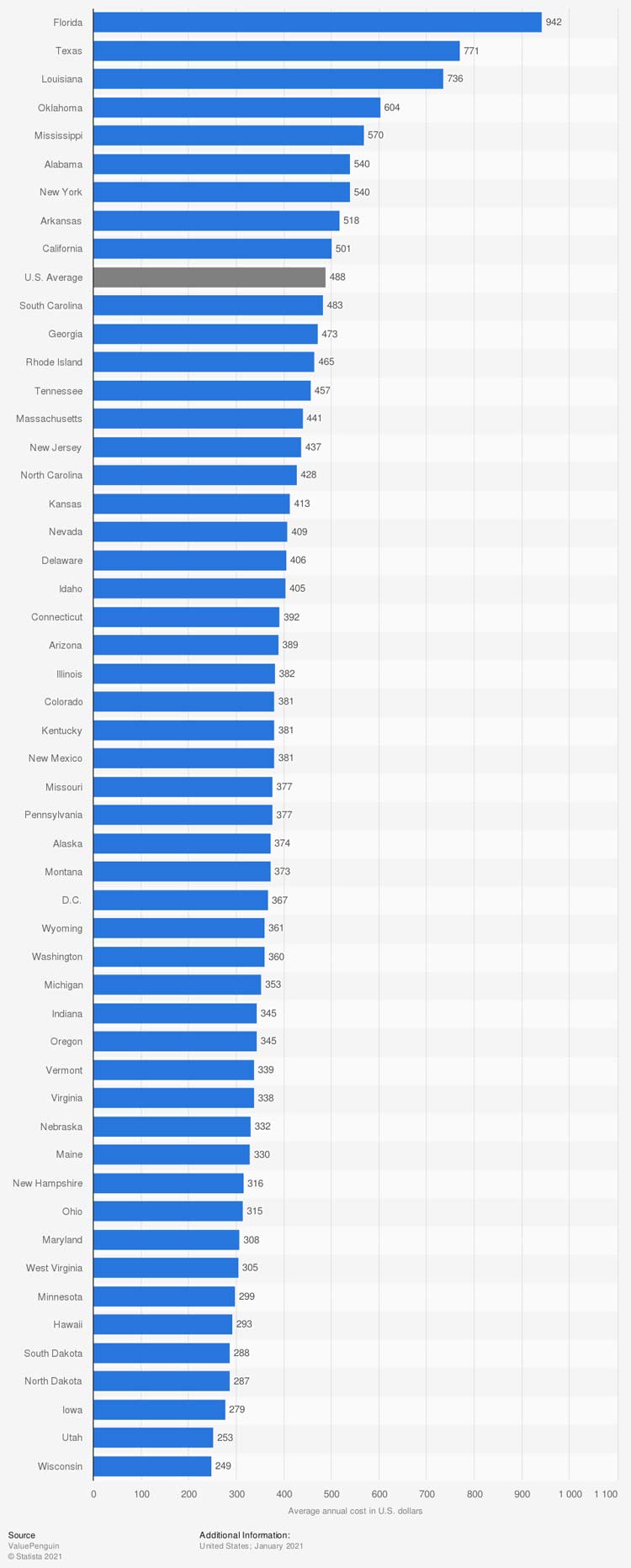

The cost of your HO6 insurance could depend on where you live, as well as a few other factors. Here's a breakdown of state-by-state premiums for this coverage.

Premiums of condo insurance in the U.S. by state in 2021

The US average for HO6 coverage as of 2021 was $488 annually. Certain states, like Florida ($942 annually), and Texas ($771 annually), paid much more for coverage. Other states, such as Wisconsin ($249 annually), paid much less.

An independent insurance agent can help you find exact quotes for HO6 insurance in your area.

Frequently Asked Questions about HO6 Insurance

To determine how much HO6 coverage you need, work together with your independent insurance agent. They'll help you assess the value of your personal property and your risk level, as well as factor in the coverage already provided by your condo association.

Yes, to an extent. HO6 policies often cover water damage that stems from your plumbing, appliances like water heaters, HVAC units, etc. However, to cover natural flood damage, you'd need a separate flood insurance policy.

Condo insurance is often used interchangeably with HO6 insurance. The key difference with HO6 insurance is that it's used for both condo insurance and co-op insurance. It's a specific form of homeowners coverage customized for these living situations only.

The cost of your coverage depends on where you live and the amount of coverage you need. However, the national average for HO6 insurance as of 2021 was $488 annually.

Why Are Independent Insurance Agents Awesome?

It’s simple. Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print, so you know exactly what you’re getting.

There’s no business too small for our gifted independent insurance agents. They have access to multiple insurance companies, ultimately finding you the best HO6 coverage, accessibility, and competitive pricing while working for you.

https://www.statista.com/statistics/1198046/average-annual-condo-insurance-premiums-usa/

https://www.iii.org/article/homeowners-insurance-basics

https://www.irmi.com/term/insurance-definitions/homeowners-policy-unit-owners-form-6