Cheap Home Insurance

(The affordable way to protect your home)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Whether you’ve just purchased a new home or are doing some clean-up of your current home insurance policy, you’re feeling the financial effects of owning property. You’re ready to save some money where you can, and we’re here to help.

While home insurance rates are increasing across the country, our independent insurance agents are patiently waiting to use their insurance-finding superpowers to protect your humble abode without sacrificing the benefits you need in your policy.

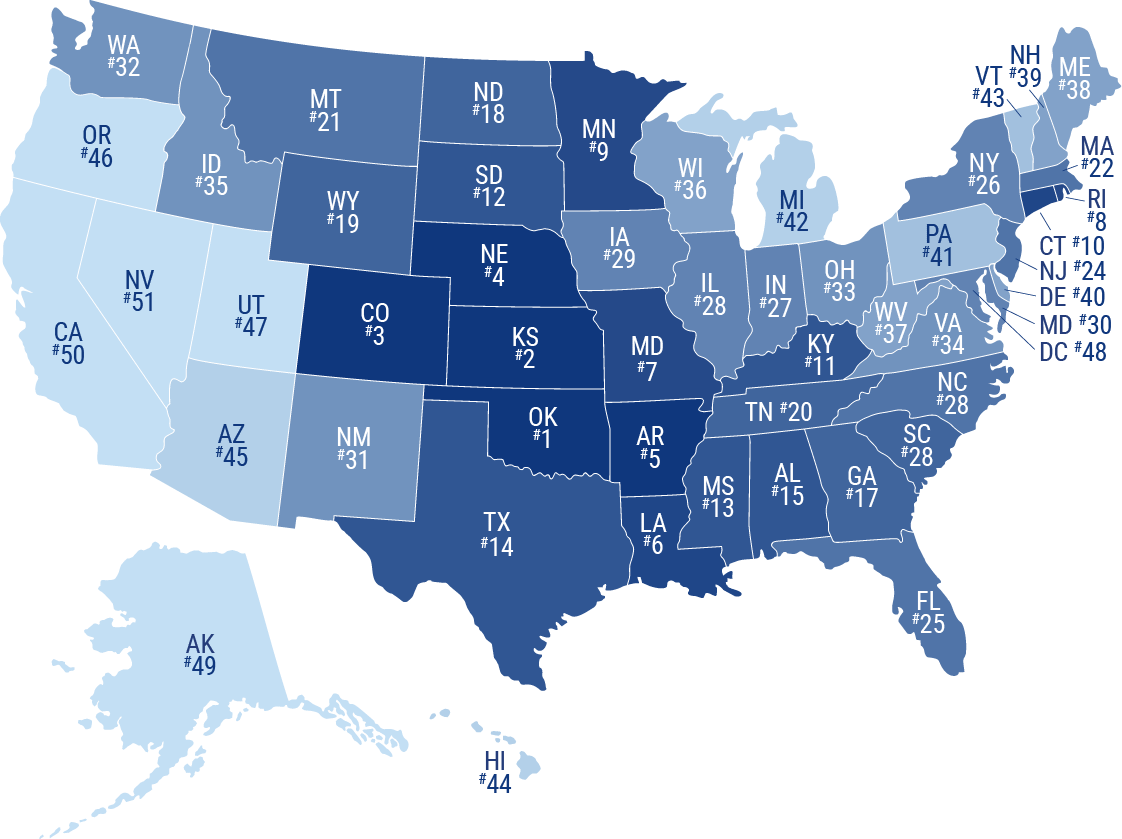

Which states have seen the biggest increases in home insurance rates?

| Rank | State | 2007 Premium | 2018 Premium | % Increase | $ Increase |

| 1 | Oklahoma | $1,054 | $1,875 | 78% | $821 |

| 2 | Kansas | $904 | $1,548 | 71% | $644 |

| 3 | Colorado | $826 | $1,446 | 75% | $620 |

| 4 | Nebraska | $807 | $1,402 | 74% | $595 |

| 5 | Arkansas | $762 | $1,348 | 77% | $586 |

| 6 | Louisiana | $1,400 | $1,967 | 41% | $567 |

| 7 | Missouri | $726 | $1,280 | 76% | $554 |

| 8 | Rhode Island | $950 | $1,496 | 57% | $546 |

| 9 | Minnesota | $800 | $1,340 | 68% | $540 |

| 10 | Connecticut | $929 | $1,455 | 57% | $526 |

| 11 | Kentucky | $578 | $1,085 | 88% | $507 |

| 12 | South Dakota | $618 | $1,125 | 82% | $507 |

| 13 | Mississippi | $1,019 | $1,525 | 50% | $506 |

| 14 | Texas | $1,448 | $1,937 | 34% | $489 |

| 15 | Alabama | $905 | $1,386 | 53% | $481 |

| 16 | South Carolina | $808 | $1,285 | 59% | $477 |

| 17 | Georgia | $724 | $1,200 | 66% | $476 |

| 18 | North Dakota | $771 | $1,239 | 61% | $468 |

| 19 | Wyoming | $656 | $1,120 | 71% | $464 |

| 20 | Tennessee | $723 | $1,185 | 64% | $462 |

| 21 | Montana | $700 | $1,130 | 61% | $430 |

| 22 | Massachusetts | $1,023 | $1,451 | 42% | $428 |

| 23 | North Carolina | $674 | $1,098 | 63% | $424 |

| 24 | New Jersey | $776 | $1,174 | 51% | $398 |

| 25 | Florida | $1,534 | $1,918 | 25% | $384 |

| 26 | New York | $936 | $1,309 | 40% | $373 |

| 27 | Indiana | $647 | $1,003 | 55% | $356 |

| 28 | Illinois | $700 | $1,042 | 49% | $342 |

| 29 | Iowa | $610 | $945 | 55% | $335 |

| 30 | Maryland | $692 | $1,022 | 48% | $330 |

| 31 | New Mexico | $667 | $996 | 49% | $329 |

| 32 | Washington | $506 | $822 | 62% | $316 |

| 33 | Ohio | $540 | $850 | 57% | $310 |

| 34 | Virginia | $683 | $966 | 41% | $283 |

| 35 | Idaho | $422 | $703 | 67% | $281 |

| 36 | Wisconsin | $491 | $762 | 55% | $271 |

| 37 | West Virginia | $646 | $917 | 42% | $271 |

| 38 | Maine | $596 | $866 | 45% | $270 |

| 39 | New Hampshire | $699 | $965 | 38% | $266 |

| 40 | Delaware | $559 | $816 | 46% | $257 |

| 41 | Pennsylvania | $689 | $927 | 35% | $238 |

| 42 | Michigan | $721 | $952 | 32% | $231 |

| 43 | Vermont | $704 | $898 | 28% | $194 |

| 44 | Hawaii | $850 | $1,026 | 21% | $176 |

| 45 | Arizona | $634 | $803 | 27% | $169 |

| 46 | Oregon | $496 | $659 | 33% | $163 |

| 47 | Utah | $505 | $664 | 31% | $159 |

| 48 | D.C. | $1,089 | $1,225 | 12% | $136 |

| 49 | Alaska | $861 | $974 | 13% | $113 |

| 50 | California | $925 | $1,000 | 8% | $75 |

| 51 | Nevada | $695 | $742 | 7% | $47 |

Why Cheaper Is Never Better

Going cheap can go south quickly, so tread lightly when trying to penny-pinch on your home insurance policy. The last thing you want to do is underinsure your home and end up with a hole in your wall that's never being replaced.

But don’t give up on your money-saving dreams. We’re not here to tell you it’s not possible to get cheap home insurance, we’re here to show you how to save money on your policy and still get everything you need to protect your precious sanctuary.

The 5 Best Cheap Homeowners Insurance Companies

| I want the best company for... | Company |

| Best Company Rating | Amica |

| Best for New Homeowners | Allstate |

| Most Personalized Quotes | State Farm |

| Extended Endorsements | Progressive |

| Best Replacement Coverage | MetLife |

Source: https://www.reviews.com/homeowners-insurance/cheap/

How Can I Save Money on My Home Insurance?

Finding the available discounts in a home insurance policy is like finding a needle in a haystack. You know it’s in there, but you’ll never see it.

Most of the ways to find cheap home insurance will not be spelled out in your policy. However, that doesn’t mean they don’t exist. Here are some super-secret ways to bring your home insurance premium down.

- Double-check the replacement cost of your home property: Your current homeowners insurance company may not be properly valuing your home. If your policy is insuring a $500,000 home but yours is actually only worth $300,000, you could be wasting thousands of dollars.

- Check in with your agent every year: Insurance agents may not be checking in on your policy every year, so it’s okay to give them a little nudge to see if anything’s changed that can save you money.

- Clean out dangerous items: Trampolines, fire hazards, wood-burning stoves, and even the breed of your dog can increase your premium.

- Enhance your safety features: Installing sprinkler systems or burglar alarms and having a high-quality roof can lower your premium.

- Bundle up: Insurance companies love to bundle your insurance. It gives them more business and saves you money.

- Understand your policy: If you live in a state that never gets tornadoes, then you don’t need tornado insurance. Make sure you fully understand what’s in your policy so you know you’re only paying for what you need.

- Buy a new home: New homes qualify for a new home discount.

What’s So Great About an Independent Insurance Agent?

Picture a personal shopper who understands every aspect of your body, knows how to accentuate your good parts and tuck away those not so great parts, and sends you out into the world feeling like a rock star every day.

Yep, that’s what an independent insurance agent is like. They get to know you inside and out. They shop the best policies and present you with the perfect option for you. They’ve got a magnifying glass on your needle and will find it in the haystack, every time.

The Scoop on Home Insurance Quotes Online

Our independent insurance agents are also just one click away, and then you’re having a conversation with a real person who is ready to find a home insurance policy that fits your wallet and your home.

Continuing Your Insurance Search

Now that you’ve got the skinny on how to find affordable home insurance that doesn’t skimp on the stuff you need to actually protect your home, you can fly out into the real world.

Free up our home insurance seeker and float your way into the arms of an independent agent to discover the best cheap home insurance options for you.

Cost stats taken from NAIC annual insurance report