The 5 Most Important Financial Decisions Entrepreneurs Face

Tom Malesic is president and founder of EZMarketing, a digital marketing agency located in Lancaster, Pennsylvania. He and his team help small businesses build and market their websites.

Making good financial decisions is like choosing to eat eggs instead of a donut for breakfast. It’s just what has to happen when you’re an adult. No one is perfect. In fact, according to the National Foundation for Credit Counseling, 4 out of 10 adults would give themselves a grade of C, D or F when it comes to their personal financial knowledge.

If you enjoy the wild life of living paycheck to paycheck, we don’t judge. But that’s not going to cut it in the business world. Your financial decisions affect your cash flow, which affects your business.

One of the top reasons that more than half of small businesses fail within the first year is because they struggle with making good financial decisions. To help you succeed, we called on entrepreneur and business professional, Tom Malesic, to spread his infinite wisdom on the most important financial decisions you’ll have to make as a small business. Now, let's learn what you’ll be up against.

How Much Money Do I Need to Run a Business?

First things first. You need to figure out how much cash you'll need to run your business. If you're a social media consultant, you don't need much working cash, because your out-of-pocket expenses are low. If you're a downtown clothing store, you'll need enough cash to cover your inventory, rent and employees.

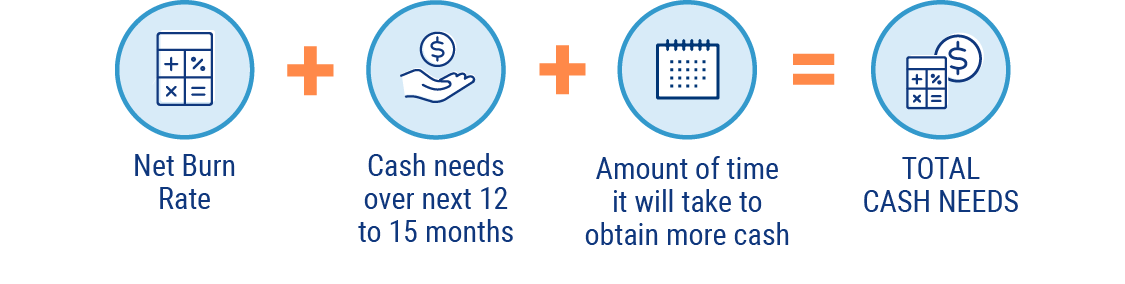

There’s no magic formula to calculate your cash needs, but we did our best to build you one.

Formula

Now, what does this formula mean?

- Determine your net burn rate: Your net burn rate is how much money you have left after you look at cash from your sales and your expenses. If you have $70,000 in sales and $20,000 in expenses, your net burn is $50,000.

- Calculate how much money you plan to use over the next 12 to 15 months: If you’re a start-up, this should be in your business plan.

- Consider the current stage of your business: A start-up will have different cash needs than an established business.

- Understand how long it will take you to get more cash if you need it: Can you obtain cash in a matter of days, weeks, or months?

Did Small Businesses Create a 2018 Budget? Company Size

Percent of total respondents

N = 301 small business owners involved in their business’s financial decisions

How Do You Get the Working Cash?

So you now have a rough idea of how much cash you need from our totally legit cash needs formula. The next step is figuring out where you’ll get this cash. In a perfect world, you grow your business organically and it self-funds as you grow. Also in a perfect world, you can cuddle puppies at the snap of a finger.

When you can’t be smothered in puppies, or your business isn’t growing organically, you will need to seek other cash options.

“You might be able to get a traditional loan from a bank, borrow money against your house, or get a line of credit at your bank,” said Malesic. “But there is a good chance you will get turned down because as a small business owner you are a high-risk investment.”

A better option would be to look for investors or ask your friends and family. Many small business owners are seeing success with GoFundMe pages and other business fundraising.

Should You Hire Employees or Outsource the Work?

As your business grows beyond you and a few employees, you will start to think about adding more staff to do the jobs that you are currently doing.

More staff means more payroll and dealing with more employees. You’ll need to make another tough decision on whether the added burden is worth the payoff.

Many positions can be outsourced, which will save you money. The following positions are easy to outsource.

Easiest Jobs to Outsource

- Bookkeeping

- Computer support

- Marketing

- Human resources

- Writing

- Social media

- Customer support

- Personal assistants

- Web programmers

- Designers

- Drafters

- Security guards

- Call centers

- Medical professionals

- Medical transcription

- Manufacturing

- Research & development

Every dollar you save on salaries is money you now have for working cash.

How Much Can You Spend on Sales and Marketing?

Thinking your business is going to grow without spending some money on sales and marketing is like thinking the Blazin sauce at Buffalo Wild Wings isn’t going to give you an upset stomach. Some things are just fact.

“When you’re getting started it’s hard to spend money on marketing because you haven’t saved the money that you need to grow the business, but if you don’t market your company you will struggle with cash.”

The solution? Consider spending 10%-15% of your revenue on marketing. This might feel like a lot, but if you don’t, you won't have a healthy business.

How Do You Plan for Emergencies?

You might still be spending every penny you make. It's hard not to. When you have a good month, you might want to spend the extra money growing the business by expanding, or you might want to spend it on yourself.

You need to save some of your money for the future. You will have emergencies you never thought of. You might find that your roof needs to be replaced, a piece of equipment broke, or you're being sued. These unexpected things will happen.

So start the habit of putting money aside. This is also a good time to reach out to an independent insurance agent about the kinds of business insurance you might need. It’s important to make sure that all your hard work is protected.

In Conclusion

Being a successful business owner is all about making good decisions. The good news is you already made a great decision by checking out this article. Asking yourself these five questions, and knowing the answers, can serve as the foundation of your company. A few smart decisions today will result in a lifetime of success. Now go make good choices!

https://www.score.org/blog/how-much-cash-should-small-business-keep-reserve

https://money.howstuffworks.com/10-jobs-to-outsource10.htm

https://screenshotmonitor.com/blog/10-jobs-in-highest-risk-of-outsourcing/

https://www.cnbc.com/2014/01/10/making-financial-literacy-fun.html

https://clutch.co/accounting/resources/why-small-businesses-need-budgets