Does My Business Liability Insurance Cover a Lawyer?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Business owners try to avoid legal battles at all costs, but sometimes life has other plans. That's why we have business insurance. Did you know your business liability coverage might include a lawyer if you need counsel? We know. So you don't have to.

Fortunately, in times of uncertainty, there are independent insurance agents. They're an invaluable asset to businesses and their success, and the perfect experts to speak to when you have questions like whether your insurance pays for a lawyer. Spoiler alert: It does, and it pays for a lot more than that when it comes to legal issues. So let's learn a bit more.

Does My Business’s Liability Coverage Provide Help with Legal Fees?

Yes! In fact, assisting you with legal fees is one of the sole purposes of liability coverage. There are a lot of ways your business can be sued: a customer gets injured on your property or by your business, faulty advertising, damaged products, poor advice, and the list goes on. Your liability insurance is designed to protect your company's assets, financial obligations, legal defense, and any settlements or judgments awarded to an injured party.

Your business's liability coverage will provide help with the following related legal fees:

- Court costs

- Lawyer fees

- Settlement fees

- Judgment fees

Are There Any Limits in Liability Coverage I Should Know about?

Your limit is the maximum amount your insurance policy will to pay in the event of an incident. There are several options when it comes to business liability insurance, including general liability, professional liability, commercial vehicle liability, premises liability, and product liability, to name a few. Each of these products covers a variety of risks and will have a policy limit that determines the most money the policy will pay toward a claim before you're on your own. This means if your general liability limit is $1,000,000, your insurance company will cover up to $1,000,000 in claims.

What's more, there are limits of liability for everything that is included in your policy. While your overall premises limit might be $300,000, your insurance may only cover up to $50,000 in damage that results from a fire. This is why it's important to work with your independent insurance agent to fully understand the limits in your policy to make sure you have enough coverage for all of your business's risks.

What Isn't Covered by Liability Insurance?

Liability insurance is the most basic recommended insurance for all businesses because it covers you for some of the largest risks you face. However, that doesn't mean you aren't still exposed in the few areas that liability insurance doesn't provide coverage for. This includes:

- If an employee gets sick or injured on the job. This is what workers' compensation is for.

- If you damage your own business property. If you get upset and throw your computer through a window, your insurance isn't going to cover it.

- Auto accidents that are caused by you or your employees while driving for work. This is what your commercial auto insurance policy is for.

- Illegal or malicious acts that are done on purpose.

What Are the Most Common Liability Coverages Needed in Business?

Even though business liability insurance is specific to your business needs and operations, risks, and loss history, there are some common liability coverages that most businesses need. The most common liability policy types are general liability, commercial auto liability, employment-related liability, and special liability.

- General liability: This is liability coverage for an injury or damage caused by your company or products used in your business operations. This policy will cover things like customer slips and falls during business operations. Should a customer get hurt as a direct result of your business product or on your business premises, then general liability is the coverage you need.

- Commercial auto liability: This is liability coverage for your commercial autos used for business operations and titled in the business name. Businesses are required to have insurance on any company-owned vehicles. Commercial auto liability needs to be written properly, meaning that the vehicles must be titled in the business name and each permissible driver needs to be listed on the policy. If a driver or vehicle is found not to be scheduled on the commercial auto policy, then coverage can, and most of the time will, be denied.

- Employment-related liability: This is for any wrongful employment practices, including fiduciary, discriminatory, and wrongful termination. It is an especially important coverage, since you can still be sued even if the claim is false — it is the employee's word against the business owner's. Documentation of every employee meeting, review, and disciplinary action is vital to ensure your business is properly protected.

- Special liability: This is liability insurance for perils involving pollution, aircraft, special off-premise events, liquor, and professional liabilities. These types of insurance can provide coverage for professionals such as lawyers, insurance advisers, and doctors, as well as for special events such as weddings and nonprofit galas.

What DOESN'T My Business Policy Cover?

If not selected carefully, you can miss out on necessary business insurance add-ons or policies that are unique to your risks. If you were to select a BOP policy, the following would not be included:

- Professional liability

- Auto insurance

- Workers' compensation

- Health and disability insurance

- Flood and sewer back-up

- Cyberrisk insurance

- Terrorism insurance

However, each of these insurances can be added on separately. Whatever risks your business faces, you can purchase a policy that provides protection. An independent agent can help make sure you have the proper coverage as well.

It is important to note that no matter how much business insurance you have, no business policy will cover any incidents related to your personal assets or well-being. If your house burns down in a fire, or you're in a personal car accident, your business policy won't cover these events.

What Other Coverages Should I Consider Adding?

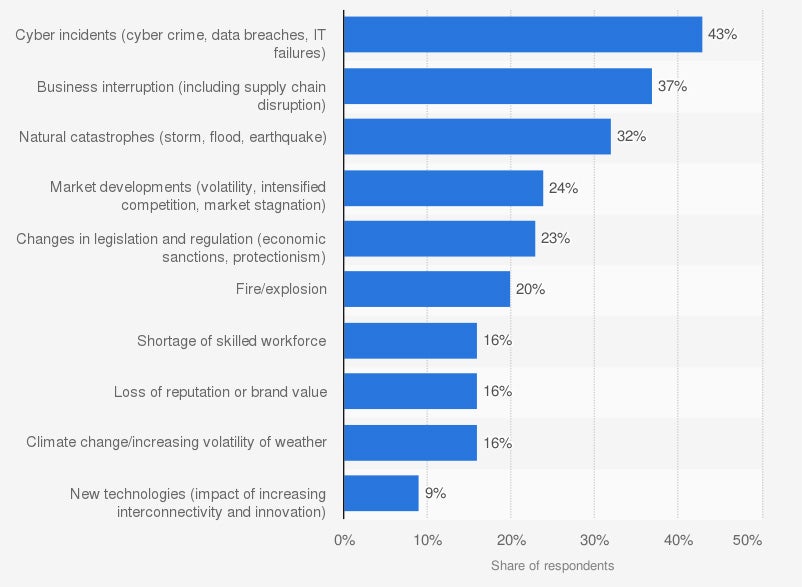

Over the years, the most common risks to businesses have shifted more towards technology-related incidents. Today, the most common risk to businesses include a variety of cyberattacks. Other common risks include business interruption incidents that result in lost income, natural catastrophes, and the other incidents listed below.

Leading risks to businesses in the United States in 2020

Source: Allianz ©Statista 2020

When you're building your business policy with your insurance agent, keep these common risks in mind to make sure you add coverage for these risks if they may affect your business.

Here’s How an Independent Insurance Agent Can Help

Business insurance stretches far and wide and can protect your business against a variety of potential perils. An independent insurance agent helps you build the right insurance package for your business and understand what's in your policy. They search through multiple carriers to find providers who specialize in business insurance, deliver quotes from a number of different sources, and walk you through them all to find the best blend of coverage and cost.