The 5 Most Overlooked Financial Risks for Your Small Business

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

If you’re starting a business, there’s a good chance you’re more than a little haunted by the word "risk." After all, it’s essentially at the core of starting any business. And that’s why risk management exists. While taking huge risks can be as scary as hitting up Costco on a Saturday afternoon, risks can also be managed if you know what risks to prepare for.

That’s why we spoke with an insurance expert/friend of ours, Paul Martin, to learn about the real financial risks that small businesses face. And we’re not talking about your typical risks, like losing clients, overspending, or not understanding your cash flow. We’re talking about the risks no one talks about – the sneaky ones. Understanding these less common financial risks can help keep your business afloat longer.

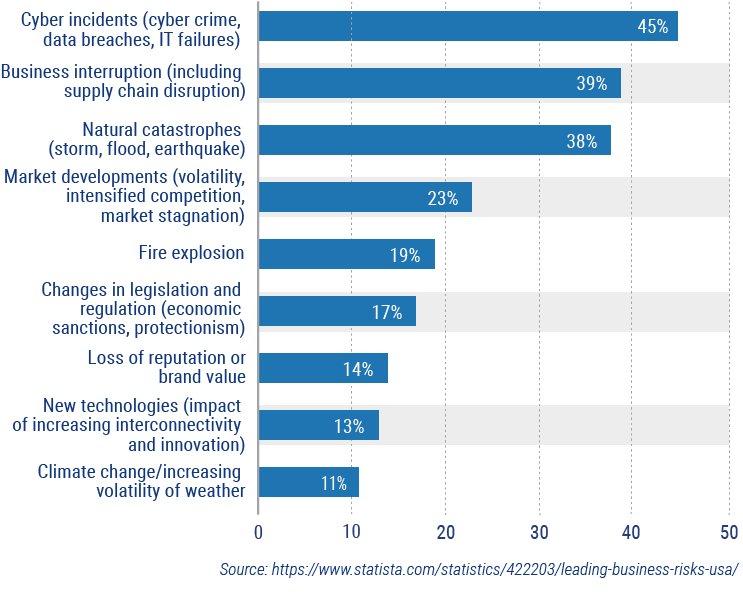

Leading risks to businesses in the United States in 2017

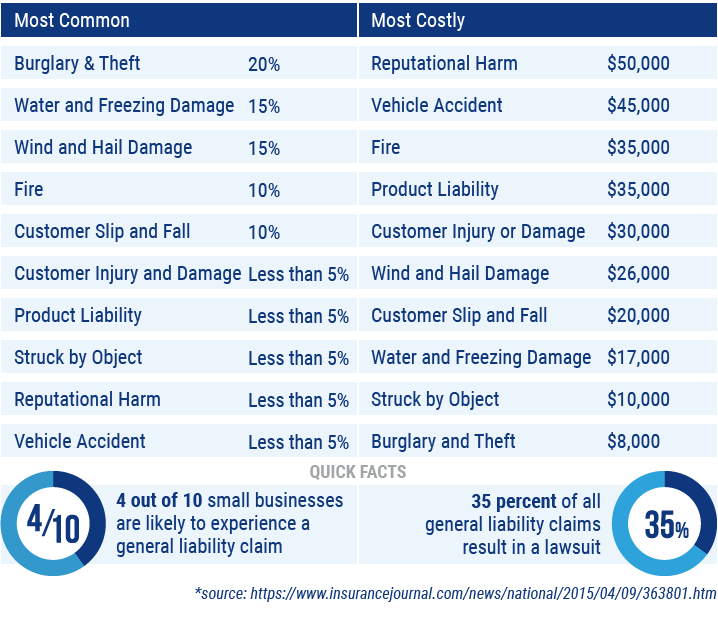

#1. General Liability Risks

The biggest insurance risk that a small business takes is the liability that you’re assuming when you begin to do business.

“People that aren’t in the insurance business don’t understand how many ways they can be sued and what for.”

To say that the United States is “sue happy” would be a bit of an understatement. People are constantly trying to get free money any way they can, and suing a successful business is one way to do it.

“Anyone can sue anybody for anything, an innocent mistake or a simple accident can result in someone suing you for something you didn’t expect.”

This is why you need a general liability policy or CGL. A CGL provides the broadest response to accidents. It doesn't cover every kind of accident or incident, but it is designed to provide for the most common events. If you screw up, someone gets hurt, or something gets damaged, it will respond and protect your business and pay on its behalf.

#2. Not Having Insurance for Common Accidents

Wait, didn’t we just cover this with general liability insurance? Well, yes and no. While your CGL will cover a variety of common accidents, it is intended to protect you from third-party incidents. This means that it mostly covers accidents that happen to your customers, but in many scenarios will not cover accidents that are caused by you or your employees.

For example, if you own a hair salon and one of your hair stylists burns a client, your CGL will cover the medical bills for the customer. However, if your employee slips and falls inside the salon, your CGL will not cover the medical bills. That’s why you have workers’ compensation, which we’ll cover next.

“I see a lot of small contractors get stuck in common accidents they didn’t think about. I had a client who was trenching and cut through an AT&T line. It was a nightmare. It knocked out the phones for several million customers and cost the trencher’s company a quarter million dollars. Without the proper insurance, that type of money comes right from the employer’s pocket.”

Here are some of things that your general liability insurance will not cover:

- Damage to your own property: If someone else drives a car through your wall, CGL will cover it. If you drive your own car through your wall, you’re on your own.

- Intended damage: If you or an employee intentionally damages a customer’s property, it won’t be covered.

- Employee injuries: If an employee is injured on the job, CGL does not cover it.

- Vehicles: CGL does not typically cover any vehicles used for business.

- Professional errors: If your hair stylist accidentally dyes someone’s hair pink the day before their wedding and the client sues you for the cost of their wedding, CGL won’t cover the costs.

The solution is to work with an insurance agent to understand all the potential risks your business may face so they can properly protect you with the right coverage.

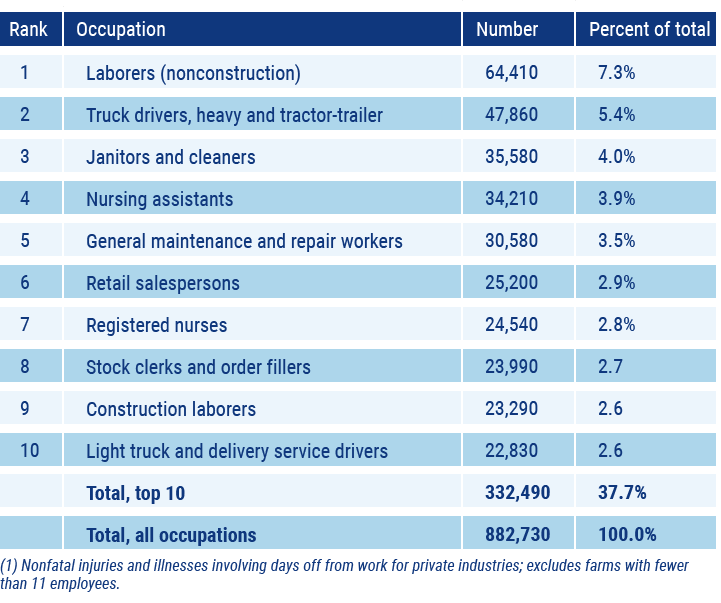

#3. Not Having Workers’ Compensation Insurance

Workers’ compensation is insurance that will provide medical and wage benefits to someone who is injured or becomes sick while at work.

It’s mandatory in 49 states (not Texas), and most states require a business to obtain it if they’re employing one or more employees. Other states allow for more employees or higher payroll before the insurance is required.

Laws aside, employee injury is a major financial risk that may slip through the mind of a business owner who doesn’t have what is considered a risky business. But if your business is caught without workers’ compensation and an employee gets injured on your watch, you’re liable to get caught twice. First, your employee can sue you for getting injured on the job, and second, the state will come after you for not having the proper coverage.

Top 10 private industry occupations with the largest number of injuries and illnesses, 2017 (1)

#4. Underestimating the Market

If you’re a new business owner, one of your biggest financial threats is underestimating or not understanding the market. Maybe you turned a hobby into a business, and all of a sudden you’re responsible for being an expert in an industry where you’ve mostly been a customer.

The most common costs that small businesses tend to underestimate are:

- Licensing

- Legal fees

- Employee and hiring costs

- Marketing and advertising costs

- Production costs

- Insurance

- Taxes

The best thing you can do is have a mentor in your corner who can provide advice and guidance. In addition, talking to other businesses in the same industry can help you gauge what kind of costs you can expect.

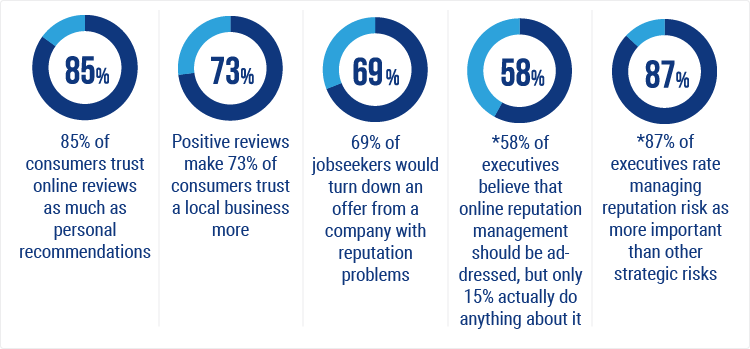

#5. Reputation Risk

Social media has made it so that one influential person can completely make a company. But that can also break it—and even faster. With the Internet, reputation management is more important than ever before.

In fact, reputation harm is one of the most costly insurance claims a business can face. Dealing with slander or libel against your business can get expensive, fast, especially if it takes you to court.

However, with proper online etiquette, you can use your satisfied customer base to build up your reputation and your online presence. You can also show general concern for customer complaints and work to fix any mistakes or dissatisfaction your customers may have.

Quick Facts:

Appreciating Risk Management

Risk management doesn’t have to be as scary as a spider hiding out in your toilet bowl, or as daunting as visiting Costco on the weekend. A proper risk management strategy and an understanding of these common financial risks can help your business avoid unexpected costs that could be detrimental to your success.

https://www.nfib.com/content/legal-compliance/legal/workers-compensation-laws-state-by-state-comparison-57181/

https://citizensgeneral.com/business-insurance-news/postid/83/5-things-your-general-liability-insurance-doesnt-cover

http://www.youngupstarts.com/2017/09/22/the-7-most-frequently-underestimated-startup-costs/

https://statuslabs.com/reputation-management-stats-2018/