Brighthouse Financial Insurance Company Review

Brighthouse Financial Insurance Company at a Glance

- Founded in 2016

- Coverage available in most states

- Specializes in life insurance

- Also offers annuities

- A Fortune 500 company

- “A” (excellent) rating through A.M. Best

- “A+” (excellent) rating by Better Business Bureau (BBB)

- Offers affordable coverage

- One of the US’s largest life insurance and annuity providers

- Strong financial stability

Brighthouse Financial Pros: Coverage rates are reportedly very affordable. Offers several types of annuities. High ratings through A.M. Best and the BBB. Strong financial stability. Offers accelerated death benefits. Provides an easy application process for new customers.

Brighthouse Financial Cons: Not BBB accredited. No 24/7 claims reporting. No online claims reporting. Concerning volume of customer complaints filed through the BBB. Virtually all customer feedback is dismal. Official website lacks many basic customer service options. Customers report frustration in getting in touch with the carrier with concerns.

What Type of Insurance Does Brighthouse Financial Offer?

Brighthouse Financial is a specialty insurance company, with a focus on life insurance. Their products include:

- Hybrid life and long-term care insurance

- Term life insurance

- Annuities

If you’re in the market for life insurance coverage or annuities, Brighthouse Financial may just have exactly what you’re looking for.

What to Know about Brighthouse Financial

Brighthouse Financial was founded in 2016, making it one of the younger insurance carriers on the market today. Though the carrier is a specialty company with a focus on life insurance with annuities, its coverage is available in most states, helping it to reach more prospective customers throughout the US. In fact, Brighthouse Financial currently has more than 2 million customers across the country.

The carrier is estimated to have between 1,250 and 1,330 employees. Brighthouse Financial celebrated making the Fortune 500 list in 2020, at number 457. They’re also one of the largest life insurance and annuity providers in the US today. Reportedly, the carrier has $224 billion in total assets.

Brighthouse Financial has been rewarded for its financial strength, receiving high ratings from Moody’s, Standard & Poor, Fitch, and A.M. Best. These ratings help to solidify the carrier’s status as a reputable and stable provider with a positive outlook for the future. A.M. Best, the leading global credit rating agency monitoring the insurance industry, gives Brighthouse Financial an “A” rating, indicating the carrier is an excellent choice for insurance customers. A high rating from A.M. Best assures customers that Brighthouse Financial is capable of offering guaranteed, secure coverage from a trustworthy carrier.

Established in 1899, A.M. Best is one of the oldest rating companies in the world. Reviews from A.M. Best indicate an insurance company’s financial strength and creditworthiness, and are based on comprehensive evaluations of the company’s operating performance, business profile, and balance sheet. For customers who aren’t as familiar with insurance companies’ reputations, A.M. Best’s rating system allows them to make an informed decision about who they can trust to meet their needs in the short term, and also to remain a strong, financially sound company in the long term.

What Discounts Does Brighthouse Financial Offer?

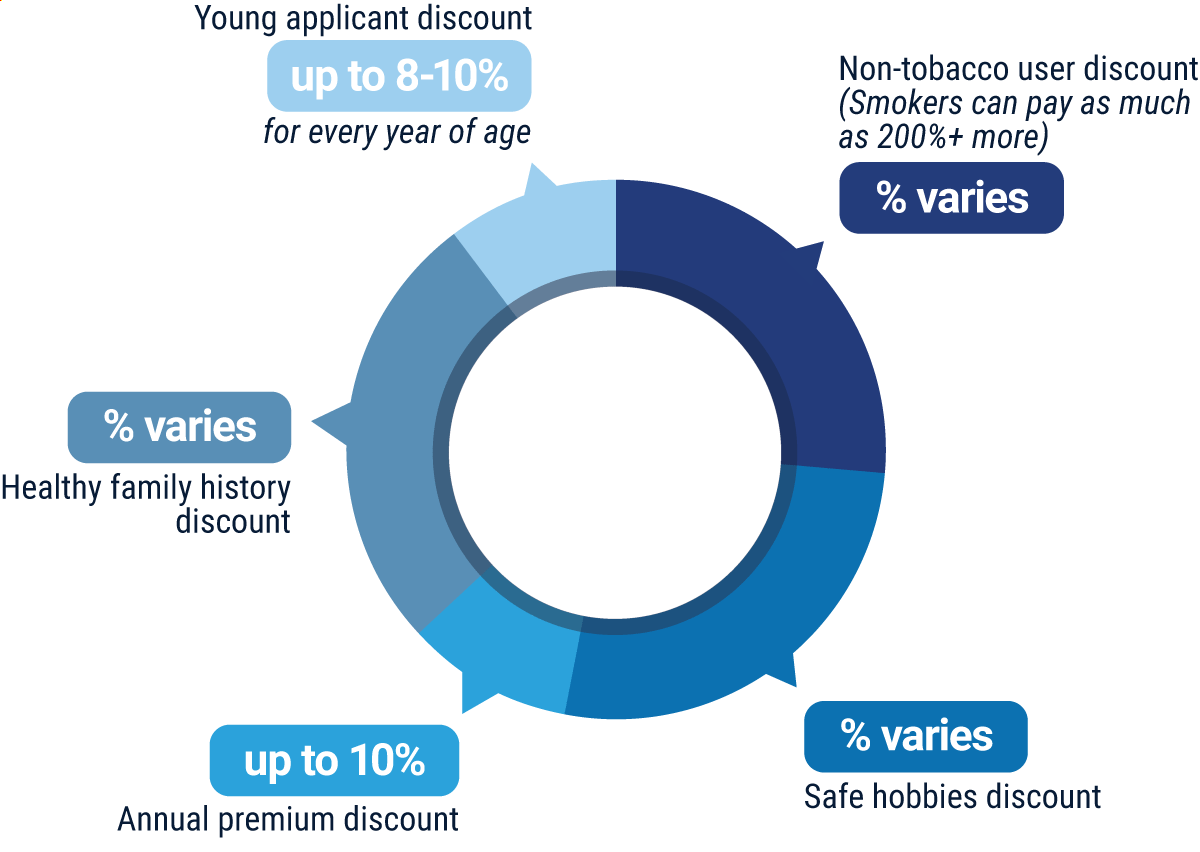

While Brighthouse Financial does not make information about their specific discounts readily available, many modern carriers offer common discounts on life insurance. These discounts may include:

- Non-tobacco user discount: Life insurance companies tend to reward customers who do not use tobacco products with cheaper premiums.

- Safe hobbies discount: Life insurance companies often award customers who practice safe, non-life threatening hobbies (e.g., no skydiving) with cheaper premiums.

- Annual premium discount: Life insurance companies often award discounts to customers who pay their premiums annually instead of monthly.

- Healthy family history discount: Life insurance companies also reward applicants with healthy genetics, or a good family health history.

- Young applicant discount: Life insurance companies often award significant discounts to applicants who purchase coverage for the first time when they are younger, such as in their 20s or 30s.

Your independent insurance agent can help you find more information on exact discounts offered by Brighthouse Financial, helping you get the most bang out of your buck on coverage.

Brighthouse Financial Customer Service

Brighthouse Financial conducts most of their customer service over the phone. The official website has several different phone numbers listed for various departments, based on what the customer is inquiring about. The carrier provides the following customer service options:

- Phone lines listed by department.

- Email contact options also available.

- Contact forms provided on the carrier’s website.

- Customer service has the following hour restrictions, according to the carrier’s Facebook page:

| Hours (EST) | |||

| Monday-Friday | 9:00 am - 5:00 pm | ||

| Saturday | 9:00 am - 10:00 pm | ||

| Sunday | 7:00 am - 10:00 pm |

For further customer assistance, reach out to an independent insurance agent. These agents can help make customer service much easier for you by handling claims and other concerns.

Brighthouse Financial FAQ

What is Brighthouse Financial's average claims response time frame?

Brighthouse Financial states that once a claim has been reported, the carrier will send the customer a claims packet within 15 days. Once a completed claim has been submitted, the carrier states that the customer will receive their official response (approval or denial) within 30 days.

What is Brighthouse Financial's customer service availability?

Brighthouse Financial does not provide 24/7 claims filing or customer service options. Their customer service hotlines are available during restricted hours on weekdays, and generous hours on weekends, so the carrier can be reached for inquiries any day of the week. The carrier also has a social media presence on Facebook, Twitter, and LinkedIn, which makes them more accessible to customers.

What is Brighthouse Financial's claims process?

Brighthouse Financial encourages customers to file claims via phone. The carrier’s official website breaks down the claims process into a few simple steps:

“1. The Owner begins a Notice of Claim by requesting a Long-Term Care (LTC) Claims Packet from Brighthouse Claims at (800) 882-1292.

2. Brighthouse Claims will send the Owner the claims packet within 15 days of the Notice of Claim.

3. The Owner submits a completed claims packet with Proof of Claim information, which must include the LTC Claim Form, Licensed Health Care Practitioner Statement, and Plan of Care to Brighthouse Claims within 90 days of the Notice of Claim.

4. Please send the completed claims packet to: Brighthouse Claims and Living Benefits P.O. Box 305074 Nashville, TN 37230-5074 - OR - Fax to: Brighthouse Claims (877) 245-8163

5. Brighthouse Claims will review the forms to ensure they are fully completed. If forms are not complete, Brighthouse Claims will request missing information.

6. Brighthouse Claims will review the completed claims documentation and validate the information as necessary. If any additional requirements are needed, we will advise the Owner accordingly. A response to the Owner will be made within 30 days after receipt of all items. The response will consist of one of the following:

• Approve claim.

• Deny claim citing specific reasons. If the claim is denied, the Owner has 60 days to appeal the decision and provide additional information.”

Customers can call the carrier to check on the status of an existing claim, or get in touch with their insurance agent.

Does Brighthouse Financial create a user-friendly experience for customers?

Brighthouse Financial’s official website falls somewhere in the middle in that it’s not the best among modern carriers today, but it’s also far from the worst around. The website’s layout is fairly easy to navigate, but some users may find it frustrating. Information is overall easy enough to find, but there are also some areas that are sorely lacking. For example, the carrier does not provide a few options that many other modern insurance companies do, such as allowing customers to get matched with an agent. Online claims filing is also not available, which automatically makes the carrier feel dated in terms of what insurance customers have come to expect from their providers today. Overall, Brighthouse Financial has some catching up to do to other carriers in terms of user-friendliness.

Brighthouse Financial Customer Reviews

| Yelp |

|

| “I actually do not know much about the company yet but - have wasted 30 minutes with 5 different phone numbers trying to get a live voice to help me!!! (I am a new customer...inherited the account).” |

| Yelp |

|

| “I have a life insurance company under NEF (New England Financial) who was bought by Brighthouse Financial. I have had a policy (whole life) for 25 years. I took a loan out and on January 13th, got a consolidation loan to pay it off, because of the interest schedule. I sent the payment on January 13th, it was cashed on January 20th but not applied to my loan. I called for a week and it was not applied until my bank showed proof it was cashed. Miraculously it was applied that day!!! That same day I spoke to 2 people to cancel my $100 a month loan payment and go back to my $41.67 premium/cash value but they withdrew $100 out of my account yesterday. I was also told to pay more than what I owed for payoff and have not received my refund!!! I have emailed customer support about this but I'm putting this review on any page I can find. It's not right.” |

| NerdWallet |

|

| “This company is terrible to work with. It takes you 45+ Minutes on hold to get in touch with a VA Specialist just to track a service request. Each time you speak with a service member, you get a different answer. They are never on time, and continually send things to me past the date they said it would be taken care of. I am fed up with this company and their sub-par processes. Would highly recommend using a different firm.” |

|

| “Why can’t I reach a human being that can help me with my policy??? No one answers, systems are down and they can’t answer questions and just hang up. What is going on with this?” |

|

| “So frustrated with this company. Trying to help my mom reestablish her insurance she has paid for over 2 years. Her husband passes, she gets put in nursing home. Her nursing home lied and said they took care of her premiums. 5 months later, I am trying to get her insurance back up to date. I am told I can sign since I am her POA. I get that notarized. I am now told I am to get my mom to sign. Who is 2 hours away in a nursing home I cannot visit. I was also told my mom would have to restart her 2 year period, and she was told she did not have to as long as we pay her up.” |

TrustedChoice.com's Final Review

We award Brighthouse Financial Insurance Group a final rating of 1.5 out of 5 stars. Normally a carrier’s long-standing history gives it some baseline credit as an established provider, but Brighthouse Financial doesn’t even have that going for it, being a much newer company. While the carrier has high ratings through A.M. Best and the BBB, it is not accredited through the BBB, and has had a concerning volume of complaints filed against it through the organization in recent years (which is almost the company’s entire history). The carrier receives props for offering accelerated death benefits, affordable rates, and an easy application process for new customers, but their customer service apparently leaves a lot to be desired. It was virtually impossible to find any glowing customer reviews, which is not something to be overlooked. The carrier also does not provide 24/7 claims reporting or even online claims filing, which is something insurance customers have come to expect from most carriers in the industry today.

Bottom Line: While Brighthouse Financial has reputable financial strength, what we’re most concerned about is whether a carrier prioritizes their customers. Reliable coverage is critical, and if a customer can’t count on their insurance company to meet their needs or deliver on their promises, no amount of financial strength can make up for that. Many customers report frustration in not only having claims approved, but even being able to get hold of the carrier at all. So, if you’re in the market for affordable life insurance or annuities, we recommend working together with your independent insurance agent to survey all your other options before settling on Brighthouse Financial to meet your coverage needs.

brighthousefinancial.com

bbb.org

ambest.om

wallethub.com

yelp.com

facebook.com