Donegal Insurance Group Company Review

Donegal Insurance Group at a Glance

- Founded in 1889

- Offers a wide variety of coverages

- Offers personal and business coverages

- Coverage offered in 26 states

- “A” (excellent) rating by A.M. Best

- Not rated through the Better Business Bureau

- Affordable coverage rates

- Strong financial stability

- 24/7 claims reporting

- Good customer feedback

Donegal Insurance Group Pros: Well-established carrier with more than a century of experience in the insurance industry. Offers coverage solutions for individuals and businesses. Offers several types of coverage, including farm insurance, homeowners insurance, auto insurance, umbrella insurance, and more. High rating through A.M. Best. Strong financial stability. Good customer feedback. Affordable rates.

Donegal Insurance Group Cons: Not a BBB accredited or rated company. Coverage not available in half the nation. Website is a bit dated.

What Types of Insurance Does Donegal Insurance Group Offer?

Donegal Insurance Group offers a wide range of coverages for both individuals and businesses. While their original focus was farm insurance, they have expanded their catalogue to include a multitude of products, including:

- Auto insurance

- Homeowners insurance

- Umbrella insurance

- Boatowners insurance

- Dwelling fire insurance

- Business owners insurance

- Commercial auto insurance

- Liquor liability insurance

- Employment practices insurance

- Contractors errors & omissions insurance

- Farm insurance

- Title insurance

This list of insurance products offered by Donegal Insurance Group is not exhaustive. An independent insurance agent can help you find more coverage options offered through this insurance company.

What to Know about Donegal Insurance Group

Donegal Insurance Group was founded in 1889, giving the carrier well over a century of experience in the insurance industry. The company currently offers coverage in 26 states across the US. Its original mission was to provide protection for farmers in Pennsylvania, but it has since expanded to offer many different coverage options in multiple locations.

As of the end of 2019, Donegal Insurance Group’s annual report cited $812.45 million in total revenue for the year. The company also reported having $1.9 billion in total assets at the year’s end. A.M. Best currently places the carrier in the $500-$750 million financial size category. The carrier’s LinkedIn page reports that between 50 and 1,000 employees currently work for Donegal Insurance Group, and thousands of independent insurance agents help them do business across the country.

Thanks to its extensive history, large size, and impressive financial strength, Donegal Insurance Group has earned a reputation as a stable insurance provider with a projected strong outlook for years to come. A.M. Best, the leading global credit rating agency monitoring the insurance industry, gives Donegal Insurance Group an “A” rating, indicating the carrier is an excellent choice for insurance customers. A high rating from A.M. Best assures customers that Donegal Insurance Group is capable of offering guaranteed, secure coverage from a trustworthy and reputable carrier.

Established in 1899, A.M. Best is one of the oldest rating companies in the world. Reviews from A.M. Best indicate an insurance company’s financial strength and creditworthiness, and are based on comprehensive evaluations of the company’s operating performance, business profile, and balance sheet. For customers who aren’t as familiar with insurance companies’ reputations, A.M. Best’s rating system allows them to make an informed decision about who they can trust to meet their needs in the short term, and also to remain a strong, financially sound company in the long term.

What Discounts Does Donegal Insurance Group Offer?

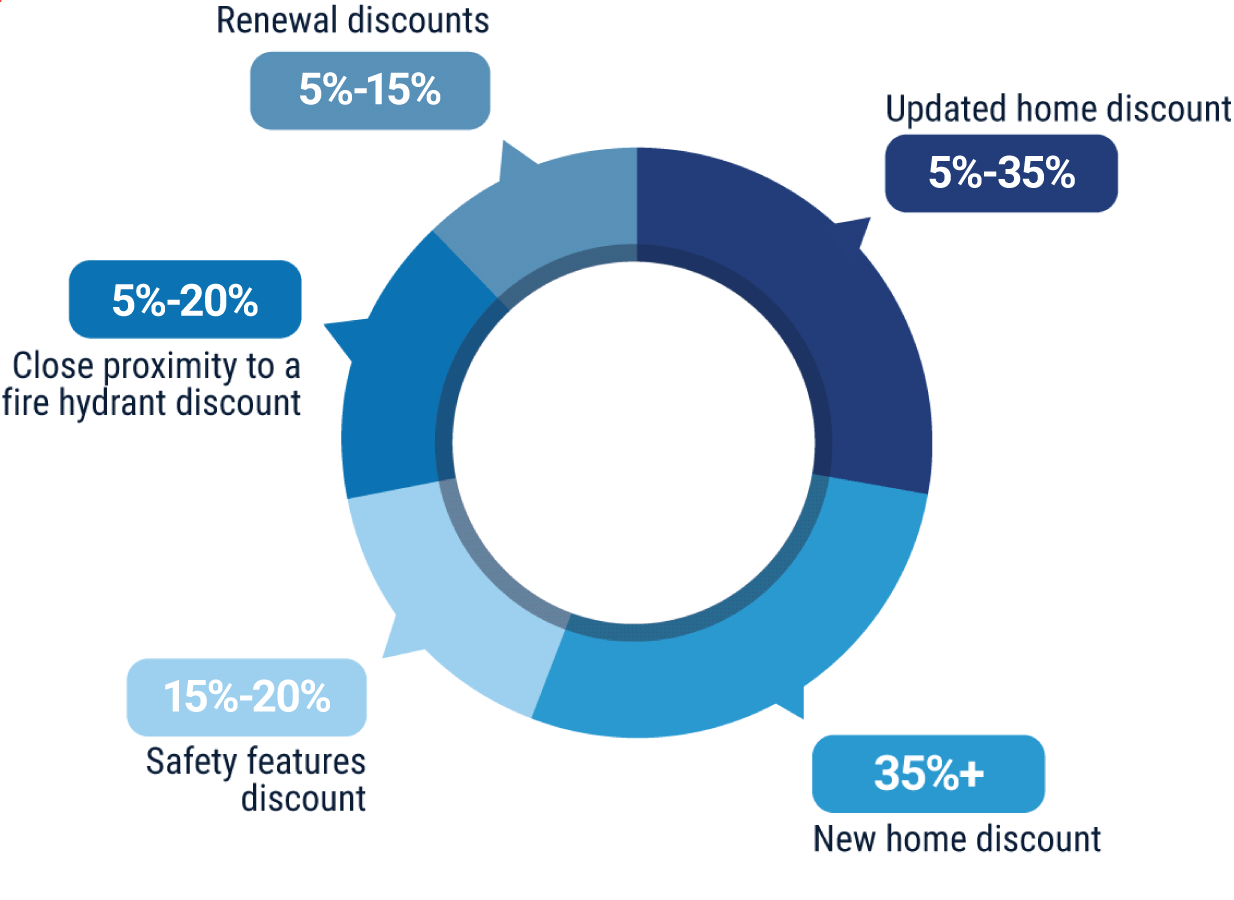

While Donegal Insurance Group does not readily provide information about their exact discounts, they offer many of the common discounts offered on insurance products such as homeowners coverage. These discounts include:

- Updated home discount: Homeowners insurance customers can save money by reporting updates they’ve made to their heating, roofing, plumbing, and electrical systems.

- New home discount: Homeowners insurance customers often qualify for discounts if their home is less than 10 years old.

- Safety features discount: Homeowners insurance customers are often offered discounts if they install burglar alarms, security cameras, or other safety features to help protect their homes from theft and break-ins.

- Close proximity to fire hydrant discount: Homeowners insurance customers can be offered a discount if they live close to a fire hydrant.

- Renewal discounts: Insurance customers are often awarded discounts for renewing their policies with the same insurance company for a specified period of time.

Your independent insurance agent can help you find more information about exact discounts offered by Donegal Insurance Group and other ways to save through the insurance company, helping you to get the most bang for your buck on coverage.

Donegal Insurance Group Customer Service

Donegal Insurance Group allows customers to file claims online or over the phone, any time of the week. The carrier also provides the following customer service options:

- 24/7 claims reporting via phone or through the website.

- General inquiry contact form available through the website.

- Mailing address contact option available.

- Main customer service hotline has the following hour restrictions:

| Hours (EST) | |||

| Monday-Friday | 8 am - 6 pm |

Another great way to get your customer service needs met is through an independent insurance agent. These agents can help make customer service easier for you by handling claims and other concerns.

Donegal Insurance Group FAQ

What is Donegal Insurance Group's average claim sresponse time frame?

Donegal Insurance Group offers 24/7 claims reporting for their customers, via phone or through the official website. The carrier states that emergency claims can expect a response within one hour of being filed via phone, while non-emergency claims will be responded to the next business day.

What is Donegal Insurance Group's customer service availability?

Donegal Insurance Group offers separate phone lines for general customer inquiries and claims filing. Their claims reporting hotline is available for customers 24/7, and the customer service hotline is available during restricted hours, Monday-Friday. The carrier also has a social media presence on Facebook, Twitter, and LinkedIn, making them even more accessible to customers.

What is Donegal Insurance Group's claims process?

Donegal Insurance Group allows customers to file claims through the website or over the phone. The official website does not provide much detail about an official claims process, other than the following:

“Policyholder Online Claim Reporting

To report a claim online, click here to login and provide us with your policy number and claim information. A claim representative will contact you on the next business day to obtain information to begin our claim handling process.

If your loss involves an emergency situation, please call our 24-Hour Claim Reporting Service at 800 877-9006 immediately.

24-Hour Claim Reporting by Telephone

We provide a 24-hour claim reporting service to our policyholders and agents. You can access this service 24 hours a day, 7 days a week. Simply call 800 877-9006.

If your loss involves an emergency situation requiring our immediate attention, our "on-call" Claim Representative will contact you to provide help and direction — within one hour of your call in most cases. In a non-emergency situation, we’ll obtain information to begin the claim process on the next business day.”

The insurance company instructs customers to contact their claims representative if they want to check on the status of a claim after filing.

Does Donegal Insurance Group create a user-friendly experience for customers?

Donegal Insurance Group’s official website leaves a bit to be desired. Its layout feels a bit dated and restrictive, and certain important information is not filled out as thoroughly as for many other modern carriers. For example, not much detail is listed about the insurance company’s claims process, other than how to file and when to expect a follow-up. However, Donegal Insurance Group does provide a couple of the basic customer service options that modern insurance customers have come to expect, such as online claims filing and online bill pay. The carrier also has a presence on social media to help them stay connected to their customers. So while the company’s website could certainly use an upgrade, overall Donegal Insurance Group provides a fairly user-friendly experience.

Does Donegal Insurance Group have good farm insurance?

Donegal Insurance Group specializes in farm insurance. Their farmowners Insurance policies include the following important coverages:

- Dwelling protection

- Personal property protection

- Barns and additional structures protection

- Personal liability

- Farm produce and supplies protection (add-on)

- Mobile machinery, poultry, and livestock protection (add-on)

Your independent insurance agent can help you find more information about farm insurance offered by Donegal Insurance Group, as well as other coverage solutions through the carrier.

Is Donegal Insurance Group a good insurance company?

Donegal Insurance Group provides many different coverage options for individuals and businesses. The carrier has also received a high rating through A.M. Best and has demonstrated impressive financial strength. Customers can access their coverage quickly, thanks to Donegal Insurance Group’s 24/7 claims reporting services. While there are certain areas where the carrier has room to grow to catch up with other modern insurance companies, such as with their website, Donegal Insurance Group can still be considered a good insurance company.

Donegal Insurance Group Customer Reviews

| Clearsurance |

|

| “We were moving into a new house, and our old insurance company refused to cover us because the roof on our new house was 30 years old. We have been with them 11 years. They said they were going to look into if they could give us a time frame to get the roof redone, but still cover us in the meantime. They never even called back. Not only did Donegal Mutual cover us, they gave us a lower rate than our old company. They also gave us up to two years to get the roof replaced. Great company!” |

| Clearsurance |

|

| “Great experience thus far with this company. This was the best quote we received, and we have had no issues since acquiring this policy.” |

| WalletHub |

|

| “I had my car insurance with Donegal insurance. It is nice to have a company that is local and you can go talk to a real person about your policy. So many companies you can only get a person on the phone and it is not personable. They are also pretty reasonably priced and they explain things very well. I am very happy with the service I received from them. I also have my renters insurance policy with them which gives me a discount.” |

| Yelp |

|

| “We needed our roof repaired due to hail. Donegal Insurance was a pleasure to work with. The company that fixed our roof commented as well [about] how prompt and efficient the company was toward the claim. We have always had very professional service with Donegal. We needed them as well when the basement floor was flooded and they were there with prompt attention to our cause. Thank you.” |

| Yelp |

|

| “Even though I provided the necessary proof of a repair done to my home, as requested by the insurer and broker, Donegal decided to cancel my policy anyway.” |

TrustedChoice.com's Final Review

We award Donegal Insurance Group a final rating of 4 out of 5 stars. For starters, the carrier has been around in the industry for well over a century now, which is both noteworthy and impressive. The company also received a high rating through A.M. Best, although they have not been accredited or rated by the BBB. Coverage is currently offered in just over half the country, but many coverage solutions are provided for both individual and business insurance customers of all kinds. Customers have reported affordable rates through the carrier, and many reviews of their overall service are positive. Donegal Insurance Group provides 24/7 claims reporting for their customers through two methods, but loses a couple of points for having a website that feels dated compared to the websites of many other modern carriers. However, their prompt claims response time frame promise helps to make up for that. Their diverse catalogue of coverage options, ranging from farm insurance to umbrella insurance and beyond, is also appealing. Overall, we say that if you’re located in an area where they offer coverage, certainly consider asking your independent insurance agent about reviewing Donegal Insurance Group as a trusted option to meet your insurance needs.

donegalgroup.com

ambest.com

bbb.org

clearsurance.com

yelp.com

wallethub.com