Rebuilding After the 2018 California Wildfires

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Insurance provides important protection for all kinds of disasters, even those caused by natural means. California’s 2018 wildfire season burned millions of acres of land and thousands of homes, and killed more than a hundred people. Fortunately for victims of this catastrophe, coverages like property and business insurance were able to help them get back to their lives.

An independent insurance agent can help you find the right coverage for your own worst disasters, even if they’re not quite as tragic, destructive, or deadly as this one. But first, here’s a closer look at the 2018 California wildfires and all the ways insurance was able to help victims recover.

What Was the Impact of the 2018 California Wildfires?

California has had many historic wildfires, but the 2018 season was the most destructive and deadliest season to ever plague the state. Spanning from mid-July to November of 2018, the wildfire season burned more acres than any wildfire season previously recorded. The impact of this particularly harsh wildfire season is still felt today.

Quick stats about the 2018 California wildfires:

- 103 deaths were reported

- More than 1.8 million acres were burned

- 17,000 homes were destroyed

- 700 businesses were destroyed

- 8,527 total fires were reported

- One of the harshest fires, the Mendocino Complex Fire, was responsible for $267 million in damage, as well as destroying 280 structures and damaging 37 others

- The Mendocino Complex Fire burned more than 459,000 acres

- $11.4 billion in total damages was reported

- $9 billion in insured losses was reported by the end of 2018

Though the 2018 California wildfires were highly destructive and costly, fortunately the victims were able to receive financial aid through insurance and relief packages.

The Toll of the 2018 California Wildfire Season on the US Economy

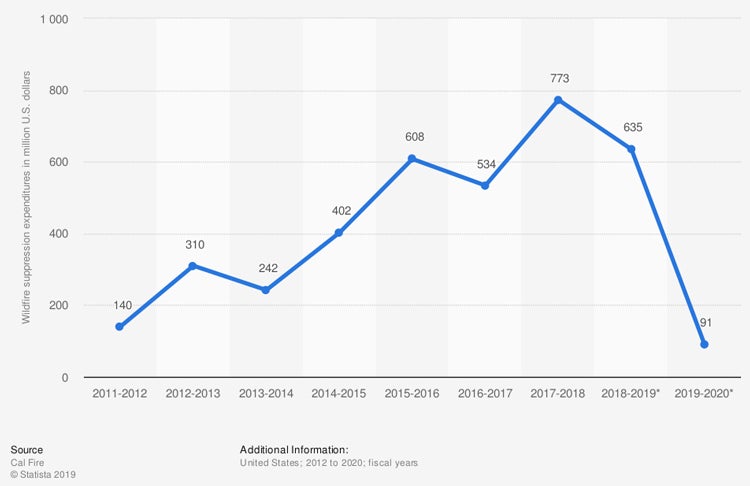

Wildfire Suppression Expenditures for the State of California from the Fiscal Year 2012 to 2020 (in million US dollars)

For the 2018-2019 California wildfire season, it was estimated that the state would spend $635 million on wildfire suppression methods, down from $773 million in 2017. For the 2019-2020 wildfire season, California was projected to decrease spending on wildfire suppression methods to just $91 million.

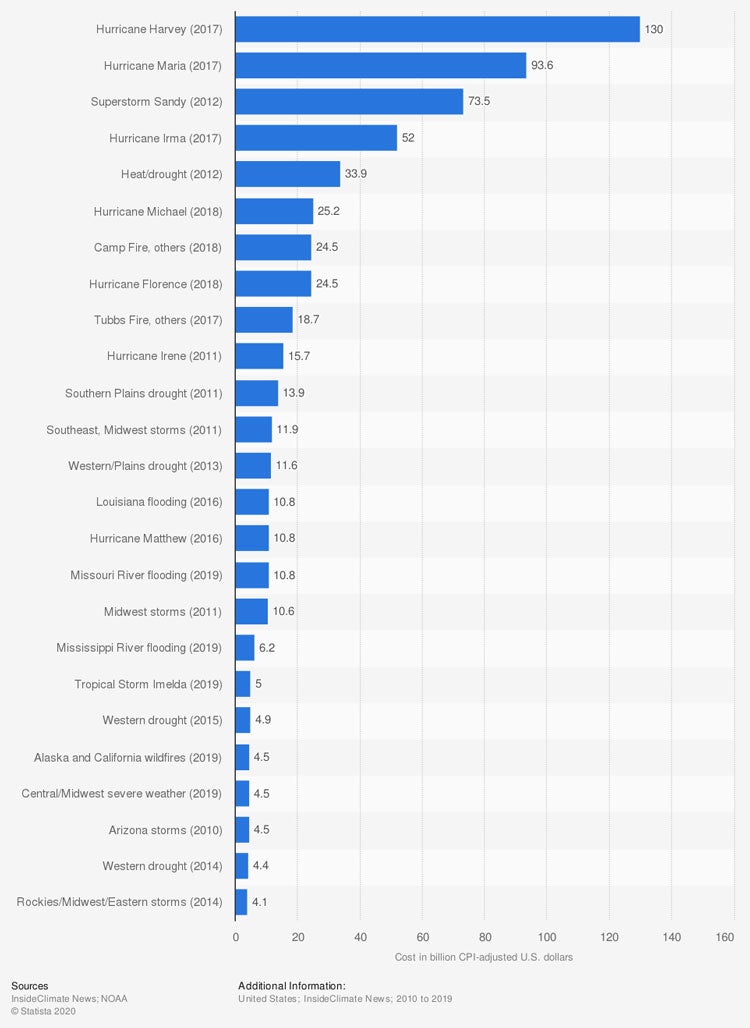

Most Expensive Natural Disasters in the United States from 2010 to 2019 (in billion CPI-adjusted US dollars)

As for the most expensive natural disasters in the nation for the previous decade, the Camp Fire among others from California’s 2018 wildfire season ranked 7th overall, costing a total of $24.5 billion in damage. Many of the top slots for costliest natural disasters were claimed by particularly harsh hurricanes such as Harvey, Maria, and Superstorm Sandy. Hurricane Harvey cost the US $130 billion in damage, making it the most expensive disaster of the decade.

Who Provided Help to the Victims of the 2018 California Wildfires?

The Red Cross provided more than 350,000 meals to victims of the 2018 California wildfires. More than 61,000 wildfire victims were able to stay in one of the Red Cross or its partners’ shelters following the disaster. The Red Cross also provided more than 81,000 relief items such as cleaning supplies to victims. Additionally, about $27 million in direct financial assistance was raised for wildfire victims by the organization.

The Small Business Administration and the Federal Emergency Management Agency provided almost $500 million in low-interest disaster loans and grants to victims of the 2018 California wildfires. Finally, the California Community Foundation’s Wildfire Relief Fund allocated $11 million in funding for recovery efforts in communities hit by the most severe wildfires of the season, including the Camp, Woolsey, and Hill Fires.

How Did Car Insurance Help Victims Get Back to Their Lives?

Fortunately for victims of the 2018 California wildfires, having auto insurance allowed them further assistance in resuming their lives. Auto insurance helped the 2018 California wildfire victims in the following ways:

- Repairs: For victims whose cars were badly damaged by accidents during the wildfires, auto insurance covered repairs to their vehicles under the collision section of their policies.

- Replacement: Those victims whose cars were completely totaled by the fires were able to obtain new vehicles through the help of their auto insurance.

- Rental cars: While victims awaited repairs on their vehicles, auto insurance provided them with rental cars so they could still commute to work, run errands, etc.

- Medical payments: The victims who sustained injuries during the 2018 California wildfires were able to be compensated by their auto insurance policy for medical payments while receiving treatment.

Though not all car insurance claims stem from damage caused by massive wildfires, it’s helpful to see just how auto insurance provided relief for victims of this huge tragedy in a myriad of ways.

Is Wildfire Coverage Part of Every Homeowners Policy?

While wildfire damage is often included in standard homeowners insurance policies, there are some exceptions, including for victims of the 2018 California wildfire season. Homeowners who live in high-risk areas for wildfires, such as parts of California, are sometimes required to purchase additional wildfire coverage, or take additional fireproofing measures around their home in order to qualify for reimbursement from their policy following a disaster.

Without adequate coverage, victims of wildfire damage may be forced to pay for expenses out of pocket. Though homeowners insurance generally provides coverage for structural and property damage caused by wildfires, your geographic location may cause your insurance company to exclude coverage. Be sure to check with your independent insurance agent if you’re concerned your homeowners insurance lacks coverage for wildfires or any other natural disasters.

How Did Property Insurance Help Victims Get Back to Their Lives?

Property insurance helped victims of the 2018 California wildfires to rebuild and restructure their lives, as long as they had adequate coverage. For wildfire victims, property insurance coverage provided protection in the following ways:

- Rebuilding homes: Property insurance coverage pays to rebuild homes in the event they are destroyed by a covered peril, such as a wildfire. The 2018 California wildfires’ victims were able to rebuild homes that were destroyed thanks to property insurance.

- Ending homelessness: Many of the 2018 wildfire season’s victims were left temporarily homeless following the disaster. Fortunately their property insurance coverage provided the financial assistance necessary to rebuild their homes. Homeowners insurance also provided additional living expenses coverage for victims to pay for fees associated with temporary housing, such as hotels, while awaiting repairs on their homes.

- Replacing personal property: The 2018 California wildfires’ victims were largely able to replace, repair, and recover from lost, damaged, or destroyed personal belongings such as clothing, furniture, silverware, etc. following the disaster. Property insurance typically covers personal property up to 50% to 70% of the insured value of the structure of the home if it’s lost/damaged/destroyed by wildfires.

- Replacing property stored elsewhere: Property insurance also covered the 2018 California wildfires victims’ personal belongings stored off premises, such as in storage units, following the disaster. Limits on off premises stored property are sometimes 10% of the total value of personal property coverage, but additional coverage can be added.

- Mending foliage around homes: Property coverage also includes reimbursement for foliage around the home, including trees, plants, and shrubs if they are damaged or destroyed by a wildfire. Limits typically cap at $500 per plant, but coverage amounts can be increased. California wildfire victims were able to repair their gardens and general appearance surrounding their homes thanks to property insurance.

While you may never have to submit property insurance claims for extensive wildfire damage, it’s still helpful to learn all the relief this coverage provided to victims of the 2018 California wildfire season.

How Did Business Insurance Help Owners Get Back to Work?

Not all of the 2018 California wildfire season’s victims were just homeowners, many were business owners as well. Luckily, business insurance provided additional coverage that allowed business owners to reopen their doors and get back to work.

Business insurance helped victims of the 2018 California wildfires in the following ways:

- Loss of income: Business insurance includes coverage for lost income suffered during temporary closings due to covered disasters, including wildfires. Business owners who were victims of the 2018 California wildfires were able to recover lost income thanks to business insurance.

- Property repairs: Business insurance covers damage to or loss of your business’s physical property, including the structure of the building and often the inventory inside of it, due to a covered disaster like a wildfire. Wildfire victims were able to rely on their business insurance to help them rebuild their businesses from the ground up, repair less major damages, and to recover lost property such as inventory.

- Lost employee wages: Business insurance also helps pay employee wages that are lost while a business is closed due to covered perils like wildfires. Victims of the 2018 California wildfires were able to compensate their employees during long shutdowns thanks to business insurance coverage.

Businesses close for all kinds of reasons, not just due to historic natural disasters like those of California’s 2018 wildfire season. That being said, knowing all the ways business insurance provided relief to business owners following this catastrophe proves just how important coverage is to have for all potential disasters.

Are Victims of the 2018 Wildfires and the State of California Back to Normal Now?

While recovery efforts continue to this day, fortunately insurance helped many of the 2018 California wildfire season’s victims to resume their lives. Payouts from homeowners and wildfire insurance claims allowed many victims to repair or rebuild their homes and end homelessness. Car insurance allowed victims to repair or replace lost or damaged vehicles, and business insurance allowed professionals to recover lost income and wages and get back to work.

However, many families who lost their homes in the tragic wildfire season have yet to rebuild. Since most of the rescue shelters have closed, many victims are still struggling to find temporary lodging. Further, California was plagued by another rough wildfire season in 2019, which left even more of the state charred and burned. Recovery efforts may be a work in progress for the state for years to come, but luckily insurance has been able to assist many victims already.

Here’s How an Independent Insurance Agent Can Help Protect You from Your Own Disasters

You’ll hopefully never encounter a natural disaster as destructive as California’s wildfires, but independent insurance agents can certainly help protect you from your own disasters. Independent insurance agents search through multiple carriers to find providers who specialize in home, auto, business, and all other forms of insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Statista

iii.org

census.gov

fire.ca.gov

redcross.org

directrelief.org

latimes.com

insurancejournal.com