How Can Homeowners Insurance Protect Against Christmas Toy Dangers?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

One of the great joys of the holiday season is all those shiny new toys. But along with the fun, some toys bring their own set of hazards with them, which means you may need to beef up your insurance coverage. So before the kids ever get to tear that wrapping paper to shreds this year, be sure to consider all the potential risks involved with anything new that’s entering your home.

Fortunately an independent insurance agent is more than qualified to review these possible toy-related disasters with you, and adjust your homeowners insurance as necessary. Some bigger toys may even require their own special type of coverage. Check out this guide to some of the riskier Christmas gifts and why it’s so important to have your coverage in check first.

Toy Hazard Stats

Everybody loves getting new stuff, especially for free. But before you even take those new toys out of their packages, it’s crucial to keep any potential dangers in mind. To help put things into perspective (and encourage you to call up your independent insurance agent), take a look at a couple of eye-opening toy hazard stats.

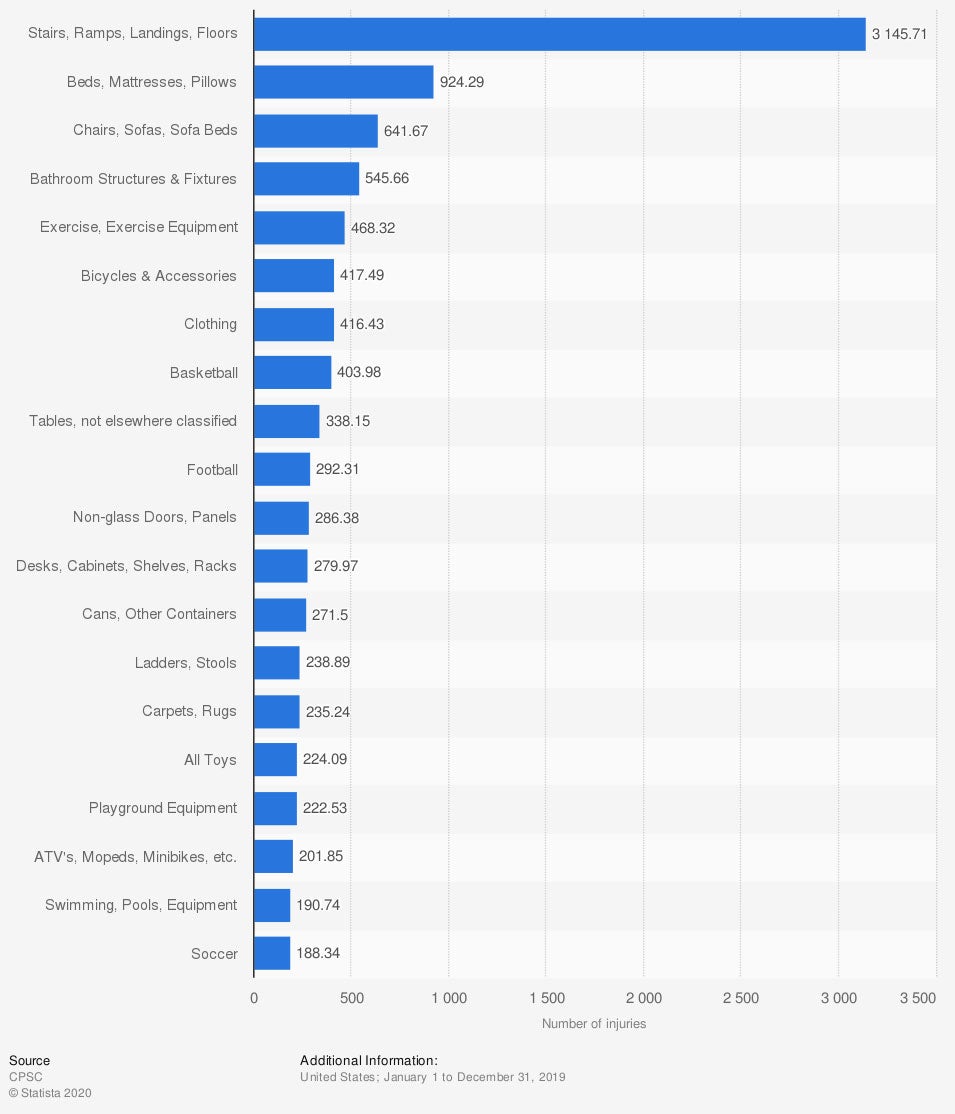

Most dangerous consumer products in the US in 2019, by number of associated injuries (in thousands)

In 2019, there were more than 224,000 reported injuries caused by toys. Since many toys are given as gifts over the holiday season, it’s safe to assume a good percentage of those injuries happened due to Christmas presents. Exercise equipment and bicycles with their associated accessories ranked much higher on the list, with more than 468,000 and 417,000 injuries reported, respectively. This is something to keep in mind while shopping for your loved ones.

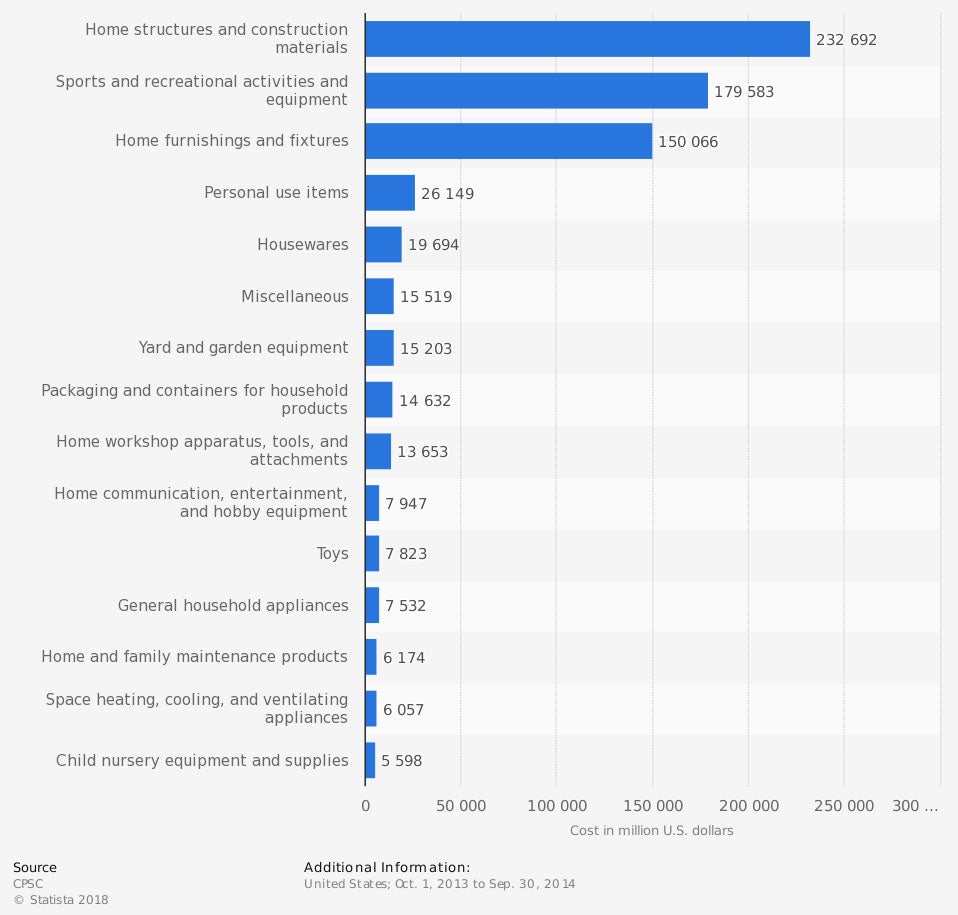

Cost of injuries associated with the use of consumer products in the United States in fiscal year 2014, by product type (in million US dollars)

In 2014, injuries caused by toys cost a shocking $7.8 million dollars in medical treatments, just edging out injuries associated with household appliances. Sports and recreational activities and equipment injuries cost much more, ranking at more than $179.5 million. So you might think twice before getting that basketball hoop installed over the holidays.

Common Holiday Toy Hazards

When considering possible risks and physical trauma that could arise from Christmas gifts, it’s helpful to brainstorm a few common, totally plausible scenarios that warrant their own insurance discussions, like:

- A new trampoline: Trampolines are considered an “attractive nuisance” by homeowners insurance companies, and adding one to your household could increase your premiums by as much as $100 per year. It’s important to tell your insurance company up front when you buy one, though, because trampolines can be easily spotted on Google Maps. If your insurance company catches you trying to keep one a secret, they’ll probably not renew your coverage.

- A Red Ryder BB gun: While Ralphie from A Christmas Story made these toys especially famous (i.e., “You’ll shoot your eye out!”), they don’t actually require you to make any additions or changes to your homeowners insurance. However, it’s helpful to review your coverage limits for liability and medical payments, just in case a guest in your home gets injured when your child (or spouse) decides to show off their new toy and it doesn’t end well.

- A snowmobile: Here’s one that requires an insurance policy all of its own. Snowmobile insurance, while not required everywhere, is mandatory in certain states as well as various parks and recreation areas where it may be operated. It’s always better to be safe than sorry, regardless. If you’ll be adding a snowmobile to your home’s inventory, make sure to speak with an independent insurance agent to get set up with all the coverage you need beforehand.

- A drone: While you may not need a separate policy for your drone, it’s important to be familiar with why these toys can be concerning in terms of potential insurance disasters. Drones can cause physical damage to property and humans, but they can also cause a huge invasion of privacy if they’re used to spy on a neighbor against their will or without their knowledge. Make sure to double-check your liability coverage limits with your independent insurance agent before buying a drone.

How Do I Know if I Need to Talk to an Independent Insurance Agent about Changing My Coverage?

A good rule of thumb is that if your new toy moves, has wheels, or flies, you’ll want to double-check your coverage. Toys that have motors, like ATVs, boats, drones, etc. are typically insurance considerations. Motorized toys can cause physical damage to property or people, and in some cases can be liability risks.

Also, other “attractive nuisances,” or things that seem fun but have the potential to be extremely dangerous, warrant their own insurance discussions because they might affect your coverage. Attractive nuisances typically pose the most danger to children. Aside from trampolines, swimming pools are another example of an attractive nuisance.

How Can These Toys Affect My Homeowners Insurance Premiums?

In the case of attractive nuisances, you’ll likely experience an increase in your homeowners insurance premiums, and there’s not really a way around it. Often these increases don’t surpass about $100 annually, but there can be exceptions. Other potentially dangerous toys like snowmobiles require their own policies, so they won’t affect your homeowners insurance premiums. Snowmobile insurance on its own can run anywhere from $80-$400 annually.

How Do I Know if I Have Enough Home Insurance to Cover Potential Disasters?

Well, mainly by working together with your independent insurance agent. Together, you’ll review your specific homeowners insurance policy and double-check that you have enough coverage to protect you in the following areas:

- Potential injuries to third parties: Especially with toys like a new BB gun, it’s critical that you’re covered against possible injuries to third parties who visit your home. The liability section of your policy covers these mishaps.

- Potential damage to personal property: Drones and other fancy toys have the ability to damage your personal property like furniture, antique breakables, and more. Review the coverage under your homeowners policy’s personal property section to be safe.

- Potential damage to the home: Things like snowmobiles can also cause damage to the structure of your home if used recklessly. Review the dwelling coverage section of your homeowners insurance policy with your independent insurance agent to protect yourself against possible mishaps.

By working together with your independent insurance agent to review your homeowners coverage before any gifts are unwrapped, you’ll ensure your family has the best possible chance at having a happy holiday season. Your independent insurance agent will be able to spot any gaps or areas of concern with your coverage, and help you add more if necessary.

Here’s How an Independent Insurance Agent Would Help

When it comes to protecting you and your family against dangerous Christmas toys and all other hidden holiday hazards, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in homeowners insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Statista

irmi.com