Who's Responsible If Someone Slips on the Icy Sidewalk in Front of Your House?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

As a proud homeowner, you have to consider all aspects of your property and how they could potentially be hazardous to others. So what happens if it’s the dead of winter and someone slips on your icy sidewalk, falls, and gets injured? Who’s responsible for this mess, anyway?

Fortunately, an independent insurance agent has experience with keeping all potential risks homeowners can face at the forefront of their mind. Due to their expertise with handling all kinds of claims, from the most serious to the most obscure, they’re the best equipped to get you the coverage you need long before you ever need it. To help protect you against someone slipping on your icy sidewalk, here’s how they’d hook you up with the right coverage.

Who’s Responsible If Someone Slips and Falls on Your Icy Sidewalk?

Well, it really depends on the specific scenario. If runoff from your gutters reaches your sidewalk and then freezes, you as the homeowner will be held responsible. The homeowner is also held responsible, in certain cases, when their town requires all residents to keep their sidewalks clear of precipitation. Double-check your local ordinances to be sure of what your responsibilities as a homeowner are when it comes to precipitation and sidewalks.

That being said, you may be relieved to know that you're unlikely to be held liable for slip-and-fall injuries on your icy sidewalk, since precipitation is an act of nature, and not your personal negligence. Furthermore, a homeowner cannot be held liable for a third party’s injury if they slip while a storm is still in progress.

While certain towns have narrower windows for how soon precipitation must be cleared after a storm ends, no homeowner anywhere in the country is expected to do this while snow/ice is still falling. Whatever your specific town’s official rules, it’s a good idea to work with your independent insurance agent to get covered, just in case.

Is a Sidewalk Always the Homeowner’s Responsibility?

Sadly, the answer to this is that it depends. If a sidewalk is public property, its maintenance is the responsibility of the local government. But while sidewalks are considered public property by certain cities, this isn’t always the case. Also, some smaller towns will still require the homeowner to keep up a sidewalk’s maintenance, even if it’s public property. Read up on your town’s ordinances to confirm whether your sidewalk’s maintenance is your responsibility.

What Kind of Coverage Do I Need to Protect Myself?

If a third party slips and falls and sustains an injury on your icy sidewalk, you’ll rely on a good homeowners policy to protect you in case you get sued. Insurance companies consider icy sidewalks to be premises exposures and a covered peril across standard homeowners policies. Homeowners insurance helps to protect you through the liability coverage section of the policy, whether or not you’re held liable and accused of negligence.

How Does Liability Insurance Cover Homeowners in This Scenario?

The liability coverage provided by your homeowners insurance is designed to protect you if someone gets injured on your property due to a covered peril and sues you for it. Homeowners have to pay for legal fees in the event they are sued, whether or not they end up being held liable for the injury.

Liability coverage protects homeowners in the following ways:

- Payment of legal fees: Liability coverage reimburses homeowners for court and attorney fees, as well as any settlements they’re ordered to pay in the event they are held responsible for an incident such as someone slipping on their sidewalk.

- Medical payments: Liability coverage also takes care of fees associated with treating any third-party injuries that occur on your property due to a covered peril, like an icy sidewalk.

Since lawsuits are already stressful enough to deal with, it’s important to have adequate homeowners insurance and liability coverage to help protect you from the financial ramifications.

Is Umbrella Insurance a Good Idea?

To extend your liability coverage limits under your homeowners insurance, you may want to considering adding an umbrella policy. Umbrella insurance stacks on top of the underlying liability coverage included in homeowners policies and typically comes with a limit of $1 million.

Though slips on icy sidewalks typically aren’t costly enough to require umbrella coverage, homeowners face many scenarios that could easily benefit from increased liability limits. Other than icy sidewalk injuries, the most common lawsuits homeowners face that could benefit from umbrella coverage include:

- Dog bites: Even injuries caused by a family pet can cost an average of $30,000 in claim settlements.

- Fallen trees: If a tree on your property falls and damages your neighbor’s home, the resulting damage could easily reach into the ten-thousands.

- Hired help injuries: If a domestic worker, such as a maid or gardener, is injured on your property due to your failure to maintain safe premises, the resulting lawsuit and medical payments required could get expensive, fast.

- Intoxicated guests: When you throw a party and it gets a little out of hand, you as the homeowner are still held responsible for any property damage or bodily injuries an intoxicated guest causes to other guests.

Umbrella insurance can come in handy for many common, costly lawsuits, even if icy sidewalks aren’t a huge cause for concern in your area.

What If I Don’t Have Insurance?

Even if you are uninsured, you can still get sued by someone who sustains an injury on your property. The trick is whether you’ll actually be held liable. But even in the event you’re not found guilty for a third party’s injury, you’ll still be responsible for paying court fees out of pocket, and lawyers can be expensive. That’s why it’s best to work with an independent insurance agent to get set up with the proper coverage long before you ever need it.

Other Common Risks Worth Considering Coverage for

Not all homeowners are concerned about icy sidewalks, but there are plenty of common risks that warrant having the proper coverage. Check out these stats regarding common home insurance claims.

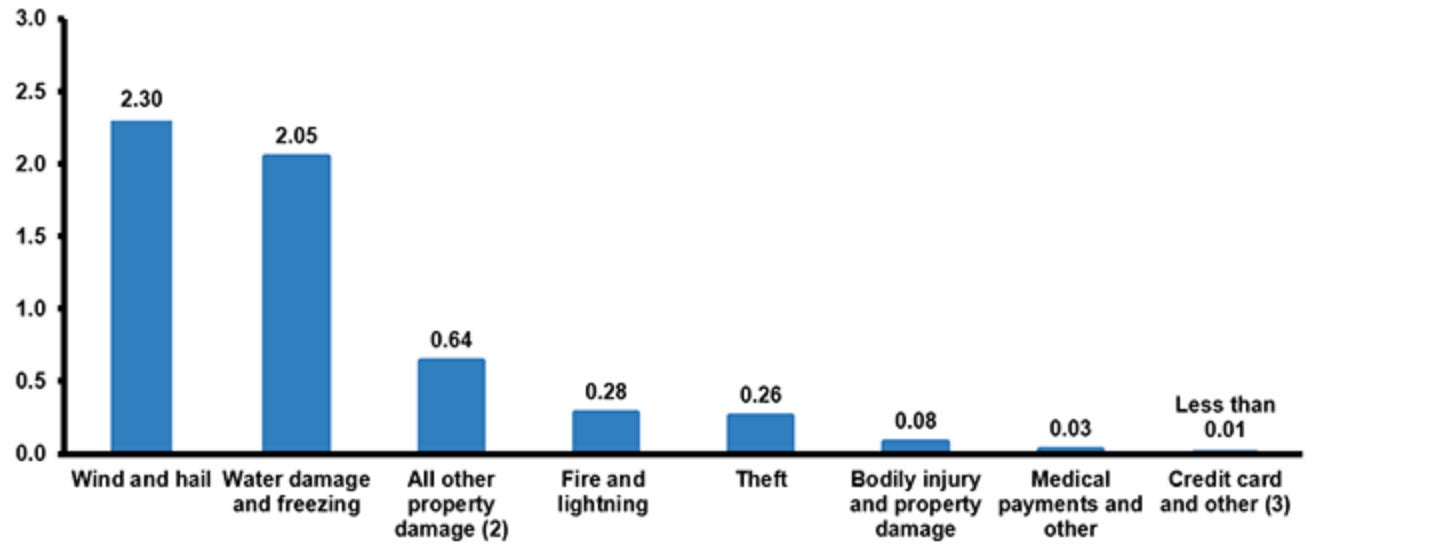

Homeowners Losses Ranked By Claims Frequency, 2014-2018

(Weighted average, 2014-2018)

The most commonly submitted claims by homeowners in the 2014-2018 period were due to wind and hail damage. Following those disasters were claims made due to water damage and freezing. Property damage, fire and lightning, and theft were also commonly reported, as were bodily injury claims, theft, medical payments and credit card misuse.

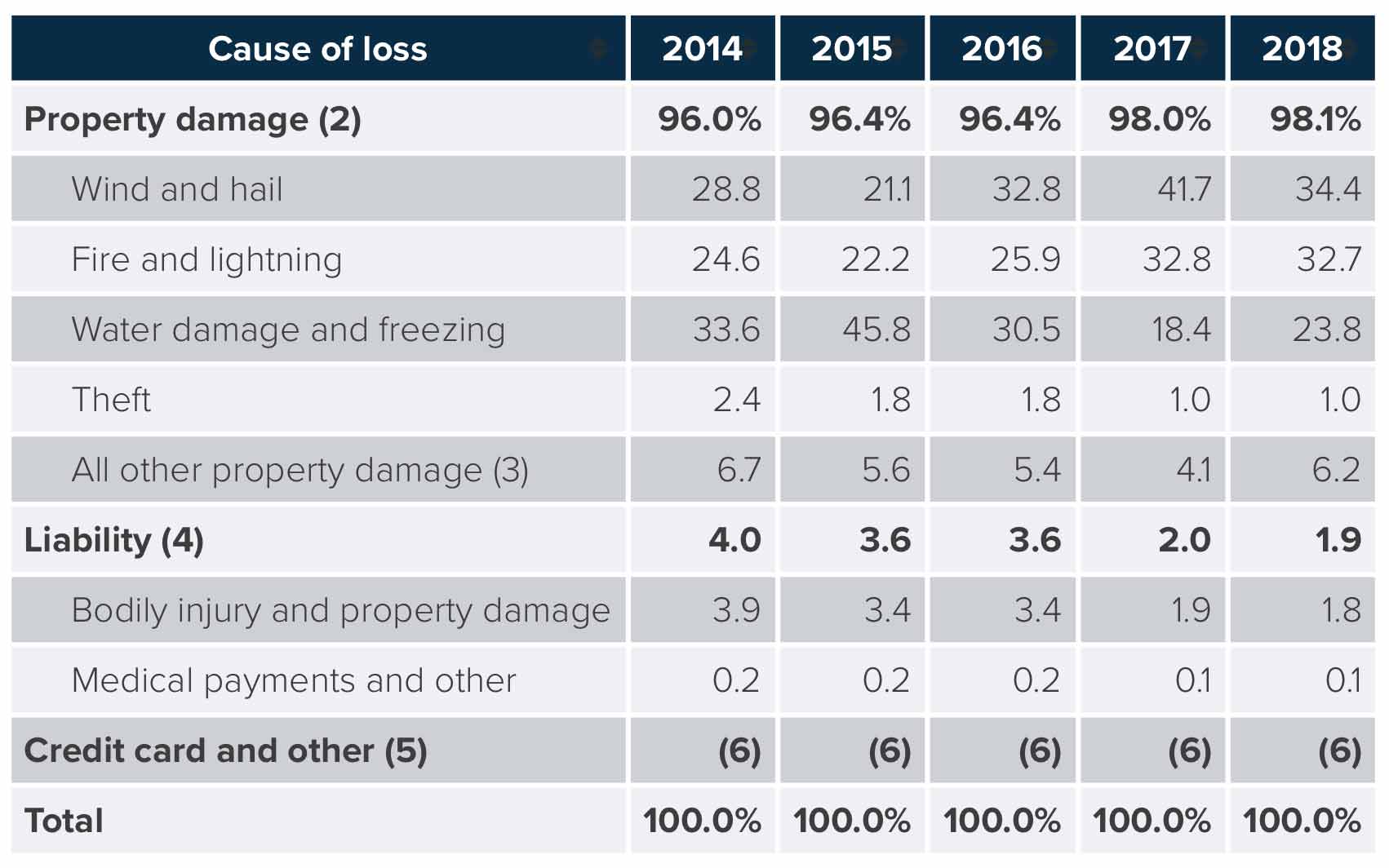

Homeowners Insurance Losses By Cause, 2014-2018

Property damage claims were by far the most frequently reported claims for home insurance between 2014-2018, with water damage and freezing specifically accounting for 33.6% of all claims in 2014. In 2018, wind and hail claims took the top spot for frequency, accounting for 34.4% of all home claims reported that year. Liability-elated claims accounted for less than 4% of total claims each year during the observed period.

Here’s How an Independent Insurance Agent Would Help

When it comes to protecting third parties against slips on an icy sidewalk and all other strange incidents, no one’s better equipped to help than an independent insurance agent. These agents search through multiple carriers to find providers who specialize in homeowners insurance, deliver quotes from a number of different sources, and help walk you through them all to find the best blend of coverage and cost.

iii.org

economical.com

alllaw.com

coverhound.com