Is a Reverse Mortgage Right for You?

Are you under the age of 62? If so, bye Felicia. Reverse mortgages are only for homeowners age 62 and older. But if you like to read about really exciting stuff, like home mortgages, then stick around.

To help us break through the noise, we spoke with Doug Carling, a mortgage banker with 15+ years of experience in mortgages, so you’ll know exactly what you need before you jump into a reverse mortgage.

Like any mortgage talk, it’s confusing as hell, so we’re going to boil down what a reverse mortgage is, what it takes to qualify (aside from being old[er]), and help you determine whether it’s a smart move for you.

What Is a Reverse Mortgage?

To smart people that use big words, a reverse mortgage is a home equity conversion mortgage (HECM) insured by the Federal Housing Administration (FHA). For the rest of us, a reverse mortgage lets you turn your home’s equity into cash. You stop making mortgage payments, and you get some extra spending money.

“This loan allows someone to continue living in their home without making mortgage payments. The payments you would be making get added onto the balance of your home. You’d pay this off if you leave the home, or you pass away and the government gets your home,” explained Doug Carling.

The amount of money you can receive from a reverse mortgage is based on your age, the value of the home, interest rates, and the amount left on your mortgage.

Too good to be true? No. As easy as it sounds? Also, no. However, if done strategically, a reverse mortgage could be a great option for keeping your home if you have enough equity and you’re not financially able to continue making mortgage payments.

Who Benefits from a Reverse Mortgage?

Reverse mortgages are not for everyone, but can be a great option if you fit into one of the following categories:

- A homeowner who can’t financially afford to stay in their home but wants to keep it.

- Homeowners who have a second mortgage that needs to be paid off.

- Someone whose spouse passes away and they can’t afford the mortgage payments.

- Someone who is facing retirement and needs extra cash.

- Someone who needs money for home renovations, medical bills, and daily living expenses.

“Reverse mortgages are not ideal for someone who has other sources of income that can be financially secure. You are essentially losing your equity,” said Doug.

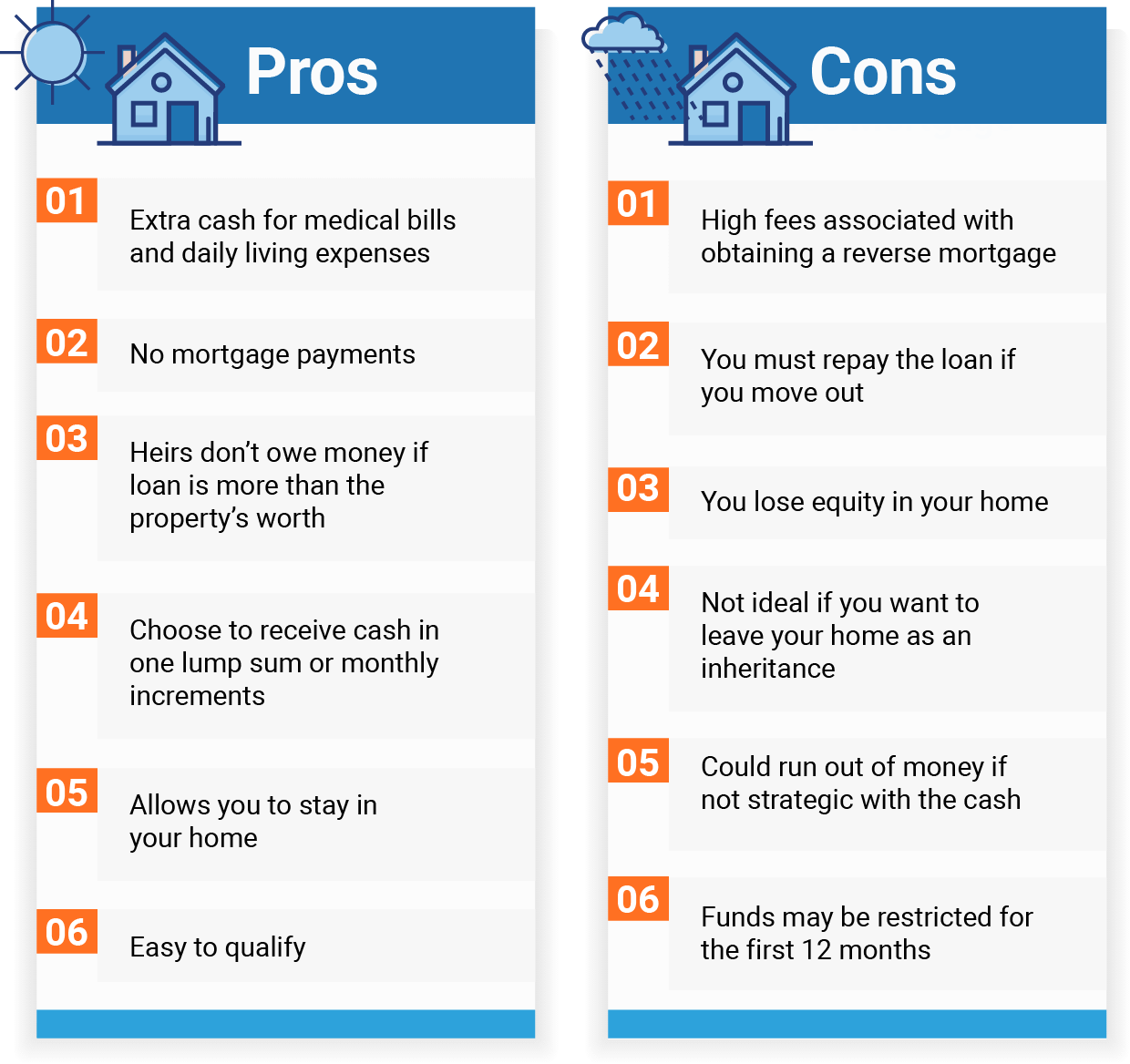

Things To Know (Good and Bad) about Reverse Mortgages

As with any mortgage, there are a variety of stipulations to a reverse mortgage. If you’re reading this and thinking, “Who doesn’t love extra cash?” and you’re on your way out the door to your lender, pump yo’ breaks.

Things to keep in mind about a reverse mortgage:

- It will cost you: You’ll still be responsible for property tax and insurance, as well as appraisal fees, raised closing costs, and interest.

- Consider how you want your money: Your cash will be disbursed to you in one lump sum or in monthly payments. Think about how you will be spending the money before deciding which route is best.

- Your kids may hate you: If your kids are waiting for you to kick the bucket so they can move in, a reverse mortgage may crush their dreams. Reverse mortgages mean your home loses equity, so it may not provide the inheritance they’re hoping for. If you die, your heirs will have six months to pay off the loan, sell the property, or give it to the lender.

- Your kids may hate you less: The flip side is that heirs are not liable if the property is worth more than what it was purchased for. Reverse mortgages are “nonrecourse,” meaning you can never owe more than the value of the property.

- You really don’t want to leave your home: Reverse mortgages are meant for people who plan on never leaving their home, like ever. If you move out, you’ll be responsible for paying off your loan, and don’t forget that all those mortgage payments you haven’t been making have been added onto your loan.

- The government doesn’t care what you owe: If you don’t plan on leaving your home, and you have no greedy kids, once you pass away the government happily takes your home and you just lived out your days not paying a mortgage.

Is a Reverse Mortgage a Good Idea or a Bad Idea?

If you’re smart with your money but just didn’t end up with a lot of it by the time you retired, then a reverse mortgage can be a way to live with a little less stress later in life. If you’re thinking that a reverse mortgage is just a way to work the system so you have more cash, it will backfire.

Be Smart with Your Reverse Mortgage

The people who find themselves in trouble with a reverse mortgage are the ones who are not strategic about spending. If you’re taking out a reverse mortgage for living expenses, making a financial plan that lays out how you’ll use your money can ensure that you won’t run out of equity before running out of time.

As previously mentioned, a reverse mortgage can be used to pay off a second mortgage (but don’t forget you must be living in your home in order to take out a reverse mortgage on it).

Time To Put It in Reverse

Doug reminded us that reverse mortgages are designed to benefit seniors. If done properly, a reverse mortgage can provide a stress-free way to spend your golden years or ensure that your spouse is not left with a house payment they can’t make if you pass away.

So if you’re over 62 and didn’t retire with as much money as you hoped, and want to spend your time living your best life before you bite the dust, a reverse mortgage could be the best solution for you.