What Credit Score Is Needed To Buy a House?

You’ve decided you’re ready to buy a house. Up until now you’ve been one of two people: someone who annoyingly pays all of their bills on time, ensuring they never go in debt; or someone who annoyingly never pays any of their bills on time and takes full advantage of credit cards. Find out more by contacting an insurance agent in your area.

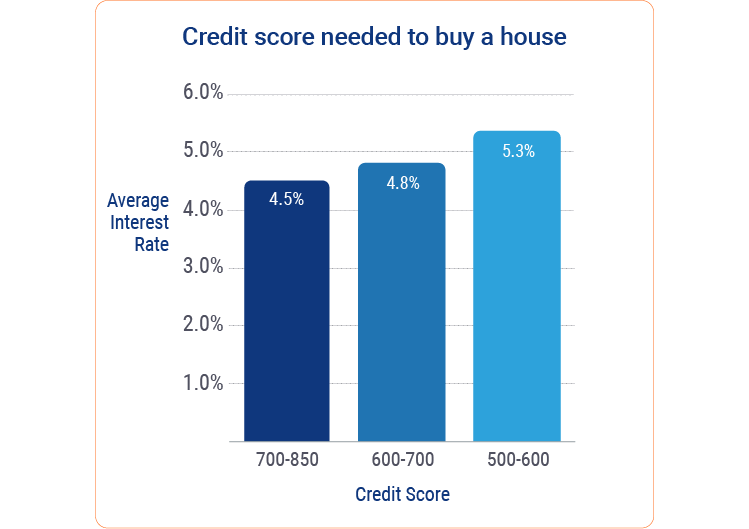

This may be the first time in your life you wish you were the bill-paying type of annoying person, because when it comes to buying a house, the best credit score wins. In fact, two major factors determine your home interest rate, credit score and the amount you put down.

Doug Carling, a mortgage banker with 15+ years of experience, helped us break down the four most common credit score brackets and what home-buying will look like, depending on which one you fall into.

Hold onto your shoelaces, we’re about to learn what kind of roof you can afford to put over your head.

Buying a House?

Get InsuranceA Quick Credit Score Preview

Before we can even jump into what credit score is needed to buy a house, you need to know that most mortgages will fall into two different home loan types, conventional and FHA.

- Conventional: For those who have a higher credit score and are able to put more money down.

- Federal Housing Administration (FHA): For those with lower credit scores and lower down payments, which are commonly used by first-time buyers and those looking to refinance.

While other loans are available, the info in this article will focus on qualifying for one of these two types of loans.

Credit Score of 700+

Congrats, you’re the cream of the crop and top of the food chain! This credit score, which is higher than the average American homebuyer, means you’ll qualify for a conventional loan with the option of putting as little as 3.5% down. The higher your credit score is, the lower your interest rate will be.

In addition, the more you put down, the lower your interest rate will be, and if you’re able to put down 20%, you won’t have a mortgage tax. If you put less than 20% down, you’ll need private mortgage insurance (PMI), which you’ll have to pay monthly.

However, your PMI can be dropped when one of three things happens:

- You own 20% equity in your home.

- You’ve paid down your mortgage to 80% of the home’s original appraised value.

- Your home loan balance drops to 78%.

Credit Score of 600-700

You’re an average Joe or Jane, but this is one time where being average is totally fine. The average American homebuyer has a credit score of 670, and while you’ll most likely have the option of a conventional or FHA loan, Doug suggests you go with the government-backed loan (FHA).

“In this case the homebuyer is better off going with an FHA loan because they aren’t looking as closely at the credit score,” said Doug.

Unless you’re sitting closer to 700, you should get a better interest rate with an FHA loan. Doug explained that someone whose credit score is in the lower 600s would see almost a 1% higher interest rate with a conventional loan vs. being in the 700+ range.

Credit Score of 500-600

You need some assistance, but not all is lost. Being in the 500-600 range is not ideal for buying a home, but you’re not completely out of options. With this score you’ll only qualify for an FHA loan, but hey, it’s better than nothing.

You’ll need a mortgage insurance premium (MIP) that you’ll have to pay monthly. Unlike the mortgage tax of a conventional loan, the MIP never goes away, as long as you own the loan.

Credit Score of 500 or Less

Dun dun DUN! Can you hear it in your head? Having a credit score less than 500 pretty much means you can’t buy a home. There are no traditional financing options, unless you’re married and your spouse has a decent credit score. Some programs will allow a spouse to purchase without taking their better half’s score into consideration.

If you’re out of options, here are some tips to help raise your credit score:

- Pay your bills on time.

- Avoid unnecessary credit inquiries.

- Keep your old and paid-off accounts open.

- Keep your balances on credit accounts below 40% of your available credit.

- Review your credit report regularly and dispute incorrect information.

- Add a fraud protection or explanation statement to your credit report.

“Getting your balances down and getting payments current can have an immediate effect on your credit score,” said Doug. “You want to work with someone that can advise you on your credit score because the right lender can plan it properly so you can tinker with your score and ensure that it’s at its best when the lender runs the report.”

And There You Have It

If you’ve notoriously not paid your bills, aren’t married to someone who is a better bill-payer than you, or you don’t have a rich aunt or uncle, then you’ll need to re-evaluate your life choices.

The good news is, depending on your credit score, you can increase it in anywhere between 3 and 10 years. So the chances that you’ll never be able to own a home are slim. If you’re still holding onto your shoelaces, you can let go. It’s time to (hopefully) buy a new (to you) house! Find out more by contacting an insurance agent in your area.