Arizona Construction Insurance

We’ll get you covered, so you can get to work.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Construction work can be tough. Projects often require workers to work at great heights, operate heavy machinery, and deal with the elements—all in the same day. Though the end results are impressive, there are numerous hazards along the way. These risks must be addressed before setting foot on a job site. Luckily, construction insurance can offer a great deal of protection.

That's where our independent insurance agents come in. They'll break down all kinds of construction insurance options available in Arizona, including coverages for solo contractors all the way up to large-scale construction companies. Whatever the scale of your business or project load, they'll get you set up with the protection you need. But first, let’s start with an overview.

What Is Construction Insurance?

In short, construction insurance is a bundle of policies packaged together that’s designed to cover all the components involved in construction work. This includes everything from the tools workers use, to the job site’s property, to all the people connected to that job.

Now, it should be no surprise that all construction businesses and jobs are different. But that also means the insurance that’s needed to protect the company—or job— isn’t one-size-fits-all. The perfect coverage for one site might not be enough to protect yours. And what another company has may just be way too much.

That’s why it’s so important that your coverage is tailored specifically for you. When you work closely with an independent insurance agent, you get the protection that’s right for you—no more, and no less.

Is Construction Insurance Required in Arizona?

Sometimes yes. Sometimes no. Small-scale projects involving less risky operations may not require coverage, while larger jobs that involve more hazardous equipment and complex labor absolutely will. But required or not, construction work comes with numerous risks, both obvious and hidden, so coverage is always a good idea, especially if you are a:

- Property owner: If a construction mishap occurs on your property, you can be sued — even if the incident wasn't your fault. Construction mishaps can potentially cause injury to guests on your property, so you'll need protection against lawsuits.

- Contractor: If you make a calculation error that somehow causes injury to workers and property guests, or damage to the actual property, you can be sued. Protection against lawsuits is crucial for contractors.

- Subcontractor: As with contractors, subcontractors need coverage to protect themselves against lawsuits.

- Construction company: Construction companies need protection for themselves and their workers. If your employees cause damage to a job site or get injured while on the job, coverage is essential. Also, you'll definitely want to be protected if a property owner decides to sue you because of a mistake your workers may have made.

Why Do I Need Construction Insurance?

From potential injuries to property damage and lawsuits, construction insurance is definitely a must-have. In order to keep the job and the hand-off running smoothly, you'll need to consider the construction risks specific to your state. What kind of risks? Well, the most common construction insurance claims in Arizona include:

- Wildfire damage: Construction projects located in several western states are at risk of being hit or delayed by wildfires. Worse yet, wildfire seasons in this region are expected to get longer and more destructive as time goes by. Wildfires can cause serious damage to job sites and equipment, present hazardous conditions for workers, and even force you to suspend your operations. And not working means not making money.

- Employee injury: It's no secret that construction is a risky business. Projects come with all sorts of hazards, from working at great heights on unstable surfaces, to dealing with dangerous equipment, and even direct exposure to the elements. Injuries, and even death, are a risk that all construction workers need to be mindful of, and protected from.

- Damage due to defective work: Mistakes made during a construction job can (and often do) cause damage to the structure and any surrounding property, or injure someone on the site — during or afterwards. Sewer line disturbances due to construction projects are some of the most common and costly claims.

- Damage due to falling objects: Overloaded cranes, workers dropping materials, and pieces of a structure being knocked off are all-too-common mishaps. And as you can imagine, falling objects can cause serious destruction in the form of property damage, injury, or even death.

- Business interruption: Regardless of where a construction project takes place, it's always prone to nature's elements. Whether you're contracted in an earthquake zone, flood zone, Tornado Alley, or anywhere else, you run the risk of losing precious income if a natural disaster forces you to temporarily suspend operations.

With the proper coverage in place, however, you can help minimize your risks and protect your construction projects and workers from unexpected catastrophes.

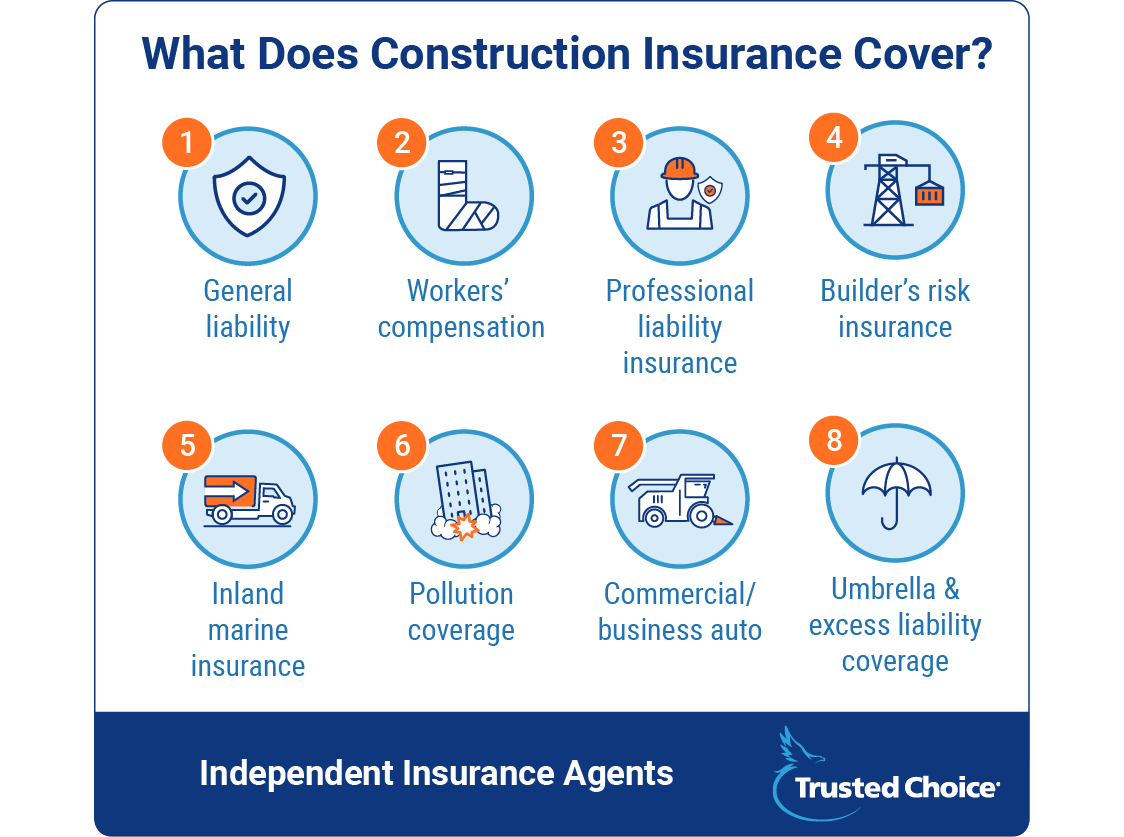

What Does Construction Insurance Cover?

A construction insurance policy is typically the easiest option when it comes to knocking out your extensive list of coverage needs all together in one tidy package. These policies offer most of the liability insurance you'll need, and your independent insurance agent can hook you up with any additional coverage you may need depending on the size and scope of your business, the type of construction work you do, etc.

Here are several common construction insurance coverage options:

- General liability: This coverage protects you against property damage or injury claims made by a third party.

- Workers' compensation: If your employees become ill, get injured, or die from a work-related incident, this aspect of the insurance will cover the financial ramifications. Depending on the type of work being performed, this coverage is often mandatory in most states.

- Professional liability insurance: Also known as "errors and omissions insurance," this coverage protects against claims made by clients who have suffered financial loss due to the work they've hired you for. This coverage is important if you offer advice, consulting, or design work as part of your services.

- Builders risk insurance: This aspect of insurance provides coverage for the structure on a job site as well as the materials used for the job, from the time a job begins until its full completion. Damage/theft to the structure and materials is usually covered. Builders risk, in many cases, also provides coverage against business interruption or financial losses due to a delay in a construction project’s completion.

- Inland marine insurance: Covers the construction tools and equipment used that cannot be affixed to a permanent location, even while it's in transit.

- Pollution coverage: Provides protection against third-party claims for property damage or bodily injury for construction incidents involving pollution. Demolition and paving are a couple of examples of construction projects that could lead to pollution-related incidents.

- Commercial/business auto: Provides protection for any company vehicles against things like theft, vandalism, and damage from natural disasters.

- Umbrella and excess liability coverage: These coverage options provide a buffer against excess liability charges that reach beyond your existing liability policies’ limits. Umbrella coverage can be applied to many types of policies, including business auto and pollution.

Your construction insurance package will be assembled by selecting the coverages that work for your unique business from a big list of available options. Coverage applies to everything from lost business revenue to potential legal/court fees and beyond.

How Much Does Construction Insurance Cost in Arizona?

The short answer is: It depends. On a lot. A small construction company with just a few employees that only handles sidewalk paving might pay around $25,000/year. But a solo construction worker completing the same type of project would probably only pay somewhere in the low thousands annually, since they have less equipment and no employees to cover with workers' comp.

Now, on the other end of the spectrum, a huge construction business working on a large-scale project in a major city, like a new stadium for the Chicago Bears, could easily have premiums ranging in the millions each year. Really, it all depends on a number of factors, like:

- The type of project: Construction projects come in all different scopes and sizes, and will require varying amounts of equipment and manpower. Also, the more dangerous a project is considered, the higher the risk (and potentially cost) that comes with it for an insurance company.

- The location of the project: A construction project may cost up to 20% more to insure if it's located on the coast, vs. somewhere 50 miles inland. Job sites located within a certain distance (dictated by the specific insurance company) of the Atlantic coast have to factor in windstorm coverage. Of course, other regions of the country have their own unique natural disasters that also need to be factored in.

- The number of employees: The more you've got, the more workers' comp. you’ll need. Simple as that.

- How much business you generate: Premiums are calculated based on business projections for the upcoming year. If your workload doubles, so will your premium, most likely.

Top 5 Ways to Score Construction Insurance Discounts in Arizona

Every business owner loves to save a buck or two wherever they can. And fortunately, there are some tips and tricks out there to help you significantly lower your premium, like:

- Maintain a track record of safety: Insurance companies love working with clients who put safety first. Put practices in place to keep your employees, equipment, and project sites as safe as possible, and you'll probably be rewarded by your insurance company.

- Maintain a track record of quality work: Another tip is to prove that your construction company finishes projects on-schedule and in-budget. Essentially, keeping your clients happy is the key to keeping your insurance company happy, and they just might slash your premium as a thank-you in return.

- Keep your claims history low: This pretty much goes hand-in-hand with maintaining a safe and efficient business. Plus, if you ever need to switch insurance policies or companies, having a low or even squeaky-clean claims record will definitely help you land a lower premium.

- Keep it professional: Sometimes insurance companies send industrial hygienists or safety engineers out to observe a construction project in progress. If your equipment is clean and well-maintained and your employees are following necessary safety protocols, you’ll get a good report. A favorable evaluation could reward you with a reduced premium.

- Work with an experienced agent: An expert independent insurance agent in the Trusted Choice network will not only know where to find the best coverage and price, but also help make sense of all the fine print. In the end, you’ll get the right protection and the best price, and you’ll know your policy just as well as your agent does.

Compare Arizona Construction Insurance Quotes with an Independent Insurance Agent

We all know how valuable your time is, so why spend it doing all the hard work yourself? From insurance packages to add-on policies, our independent insurance agents will help you determine which types of coverage make the most sense for your business and your budget

They’re not just there at the beginning, either. If disaster strikes, your agent will be there to help you through the entire claim process and get your construction business back on track. It’s nice having someone in your corner with you, isn’t it.

https://www.12news.com/article/news/local/arizona/wildfire-season-getting-longer-and-fires-more-destructive-data-shows/75-586971702

https://uanews.arizona.edu/story/wildfire-problem-will-get-bigger-coming-decades