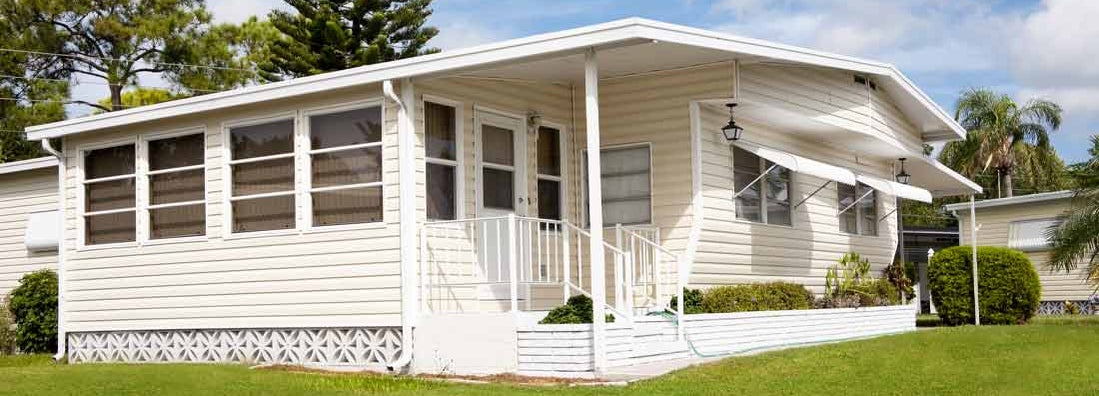

Arizona Mobile Home Insurance

Find the right mobile home insurance policy for you.

Whether you recently purchased your Flagstaff mobile home or you've lived in your Tempe mobile home community for decades and are looking to change policies, only a comprehensive mobile home insurance package can fully protect your home and its contents.

Before you search for mobile home insurance quotes, however, there are several factors to consider.

Use our independent agent matching system to find the best insurance plan in your area. You tell us what you’re looking for, and our technology will recommend the best agents for you. Any information you provide will be sent to only the agents you pick. We do not sell to third parties.

Why Choose a Mobile Home?

Arizona is home to dozens of mobile home communities. Some offer the peace of mind of gated access. Others are conveniently located near shopping and urban centers. And all of them feature affordable living.

No matter why you have chosen to purchase your mobile home, most likely you have made a considerable investment in the structure itself and all the valuables you keep inside. The benefits of living in a mobile or manufactured home are lost if it is not properly insured against potentially devastating damage.

Mobile home insurance also protects you from lawsuits should a neighbor or guest injure themselves while on your property.

How is Mobile Home Insurance Different?

Mobile homeowners need an insurance policy that fits the specific needs of their homes. Since mobile homes are constructed in a factory using lighter materials and then attached to the ground by anchors, these homes face different risks than traditional site-built homes. Mobile homes take more damage during severe wind and other weather events. Your home is most likely perfectly safe, but you need an insurance policy that reflects your home's set of risks.

Modular homes on the other hand, while still built in a factory and transported in sections to the site, are similar to traditional homes because they are built on a foundation. You should be able to secure a traditional homeowners insurance policy for your modular home.

If you rent your mobile or modular home, a renters insurance policy is a must-have to protect your belongings.

What Does Mobile Home Insurance Cover?

Most insurance companies offer the same type of coverage options for mobile home residents as they do for owners of traditional site-built homes. The structure of your mobile home insurance policy and the amount of coverage you will need depends on the size and value of the home, whether you own the land the home is built on, and the risks in the area, among other factors.

The Arizona insurance company you choose should offer:

- Mobile Home Liability Coverage: Covers you if a visitor on your property gets injured due to your negligence, or if you damage someone else's property and you are taken to court. This policy option will assist you in paying your court fees and legal defense and even shield your income and assets should the judge not rule in your favor.

- Property damage: Covers any significant loss to your mobile home that requires repair. It can also replace your mobile home if it is damaged beyond repair.

- Personal property: Sometimes called contents coverage, this policy option covers your belongings in case of burglary or theft, as well as damage or loss due to severe weather events.

You should be able to choose from two types of personal property or contents coverage:

- Actual cash value: This type of reimbursement takes depreciation into account. If your 10-year-old mobile home is destroyed by a flash flood, this coverage will reimburse you the cost to replace a 10-year-old mobile home.

- Replacement cost: This option ignores depreciation. Your insurance company would reimburse you the cost to replace your old mobile home with a brand new one with comparable features.

What Will My Mobile Home Insurance Quote Look Like?

Most mobile home owners will find insurance quotes for less than traditional homeowners, as the value of a mobile home is often much less than a site-built home. However, some mobile homes are quite valuable and you may see insurance policy quotes higher than for similarly valued site-built homes to reflect your different risks.

Insurance companies also take several other things into consideration when calculating your mobile home insurance quote, including:

- Your AZ location: High-crime areas will have higher quotes than low-crime neighborhoods and locations subject to frequent flash floods will see higher quotes than those with few weather risks.

- The age of your home: Older mobile and manufactured homes can be difficult to insure and will receive higher quotes because of the risks of incidents such as weather and fire damage.

- How much liability coverage you choose: Most insurance companies give you a wide range of liability coverage options. The more coverage you choose, the higher your quote.

- The amount of contents coverage you need: In order to calculate how much contents coverage you should purchase, it's a good idea to conduct an inventory of all your personal property. The total value should give you an idea of how much contents coverage to purchase. The more you need, the higher your quote.

- The deductible you choose: When you select a deductible, you are choosing the amount that you will pay out of pocket in the event of a claim before your mobile home insurance coverage kicks in. The lower the deductible, the higher the premium rate tends to be, but be sure you choose a deductible you could comfortably afford should you need to file a claim.

Where Can I Find Mobile Home Insurance Quotes?

Your home is your castle and the last thing you want to worry about as a severe thunderstorm rolls into town is if you have sufficient insurance coverage. Knowledgeable, independent insurance agents on the Trusted Choice® network are always available to answer your questions, suggest coverage options suitable to your mobile home, and even assist you in filing a claim.

These agents have years of experience working with AZ insurance providers, enabling them to find you a number of quotes from a variety of companies. You will only receive those quotes with the best coverage at affordable rates. Contact a Trusted Choice agent near you to find out how you can secure the perfect mobile home insurance policy that meets your needs and budget.