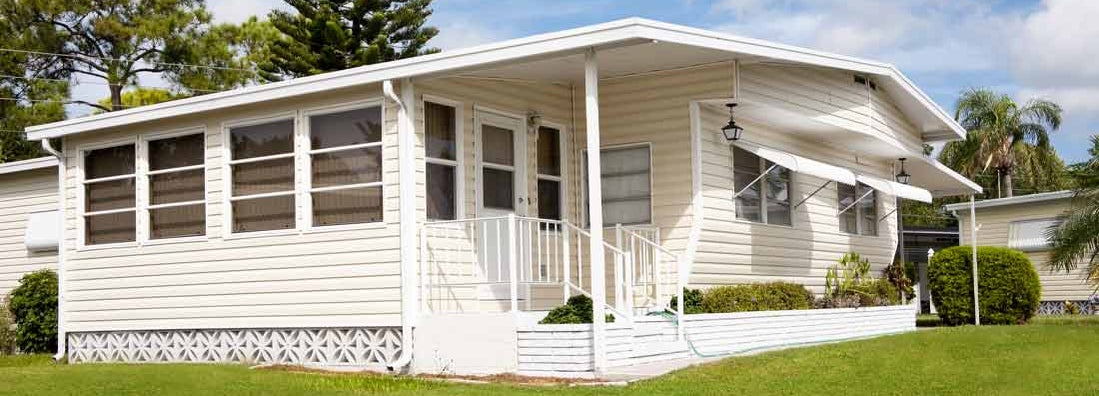

Louisiana Mobile Home Insurance

Find the right mobile home insurance policy for you.

Mobile homes, also called manufactured homes, are certainly an attractive housing option for many in America, including those in Louisiana. Mobile homes have low price points compared to site-built residences, and they generally can be installed quickly on a new home site. They are a good option for those with lower incomes, young people just starting out or those who are “empty nesters” and don’t need lots of living space. However, the same lightweight materials and quick construction that make these homes mobile, also make them more vulnerable to tornado, hurricane and fire. You can protect your manufactured home with Louisiana mobile home insurance.

Use our independent agent matching system to find the best insurance plan in your area. You tell us what you’re looking for, and our search engine will recommend the best agents for you. Any information you provide will be sent to only the agents you pick. We do not sell to third parties.

Mobile Homes in Louisiana

- According to recent U.S. Census Bureau data, 13.4% of all housing units in Louisiana are mobile or manufactured homes.

- Louisiana’s percentage of mobile homes is twice the U.S. average and the eighth-highest rate in America.

- Mobile homes are the second-most popular structure in the state, as a single-family residence.

As you can see from the numbers above, mobile homes are part of the fabric of Louisiana, whether you’re in Shreveport, Baton Rouge or Lake Charles. With many of your neighbors in mobile homes, there is a sizable market and a sizable demand for Louisiana mobile home insurance. The key is, however, to do your homework before signing the paperwork.

Understanding Mobile, Manufactured and Modular Homes

Mobile and manufactured homes are essentially the same things. The term “manufactured home” has been used since 1976 when HUD developed new standards for mobile home construction. Modular homes, which are often confused with mobile and manufactured homes, are more similar to traditional site-built homes, with the exception that the house is manufactured in segments off-site and then transported to the home site for construction on a traditional foundation. These homes typically need a standard homeowners policy, rather than a mobile home policy.

How Does Mobile Home Insurance Differ from Homeowners Insurance?

Louisiana mobile home insurance, in many ways, is similar to regular homeowners insurance. The big difference is that a mobile home has more risk of damage and loss due to storm damage, and due to the relative ease with which they can broken into or suffer major fire damage. This is because mobile homes are built quickly, out of lightweight materials. It means that your premiums may be slightly higher than those of a traditional homeowner.

When you get Louisiana manufactured home coverage, be sure to fully understand what is and is not covered, and request information on coverage for windstorms, fires and floods. You may need additional insurance to be fully covered. For example, flood insurance is a separate policy from your mobile home coverage, and must be purchased through the National Flood Insurance Program. Another big difference to consider between mobile home and homeowners insurance is that mobile homes tend to be lower in value at the outset, and they depreciate, while regular single-family homes built on a foundation are more expensive and tend to appreciate in value.

The coverage you’ll find in Louisiana mobile home insurance policy will be similar but will cover a value that depreciates, so in case of a loss, you may get less than you paid for the home in the first place. However, you can opt to pay a little more for replacement value coverage, so that if your mobile home is destroyed by fire, wind, or other covered causes, you can purchase a new one of similar size and quality. Mobile home insurance usually covers the following:

- The mobile home structure, including attached porches, and other structures on your property, like sheds and carports

- Your personal property kept in the home, like clothing, furniture, and electronics

- Your liability on the property, in case of a bodily injury or property damage claim against you

- Medical payments for injury to others on your property

Compare Louisiana Manufactured Home Insurance Quotes

Louisiana manufactured home insurance quotes vary, depending on your ZIP code, the materials used to build your home, the land it is built upon, whether the home has a foundation, the size of the land plot as well as other factors. If you have expensive, antique or collector items, you might need to consider purchasing a separate policy for each item or have a rider attached to your policy to cover each item individually. A local independent agent can help you compare Louisiana manufactured home insurance quotes and find the best policy for your budget.

Get in touch with an agent near you to get covered.