Average Mobile Home Insurance Cost

How much is mobile home insurance?

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

If you have a mobile or manufactured home, it’s worth protecting, even if you don’t live there full time. Mobile home insurance is affordable and delivers the necessary coverage for your investment and the peace of mind that comes from knowing that your home, personal property, and potential liabilities are safeguarded.

Just like homeowners insurance, the cost of mobile home insurance will depend on things like your home’s value, age, and location, as well as the coverage limits and deductibles you choose. An independent insurance agent can help you review options. Read on to better understand factors that could influence the average mobile home insurance cost, coverage options, and ways to save.

How Much Does Mobile Home Insurance Cost?

The national average mobile home insurance cost ranges between $700 and $1,500. However, these costs vary depending on how much dwelling and liability coverage you need, as well as your policy's deductible amount. There are many factors to consider when it comes to mobile home insurance costs, including your location, the size of your home, and more. Other factors that influence the final cost of a mobile home insurance policy can include the purchase price of the home, the age of the property, the current value of the home, and the coverage options you select.

The average costs of mobile home insurance depend on a number of factors, and premiums can range from several hundred dollars to over $1,000 a year.

For comparison, let’s look at the average costs of mobile home insurance in two areas: Texas and California.

These costs are examples only. Please consult an independent insurance agent for coverage that meets your needs.

How Does My Location Influence the Cost of My Mobile Home Insurance?

Mobile home insurance costs fluctuate, just like anything else, depending on where you live. A mobile home in Florida, where severe weather is frequent, is likely to be more expensive to insure than one in Pennsylvania. A mobile home in a ZIP code with a low crime rate and nearby access to emergency services will cost less to insure than a mobile home in a remote location or an area with a high crime rate.

A few of the location-based factors that can influence a higher cost of coverage are:

- Risk of frequency of storms and severe weather

- Flood zones

- Risk of wildfires

- High crime rates

An independent insurance agent can help provide you with exact quotes for mobile home insurance in your town.

How Mobile Home Insurance Costs Are Calculated

Your mobile home insurance cost quote is calculated using the information in your application, such as the size and age of your mobile home, its location, and the amount and type of coverage you want. This data helps the insurance company analyze risk. The insurance company also reviews the number of losses claimed by mobile homeowners in your area. Finally, they calculate administrative costs and add in a profit.

NOTE: The cost of your coverage might change over time, such as by going down if the value of your mobile home depreciates, or by going up if the financial demands of offering the plan increase. So keep that in mind. It’s important to review your mobile home insurance coverage regularly with your independent agent to be sure you have the best coverage at the best price.

What Factors Influence the Cost of My Mobile Home Insurance Plan?

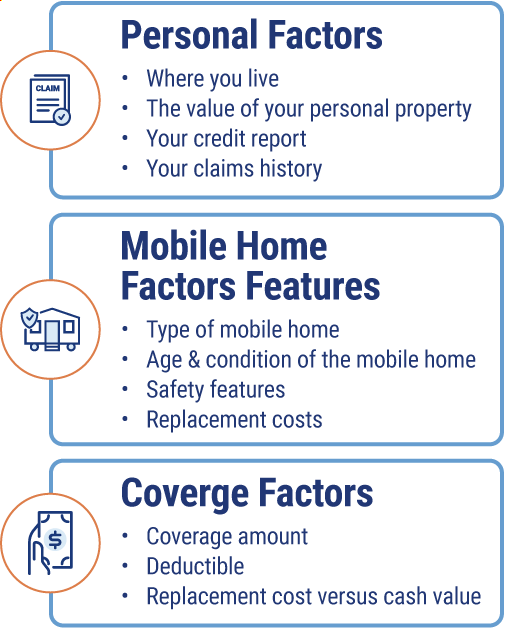

Many factors are considered in creating a quote for mobile home insurance. Let’s look at the three most common: personal factors, mobile home features, and the type of coverage you prefer.

Personal Factors

Where you live: Your address is a primary consideration in calculating the cost of mobile home insurance. Do you live near the coast, in an area prone to storms or wildfires, or in a ZIP code with a high crime rate? If so, your insurance rate will likely be higher than if you live in a state where few natural disasters occur or in an area where theft or crime is rare.

The value of your personal property: Your mobile home insurance will also cover damage or theft of your personal property. Policies have limits on this coverage, so if you own expensive technology, jewelry, art, or other high-end goods, you may need to budget for extra coverage to protect them.

Your credit report: How you manage your finances can impact how much you pay for mobile home coverage. That information is available to insurance companies via your credit report. Insurers want to know how well you handle credit, how much outstanding debt you have, if you have filed for bankruptcy, and if any of your accounts have been sent to collections. According to the Insurance Information Institute, the better you manage your money, the less likely you are to file a claim. That means a lower risk for the insurance company and possibly a lower premium for you.

Your claims history: Do you frequently file insurance claims? If so, that’s a risk that your insurance company will likely manage by charging you a higher rate.

Mobile Home Features

There are many styles of mobile homes, all with varying features and customizations. Here’s how some of those different features factor into the cost of mobile home insurance:

Type of mobile home: There are many types of mobile homes: single-wide, double-wide, triple-wide, and multi-section. Your mobile home's total square footage and floor plan will influence how much you pay for insurance.

The age and condition of the mobile home: Factors like the condition of your roof and the sturdiness of the materials used in building your mobile home will factor into the cost to insure it. The age of your mobile home is also taken into consideration. Old or outdated systems are more expensive to repair and typically mean a higher insurance premium. If your mobile home is older and does not meet the Department of Housing and Urban Development standards, insurance companies consider it a higher risk.

Safety features: If your mobile home has certain safety features (like smoke and carbon monoxide detectors, burglar alarms, and deadbolts), your insurance carrier may see a lower risk in providing you with policy coverage.

Replacement costs: The cost to replace your mobile home will influence how much you will pay for insurance coverage. A large luxury model will likely have a higher insurance premium than a more modest mobile home because it will be costlier to repair or replace

Coverage Factors

Mobile home insurance can offer various levels of protection. The type of coverage you choose will affect your mobile home insurance cost.

Coverage amount: It’s always wise to pay for coverage that equals the costs to replace your mobile home and personal property. But you may also want additional coverages for things like transporting your mobile home, flood damage, or appliance breakdown. These extra coverages will increase the cost to insure your mobile home.

Deductible: Your deductible is the amount you are responsible for paying for an insured loss before your coverage kicks in. Generally, the larger your deductible, the lower your cost for mobile home insurance.

Replacement cost vs. cash value: You may insure your mobile home in one of two ways: actual cash value or replacement cost. Actual cash value covers the cost of your mobile home plus the value of your possessions after deducting depreciation. “Depreciation” means the present-day worth of something, not the original purchase price. If you choose replacement cost coverage, your policy will cover the cost to repair or replace your damaged property with materials similar in kind and quality.

What Kind of Mobile Home Insurance Coverage Do I Need?

Mobile home insurance is a safety net that helps protect your investment and deliver peace of mind. You have many options for coverage, but in general, mobile home insurance should include the following:

- The mobile home and its contents: This coverage provides payment to replace or repair your mobile home and possessions if they are damaged or stolen, up to the limits of your policy and after your deductible is satisfied. This coverage often extends to structures not attached to your mobile home, like a shed or a fence.

- Liability protection: This coverage protects your finances from lawsuits filed against you if someone is injured while on your property or if you or those living in your mobile home cause damage to someone else’s property, up to the limits of your policy.

- Additional living expenses: Most mobile home coverage includes relocation expenses if an event like a fire or storm causes damage that requires you to live elsewhere temporarily until repairs are made.

You can also upgrade your mobile home insurance protection for added coverage for unforeseen events. Additional coverages you could consider include:

- Trip/transportation coverage: Also called trip collision coverage, this can help cover the costs if your home gets damaged when it's in transit.

- Flood insurance: This coverage can help cover the loss of belongings and damage to your mobile home that result from flooding. You will usually need to purchase this coverage from the National Flood Insurance Program.

- Earthquake insurance: This coverage can help pay for some of the costs associated with loss or damage caused by earthquakes.

- Appliance breakdown insurance: This coverage can help pay for expenses associated with repairing or replacing appliances that break down.

- Replacement cost coverage: This coverage can compensate for the amount it would cost to rebuild the structure to its original condition with similar materials.

- Additional structures coverage: This coverage can help compensate for damage or destruction to additional structures on your property, like sheds.

- Water backup coverage: This coverage can be added as an endorsement and can help you get reimbursed for incidents of natural water damage or sewer backup damage to your mobile home that are otherwise excluded.

An independent insurance agent can help you find the right amount of coverage for your specific needs.

Mobile Home Insurance Discounts to Consider

When you work with an independent insurance agent, you’ll learn about ways to save on your mobile home insurance premium. Some options may include:

- Bundling discounts: When you bundle other coverages like auto insurance with your mobile home insurance provided by the same insurance carrier, your loyalty is often rewarded with lower rates.

- Safety devices: If your mobile home features security devices like smoke and carbon monoxide detectors, deadbolt locks, burglar alarms, or security cameras, you may be eligible for an insurance discount.

- Newer home: If you own a newer model mobile home, it's less likely to need repairs and will likely cost less to insure than an older model.

- Paperless billing: Signing up to receive your insurance documents and pay your premiums online instead of by mail can help earn you a policy discount.

- Original owner: Some insurers offer discounts on mobile home insurance if you are the original owner of the home.

- Retirement: Those 55 or older may also qualify for mobile home insurance discounts.

An independent insurance agent can help you find all the mobile home insurance discounts you qualify for.

Mobile Home Insurance Cost FAQs

If you have a mortgage on your mobile home or live in a designated mobile home community, your lender or community will likely require that you have mobile home insurance. If those situations don’t apply to you, the choice to insure is up to you. Mobile home insurance is affordable and designed to cover you for events that would require you to repair or replace your belongings and/or your mobile home.

Mobile home insurance costs will vary depending on the home’s features, its location, and the type of coverage you choose. On average, you can expect to pay several hundred dollars to over $1,000 a year for coverage. Considering the average price of a new manufactured home (according to the US Census) is $125,000, the cost to protect it may seem reasonable.

When you work with an independent insurance agent, they will identify different insurers that offer mobile home insurance. Your agent will help you understand the various coverage options and work with you to get the right coverage for your mobile home at the right rate.

Yes. You can get flood insurance for your mobile home, and it is a very good idea to do so if you live in a flood-prone area. You will usually need to purchase this coverage from the National Flood Insurance Program, and your independent insurance agent can help you do that.

Yes. If you are renting your mobile home, you can get renters insurance to protect your personal belongings from damage or theft and provide you with liability coverage. Your renters insurance policy will not cover the mobile home – your landlord’s insurance will do that.

Just like homeowners insurance, mobile home insurance costs will vary depending on the home’s features, its location, and the type of coverage you choose. When considering cost, think about what it could cost you out of pocket to pay for repairing damage to your mobile home, purchasing a new one, or replacing some or all of your belongings if an unexpected event occurs. The cost of mobile home insurance is usually much less than the risk of loss.

Many insurance carriers offer mobile home insurance for homes built after 1976 as long as they comply with federal, state, and local safety regulations. Mobile homes built before 1976 do not meet federal construction and safety standards and are, therefore, very difficult and expensive to insure. Older mobile homes will often need an inspection before an insurance carrier agrees to provide coverage.

Connect with an Independent Agent to Compare Mobile Home Insurance Rates

Mobile home insurance is just as important as homeowners insurance, and policy coverage can be customized to fit your budget. An independent insurance agent can provide you with different options from different insurers, walk you through the process, and help you find affordable coverage that meets your needs.

https://www.businessinsider.com/personal-finance/mobile-home-insurance

https://www.foxbusiness.com/personal-finance/mobile-home-insurance-cost

https://www.investopedia.com/mobile-home-insurance-do-you-need-it-5073075

https://www.bankrate.com/insurance/homeowners-insurance/mobile-home-insurance/#what-is-the-difference-between-mobile-home-insurance-and-standard-home-insurance

https://www.insurance.com/home-and-renters-insurance/home-insurance-basics/insurers-calculate-home-insurance-premium.html

https://www.progressive.com/homeowners/faq/

https://www.iii.org/article/insurance-for-your-house-and-personal-possessions

https://www.iii.org/article/understanding-your-insurance-deductibles

https://www.amfam.com/insurance/manufactured-home/coverages

https://realestate.usnews.com/real-estate/articles/how-much-does-it-cost-to-buy-a-mobile-home#:~:text=The%20U.S.%20Census%20Bureau%20reports%20the%20average%20sale,foundation%2C%20a%20manufactured%20home%20is%20typically%20more%20affordable