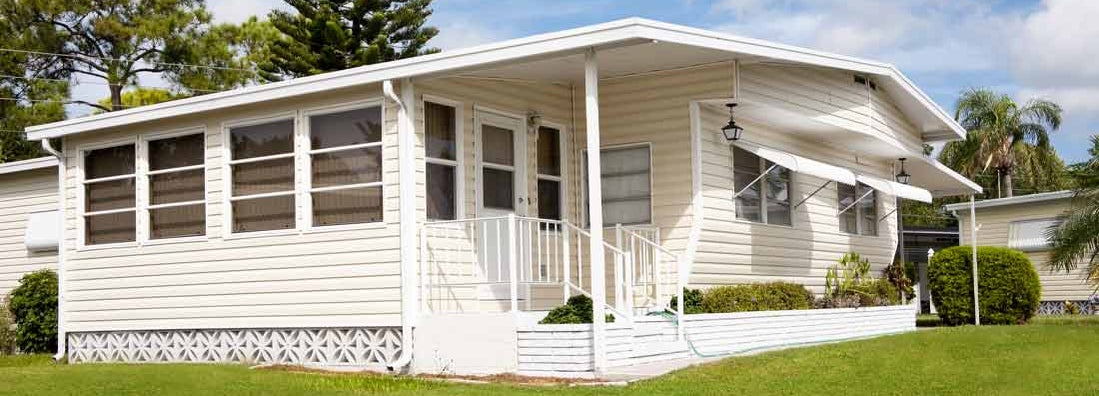

North Dakota Mobile Home Insurance

Find the right mobile home insurance policy for you.

As the housing crunch continues in North Dakota, the number of mobile home parks cropping up all over the state continues to rise. Whether you have lived in your Williston mobile home community for decades and are looking for a new mobile home insurance policy, or you have just realized your homeownership dreams and are about to move in to your Minot mobile home, you can find the right insurance policy. Before you look for mobile home insurance or manufactured home insurance, however, there are several factors to keep in mind.

Use our independent agent matching system to find the best insurance plan in your area. You tell us what you’re looking for, and our technology will recommend the best agents for you. Any information you provide will be sent to only the agents you pick. We do not sell to third parties.

Mobile Home Statistics

These are some statistics, according to census data and research analysis:

- Mobile homes comprised nearly 90% of the increase in affordable homeownership during the 1990s.

- Nearly 9% of ND residents live in mobile or manufactured homes, and that number is increasing.

- The average loss for residential home fires in ND is nearly $4,000 per fire.

- According to the 2011 U.S. Census, 74% of mobile homes are located on private property, with the remaining 26% located in land-lease communities.

Mobile Home Insurance Requirements

If you are still making mortgage payments on your mobile or manufactured home, your lender most likely requires you to carry insurance on it. If you live in a mobile home community, the association may also require you to obtain at least liability insurance. Regardless of the requirements, you can purchase a mobile or manufactured home insurance policy to protect yourself from liabilities and help you make swift repairs to your home if it sustains damage.

What Does Mobile Home Insurance Cover?

Mobile homes differ significantly from traditional, site-built homes. That's why insurance companies offer policies designed just for them. Manufacturers build mobile and manufactured homes in factories and then transport them to a site. Builders attach mobile homes to the ground using anchors, and they attach manufactured homes to a foundation.

Modular homes are similar to traditional site-built homes. A modular home consists of modules built in a factory. The builder uses the modules to construct the home at the site.

You may be able to find a traditional homeowners insurance policy if you own a manufactured home. For mobile homeowners, however, you need a specific policy that includes the following coverage:

- Liability: This can help pay for costs associated with a guest's or visitor's injuries or property damage while at your mobile home. It can also help pay your legal costs if you face a lawsuit as a result of those injuries or property damage.

- Property damage: This can help pay for repairs to or replacement of your mobile home if severe weather, theft, vandalism, fire or any other covered event damages your mobile home.

- Contents coverage: Also called personal property coverage, this can help repair or replace your belongings kept inside your home.

Getting Mobile Home Insurance Quotes

The quotes you find for mobile or manufactured home insurance will vary from company to company in North Dakota. Most insurance providers take the following into consideration as they calculate your mobile or manufactured home insurance quotes:

- The age and value of your mobile home

- Your location

- The amount of personal property coverage you need

- The deductible you choose

Higher-valued mobile homes will be costlier to insure. Also, mobile homes in high crime areas will get more expensive quotes than those in safer neighborhoods. It's always a good idea to compare coverage and cost of several quotes from different insurance companies to ensure you buy the best policy available.

Where To Find Mobile Home Insurance

Your home is your castle and you want the protection only a robust mobile home insurance policy can offer. That's why you should enlist the services of a knowledgeable, independent insurance agent on the Trusted Choice® network. These experienced agents can find you quotes from a variety of providers, ensuring the mobile home insurance policy you buy will offer the best coverage at the most affordable rates.

Contact a Trusted Choice member agent near you who can assist you in finding the perfect insurance policy that meets your needs and budget.