Architects Insurance

(Make sure your coverage is right for you)

As an architect, you’re responsible for bringing designs to life. From conception to realization, you’re part of the process of creating an architectural structure that people will use for many years to come.

Your work must meet client expectations, and there's risk involved in that. All businesses have certain risks associated with their field. The right kind of insurance protects you and your business, but how do you know which policy is right for you?

Our independent agent matching tool will find you the best insurance solution in your area. Tell us what you're looking for and we'll recommend the best agents for you. Any information you provide will only be sent to the agent you pick.

Business Risks for Architectural Firms

While we always want things to go according to plan, you may have worked on enough projects by now to understand that things often stray off course. There’s a popular saying that goes “Hope for the best and prepare for the worst.” Architects insurance helps you prepare for the worst.

Here are just a few risks that architects may encounter:

- Lack of senior manager commitment

- Unplanned legislation changes

- Vendor instability

- Funding deficiency

- Project that is too large or complex

- Inadequate infrastructure

- Use of old technology and/or products

- Increased standards

- Changes in client needs, expectations or budget

While insurance can’t thwart all the challenges involved in your daily work, it can help you if a customer blames you for problems that occur with a project. The right insurance plan, from standard business insurance to liability coverage and professional indemnity insurance for architects, is very valuable.

Tips for Reducing Liability Risk

- Document every step of your process and make sure that communication lines stay open. When they don’t, problems can arise and responsibility becomes blurry. At that point, it becomes harder to defend yourself against client accusations.

- Manage your client’s expectations. It may take more time, but sharing timelines and progress reports, no matter how favorable, is essential to the project. If deadlines need changing or the original project must change, put it in writing and make sure the project owner understands the situation.

- Educate your client about any potential risks that could develop. Even individual projects come with specific risks. When your client is aware of these risks, surprises are kept to a minimum, hopefully keeping lawsuits to a minimum as well.

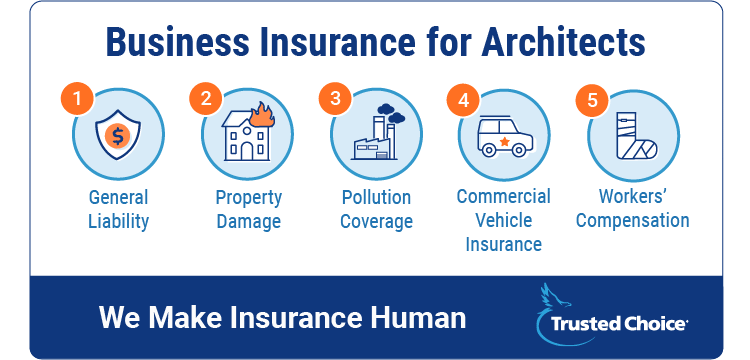

Business Insurance for Architects

The architects insurance you need depends on whether you work as an independent or run an architectural firm. Some of the basic business coverages you may need to protect your company include the following:

- General liability: If you’re held responsible for causing bodily injury or property damage related to the services you provide, this coverage allows the victim to make a claim for compensation. This is the most critical coverage you can carry regardless of the size of your operation.

- Property damage: If your office building or professional equipment is damaged due to a covered cause of loss, your insurance policy helps pay for repair or replacement.

- Pollution coverage: With any form of construction, there’s a risk of runoff or air pollution. If your work causes damage to the environment, this coverage assists you with the cost of cleanup efforts.

- Commercial vehicle insurance: Whether you have a small outfit or a large architectural firm, you most likely have company cars and perhaps other business vehicles and trucks as well. You need commercial vehicle insurance to cover the risks you and your employees face while driving in the course of your workday.

- Workers' compensation: If you have employees, this benefit provides lost income and pays for medical expenses if the employee develops a work-related illness or injury.

Note that workers' compensation laws vary by state and that you may be required to carry this coverage even if you do not have employees. Be sure to discuss your business insurance needs with an independent agent who can make sure you are in compliance in your state.

Design Professional Liability for Architects

What if a project is not completed as promised or you fail to complete a project on time or on budget? Delays or other unexpected problems can be costly for your clients. You can be sued for errors or professional negligence that harm your clients, and one lawsuit can be financially devastating.

Design professional liability insurance, or errors and omissions (E&O) insurance, provides the financial security and peace of mind you need. It provides coverage for architects, their partners, their employees, and the partnership or corporation for damage caused by providing or failing to provide professional services.

It covers costs associated with your legal defense if you are sued (even if the lawsuit is unfounded) as well as any judgments or settlements that you must pay. Clients may want to see proof that you have design liability insurance before they hire you.

Architects can be sued for professional negligence for a variety of reasons, such as the following:

- Bad or erroneous design (e.g., a house sustains water damage due to design errors)

- Wrong materials used (e.g., flooring)

- Failure to communicate changes in plans, materials, timelines and other important information about a project

- Failure to complete a project on time

- Failure to complete a project within budget

Whether you are a large architectural firm or a sole proprietor, design professional liability insurance is a wise and often necessary part of doing business.

Coverage for the Design and Build

Design-build insurance provides professional liability coverage for firms that act as the designer and the general contractor for a construction project. It typically covers claims for damage to the project itself as well as claims for bodily injury and property damage that arise during both the design and construction phases.

These situations are becoming more prevalent, and companies engaged in large construction projects with a broad scope of responsibilities and risks need to work carefully with an experienced insurance agent to find the right coverage.

Get Prepared Before Searching for Architect Insurance Quotes

Finding quotes for coverage isn't always easy. There are a few steps you can take to make this process fast.

- First, make sure you understand the risks your firm faces. This might mean taking into account your net worth, the number of employees you have, the size and/or type of projects you take on, and the amount of insurance you already have.

- Second, find reputable insurers to work with. You may want to check out local firms or look at consumer reviews first. Consider talking with colleagues doing similar projects to find coverage that might work for your firm.

- Third, consider your budget. How much money can you afford to spend on coverage? Will this affect hiring decisions or the scope of projects you take on? All of these can be reasons to consider getting sound legal and financial advice before you purchase a policy.

When you're prepared, shopping for coverage is easy. You may even be surprised at how affordable your architects insurance can be when you do some research first. Contact your local independent insurance agent for more information.