Malpractice Insurance

And how having the right coverage can help save your practice in case of an incident.

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

When you work with the human body, you’ve got to take numerous extra precautions to protect yourself and your career. One such action involves getting set up with the right coverage just in case of disaster. That means finding adequate medical malpractice insurance.

An independent insurance agent can help you get set up with the right kind of medical malpractice insurance for your needs. Even better, they’ll get you equipped with the proper coverage long before you ever need to actually use it. But before that, let’s take a deep dive into this crucial coverage.

What Is Medical Malpractice Insurance?

Medical malpractice insurance is essential a form of professional liability insurance designed to protect healthcare professionals against lawsuits relating to professional errors resulting in injury or death. Doctors and other workers in the medical field rely on this coverage to save their practice from extremely costly lawsuits that could otherwise lead to bankruptcy.

Who Needs Medical Malpractice Insurance?

Medical malpractice insurance is a critical coverage for anyone who works with the human body. Though unintentional, professional errors can be devastating for both patients/clients and the practitioner.

The following workers need medical malpractice insurance:

- Physicians and their assistants

- Registered nurses

- Optometrists

- Chiropractors

- Physical therapists

- Anesthesiologists

- Nursing students

An independent insurance agent can help you determine if your practice is in need of medical malpractice insurance.

Occurrence Coverage vs. Claims Made Coverage

When shopping for coverage, it's important to understand that medical malpractice insurance comes in three major forms. These include:

- Occurrence policies: Covers any incident that occurs during the policy period, no matter when the claim gets reported.

- Claims-made policies: Covers incidents only if they occur while the policy is active, and the claim gets filed while the policy is active.

- Modified occurrence policies: This type of policy combines aspects of occurrence with aspects of claims-made for a type of unlimited coverage. Tail coverage ranging up to seven years is automatically included. Once this additional amount of coverage has expired, you have the option of purchasing unlimited tail coverage.

Tail coverage extends a policy's protection after its term ends. Retiring physicians often purchase tail coverage to protect themselves even after they're no longer working. An independent insurance agent can help you select the right type of medical malpractice insurance for you.

What Does Medical Malpractice Insurance Cover?

Medical malpractice insurance is a special form of professional liability insurance designed to protect professionals in the medical field. This coverage protects medical professionals from the legal expenses required to defend and settle medical malpractice lawsuits, as well as settlement fees if they’re found to be liable for the claim.

Medical malpractice insurance covers the following:

- Costs of medical damages

- Costs of punitive and compensatory damages

- Costs of arbitration and settlement

- Costs of attorney and court fees

Your independent insurance agent can further explain the critical protections provided by medical malpractice insurance, and why you may need it.

Who Sells Medical Malpractice Insurance?

Medical malpractice insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. Independent insurance agents know which insurance companies to recommend to meet your needs, and can provide informed suggestions based on company reliability, rates, and more.

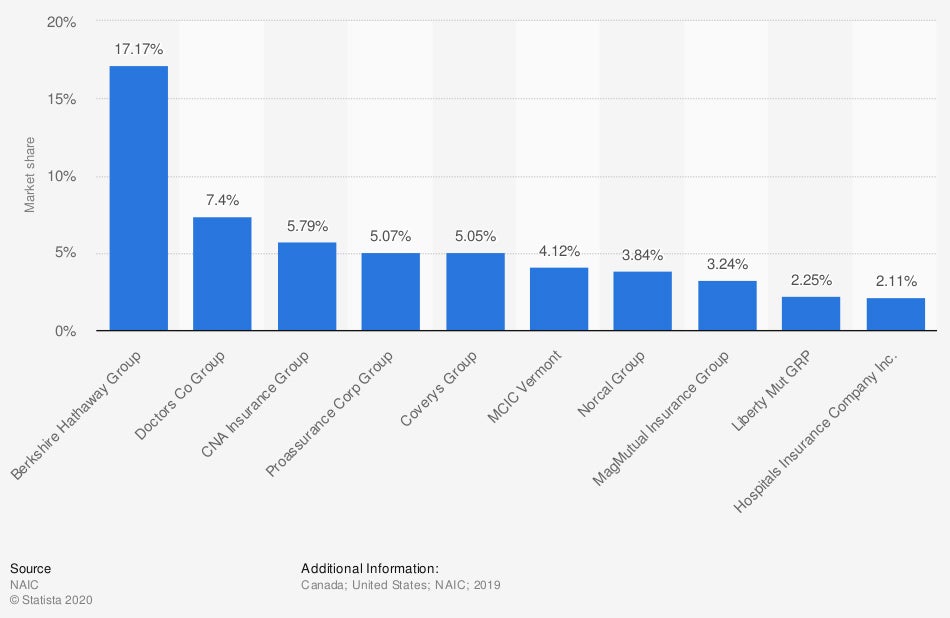

Leading medical professional liability insurers North America, by market share

Berkshire Hathaway Group is the clear current market leader for medical malpractice insurance. Other leading insurers of medical malpractice coverage include CNA Insurance Group and Liberty Mutual.

What Doesn’t Medical Malpractice Insurance Cover?

Medical malpractice insurance unquestionably provides a ton of critical coverage for professionals in the medical field, but it doesn’t cover everything. Coverage also comes with its own set of exclusions, like:

- Criminal acts

- Inappropriate alteration of medical records

- Intentional and dishonest acts

- Sexual misconduct liability

Your independent insurance agent can help address any concerns you may have about what your medical malpractice insurance excludes.

How Much Is Malpractice Insurance?

The cost of your medical malpractice insurance depends on several factors, such as the type of practice you have, your experience in the field, your location, claims history, and more. Coverage is much more expensive in select states, as shown below.

Direct premiums earned by the medical professional liability insurance market in the United States, by state

|

|

|

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recently, medical malpractice insurance premiums in the state of New York totaled $1.6 billion, by far the highest of the US overall. The second-costliest state for medical malpractice insurance was California, with coverage premiums totaling nearly $758 million.

An independent insurance agent can help find exact medical malpractice insurance quotes for coverage in your area, as well as scout out the most affordable policies you qualify for.

Top Medical Malpractice Claims

It's critical to have coverage for yourself and your practice against common, and devastating, professional errors. Here are just a few examples of common incidents for which medical malpractice insurance is necessary.

- Surgical errors, such as wrongful site or unnecessary surgery

- Failure to diagnose

- Misdiagnosis

- Medication or dosage errors

- Premature discharge

- Aftercare and follow-up errors

- Laboratory result errors

- Failure to evaluate patient history

An independent insurance agent can help you find the most comprehensive medical malpractice insurance to protect your practice from these common claims and more.

Is Medical Malpractice Insurance Required?

Medical malpractice insurance is not Federally required, but many states do require various professionals to have coverage. Some medical professionals opt to "go bare," or not have coverage, because they believe they will be less of a target to get sued.

Other professionals opt to go without coverage because of the high costs of the premiums. Regardless of whether coverage is required, it's critical for your practice to have this protection.

Options for Purchasing Medical Malpractice Insurance

Medical malpractice insurance comes in several different forms. With the help of an independent insurance agent, you'll review your options, including:

- Individual and group policies sold by traditional insurers

- Individual and group policies offered by medical risk retention groups

- Company-provided policies, such as those offered by hospitals

Even if your company or practice already provides medical malpractice insurance, it may not be enough to meet your needs. An independent insurance agent can help you evaluate your specific risk level to determine if you should purchase additional coverage.

What Are Medical Malpractice Insurance Limits and How Do They Work?

The limits shown on your medical malpractice policy are probably written similarly to how they show up on your car insurance. Insurance limits are often displayed as two amounts, such as $1 million/$3 million.

This policy's coverage limits would break down as follows:

- $1 million in coverage for each claim, or the amount your insurance company would pay up to for each covered incident

- $3 million in coverage for your entire policy year, or the total amount your insurance company would pay up to for all covered incidents within the coverage term

An independent insurance agent can explain more about the coverage limits in your medical malpractice insurance policy, and help you add extra coverage if necessary.

Frequently Asked Questions about Medical Malpractice Insurance

Medical malpractice insurance is not Federally required, but many states do require various professionals to have coverage. Some medical professionals opt to "go bare," or not have coverage, because they believe they will be less of a target to get sued. Other professionals opt to go without coverage because of the high costs of the premiums. Regardless of whether coverage is required, it's critical for your practice to have this protection.

Medical malpractice insurance will protect you financially if you get sued for professional errors, such as wrongful diagnosis or surgical errors that result in harm to your patients/clients. Coverage protects you from costly lawsuit expenses that you'd have to pay out of pocket for otherwise, and can help your coverage keep its doors open in case of a major incident.

The cost of your medical malpractice insurance will depend on several factors, such as your occupation, years of experience, claims history, location, and more. An independent insurance agent can help find quotes for your area.

To determine how much coverage you need, work together with an independent insurance agent. Together, you'll evaluate your risk level and practice's specific needs for coverage.

Basically, anyone who works with the human body and has the potential to cause injury or death to their clients/patients. Coverage is often purchased by physicians and their assistants, nurses, optometrists, physical therapists, chiropractors, and more.

The Benefits of an Independent Insurance Agent

When it comes to helping insurance customers find the absolute best medical malpractice coverage, no one’s better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who sell medical malpractice insurance, deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Statista chart - https://www.statista.com/statistics/796686/premiums-of-medical-professional-liability-insurance-usa-by-state/

https://www.gallaghermalpractice.com/blog/post/going-bare-are-doctors-required-to-have-malpractice-insurance

Statista graph - https://www.statista.com/statistics/796680/leading-medical-professional-liability-insurers-usa-by-market-share/

https://www.medicaleconomics.com/view/do-you-need-malpractice-tail-coverage