Self Insured Work Comp Companies

(And why getting a policy may be better)

Workers' compensation insurance is a great tool to help with work-related medical expenses for employee injuries or illnesses. In fact, it can mean the difference in having enough funds to stay in business when a claim arises. There are a number of companies, usually larger, that take the self-insured route, and knowing what that entails could make or break your business.

An independent insurance agent is a key advisor for every business owner when it comes to workers' compensation insurance and why self-insuring may not be in the cards. Having the agent in your corner with the best options is a pretty good place to start.

What Is Workers' Compensation Insurance?

First things first, you need to know what workers' compensation insurance is before you can know the laws that govern it. Workers' compensation insurance is an insurance policy taken out by an employer or independent contractor that will help pay for medical expenses of an injury or illness that occurred while working or as a result of an employee's job.

This policy will also pay for partial wages, usually up to two-thirds, for any employee, included owners, or independent contractors while they're recovering. An independent insurance agent is the perfect resource to have when it comes to knowing the ins and outs of workers' compensation coverage.

What Is Self-Insured Workers' Compensation Coverage?

Basically, it's like it sounds. You, the employer, are choosing to self-insure for workers' compensation. That means that when an employee comes knocking with a work-related injury or illness, then you and your company will personally have to loosen the purse strings. You'll be responsible for things like:

- Medical expenses

- Potential lawsuits

- Lost wages

- Disability

- Funeral costs

- And more

There's really not a good reason to self-insure, because it opens you and your company up to a lot of risks that could be avoided with the right policy in place. Your independent insurance agent is the best resource when going over the facts. They can whip up a pro/con list so that you can put pen to paper and make sure you make an educated decision. After all, this is your livelihood, and you don't want to leave that up to chance.

What Does a Self-Insured "Policy" Cover, Exactly?

It covers anything and everything. The sky is the limit on what it will and won't cover because it's your bank account that will be tapped into. You'll have to fend off every lawsuit and injury or illness that crosses your path concerning a workers' compensation claim and hope it's not the one that takes you under.

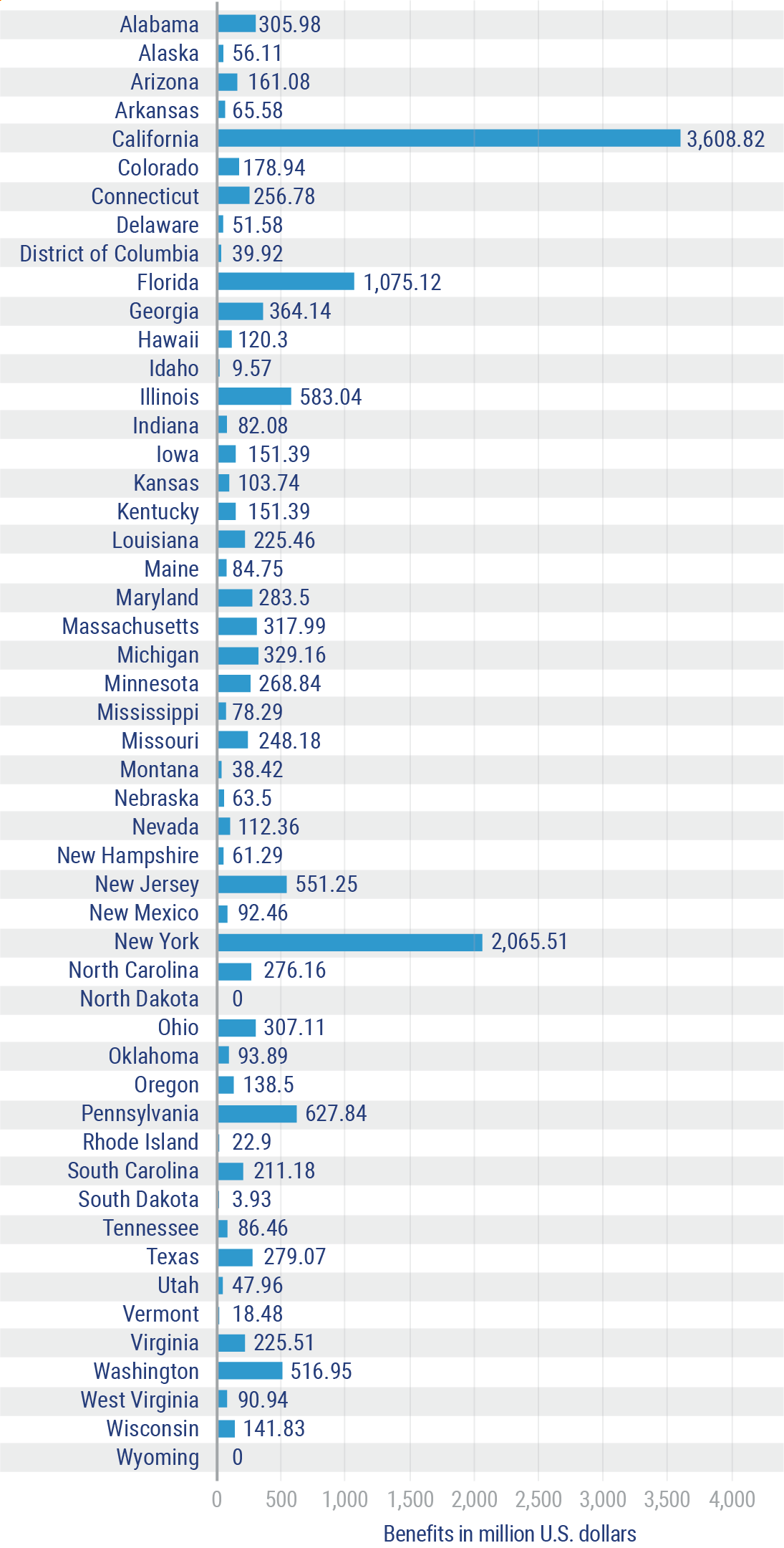

According to a recent study, the amount of self-insurance paid out in workers' compensation claims in the US is in the multi-millions and crossing into the billions. Just look at this graph charting the study:

Value of worker compensation benefits paid from self-insurance in the United States in 2017, by state (in million US dollars)

Sources: NASI; US Department of Labor; A.M. Best; National Council on Compensation Insurance; Statista 2019

That's a lot of money coming out of your pocket. And while it might seem like you are saving because you're not having to pay out monthly or annual workers' compensation premiums, the chances of a loss wiping you out altogether can be pretty high. Insurance is meant to do one thing, protect your business. Yes, it costs money to do that. But crunching the numbers with your independent insurance agent is worth the time for some peace of mind.

What Is Not Covered?

By now you should have a pretty good understanding of what self-insuring your workers' compensation coverage could look like. You just found out that the self-insured route leaves your company open and exposed with no real boundaries in place. A workers' compensation policy through an independent insurance agent and a reputable carrier will draw those lines in the sand. A good place to start is with a workers' compensation policy as a whole.

What's not covered under a workers' compensation policy:

- Full wages (this is lost income, and it usually will only cover up to two-thirds of regular pay)

- Non-work related injury or illness (this is crossing the line into insurance fraud which is discussed next)

- Coverage more than what is offered on the policy (once your policy limits are exhausted for any one claim, that's it. There is no more coverage and it has officially become a personal problem.)

Where to Purchase Workers' Compensation Insurance

Where to purchase workers' compensation insurance is easy as 1-2-3.

- One: Contact an independent insurance agent

- Two: Go over your business payroll, employee job duties, and daily operations for classification and coverage options

- Three: Your agent presents you with a number of policy options for your review and purchase

This is a good option when you consider the alternative of having to shell out who knows how many clams if you self-insure. Your independent insurance agent works with dozens of carriers that will present a variety of coverage options and pricing to fit within your budget.

Cost of Workers' Compensation Insurance vs. Self-Insured

Workers' Comp policy costs vary. It's a vast numbers game when it comes to risk factors and industry types concerning workers' compensation insurance. But you can bet that it's going to be less expensive than self-insuring. With self-insuring, you have to have deep pockets, and sometimes that's not even enough. At least if your employee takes coverage through your workers' compensation policy, they agree to not sue you or your company because they took the policy coverage. With self-insured workers' compensation, you could be sued and keep being sued any time, no matter what.

The only true way to know what a workers' compensation policy will cost you is to have your agent run the numbers on your business and its specifics. While it's nearly impossible to know what your individual workers' compensation premium will be, here are some determining factors you can look out for.

Workers' compensation price-determining factors:

- Industry: This plays a big part in the cost of your workers' compensation premium. The riskier your business, the more your premiums will be.

- Number of employees: This determines how much your rates will increase. More people equal more money.

- Gross annual payroll per employee type: Each employee is given a classification code that classifies their job duties and then charges the premium according to how risky or not risky their tasks are. The amount of money you pay them will determine the amount of premium per classification code. The more payroll, the more premium you pay.

- Experience modification rating: If your business has had workers' compensation insurance for a total of three years or more, and you are paying over $5,000 in annual premium, then you'll be assigned an experience modification rating, aka "mod." This mod will adjust throughout the years depending on the number, length, and frequency of claims turned in. The better the mod, the better rate you will receive. It's kind of like a credit score for your workers' compensation policy.

What Is the Benefit of Having Enough Workers' Compensation Insurance?

The benefits of good workers' compensation coverage far outweigh the costs involved. Having a knowledgeable independent insurance agent that can properly advise on how much coverage you should obtain will determine how much coverage your injured employees can get for medical expenses.

Unlike going the self-insured route where you could be responsible for high dollar amounts personally, the insurance company would foot the bill for the agreed upon coverage limit set in the policy.

Is Self-Insured Workers' Compensation State-Specific?

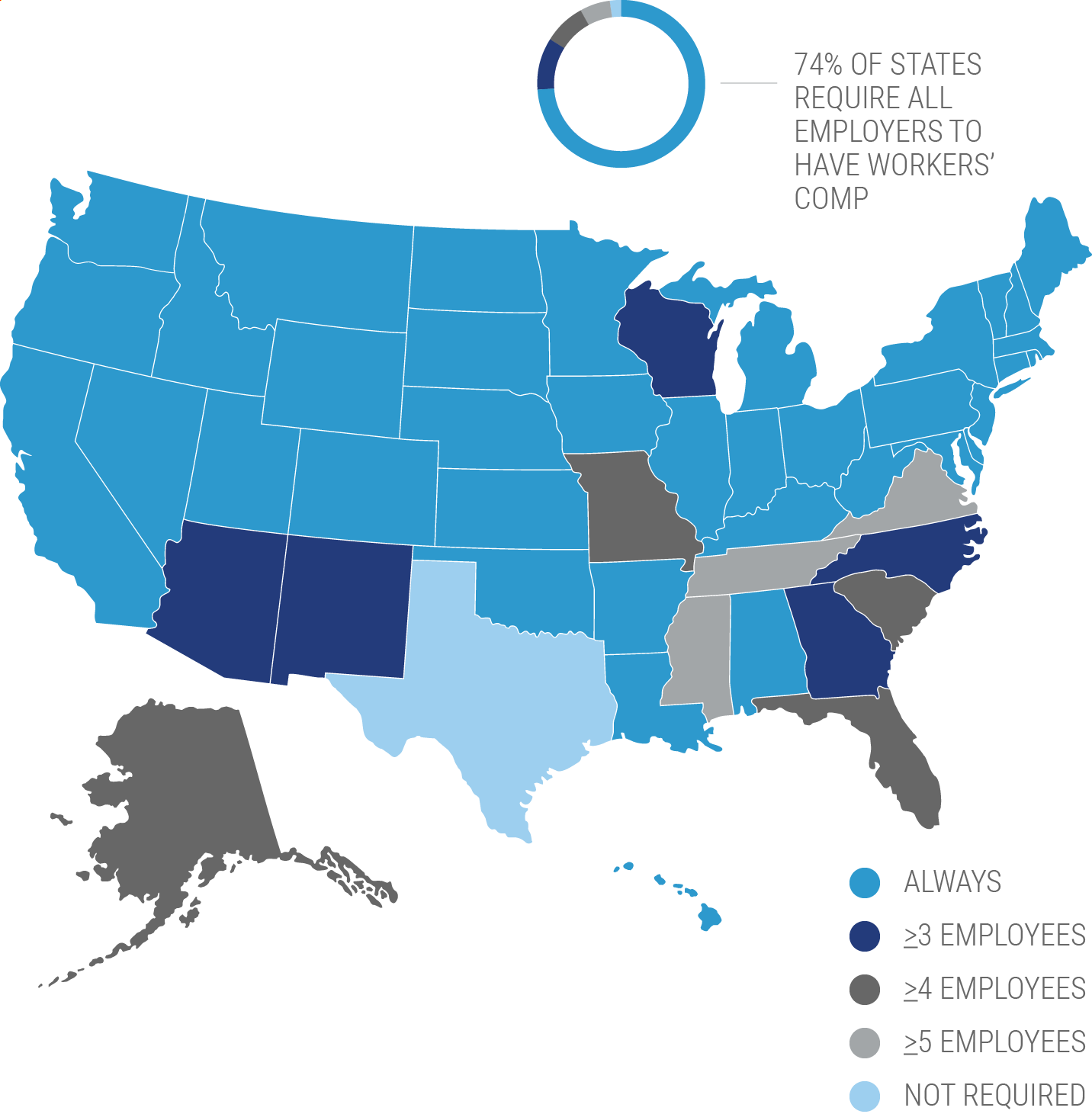

Yes. Each state has its own rules when it comes to workers' compensation insurance and whether or not they allow self-insured coverage at all. Because each state (except for Texas) has mandated workers' compensation coverage in some form or another, it's up to the powers that be.

Checking with your independent insurance agent on your state specifics will set you on the right track. Helping you make the best decision for you and your company.

Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. And as your company grows and your needs change, they'll be there to help you adjust your coverage, up or down, to make sure you're properly protected without overpaying. Find an independent insurance agent in your community here.

https://www.statista.com/statistics/195000/value-of-benefits-paid-by-self-insurance-to-workers-compensation/