How Much is Workers’ Compensation Insurance?

Get Average Workers’ Compensation Insurance Costs

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

The cost of your workers' comp varies based on several factors, but it's still possible to offer averages. Small businesses pay about $47 monthly, or $560 annually, for workers' comp.

This cost estimate is the middle of the pack for small businesses, including size and risk level. Larger businesses or those with riskier occupations, such as the construction industry, will have much higher figures. An independent insurance agent can help you find your location and industry quotes.

Average Monthly Costs of Workers' Compensation Insurance

The median and average cost of workers' comp insurance per month and year depends on your business's industry and many other factors. Here's a quick breakdown of some average and median annual and monthly costs for workers' comp insurance for several types of industries.

Average Workers' Compensation Insurance Cost by Industry

| Industry type | Median monthly workers' comp costs | Average annual workers' comp costs |

|---|---|---|

| Construction | $341 | $4,101 |

| Hotels/motels | $132 | $1,586 |

| Real estate | $21 | $255 |

| Transportation and warehousing | $275 | $3,300 |

| Wholesale trade | $150 | $1,800 |

Note: These average workers' comp insurance costs are based on businesses in Colorado, using our workers' comp calculator.

How Workers' Comp Costs Are Calculated

How an insurance company calculates your workers' compensation premium can be a bit complex. But if you're aware of how your premiums are determined, you can then figure out how to lower your rates.

The Formula for Calculating Workers' Comp Premiums

There's a lot of math involved when it comes to calculating the cost of workers' comp. Fortunately, you're unlikely to have to crunch these numbers yourself if you enlist the help of an independent insurance agent. However, it's still helpful to have an idea of what the formula is.

The workers' comp cost formula:

Multiply payroll by class rate, then divide by 100. From the clerical worker example, assuming their salary is $100,000, the formula would look like this: $100,000 x $0.43 = $43,000; $43,000 / 100 = $430.

Multiply the result by your experience rating modifier, if you have one. If you had an experience mod of 0.8, the formula would look like this: $430 x 0.8 = $344 total annual premium for clerical workers with the class code of 8810.

Follow this same formula for all employees and add their totals together to figure out your overall annual workers' comp premium.

Don't let these numbers intimidate you. Your independent insurance agent can help ensure you'll never pay too much for workers' comp coverage.

Factors That Affect the Cost of Workers' Compensation Insurance

Many different factors are used to calculate the cost of your workers' comp premiums, including your state's laws, the industry your business is in, your business's annual payroll, your claims history, and the type of work your employees perform. The higher the risk of your industry and your employees' job duties, the higher the cost of your workers' comp is likely to be.

Some factors that affect workers' compensation insurance costs are:

- State laws

- Industry

- Total annual payroll

- Type of work

- Prior claims

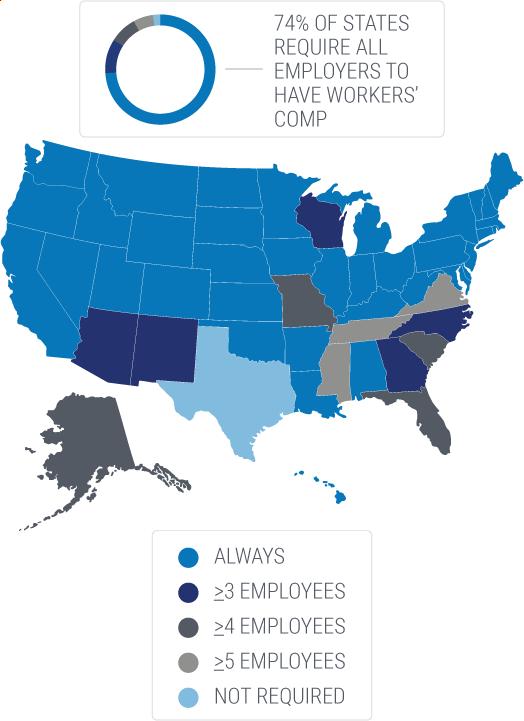

State Laws

Workers' comp is mandatory in all states except for Texas. However, the state requirements vary by how many employees you have and the type of business you run. In certain states, for example, agricultural workers are not required to be covered by workers' comp. But 74% of states overall require all employers to carry workers' comp.

Industry

The industry of your business is a major factor in your workers' compensation costs. Certain industries, like construction and restaurants, are considered far riskier to insure than others because of the nature of the employees' job duties. Employees in the restaurant industry often get injured by slips and falls, cuts, or burns. Employees in the construction industry can suffer from high falls, being crushed by heavy objects, and other devastating incidents. As a result, these are a couple of the industries with the higher costs of workers' comp.

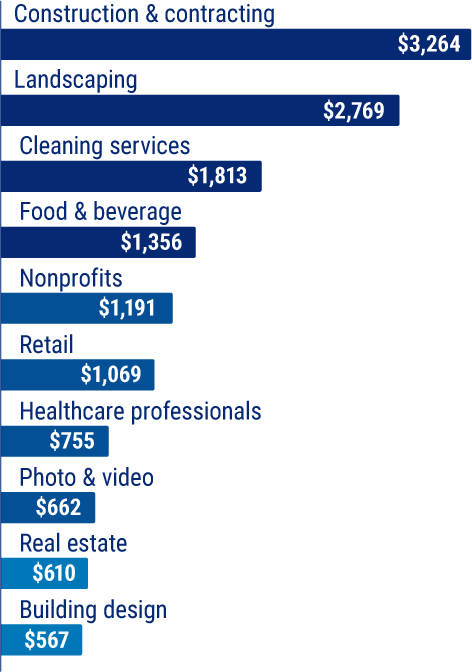

Most common costs of workers' compensation by industry:

- Hotels: Depending on what state you reside in, the average cost per employee per hour is $1.0294. Multiply that by 40 hours a week for 52 weeks and you get $2,141 annual cost per employee.

- Restaurants: Depending on what state you reside in, the average cost per employee per hour is $0.4093. Multiply that by 40 hours a week for 52 weeks and you get $851 annual cost per employee.

- Construction: Depending on what state you reside in, the average cost per employee per hour is $2.6655. Multiply that by 40 hours a week for 52 weeks and you get $5,544 annual cost per employee.

Median workers' compensation premium by industry

Total Annual Payroll

The number of your employees, as well as your overall annual payroll, are also factors that impact your workers' comp costs. The more employees you have and the higher their payroll, the higher the cost of your workers' comp coverage will be. Using the workers' comp calculator formula, for clerical businesses with employee salaries of only $50,000, you would multiply the total of $215 (using the formula provided above) by your experience mod of 0.8 to get your total of $172. Remember that an employee with a $100,000 annual salary had a result of $344 total annual premium. To calculate your business's total costs for coverage, you would repeat this process for every employee and add all the totals together to get your premium.

Type of Work Done by Employees

The type of work performed by your employees correlates to the job classification codes used in your workers' comp rate formula. Codes for more dangerous industries will correlate to higher workers' comp rates than those for less risky industries.

Just a few examples of NCCI job classification types and codes are:

- 0005 Farm

- 1320 Oil or Gas—Lease Operator—All Operations & Drivers

- 2114 Clam Digging

- 2501 Cloth, Canvas and Related Products Mfg. Noc

- 2589 Dry Cleaning and Laundry Store—Retail & Route Supervisors, Drivers

Check your state's regulations about how these class codes, and others, impact the rate of workers' comp in your area.

Prior Insurance Claims

Like with any other kind of insurance, your claims history also impacts your workers' comp rates. Prior claims can cause your insurance premiums to skyrocket, especially depending on the frequency and severity of claims filed. Businesses with low to no prior claims history will pay less for their workers' comp than those with many claims on record. If your business has filed multiple claims for employee injury or illness due to unsafe working premises, this could cause your rates to increase quite a bit.

How Much Are Workers' Compensation Out-of-Pocket Costs?

If you have a qualified independent insurance agent, you shouldn't have any out-of-pocket costs on your workers’ comp policy, besides maybe a deductible. A vetted and experienced agent will ensure they have considered the full scope of business operations, so they are covering every aspect of your business.

An independent insurance agent will make sure of the following:

- Employees are classified properly

- Employee gross annual payroll and additional wages are accounted for

- Safety and risk factors are evaluated and improved

All of these things will keep you, as the employer, from having to pay any out-of-pocket expenses. Letting the insurance work how it's supposed to and giving you peace of mind is part of the whole gig.

What Is Not Covered by Workers' Comp Insurance?

By now, you should have a pretty good understanding of how to calculate workers' compensation insurance. But you also need to understand what's not covered by workers' comp insurance. A good place to start is with a workers' compensation policy as a whole.

Items that are not covered under a workers' compensation policy:

- Full wages: This is lost income, and workers' comp will typically cover 2/3 of the worker's wages. But the percentage varies by state.

- Non-work-related injury or illness: This is crossing the line into insurance fraud.

- Coverage beyond what's offered on the policy: Once your policy limits are exhausted for any one claim, that's it.

An independent insurance agent can further explain what a workers' comp policy won't cover for your business.

Understanding the Cost of Workers' Compensation Insurance

Workers' comp insurance is critical for most businesses with employees to protect against incidents of employee injury or illness caused by the job or work environment. Having workers' comp can also exempt your business from employee lawsuits for related incidents. While calculating the costs of your premiums can be complicated, working with an independent insurance agent can make things much simpler by providing a ton of different quotes for you together in one place. Working with an independent insurance agent is also the best way to have your coverage details outlined and explained in plain English so you know exactly what you're getting.

https://www.twc.texas.gov/news/efte/workers_compensation.html

https://www.workerscompensationshop.com/workers-comp-rates/

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/workers-compensation-insurance

https://www.forbes.com/advisor/business-insurance/workers-compensation-insurance-cost/

https://classcodes.com/numerical-ncci-code-list/