How to Apply for Work Comp

(Don't worry, it's not as hard as you may think)

Workers' compensation coverage is an important piece to your business. Protecting you and your employees from unexpected accidents and illnesses is a great thing and one that an independent insurance agent can assist you with.

An agent has the knowledge and licensing to back up their workers' compensation advice. If you're looking for options, they have them too. Since they work with multiple insurance carriers, they can find competitive pricing and the best coverage around.

What Is Workers' Compensation Insurance?

Workers' compensation insurance is taken out by the employer or independent contractor and pays for medical expenses resulting from a work-related injury or illness. The policy will also provide coverage for partial wages of an injured employee so they can keep up with their status quo while recovering.

Do I Need Workers' Compensation Insurance?

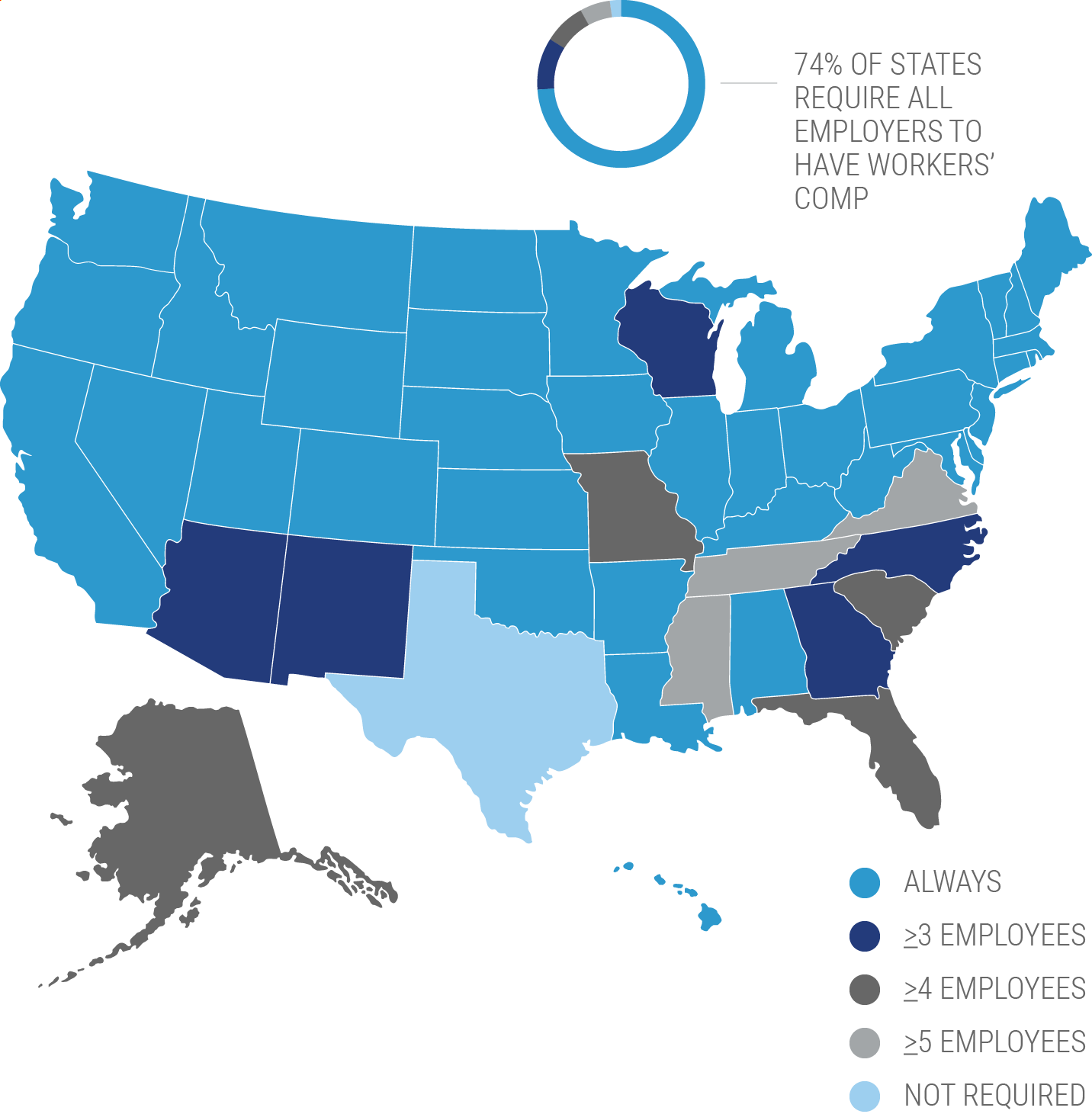

This depends on a few factors, one of which is where you live. Each state has a different set of rules and requirements when it comes to workers' compensation insurance, but every state mandates it either through a private insurer or a state-funded program.

Either way, if you're an employer and have employees, you should have a workers' compensation policy in place. Considering a total of $61.9 billion was paid out in workers' compensation claims in past polls, you should make sure you're covered.

How to Apply for Workers' Compensation In a State-Funded Program

As a business owner, knowing who to get workers' compensation insurance from can be a bit confusing if you're not familiar with your state requirements. Sure you can just Google it or ask around, but who knows what you're going to get. With an independent insurance agent, you get a local state expert who can scour the state workers' compensation program like a pro. It's really as simple as it gets.

There are four states out of the fifty that have state-funded workers' compensation insurance programs and they are North Dakota, Ohio, Washington and Wyoming. If you reside in one of these states, you are required to get workers' compensation through the state program and only through the state program. No outside private sector can provide coverage, but that doesn't mean they can't help. Your trusted independent insurance agent can be a great resource when it comes to state programs, so lean on them.

Getting workers' compensation coverage through a state program goes like this:

| Step One: |

| Find a trusted independent insurance agent here. |

| Step Two: |

| Go over your business details, such as employee demographics, payroll, and daily operations for proper classification of workers on your workers' compensation policy. |

| Step Three: |

| Your independent insurance agent will take your information to the state program and let the offers pour in on coverage and rates. |

| Step Four: |

| You and your independent insurance agent decide on your best coverage option as it applies to your specific situation through the state program. |

| Step Five: |

| Enjoy the freedom of working with a trusted advisor and having them handle all your workers' compensation insurance needs. |

Following these five simple steps will ensure that you're on the road to a more protected future as a business owner. Giving you appropriate coverage quickly and when you need it.

Costs of a Workers' Compensation Policy

The cost of workers' compensation insurance varies. To know exact pricing would take a crystal ball with very accurate future predictability. Or you could go the easier and more efficient route of getting an independent insurance agent who can determine cost range from your company's years of experience to number of employees to the industry of your business. Contacting your independent insurance agent will get you an accurate number to chew on.

Benefits of an Independent Insurance Agent

An independent insurance agent can be your knight in shining armor when it comes to applying for workers' compensation insurance. They've done all the research and know which carriers to state your case to and which ones will have the lowest premiums.

An independent insurance agent works for you and they like it. Serving your business is their number one priority, and you can tell.

Social Security. Annual Statistical Supplement. (2017). https://www.ssa.gov/policy/docs/statcomps/supplement/2017/workerscomp.html