Work Comp Medical Coverage

(And how to better protect your business)

Workers' compensation insurance is a great tool to help with work-related medical expenses for employee injuries or illnesses. In fact, it can mean the difference in having enough funds to stay in business when a claim arises. Don't be caught in the dark.

An independent insurance agent is a key advisor for every business owner when it comes to workers' compensation insurance and how medical coverage works. Having the agent in your corner with the best options is a pretty good place to start.

What Is Workers' Compensation Insurance?

First things first. You need to know what workers' compensation insurance is before you can know the laws that govern it. Workers' compensation insurance is an insurance policy taken out by an employer or independent contractor that will help pay for medical expenses of an injury or illness that occurred while working or as a result of an employee's job.

This policy will also pay for partial wages, usually up to two-thirds, for any employee, included owners, or independent contractors while they're recovering. An independent insurance agent is the perfect resource to have when it comes to knowing the ins and outs of workers' compensation coverage.

What Is Workers' Compensation Medical Insurance?

Medical coverage on a workers' compensation policy covers medical expenses arising out of a workplace injury or illness. As a business owner, there is a good chance that you will have an employee-related injury or illness in your lifetime.

According to a recent five-year study, it states that out of 100 employees a year 2.4 of them will have emergency room visits due to a workplace injury.

Considering the number of employees in the US, and also considering that this study only accounted for emergency room related workplace injuries, leaving the door open to all other injuries and illnesses that could occur, it may be safe to say you need to have protection.

What Do Medical Insurance Cover?

You just found out what medical coverage is as it relates to a workers' compensation insurance claim, but what does it actually cover? It typically covers most medical expenses arising from a work-related injury or illness. There is always a maximum that will be paid out which is the policy limit, but making sure coverage is sufficient is best discussed with your independent insurance agent.

Some medical expenses it may cover are as follows:

- Ambulance rides to the hospital

- Medications as a result of a workplace injury or illness

- Surgical procedures as a result of a workplace injury or illness

- Hospital stays

Basically, the policy will cover most any medical expenses as the result of a workplace injury or illness. As long as the claim is legitimate, the coverage will apply.

What Is Not Covered?

By now you should have a pretty good understanding of what medical coverage will cover. What you need to know is what it's not going to cover. A good place to start is with a workers' compensation policy as a whole.

What's not covered under a workers' compensation policy:

- Full wages (this is lost income, and it will usually only cover up to two-thirds of regular pay)

- Non-work related injury or illness (this is crossing the line into insurance fraud which is discussed next)

- Coverage more than what is offered on the policy (once your policy limits are exhausted for any one claim, that's it. There is no more coverage and it has officially become a personal problem.)

Workers' Compensation Insurance Fraud Laws

Insurance fraud is a big deal. Filing a claim that isn't real or has been manipulated all in an effort to get a large payout from the insurance company should be taken very seriously mainly because it lacks integrity, but also because the consequences could be dire to you, your employee, and your business.

Some insurance fraud consequences:

- Penalties and fines ranging from hundreds to thousands of dollars

- Jail time from one year to thirty years

The result of filing a faulty workers' compensation claim and being caught isn't worth the risk. An employee can file a false claim wanting a payout for an injury or exaggerated illness. An employer can misclassify an employee to avoid them filing a claim in the first place, and a healthcare provider can extend the injury or illness to continue getting payments from an insurance company. As the employer, you set the stage. And by setting up proper safety practices and a clean claims reporting process, you can help curb the chances of false claims being filed.

Cost of Workers' Compensation and Medical Insurance

Workers' comp policy costs vary. It's a vast numbers game when it comes to risk factors and industry types concerning workers' compensation insurance. The only true way to know is to have your agent run the numbers on your business and its specifics. While it's near impossible to know what your individual workers' compensation premium will be, here are some determining factors you can look out for.

Workers' compensation price-determining factors:

- Industry: This plays a big part in the cost of your workers' compensation premium. The riskier your business, the more your premiums will be.

- Number of employees: This determines how much your rates will increase. More people equal more money.

- Gross annual payroll per employee type: Each employee is given a classification code that classifies their job duties and then charges a premium according to how risky or not risky their tasks are. The amount of money you pay them will determine the amount of premium per classification code. The more payroll, the more premium you pay.

- Experience modification rating: If your business has had workers' compensation insurance for a total of three years or more, and you are paying over $5,000 in annual premium, then you'll be assigned an experience modification rating, aka "mod." This mod will adjust throughout the years depending on the number, length, and frequency of claims turned in. The better the mod, the better rate you will receive. It's kind of like a credit score for your workers' compensation policy.

The cost of medical coverage within a workers' compensation policy is included in the premiums and is not a separate or individual coverage. However, the amount of coverage can be increased or decrease per your request and your specific business coverage needs.

What Is the Benefit of Having Enough Medical Insurance?

The benefits of good medical coverage far outweigh the costs involved. Having a knowledgeable independent insurance agent who can properly advise you on how much coverage you should obtain will determine how much coverage your injured employees can get for medical expenses.

The less coverage you have, the greater risk you are for having a disgruntled employee who declines coverage altogether and files a lawsuit against you personally. It's best to do things right the first time around and avoid a decreasing bottom line.

Is Medical Coverage State-Specific?

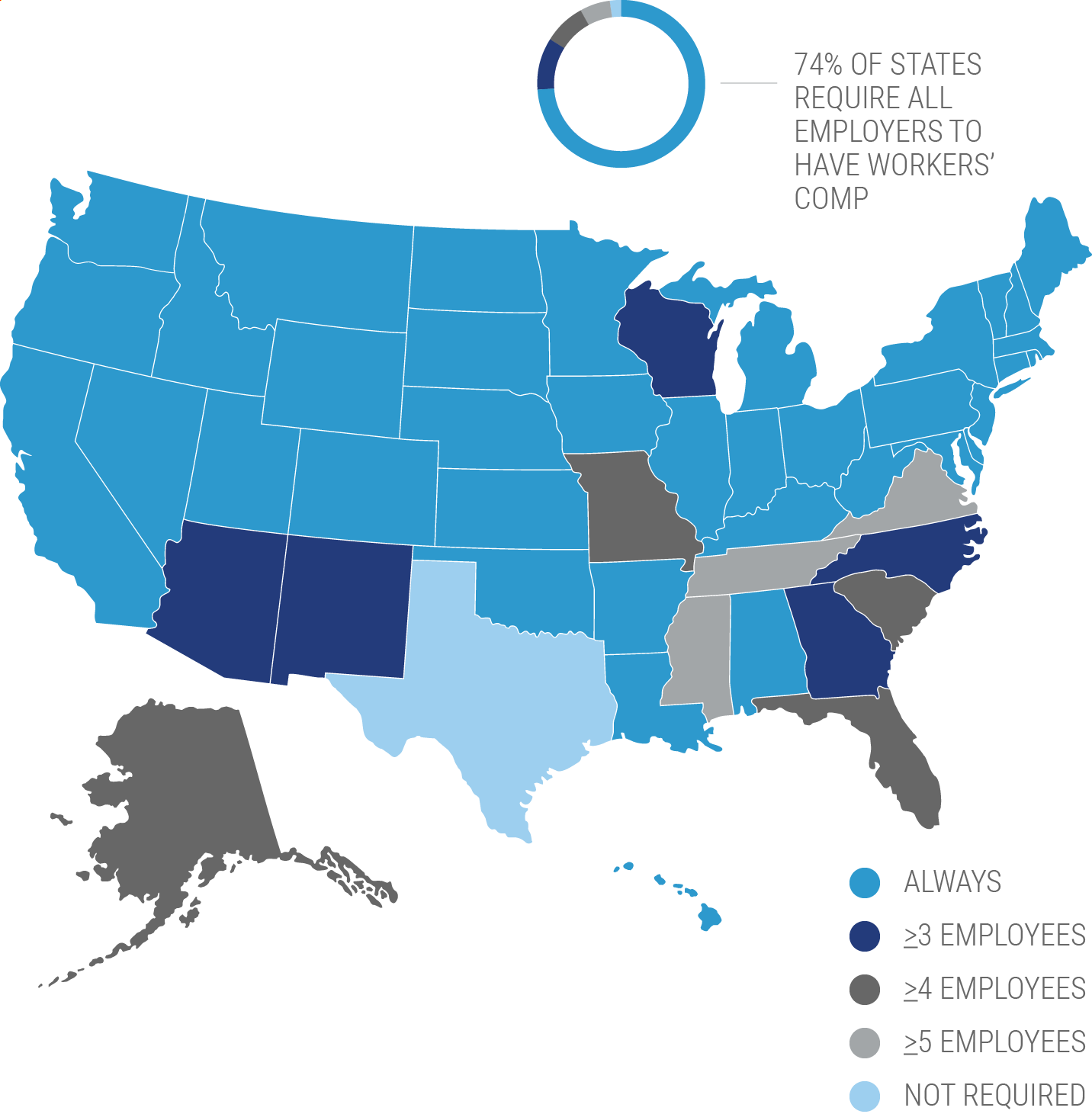

Medical coverage can be state-dependent, meaning it depends on what the state allows in its workers' compensation laws and guidelines. Each state has its own rules when it comes to workers' compensation insurance because each state {except for Texas} has mandated workers' compensation coverage in some form or another.

Usually there are not additional forms or endorsement add-ons associated with medical coverage through the insurance provider because it's an included coverage within the workers' compensation policy. But to sure, checking with your agent on your state specifics will set you on the right track.

Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. And as your company grows and your needs change, they'll be there to help you adjust your coverage, up or down, to make sure you're properly protected without overpaying. Find an independent insurance agent in your community here.

https://www.statista.com/statistics/284871/emergency-department-visit-rate-due-to-work-related-injuries-in-the-us/