Flood Insurance

To protect your home or business against damage caused by natural floodwaters, you'll need a separate policy.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

Regardless of where you live, there’s at least some risk of flooding. One of your main priorities as a homeowner is to keep your home and other property safe from numerous disasters, including those stemming from nature. Unfortunately, your homeowners insurance will not cover the cost of flood damage.

That’s why having the right flood insurance is crucial for maintaining financial security within your own home. But flood insurance is also important for businesses, because business insurance does not cover flood damage, either.

Independent insurance agents are here to eliminate the hassle of searching on your own by walking you through a handpicked selection of top policies for you. But first, here's a deep dive into this crucial coverage.

Table of Contents:

Why Do I Need Flood Insurance?

What Does Flood Insurance Cover?

What's Not Covered by Flood Insurance?

Will My Homeowners Insurance Policy Cover Flood Damage?

Where Is Flood Insurance Available?

What Type of Flood Insurance Do I Need?

How Much Does Flood Insurance Cost?

Things to Keep in Mind When Shopping for Flood Insurance

Flood Insurance Quotes and Claims

What Is Flood Insurance?

Flood insurance will cover your property or structure and most of your belongings if they're inundated by natural water (i.e., rain, waves, etc.). Many policies dictate that the water must cover at least two acres of normally dry land in order to qualify for reimbursement. Homeowners, business owners, and even renters can purchase flood insurance.

Is Flood Insurance Mandatory?

In certain situations, this coverage can be required. Your mortgage lender may require you to have a policy if your property is located in an area deemed to be at high risk of flooding. However, even properties that are not in designated high-risk areas may require coverage.

Check with your mortgage lender to be certain of whether flood insurance is mandatory. Either way, having coverage can be a wise choice. Without flood insurance, you could have to pay thousands of dollars or even more out of pocket to repair or rebuild your home, or replace your personal property after an incident.

Why Do I Need Flood Insurance?

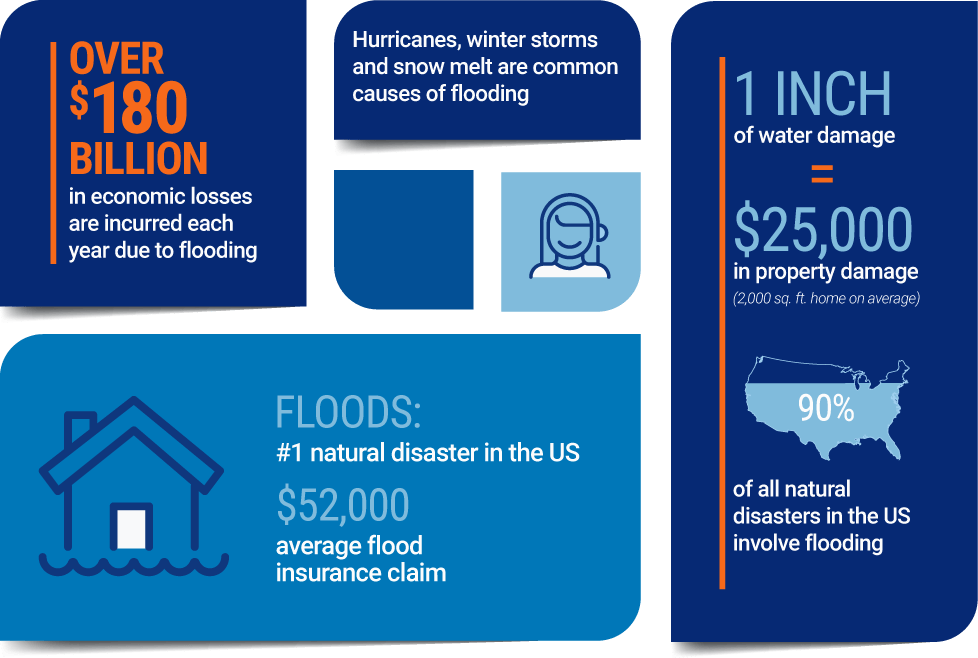

Flood insurance can help protect your assets, finances, and property. Floods cause millions of dollars in damage each year and are the most common natural disaster in the U.S. Water damage is also extremely costly.

DID YOU KNOW?

Damage from as little as one inch of water in a home can cost more than $25,000.

Having coverage could mean the difference between financial devastation and being able to recover quickly, should a storm hit your area.

Who Sells Flood Insurance?

Flood insurance is available from many different insurance companies, and the best way to find the right carrier for you is through working with an independent insurance agent. Independent insurance agents have helped all types of insurance customers, including those in search of flood insurance. They know which insurance companies to recommend to meet your needs and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies may provide flood insurance, finding coverage could also depend on the area you live in. Here are just a few of our top picks for the best flood insurance carriers on the market today:

| Flood Insurance Companies | Carrier Star Rating |

| Millers Mutual |

|

| The Hartford |

|

| Tuscano Agency |

|

| Chubb |

|

| Travelers |

|

| Southern Oak Insurance |

|

| USAA |

|

| People's Trust Insurance |

|

| Privilege Underwriters (PURE) |

|

| Union Mutual of Vermont |

|

| Amica Mutual |

|

| Shelter Insurance |

|

| Wright Flood |

|

| MetLife |

|

One flood insurance company outshines its competitors:

- Best overall flood insurance company: USAA

USAA has been around in the insurance market for over a century and has received the highest rating possible, "A++," from AM Best. The carrier has also been highly rated by J.D. Power.

USAA stands apart from other insurance companies by offering flood coverage as part of its renters insurance policies and in separate coverage for homeowners or businesses. The company also offers its flood coverage at premiums below the national average.

What Does Flood Insurance Cover?

Flood insurance policies are similar to homeowners insurance policies in the sense that they both exist to protect your home and your belongings. The difference is that flood insurance is there to cushion the financial blow should your property become flooded by a natural water source.

Flood insurance will specifically cover:

- Damage to/loss of your home: This includes the foundation of the structure, electrical systems, indoor plumbing, built-in appliances, and additional installed flooring, such as carpeting. Detached structures like sheds can also be covered, but usually to a lesser extent.

- Damage to/loss of your stuff: This includes furniture, smaller appliances, artwork, some food, valuables, and clothing.

Any depreciation of your property's value will be factored into what the insurance policy pays towards reimbursement for damage.

Additional flood coverage may include the following:

- Debris removal

- Loss avoidance measures

- Floodproofing costs

An independent insurance agent is your best ally when it comes to selecting a flood insurance policy that best meets your needs.

What's Not Covered by Flood Insurance?

Flood insurance is only meant to cover natural flooding events, so coverage comes with certain exclusions. However, other types of flooding events are often covered by homeowners insurance.

Flood insurance tends to exclude the following:

- Flooding caused by non-natural water events (e.g., backed-up toilets or sewers)

- Property outside of the dwelling, such as patios, fences, pools, septic systems, and plants

- Natural flooding events that inundate less than two acres of land

- Sump pump backups (unless a rider is purchased)

- Mold, mildew, or other moisture damage

- Earthquake or mudslide damage

- Additional living expenses*

*Homeowners insurance does cover additional living expenses if you’re forced to live elsewhere while repairs are made to your home after a flood. This coverage can pay for additional expenses such as hotel rooms, takeout meals, extra gas mileage to get to work, laundry services, and more. Your independent insurance agent can help you review other exclusions under flood insurance and help address any concerns you may have.

Will My Homeowners Insurance Policy Cover Flood Damage?

Unfortunately, no. A homeowners policy will never cover the cost of flood damage or a number of other catastrophic accidents. It's too difficult for insurers to predict the total cost of flood damage (or damage by other non-covered natural disasters) to homes each year. But your homeowners insurance does cover other types of flooding incidents, such as those stemming from built-in plumbing and certain kinds of water leaks.

Also, not enough insurance policyholders will pay extra towards their premiums for this protection to cover the amount of money the insurance company would have to pay in damage claims. Therefore, offering flood coverage wouldn't be a profitable option for homeowners insurance companies.

Who Needs Flood Insurance?

Those who live in flood zones especially need flood insurance, but if you live anywhere at risk of natural flooding, it can be wise to get coverage. Homeowners insurance across the U.S. does not cover flood damage to homes, and paying for destruction out of pocket can be devastating. An independent insurance agent can talk with you further about whether getting flood insurance is the right choice for you.

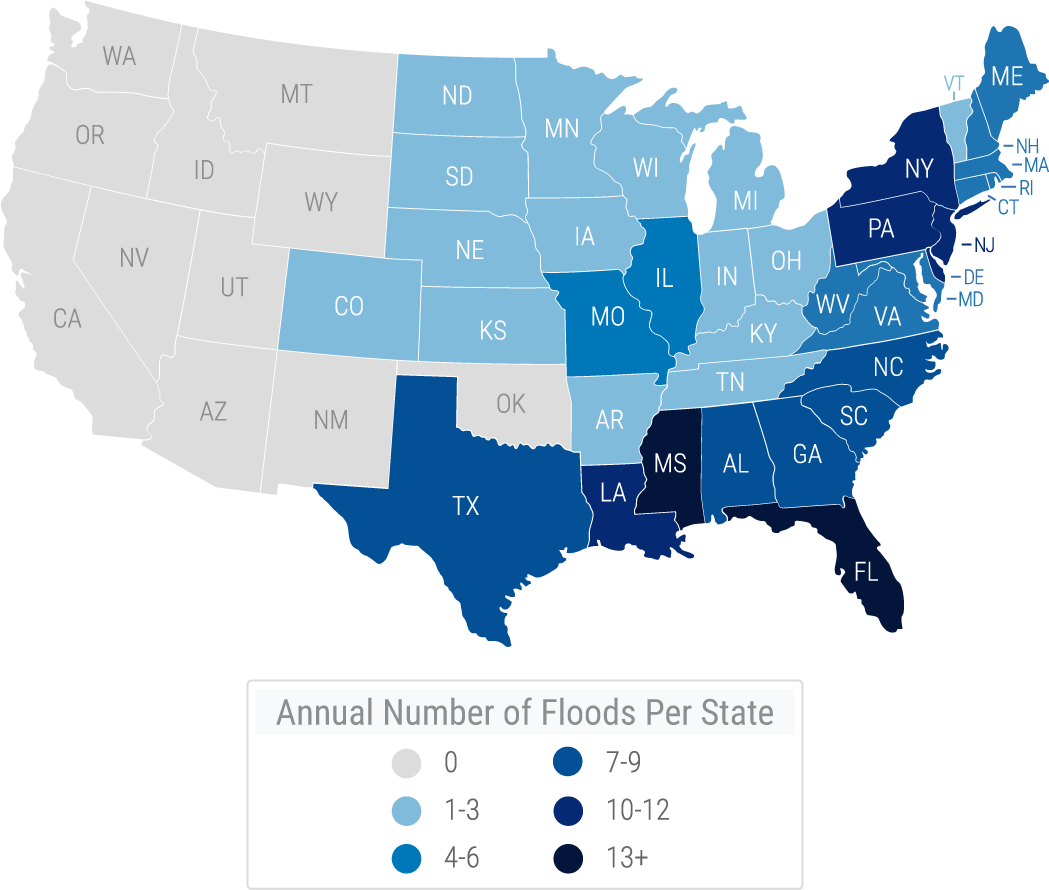

The U.S. Flood Risk Map

Which states are most at risk of damage from significant flood events?

| State | Residents Living in Flood-Prone Areas | |

|---|---|---|

| 1 | Florida | 2.7 million |

| 2 | Texas | 1.8 million |

| 3 | Louisiana | 1.5 million |

| 4 | California | 1.3 million |

| 5 | New Jersey | 1.2 million |

| 6 | New York | 1.1 million |

| 7 | North Carolina | 1 million |

| 8 | South Carolina | 900,000 |

| 9 | Mississippi | 800,000 |

| 10 | Missouri | 700,000 |

Where Is Flood Insurance Available?

Flood insurance is sold by the National Flood Insurance Program (NFIP), which is part of FEMA, but you can also find policies from private insurance companies. Participating insurance carriers can offer you the right flood coverage for your area. To find coverage, an independent insurance agent can greatly assist you in selecting carriers that not only offer flood insurance but also offer the most comprehensive coverage at the most affordable rates.

Can I only get flood insurance from the state in which I live?

It's not necessary to get a state-specific flood insurance plan. An independent insurance agent can help you get the right flood coverage, regardless of your location.

What Type of Flood Insurance Do I Need?

When selecting your flood insurance policy, it's helpful to understand the differences in coverage from the NFIP and from a private insurer. Additionally, the type of coverage you need for your property will vary depending on whether you're a homeowner, renter, or business owner.

NFIP vs. private flood insurance

| Private | NFIP | |

|---|---|---|

| Building Coverage | $1 million | $250,000 |

| Max. Personal Property Coverage | $250,000 | $100,000 |

| Replacement Cost/ Actual Cash Value |

Replacement cost available on secondary residences and contents | Replacement cost only on primary residence; contents covered at actual cash value |

| Waiting Period | 0-15 days | 30 days |

| Additional Living Expenses | Yes | No |

| Additional Coverage | Yes | No |

Coverage differences

While flood insurance policies sold by the NFIP provide a maximum of $250,000 in building coverage, private insurers can provide up to $1 million or more in building coverage. With NFIP flood insurance, you'd have to purchase excess coverage if you needed more than $250,000 in protection.

Replacement cost coverage is only available for NFIP policyholders with primary residences, while all others are covered at actual cash value. However, private insurers allow policyholders to add replacement cost coverage for secondary residences and personal belongings or contents.

Additionally, the following coverages are only available through private flood insurers, not the NFIP:

- Additional living expenses

- Business income

- Enhanced coverage for detached structures

- Pool fill and repair

Waiting period differences

While NFIP flood insurance enforces a mandatory 30-day waiting period after your first payment before your coverage becomes active, private flood insurance comes with a maximum 15-day waiting period. Some private flood insurers even allow coverage to be effective immediately.

The kind of flood insurance you need

| Homeowners |

| Owners of stand-alone homes, condos, and townhouses qualify for the NFIP's coverage for structural and contents damage due to natural flooding. |

| Coverage applies to: Your home's structure/foundation, electrical systems, appliances, plumbing systems, and electronics, as well as furniture and other personal belongings. |

| Typical coverage limits: The dwelling of your home often comes with a $250,000 limit in flood coverage, and the contents of your home often come with a $100,000 limit. Both aspects of coverage often have separate deductibles. |

| Renters |

| Renters of apartments and more qualify for the NFIP's coverage on their personal belongings, often at highly affordable rates. Before purchasing separate coverage, check with your landlord to see if they have coverage for your building's structure. Also, some renters insurance includes flood coverage, so you may not need extra. |

| Coverage applies to: Your personal belongings stored in the apartment, etc. that you rent, like your clothing, electronics, furniture, and more. |

| Typical coverage limits: Contents coverage limits are often $100,000. |

| Business Owners |

| Business owners qualify for coverage through the NFIP as well. The NFIP's commercial flood insurance provides coverage for your office space and the contents inside. |

| Coverage applies to: Your business's structure or building and foundation and the contents inside, including furniture, inventory, electrical and plumbing systems, additional flooring, and more. |

| Typical coverage limits: The business's structure often comes with a coverage limit of $500,000, which is the same as the usual limit for business contents. Both aspects of coverage come with their own deductibles. |

A note about separate deductibles

Flood insurance policies often have separate deductibles for structural and contents coverage. That's because building coverage and contents coverage are typically purchased separately, and as such, each type of coverage comes with its own deductible.

So, if you filed a flood insurance claim that included $5,000 in damage to your home's structure and $2,000 in damage to your personal property, your structural coverage might have a $1,000 deductible, and your contents coverage might have a $500 deductible. That would mean you'd have to pay $1,500 out of your own pocket before receiving any reimbursement.

How Much Does Flood Insurance Cost?

The cost of flood insurance policies can depend on several factors, such as your location, flooding history, and the elevation of your property. The further away from flood zones you are and the less history of flooding you have, the less you're likely to pay.

The current average cost of flood insurance is $899 per year, or about $75 per month. An independent insurance agent can help provide you with exact figures and quotes for flood insurance in your area.

Average cost of flood insurance by state

| State | Average Policy Cost Per Year | Average Policy Cost Per Month |

|---|---|---|

| U.S. Average | $899 | $75 |

| Alabama | $853 | $71 |

| Alaska | $442 | $37 |

| Arizona | $803 | $67 |

| Arkansas | $966 | $80 |

| California | $938 | $78 |

| Colorado | $879 | $73 |

| Connecticut | $1,404 | $117 |

| Delaware | $765 | $64 |

| Florida | $865 | $72 |

| Georgia | $817 | $68 |

| Hawaii | $755 | $63 |

| Idaho | $927 | $77 |

| Illinois | $1,014 | $85 |

| Indiana | $962 | $80 |

| Iowa | $1,245 | $104 |

| Kansas | $984 | $82 |

| Kentucky | $1,325 | $110 |

| Louisiana | $920 | $77 |

| Maine | $1,265 | $105 |

| Maryland | $482 | $40 |

| Massachusetts | $1,146 | $96 |

| Michigan | $817 | $68 |

| Minnesota | $1,045 | $87 |

| Mississippi | $1,058 | $88 |

| Missouri | $1,334 | $111 |

| Montana | $901 | $75 |

| Nebraska | $924 | $77 |

| Nevada | $850 | $71 |

| New Hampshire | $1,109 | $92 |

| New Jersey | $1,011 | $84 |

| New Mexico | $1,096 | $91 |

| New York | $1,133 | $94 |

| North Carolina | $833 | $69 |

| North Dakota | $820 | $68 |

| Ohio | $1,042 | $87 |

| Oklahoma | $1,012 | $84 |

| Oregon | $895 | $75 |

| Pennsylvania | $1,386 | $115 |

| Rhode Island | $1,046 | $87 |

| South Carolina | $707 | $59 |

| South Dakota | $1,128 | $94 |

| Tennessee | $1,126 | $94 |

| Texas | $879 | $73 |

| Utah | $644 | $54 |

| Vermont | $1,590 | $132 |

| Virginia | $726 | $60 |

| Washington | $957 | $80 |

| Washington D.C. | $440 | $37 |

| West Virginia | $1,563 | $130 |

| Wisconsin | $906 | $75 |

| Wyoming | $942 | $78 |

A note about policy costs and risk assessment changes

The NFIP regularly updates its policies to better reflect accurate flooding risks and the price of offering coverage in each area. In 2023, the NFIP implemented its Risk Rating 2.0 pricing approach, which changed premium rates and flooding risk designations for some policyholders. Be sure to stay updated with the NFIP's evolving policies, as your coverage costs and risk assessment may shift over time.

Things to Keep in Mind When Shopping for Flood Insurance

Before meeting with an independent insurance agent to discuss your flood insurance options, it's helpful to keep these points in mind:

- The value of your home/business structure

- The value of your personal belongings/business inventory

- The value of any upgrades you've made to your home/business

- How often your area floods

- Any floodproofing measures you've taken with your home or business

Considering these factors beforehand can seriously help streamline the process of shopping for the right flood insurance policy.

Flood Insurance Quotes and Claims

Need help getting flood insurance quotes or filing flood insurance claims? Use our handy checklists for both.

How to Get Flood Insurance Quotes

Follow these steps to get several flood insurance quotes fast.

- Prepare all the information you need: When you're ready to get flood insurance quotes, make sure to have all the necessary information ready to go. This includes the address of the property you want to insure and the value of the structure and any contents.

- Contact an independent insurance agent: An independent insurance agent has access to multiple flood insurance companies in your area. They can complete the entire process of gathering quotes for you. If you'd prefer not to work with an agent, you can skip to step three.

- Gather quotes from several carriers: If you choose not to work with an agent, you can gather quotes yourself by visiting insurance company websites or calling the carriers directly.

- Compare your options: If you're working with an agent, they can advise you on which option might be the best choice. Otherwise, review all the quotes you've gathered to make your decision. Remember that while the lowest premium might be enticing, you'll want to make sure you're also getting coverage from a reputable carrier and that your policy has high enough coverage limits.

Working with an independent insurance agent is the easiest and most efficient way to shop and compare quotes from multiple flood insurance carriers that offer coverage in your area.

What to expect after filing a flood insurance claim

Your independent insurance agent can file flood insurance claims through your insurer directly for you. Here are a few things you can expect after filing a flood insurance claim.

| What to Expect After Filing a Flood Insurance Claim | |

| Complete Documents: | Your insurance company will send you claims forms to complete, detailing the incident and the damage. |

| Adjuster Visit: | Your insurance company will assign a claims adjuster to your case, who will likely need to inspect your property in person to evaluate the damage and provide an estimate for reimbursement based on your coverage. |

| Processing Time: | The amount of time it will take to complete your claim and issue reimbursement will depend on your insurance company and the complexity of your claim. |

FAQs About Flood Insurance

One convenient way to file a claim is by contacting your independent insurance agent. Otherwise, you can contact your insurance company directly. In order to have the best chance at reimbursement for flood damage, document the event's aftermath through photos, videos, or both for your insurance company before filing.

Yes, in order to qualify as a flood claim, the damage will have to have been caused by a natural flooding event, such as a hurricane or a monsoon. Typically, to be qualified as a flood, water must inundate at least two acres of normally dry land.

That depends, because technically, some of your physical property, such as your house, can qualify as an asset, and flood coverage does apply to that category. However, flood insurance does not cover currency, precious metals, and other types of assets. To be sure of which types of assets may qualify for coverage, double-check with your independent insurance agent.

The best way to get set up with all the flood insurance you need is by working with an independent insurance agent. The two of you will determine how much coverage you need based on factors like the size and value of your property, the amount and value of your personal belongings or business inventory, and more.

That depends on your insurance company. Many carriers require you to submit a claim within 60 days of a flooding event, but this time frame can vary. As far as the settlement goes, some carriers promise to get claims processed and an approval decision made within a few days to weeks, while others can take as long as several months.

No, unfortunately, flood insurance does not cover additional living expenses, such as staying in hotels, after a flooding event damages your home. However, your homeowners insurance policy may cover these costs.

You can still get flood insurance if you've filed a claim in the past. An independent insurance agent can help you find coverage today.

Yes, there is usually a waiting period before your coverage starts, though some private insurers allow coverage to be effective immediately. The NFIP enforces a waiting period of up to 30 days, while private flood insurance companies typically have a maximum waiting period of 15 days.

Whether your flood insurance policy is transferable to a new property depends on the specifics of your coverage. Certain restrictions may vary between NFIP and private flood policies. Your independent insurance agent can help you determine if your specific flood insurance policy can be transferred to a new home.

https://www.fema.gov/national-flood-insurance-program

https://www.nerdwallet.com/article/insurance/flood-insurance-cost

https://www.ready.gov/

https://www.floodsmart.gov/

https://www.weather.gov/

https://venngage.com/gallery/post/the-us-flood-risk-map/

https://www.libertymutual.com/property/flood-insurance

https://www.libertymutual.com/property/flood-insurance

https://www.puroclean.com/blog/top-10-states-most-at-risk-for-flooding/

https://www.nationalfloodinsurance.org/nfip-vs-private/

https://www.fema.gov/flood-insurance/risk-rating

https://www.forbes.com/advisor/homeowners-insurance/flood-insurance/

https://www.jec.senate.gov/public/index.cfm/democrats/2024/6/flooding-costs-the-u-s-between-179-8-and-496-0-billion-each-year