Finding the Right Type of Loan for Your Home

Ask most homeowners about their mortgage and you’ll probably get a lot of puzzled looks and shoulder shrugs. Very few know anything more than how much they have to pay each month. It’s a shame, too, because the more you know about your mortgage, the better it’ll work for you and the faster you can pay it off.

So let’s take a nice little dive into the different types of mortgages out there. We’ll help you understand what to look for to help you find your first mortgage, or maybe just the first mortgage you actually understand. Just make sure you're covered with an affordable home insurance policy.

The 5 Most Common Types of Home Loans

To start, all loans fall under three main categories:

- Conventional loans are not backed or insured by government agencies like the FHA or Department of Veteran Affairs and are best for people with a high credit score. But if you put less than 20% down on a conventional loan, you’ll be stuck with added private mortgage insurance (PMI)). However, once you have more than 20% of equity in your house, or you’ve had your loan for two years, you can have it removed.

- Conforming loans are backed by Fannie Mae and Freddie Mac and fall under federally regulated terms and limits that are different for every county. They typically max out around $679,650, are easier to qualify for, offer lower interest rates, and may have lower down payments and credit score requirements.

- FHA: Federal Housing Association loans have become common among first-time home buyers for their low down payment requirements. In fact, you only need to put down 3.5% to qualify for an FHA loan. However, no matter how much money you put down, you’ll have an annual mortgage insurance premium (MIP) based on the down payment amount.

- VA: This loan is available to United States veterans, service members and remarried spouses. According to sources, the VA will guarantee a maximum of 25% of a home loan amount up to $113,275, which limits the maximum loan amount to $453,100. Veterans must still meet credit and income requirements.

- USDA Loan: These loans were designed for home buyers in rural and suburban areas. The loans are backed by the US Department of Agriculture and require zero down payment.

- Jumbo Loan: Like the name suggests, jumbo loans are for homes that cost a jumbo amount of money. In general, if a house is more than $453,000 it requires a jumbo loan, but this can vary based on location and average home price. All the other loan requirements are similar to conforming loans.

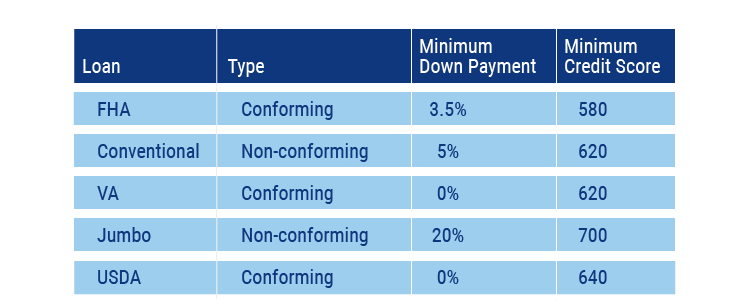

Here's a lil’ cheat sheet to help make sense of it all:

How to Qualify for a Home Loan

Think about it with what we affectionately call ‘The 3 Cs’—and not candy, cupcakes and cookies. ‘The 3 Cs’ that determine your best option, and its approval, are:

- Collateral: Your total equity

- What d’ya got? Your approval, and mortgage payments, will depend on how much you put down.

- Capacity: Your income-to-debt ratio

- Can you afford it? Lenders look at the debts you have compared to the money you bring in to make sure it’s safe for you to pay monthly.

- Credit: Your credit score

- How high’s your score? If you have a higher score, the odds of you being responsible and able to pay your mortgage increases, so rates drop.

NOTE: In the case of each of ‘The 3 Cs’, every type of loan and lender will have different minimum requirements that will affect your approval and rates.

Where you fall within the combo of these three components will help determine which home loan is right for you.

Tips for Finding the Right Types of Mortgage Loans

- Find a mortgage lender you trust: Get a referral through a friend or financial institution. A great mortgage lender will educate you and guide you in finding the best loan for you. But above all, DO YOUR RESEARCH.

- Know your options: Reading this article is step one. Step two is, again, DO YOUR RESEARCH.

- Understand the process: Know all the things that go into buying a home from payments, to credit, to out-of-pocket costs and so on. This will help determine the right loan for you.

We hope to have helped turn the lights up on what you thought was a scary mortgage monster in your closet. And now it's time for us to send you out into the real world. So stay educated, stay hydrated and find a mortgage lender you trust. Just make sure you're covered with an affordable home insurance policy.

www.valoans.com

https://iservelending.com/pages/types-of-loans#vertConforming

https://www.quickenloans.com/blog/conforming-vs-nonconforming-loans-whats-difference

https://www.nerdwallet.com/blog/mortgages/differences-conforming-nonconforming-loans/

https://www.cnbc.com/id/26045509

https://www.quickenloans.com/blog/conforming-vs-nonconforming-loans-whats-difference