Average Work Comp Impairment Rating

(Because in a time of need, you want to know what kind of help you're getting, right?)

When a worker is injured or comes down with an illness due to their employment, workers' compensation insurance helps ease their financial burden while they recover. And if and when this happens, one of your immediate concerns is, "How much will I receive for my workers’ comp claim?" Now, the average workers' comp claim is around $21,800, and most claims fall between $2,000 to $40,000 in settlements. But what's with that large difference, and how is your settlement decided upon?

While this article will explain the basics of how a workers' comp impairment rating affects employers and employees, speaking with a financial professional can provide more information that’s specific to your situation. Independent insurance agents are available to answer your questions, explain the fine print of state-specific policies, and much more.

First, What Happens after a Workplace-Related Injury or Illness?

When an injury occurs at the workplace that results in legal or insurance claims, there are often a lot of questions around what happened and what type of injury was sustained. In order to determine the extent of the injury and the cause, a number of tests and evaluations may be ordered.

Some of these tests include:

- An Independent Medical Exam, or IME, is an evaluation by a third-party medical professional who determines what happened and what the injury is.

- A Functional Capacity Evaluation, or FCE, is an evaluation that decides what work tasks someone may complete after their injury.

The purpose of these tests and evaluations is to protect all parties after an injury and help everyone achieve a fair resolution. A medical professional provides an objective view of the injury and allows a workers’ comp claim to move forward. This helps counteract such instances where an attorney representing the injured party claims that the injury is very serious, while the employer may claim the injury was minor.

What’s an Impairment?

For workers’ comp claims, medical professionals determine the extent of the injury, which may be classified as an impairment.

An impairment is a problem that affects the functioning of a part of the body, preventing an individual from being able to use their body the same way they did before the injury or illness. Because of the broad definition, impairments can include physical impairments or mental impairments caused by employment-related injuries or illnesses.

Impairments can affect a person’s ability to perform their work, and therefore have a big impact on workers' comp as well as Social Security claims. Furthermore, impairments are classified by their severity based on state-specific classifications in two main categories:

- Permanent vs. temporary impairment

- Total vs. partial disability

Types of Workers' Comp Disability Benefits

Those state-specific impairment classifications result in four different types of workers’ comp disability benefits, each with their own compensations and term lengths.

The four types of workers' comp benefit categories are:

- Temporary Total Disability Benefits (TTD)

- Temporary Partial Disability Benefits (TPD)

- Permanent Partial Disability Benefits (PPD)

- Permanent Total Disability Benefits (PTD)

Temporary Total Disability Benefits (TTD)

- Paid out to employees while they’re unable to work and are recuperating from a workplace illness or injury.

- TTD is generally two-thirds of an individual’s average weekly wage.

- Similar to the elimination period for disability insurance, there is usually a waiting period for TTD where the injury must keep the employee out of work for a certain number of days before being eligible to file a claim.

- TTD typically continues until the employee:

- returns to work,

- reaches Maximum Medical Improvement (MMI),

- or receives benefits for the maximum number of weeks determined by the state

- Examples of injuries qualifying for TTD include smoke inhalation, minor sprains and bruising, non-invasive surgeries, and so forth.

Temporary Partial Disability Benefits (TPD)

- Paid out to employees who can return to work in a modified or “light duty” capacity.

- TPD is typically the difference of what you’re paid under TTD and what you’re making in a new position of employment.

- TPD ends when an employee returns to work full-time or reaches the maximum number of weeks allotted by state law.

Permanent Partial Disability Benefits (PPD)

- Paid out when an employee experiences a permanent impairment as a result of a workplace incident.

- Payments are correlated to the severity of the disability with number of weeks as assigned to the injury and multiplied by the wages the employee is eligible for under TTD.

- PPD is generally determined and paid out after you reach maximum medical improvement.

- Workers are eligible for PPD even while receiving other workers’ comp wage benefits.

- Examples of PPD include loss of limbs, head trauma, blindness, and so forth.

Permanent Total Disability Benefits (PTD)

- Paid out to workers who are severely disabled due to a job-related injury and cannot return to the workforce as a result.

- Some states cap PTD benefits and may reduce benefits once the individual qualifies for Social Security Disability Insurance.

- Examples of PTD includes brain damage, loss of limbs, extensive burns, and so forth.

Disability vs. Impairment: What’s the Difference?

The terms disability and impairment are sometimes used interchangeably, but when it comes to how workers' comp benefits are calculated, they mean very different things:

- Impairment, as defined before, refers to the issue affecting the neurology or physical condition of the person.

- Disability refers to limits and restrictions on a person’s ability to complete tasks.

The best way to learn the distinction is through an example:

Suppose a postal employee sustains a permanent back injury on the job. The physical condition of their back is the impairment; their subsequent inability to drive and to carry mailbags is the disability.

Compare this to an office worker with the same impairment affecting their back. The individual may not be considered disabled because they can continue working in the office. Therefore, they might not qualify for the same long-term benefits as the postal worker because they’re not prevented from working.

Of course, it can be difficult to quantify the level of pain/discomfort or how much a worker has been affected by an injury. That’s where impairment ratings can offer a more nuanced approach to providing accurate benefits to injured workers.

So What’s an Impairment Rating?

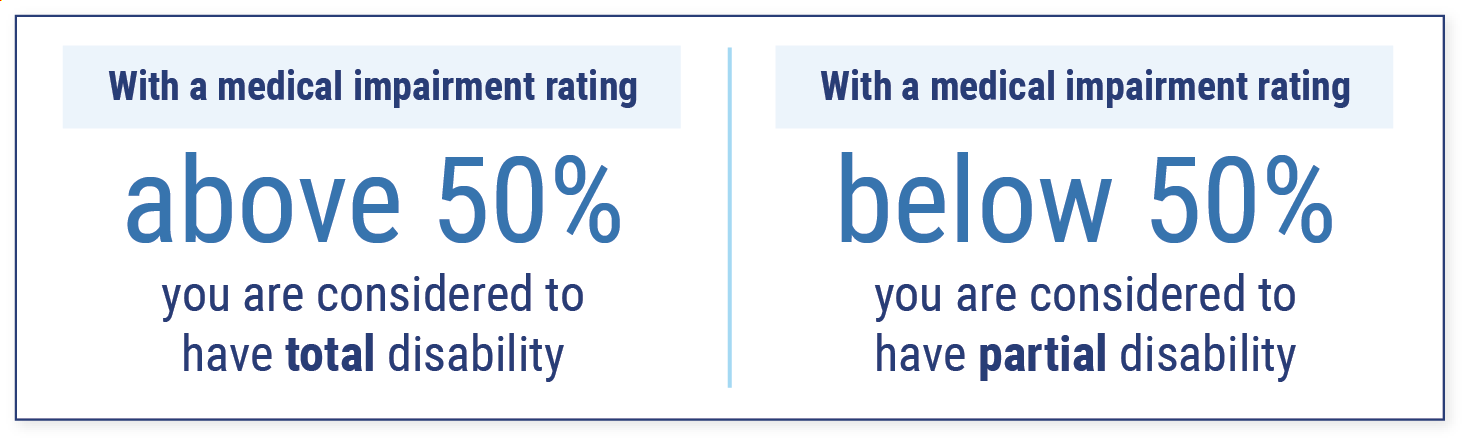

The type of impairment is determined by an impairment rating, a scale that quantifies the severity of impairment, defined as a percentage from 0% to 100%.

- If a medical impartment rating is more than 50%, the worker is considered to have a total disability. This means that the individual cannot return to work. enabling workers to keep claiming workers’ compensation benefits with no time limits.

- If a medical impairment rating is less than 50%, the worker is said to have a partial disability. This means that he or she is eligible to return to work in some capacity. However, a worker with a partial disability can still claim workers’ compensation.

The average impairment rating is between 5% to 35% in the United States.

Impairment Rating Evaluation (IRE)

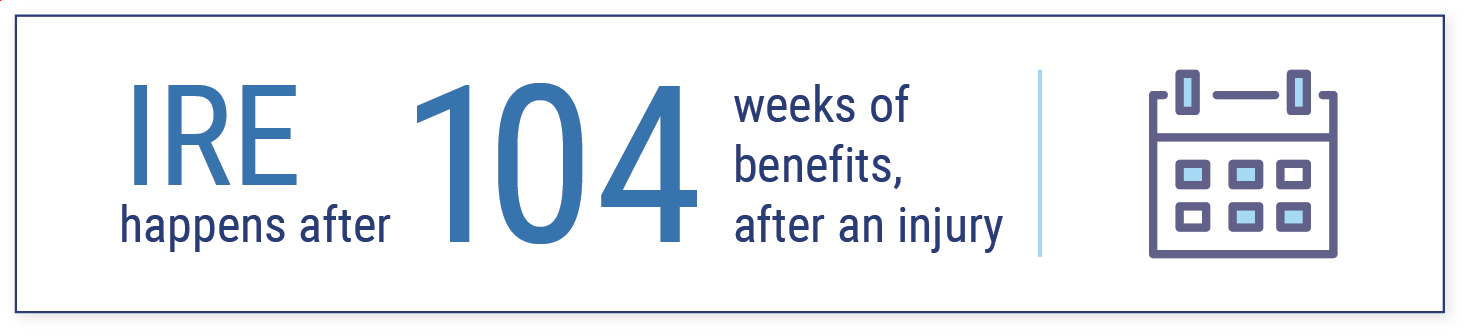

A medical impairment rating is completed by an independent medical professional in an appointment known as an Impairment Rating Evaluation (IRE). IREs are typically performed after someone has received 104 weeks, or 2 years, of benefits after an injury/illness.

The results of the medical impairment rating determine:

- How long a person might receive workers’ comp benefits

- How much compensation a person might receive

- Whether a person is expected to return to work and in what capacity

Partial Disability vs. Total Disability

If the impairment rating shows that a worker can return to work at a lower-paying and less stressful job, they are considered partially disabled. Thus, the impairment rating is used to make up for the income loss.

If a worker is unable to return to work, they are considered totally disabled. A medical impairment rating can be used to help secure benefits to pay for everyday expenses. In most cases, if a worker has a permanent, total disability, they will receive disability payments for 104 weeks through workers’ comp insurance. After this period of time, the insurer may request for an IRE to evaluate whether the injury or impairment has changed.

The purpose of this reevaluation is to determine whether the patient reached what is known as Maximum Medical Improvement (MMI). MMI is an official designation that the patient won’t improve more and therefore the focus of treatment and benefits will turn to managing the condition. A permanent impairment is stable and unlikely to change for at least a year.

State-Specific Workers' Comp Guidelines

Each state uses a slightly different impairment rating guide and a different system of compensation for injured workers who file workers' comp claims. However, the rating is the basis of every state’s disability and workers’ compensation benefits system, so understanding the basics can help you understand which benefits you are entitled to.

Speaking with an independent insurance agent can shed light on how your state evaluates disability claims. Independent insurance agents can provide you with state-specific guidelines, how to apply for benefits, whether your own disability insurance covers your injuries, and more.

The Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working entirely for you. If you've got questions on your workers' comp policy or benefits, they've got answers. They're there for you for the life of your policy coverage.

If you're looking to find a local independent insurance agent, you can get started right here.

http://imecarecenter.com/workers-comp-impairment-rating-guide/

https://www.injuryclaimcoach.com/return-to-work.html

https://www.injuryclaimcoach.com/permanent-disability.html