Employers Liability Vs. Work Comp

(What's the difference anyway?)

What is an employers' liability policy and do you need workers' compensation insurance too? There is a difference between the two policies and both offer protection for different things. Knowing where to turn for advice is the first step.

Have no fear, your independent insurance agent can help guide you to the path of knowledge. Determining which policy to get for your business and how much coverage you need can be a tricky thing. An independent insurance agent can light the way.

What Is Workers' Compensation Insurance?

Workers' compensation insurance is a policy taken out by the employer to provide coverage in the event an employee or included owner gets injured or ill on the job. This policy will also cover things like partial employee wages until they get back from recovery. Mental illness may be coverable if it's found that the illness was a result of problematic working conditions.

All in all, it's a pretty important piece to any successful business operation, and one than an independent insurance agent can help with.

What Is Employers' Liability Insurance?

Employers' liability insurance is another policy taken out by the employer and is different in that it provides coverage for defense arising out of a workers' compensation claim. If you as the employer are found negligent and that negligence resulted in an employee injury or illness, then you could be on the hook for a lengthy legal battle. Employers' liability has got you covered and will provide coverage for things like:

- Attorney's fees

- Court fees

- Settlements

Employers' Liability vs. Workers' Compensation

Do you need both employers' liability and workers' compensation insurance? The answer is yes. You just read that each policy covers different things from a claims standpoint, and now it's time to think of them as working together. They are the peanut butter and jelly of the insurance world and can save you a lot of heartache when it comes to employee injuries and lawsuits.

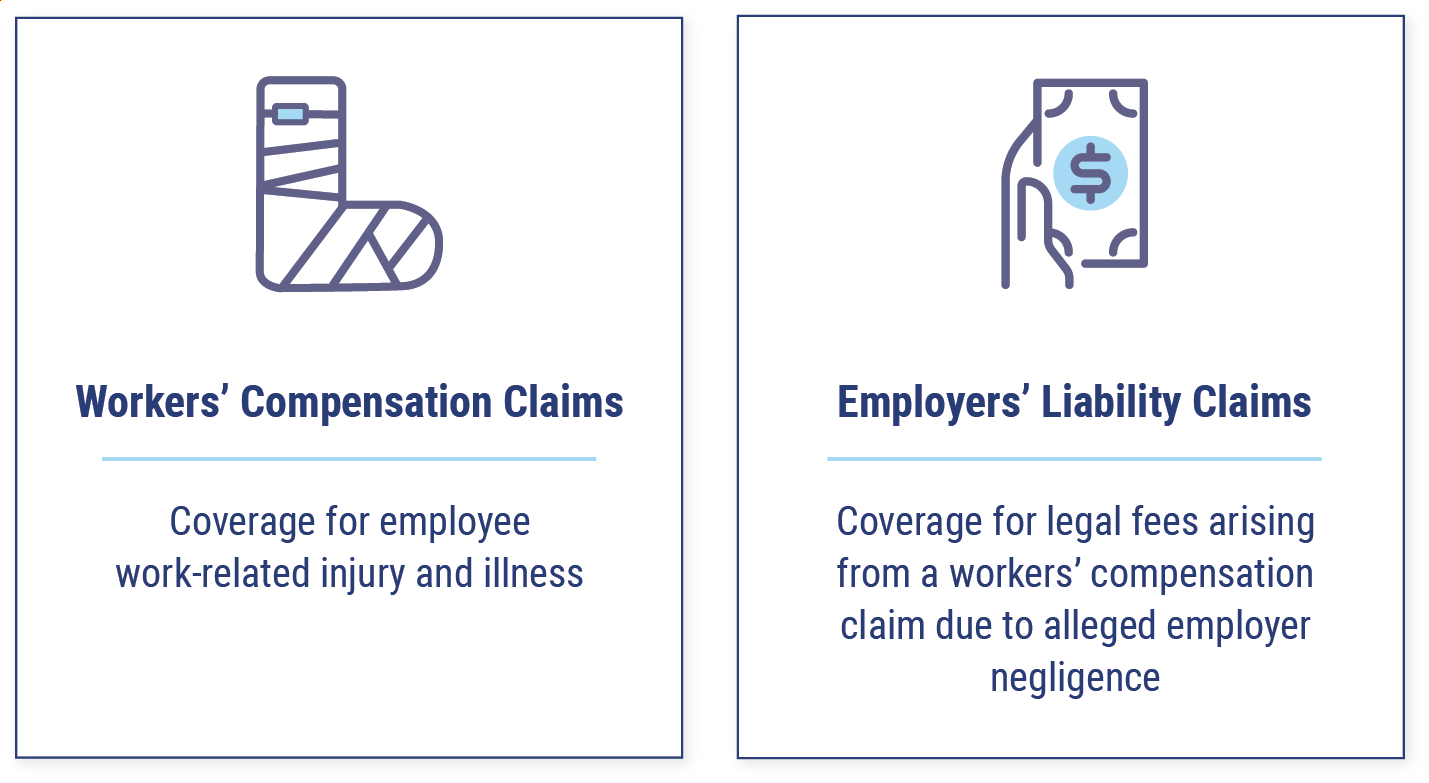

Here's a nice little visual to make things super clear:

Costs of Employers' Liability and Workers' Compensation Insurance

The big question is what's this going to cost? Well, the answer is a bit vague until you get your independent insurance agent involved. The premiums for an employers' liability policy are as different as the businesses that obtain them. The same goes for workers' compensation insurance premiums. There is just not a one-size-fits-all policy and therefore they have to be graded and rated on an individual basis. A few factors that do go into determining prices are listed below for your reading pleasure.

Cost determining factors:

- State: Location, location, location. It matters what state you reside in and where you ultimately set up shop. Rates are based on territory. Concerning employers' liability and workers' compensation, location is lower on the list of factors but still included.

- Industry: What industry you settled down in makes a big difference in your insurance premiums. The riskier the enterprise, the more premium you will pay to cover said risks.

- Loss history: If you've had any prior losses (aka claims) on past insurance policies, those can follow you around like bad habit and can determine future pricing.

- Coverage: Coverage is always a factor, because the more coverage the higher the premium, and the less coverage the lower the premium.

- Experience: Yep, it comes down to experience. If you've been in business a long time, you've got a track record and insurance companies like good records. If it's bad, then it can work against you.

The Benefits of an Independent Insurance Agent

The benefits of having an independent insurance agent by your side are plentiful. They will gather all the information and get it to the right insurance companies, finding you better rates and the best coverage for your business. An independent insurance agent works for you, not the insurance companies.

Knowing where to find the right insurance for your situation is half the battle. You're almost there to better and more affordable coverage.