Joint Life Annuity

(Maybe it's right for you and your spouse and maybe it's not — only one way to find out)

You probably already know there are handfuls of different types of annuities out there — each with their own set of unique perks. So what makes a joint and survivor annuity such a good option? Actually, for some, it might not be. And the best way to find out is to talk to a local independent insurance agent.

An independent insurance agent will listen to all your goals and needs to help find the right annuity option for you. They'll help find the best rates and companies for your situation and walk you through every step of the way. It just doesn't get any easier than that. But first, here's a bit of background on joint and survivor annuities to help get you started.

How Does a Joint and Survivor Annuity Work?

A joint life annuity is a monthly payment plan designed to create a lasting retirement income for individuals and their beneficiaries (typically a spouse). The annuity checks keep coming month after month until the second person (or third in some cases) passes away. That’s the beauty of a joint and survivor annuity, because it makes sure both people are taken care of financially for as long as it’s needed.

A joint and survivor annuity is like reverse life insurance. While setting up a life policy, the carrier will calculate your expected risk of death. While setting up an annuity, the insurance company will estimate the risk of your survival.

All annuities will help supplement your, and your beneficiary's, retirement income. You can take your annuity check to the bank right along with your pension and Social Security. Plus, there’s no annual contribution limit (or cap) for an annuity, so you can catch up on retirement savings quickly.

What about a Third Beneficiary?

Wait, a third beneficiary? Sure, you could. If your annuity has an installment or a cash refund provision, the company must pay out an amount equal to the original value of the annuity. And if both annuitants pass away before their monthly payments have gone beyond the original principal, monthly payments continue going to the annuitants' estate or to a named beneficiary. Oftentimes this is where people include a child or other dependent to leave behind a financial safety net.

What about Joint and Survivor Annuity vs. Single Life Annuity?

Investing in a life annuity for one person means your monthly retirement annuity will keep going until you can’t go anymore. A single life annuity only lasts until your death and then the money stops. If you and your spouse decide it’s best to get a joint and survivor annuity then the benefits for both of you will keep coming even if one of you should pass away. That’s because a joint and survivor annuity has two beneficiaries, both Mr. and Mrs. On the other hand, a single life annuity does just what the name says by paying retirement income to only one beneficiary.

Keep in mind, joint and survivor annuity vs. single life annuity is different when it comes to the monthly payment amount too. Usually the joint and survivor annuity pays more since the benefit is covering a deux (“two” for those non-French speakers). It makes sense because the company will end up paying benefits longer when covering two lives versus a solo annuity so they want to stretch out that money.

Pros and Cons of Joint and Survivor Annuities

As with any investment out there, a joint and survivor annuity also comes with its own set of advantages and disadvantages, like:

Pros

- Joint life annuity payouts are guaranteed and will keep coming as long as you're alive. The cash might be a lifesaver when you get older and have more medical expenses.

- Your survivor will also get guaranteed annuity payouts even after you pass away. That means he/she can maintain their current lifestyle.

- Your remaining annuity can be passed on to a third beneficiary, like a child or any other dependent.

Cons

- Annuities have higher fees than other types of investments. That’s because you’re paying the premium on top of broker commissions and investment costs.

- You’ll get back a little bit less than what you actually paid up front because of the miscellaneous charges.

- Sacrificing a portion of your current monthly income may be viewed as a con. Keep in mind, by putting this money into an annuity now you’ll be gaining a steady influx of cash later.

What are the exact pros vs. cons for your lifestyle? What’s your current financial situation and where do you need to be? An independent insurance agent can help walk through your goals and needs with the pros and cons of a joint life annuity to find out if it's the right call for you.

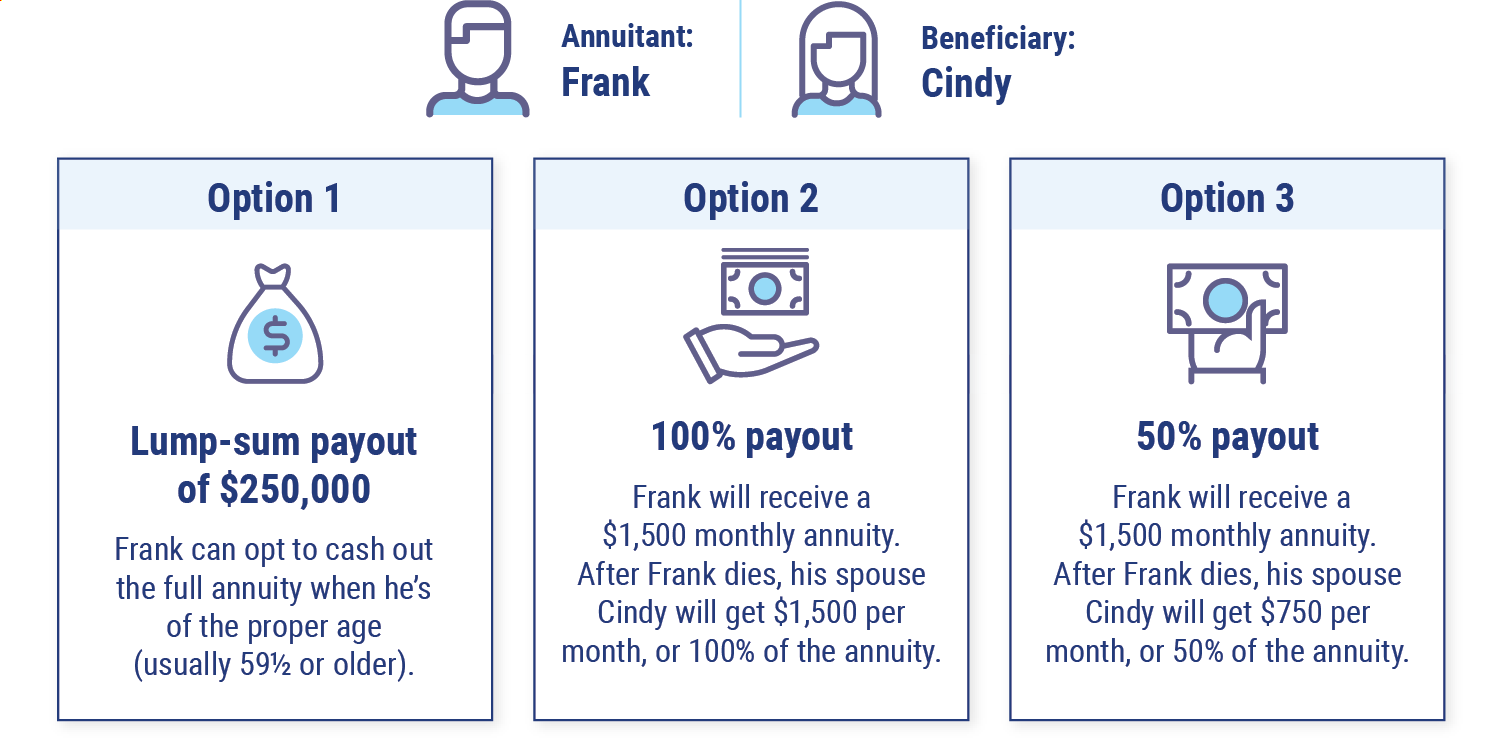

Joint Life Annuity Payout Example

Different insurance companies have different distribution options for their joint and survivor annuities, and your insurance agent will talk you through all of your choices. But to give you a better understanding of what you may be offered, have a look at this:

Where Do You Get a Joint and Survivor Annuity?

Thankfully, annuities are not big and scary financial concepts. They're really just a simple insurance product like car insurance, that with the right bit of background info, can really help protect you in your retirement years. You can buy a joint life annuity from a ton of different life insurance carriers out there. But let's be honest, why would you want to shop a bunch of different carriers and rates separately? That just sounds like a lot of work.

Your best bet is to talk to an independent insurance agent who can help you shop multiple carriers all at once. They'll pool together some of the best rates from the best carriers out there to give you a good sample of the best out there. And if you've got loads of questions, they've got answers. That's because they deal with annuities, insurance, and other financial protections on a daily basis.

So What's Next?

Annuities can be an important part of your retirement plan. While they have many features and benefits, they aren't always for everyone. Talk to your independent insurance agent. They can help you decide if a fixed annuity is right for you.

Benefits of an Independent Insurance Agent

Independent insurance agents are experts at helping make sense of the ins and outs of all types of annuities and other financial tools. They have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working entirely for you. And in the end, you'll be all set with the perfect retirement investment to match your needs, goals, and budget.