Arkansas Restaurant Insurance

Because the right coverage is just as tasty as your perfect menu.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

So you've just set up your own restaurant in Arkansas, and you're itching to cook up some of your delicious recipes for willing customers. But before you can even start passing out the menus, you'll need to get your business equipped with the proper coverage.

No one wants to think about potential lawsuits or other mishaps associated with owning and running a restaurant, but knowing the ins and outs of restaurant insurance in your state can help you get the protection you need to keep the customers coming. And our independent insurance agents are here to help you every step of the way. So let's get cookin'.

What Is Restaurant Insurance?

In short, restaurant insurance is a policy designed to cover all the components involved in your restaurant, from your property and supplies to your employees and customers. Obviously, serving food to the public ties directly into concerns about protecting their health, but restaurant operation comes with many different risks that are important to consider before setting up shop.

What Type of Restaurant Insurance Do I Need in Arkansas?

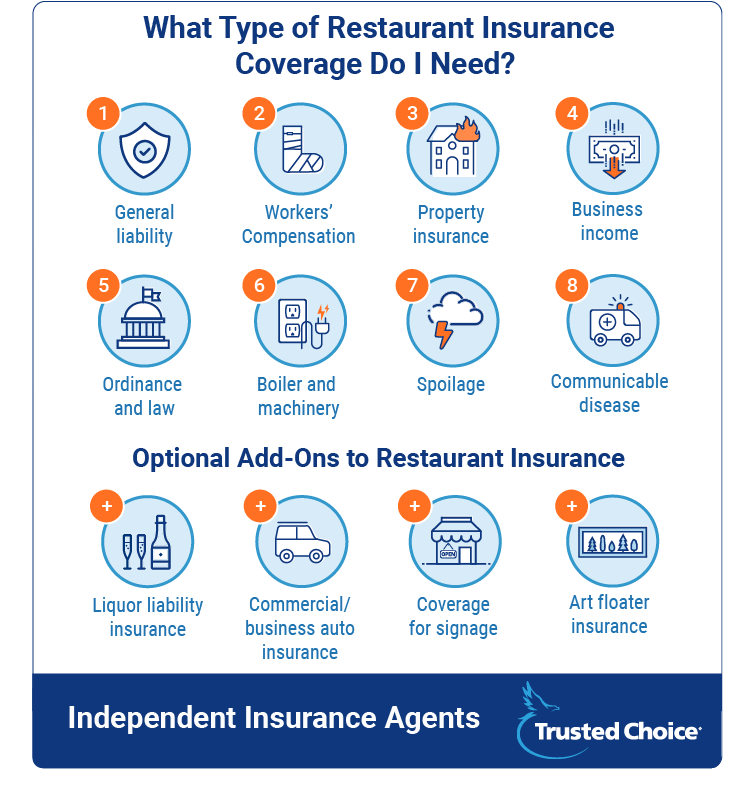

We'll check out specifics for the Natural State shortly, but first, we'll go over the types of coverage generally needed for restaurant owners everywhere. A restaurant insurance policy typically includes the following:

- General liability: This protects against lawsuits related to injury or property damage done by the business, and it's mandatory. Food poisoning claims would fall under this category.

- Workers' compensation: If your employees become ill, get injured or die from a work-related incident, this aspect of the insurance will cover the financial ramifications. Coverage is mandatory in Arkansas, as well as most other states.

- Property insurance: This covers any damage to the physical building that houses your restaurant, in case of fire, etc. The type of cooking equipment your establishment uses will contribute to the risk of fire damage, and may influence the cost of your policy. Businesses with deep fryers that use grease, for example, are considered a higher risk.

Note: Restaurants with a drive-thru will have extra property that needs coverage, and paved surfaces (like driveways) are not typically covered by general property insurance. - Business income: A part of property insurance, this aspect covers the financial loss suffered while a business is closed due to fire damage or other disasters.

- Ordinance and law: Another part of property insurance, it covers the financial ramifications if your building is found to not be up to current state code. This coverage also applies in the event that you need to rebuild your restaurant, or if you're building one from the ground up, yourself. Handicap compliant features, fire safety equipment, and emergency exits are all factors, here.

- Boiler & machinery: Also known as "equipment insurance," it covers electric equipment in the building (e.g., AC units and boilers) that breaks down due to power surges, etc. Property insurance may cover this stuff, but not always.

- Spoilage: This coverage takes care of the replacement costs of food that spoils due to power outages caused by storms, surges, etc.

- Communicable disease: Covers any illnesses transmitted to customers due to improper hygiene of your employees.

Optional Add-Ons to Restaurant Insurance in Arkansas

It's good to know what basics are included in a typical restaurant insurance policy, but the fact is that the package might not cover all of your specific needs. Your independent insurance agent can find the right add-ons for your policy like a pro, but that doesn't mean you can't familiarize yourself with a few that you might need ahead of time, like:

- Commercial/business auto insurance: If you run a carry-out restaurant that makes deliveries, you'll want to look into getting coverage for your company vehicles for things like theft and vandalism. Your restaurant will also be held responsible for damage done by your driver while in a company vehicle. Food trucks will also need this coverage.

- Coverage for signage: This protects your signage from things like weather and vandalism, since it's not typically covered under regular property insurance. It's especially important for restaurants with a drive-thru, with all the extra signage that could be damaged due to distracted or impaired drivers, or vandalism.

- Art floater insurance: This option exists mainly for the bigger/fancier restaurants with artwork on display. Scheduling an appraisal for the specific pieces you want to cover is the first required step. In case of fire or even theft, this coverage can help prevent having to pay for the replacements out of pocket.

- Liquor liability insurance: While not mandatory, this coverage can fill in some important gaps. General liability will NOT protect you if your employees overserve a customer who ends up with a DUI or other alcohol-related charge. Coverage is more necessary for smaller restaurants, as chains tend to have stricter serving rules and training policies in place to prevent mishaps.

How Do Arkansas's Dram Shop Laws Influence My Coverage Needs?

Dram shop laws hold a business liable for serving alcohol to minors, as well as for harm caused by an individual who has been overserved by that business — even after they leave your establishment. A state's specific laws and set of associated penalties/fines for violating them can influence your liquor liability coverage needs and the cost of your coverage.

In Arkansas, as well as most other states, a guest who sustains injuries to themselves due to over intoxication may not sue the establishment, since it's considered the guest's personal responsibility to monitor how much they consume. So, liability coverage for first-party cases is mainly only required in the case that a minor is served, since minors are not legally allowed to drink in any state.

However, third-party liability coverage is crucial. In the case that another individual is harmed by an intoxicated guest, such as in a bar fight or auto accident, they may sue your establishment. For these cases, the third party will need proof that the intoxicated guest continued to be intentionally served past the point of visible intoxication by your restaurant.

Lawsuits can seriously cost you or your business, in the form of significant financial penalties, loss of employment or liquor license, or even jail sentences. Your agent will set you up with the proper liquor liability coverage based on Arkansas's unique laws. They'll also explain the costs associated with each level of coverage.

Tornadoes May Affect Your Coverage Needs in Arkansas

The disaster Arkansas deals with the most is Severe Storms. In fact, the problem's actually getting worse. Tornado Alley has shifted further east in recent years, making Arkansas now one of the four reported deadliest states for tornadoes.

That being said, make sure you've got tornado coverage specifically named among covered events in your policy. Many Arkansas homeowners and business property insurance policies cover tornado damage, but it's not a guarantee that yours will. Some policies require an additional, separate tornado insurance rider. Ask your independent insurance agent to review your coverage, and determine if you need more. Being covered from the start can seriously limit any potential hassle later on.

How Much Does Restaurant Insurance Cost in Arkansas?

It depends on what kind of restaurant you run and a few other factors, such as if you've got employees, offer a delivery service, operate a drive-thru or serve liquor. However, a typical range for coverage starts on the low end of about $10,000/year for a smaller establishment with fewer employees, and the high end hits at $100,000/year for a much larger restaurant, like a chain.

A restaurant insurance policy is typically the cheapest and easiest way to go. This package offers most of the liability and property coverage you'll need, and you can always add on specifics as necessary. Your independent insurance agent will know exactly what to hook you up with.

What's the Safest/Cheapest Kind of Restaurant I Can Start?

Obviously, smaller is going to be cheaper. A food truck or corner stand downtown will be by far the cheapest option, because there won't be as many sales as in a larger chain, there aren't any other employees (that would require workers' comp), and you won't be serving alcohol. Coverage costs would most likely be in the low thousands each year.

What's the Most Expensive/Riskiest Kind of Restaurant I Can Start?

On the other end of the spectrum, a large dine-in chain restaurant with lots of employees, features like a salad bar and buffet, and a liquor bar is by far the priciest/riskiest venture. All the required workers' comp, property and liability insurance drive up costs exponentially. It ultimately depends on lots of specifics like the number of employees and the value of the property, of course, but we're talking big numbers, like more than $100,000 per year.

Finding/Comparing Arkansas Restaurant Insurance Quotes

Insurance policies are often filled with lots of technical jargon. Additionally, it's a real process to hunt for the RIGHT policy. Fortunately, sifting through the available options and pinpointing the necessary coverage is a task that can easily be handed off to someone else. independent insurance agents compare policies and quotes from several different insurance companies to make sure they're setting you up with protection that's among the best around. Talked with a Trusted Choice independent insurance agent to see all of your policy options.

ncsl.org

alcohol.org

dui.findlaw.com

servsafe.com

texarkanagazette.com