Life Insurance Taxes

(A closer look at exactly where all your hard-earned money is going)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Life insurance is a great way to wrap up any loose financial ends left behind after you pass. Life insurance can not only help cover your last expenses, but can also save your loved ones from having to pick up your final, potentially hefty tab.

But do life insurance policyholders and their beneficiaries actually receive all the money they expect, or does Uncle Sam get first dibs on a huge slice of the pie? We’ll answer some common questions when it comes to taxes and life insurance, and hopefully clear up some confusion about where your money’s actually going.

Our independent agent matching tool will find you the best insurance solution in your area. Tell us what you're looking for and we'll recommend the best agents for you. Any information you provide will only be sent to the agent you pick.

Are Life Insurance Proceeds Taxable?

Life insurance proceeds, a.k.a. the “death benefit,” aren’t taxable as long as they go to a beneficiary in the form of one giant payment.

That being said, if your policy is set up so your death benefit is paid out in installments, the beneficiary is likely to have to pay tax on the interest for the outstanding balance. It’s also common for the death benefit to be taxed if your designated beneficiary is your estate.

If the value of your estate exceeds the IRS’s threshold limits—federal and state exemptions—the difference will be hit with estate and possibly inheritance taxes.

Estates valued in the millions could be slammed by taxes up to a whopping 40%. Certain states also have inheritance taxes for multi-million dollar estates, with rates as high as 20% in some areas.

The federal estate tax threshold, as of 2019, is $11.4 million. If the value of your entire estate, including your life insurance payout, exceeds this limit, only the remaining balance will be taxed.

So, if your life insurance policy is $5 million and your estate is worth $7 million, the $0.6 million difference will be subject to taxes. However, certain states have much lower threshold limits for their state estate taxes.

Can Estate Taxes Be Avoided?

Setting up an irrevocable life insurance trust, or “ILIT,” is a way to potentially avoid estate taxes. This action can’t be undone—hence the “irrevocable” part. Basically, you’re transferring ownership of the life insurance policy to the trust, and you can’t name yourself as the trustee, or the person in charge of it.

The trustee will carry out the rules of the trust that you establish, such as paying out a certain amount of your benefit to your kids annually or donating the entire sum to your alma mater—it’s up to you.

You might choose to make your trustee a member of your family, like your spouse or a grown child, but you could also assign that role to a bank, your attorney, a trusted friend, or anyone else.

The death benefit paid to the trust is not counted in your estate’s gross value when you pass. This is what makes an ILIT ideal for those with estates exceeding the $11.4 million threshold.

Setting up an ILIT for at least the difference in your estate’s value from the federal threshold can help a lot more of your money go where you want it to—instead of back into the IRS’s pocket.

Are Life Insurance Living Benefits Taxed?

If you are diagnosed with cancer or another chronic or terminal condition, your life insurance policy may offer living benefits. In other words, you may be able to collect a portion of your death benefit while you’re still alive, to help pay for your treatment and medical bills.

Living benefits are usually not taxable, since they’re basically the equivalent of a life insurance payout to a beneficiary, who in this case is you.

Are Life Insurance Payments Tax Deductible?

Only in certain circumstances, like with group policies provided by an employer. The employer offering the group policy may write off life insurance premiums—typically up to $50,000 per employee—as long as they aren’t listed as the designated beneficiary. Employees under this policy can add the cost of their insurance to their taxable income.

Are Life Insurance Settlements Taxed?

You may decide at some point that you no longer need your life insurance policy. Maybe your spouse has died, you don’t have any heirs, or you’re just of a certain age and could use that cash now.

In this scenario, you may qualify for a life insurance settlement, where a third party takes over the premium payments after buying the policy from you, so they can become the policyholder and beneficiary.

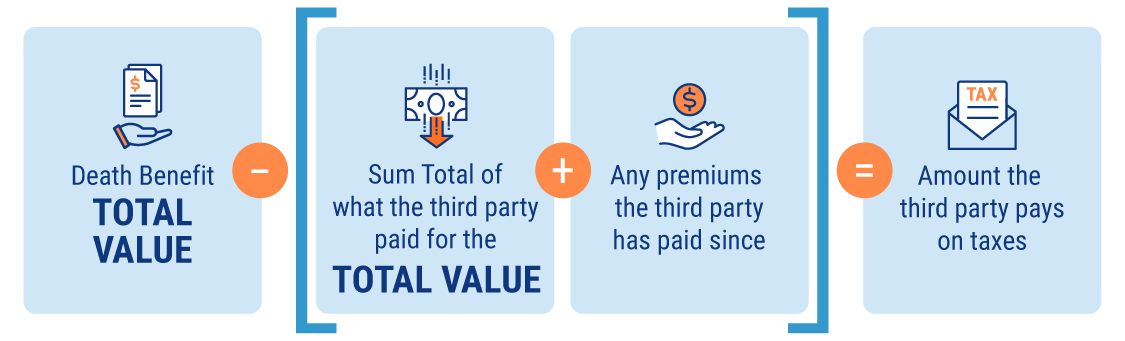

The third party also becomes responsible for paying taxes on the death benefit after you pass, but the only amount taxed is the difference between the death benefit’s total value and the sum of whatever they originally paid for your policy PLUS any premiums they’ve covered since then. Laid out, the formula looks like this:

- Death benefit total value – (sum total of what the third party paid for the policy + any premiums the third party has paid since) = amount the third party pays taxes on

You will also pay taxes (both income tax and capital gains tax) on the actual sale of your policy to the third party. The formulas for figuring out those taxable amounts look like this:

- Cash value of policy – premiums you’ve already paid = amount subject to income tax

- Total gain (settlement amount received – premiums you’ve already paid) – amount subject to income tax = amount subject to capital gains tax

Basically, you’ll need to figure out if the amount you stand to gain from a life insurance settlement is worth all the taxes—and the crazy amount of math involved in figuring it all out.

Will I Be Taxed If I Surrender My Life Insurance Policy?

When you reach a certain age, your life insurance policy will have accumulated a cash value. You may opt to surrender your policy if you’re unable to/uninterested in getting a settlement instead. Surrendering your policy is essentially the same as cashing it in with your insurance company.

As far as being subject to taxes, it depends on your policy’s cash value at the time of surrender. If the amount of premiums you’ve already paid totals more than the policy’s value at the time of surrender, you won’t owe any taxes.

However, if the opposite applies and the total sum of your completed premium payments is less than the policy’s cash value, the difference will be considered income—that’s subject to taxes.

How to Find the Best Life Insurance for You

In order to get the protection you need (and deserve), you’ll want to work with a trusted expert. Independent insurance agents will not only know where to find the best coverage and price, but also help to make sense of the fine print.

Consider your unique needs, then connect with an agent to help you take it from there. Have a list of your specific concerns and desires handy before you reach out, to help make the process even smoother.

Compare Life Insurance Quotes with an Independent Insurance Agent

We all know how valuable your time is, so why spend it doing all the hard work yourself? From life insurance policies to special add-ons, our expert independent insurance agents will help you determine what type of coverage makes the most sense for you.

Our independent insurance agents stay on top of the insurance industry and all the latest discounts so you don’t have to. That means they’ll help find the right coverage at the right price for you.

They’re not just there at the beginning, either. If disaster strikes, your agent will be there to help walk your loved ones through the process of getting the benefits they’re entitled to. Now that’s thinking ahead.