Long-Term Care Insurance Cost

How much does long-term care insurance cost?

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

Traditional health insurance policies often don't cover most long-term healthcare services, which means many seniors may need additional long-term care insurance. Average long-term care insurance costs for single males aged 55 are $1,700, while single females aged 55 pay about $2,675 per year. The cost of long-term care insurance can vary depending on many different factors like your health status when applying for coverage, your age, your location, how much coverage you need, and more. An independent insurance agent can help you find the best rates for long-term care insurance, but first, here's a breakdown of this important coverage.

What Is Long-Term Care Insurance?

Long-term care insurance pays for long-term care services, usually in a nursing home, but sometimes from assisted living or a home health aide. Policyholders pay monthly or yearly premiums in exchange for coverage.

There are two main types of long-term care insurance: hybrid and traditional.

Traditional long-term care insurance is a stand-alone policy. Hybrid long-term care insurance is blended with life insurance. Both have their perks. Traditional policies tend to be simpler and more streamlined. Hybrid policies are more flexible.

What Does Long-Term Care Insurance Cover?

Long-term care insurance comes with a number of different options. Working together with an independent insurance agent is a great way to get set up with the right policy that covers exactly what you need it to. But here are some of the most commonly covered services, etc. by long-term care insurance:

- Services not covered by health insurance: This includes things like assistance around the house with eating, getting dressed, bathing, using the bathroom, and other routine activities.

- Care for chronic health conditions: This can include cognitive disorders like Alzheimer's, cancer, and other chronic health conditions that require ongoing care and assistance.

Long-term care insurance policies aren't standard, so the coverage provided by one policy can vary greatly from another. Work together with an independent insurance agent to select the policy that's right for you, including one that has a coverage period that's ideal. These also range by policy and insurance carrier, with many long-term care policies having a coverage limit of five years.

What Is the Average Cost of Long-Term Care Insurance?

The cost of long-term care insurance can vary widely depending on the age of the individual insured, the coverages needed, etc. But here's a general idea of how much individuals or a couple can expect to pay for coverage.

Annual Average Long-Term Care Insurance Costs

| Status | Age | Premium |

| Single Female | 55 | $2,675 |

| Single Male | 55 | $1,700 |

| Couple | 55 | $3,050 |

An independent insurance agent can help provide you with exact quotes from multiple long-term care insurance companies in your area.

What Factors Affect Your Long-Term Care Premiums

Like other types of insurance, several factors go into determining the cost of your long-term care coverage premiums. These include:

- Your age: The younger you are, the cheaper your coverage will typically be since you’re likely to go for a longer period before filing a claim.

- Daily benefit and coverage term: Selecting a lower daily benefit amount and fewer years of overall coverage leads to cheaper premiums.

- Your location: Your state and its cost of living affect the cost of long-term care insurance.

People in their 40s and 50s can expect to pay $1,000-$4,000 per year. People in their 60s and up can expect to pay $2,000-$10,000.

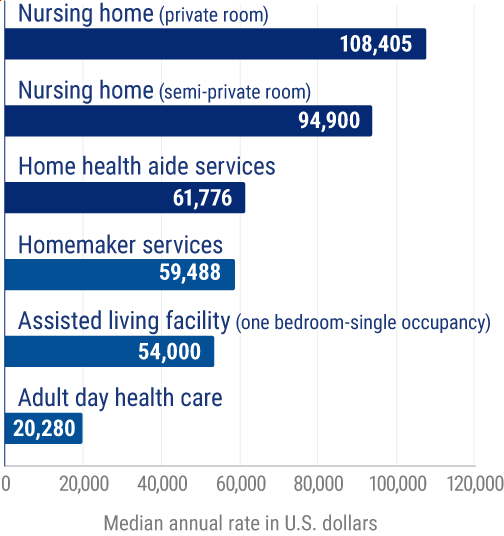

Thousands of dollars per year in premiums may seem like a lot, but long-term care insurance can still be a smart buy. Especially when considering that the average cost of just one month in a private nursing home room is about $9,300, currently.

Annual average rate of long-term health care services in the United States as of 2021, by type (in US dollars)

In some states, the cost of a stay in a nursing home can be much higher. States in the northeastern US, as well as Alaska and Hawaii, have notoriously expensive long-term care.

Considering this, getting hundreds of thousands of dollars worth of benefits in exchange for a few years of paying high premiums might not seem like such a bad deal after all to many folks.

Hybrid vs. Traditional Long-Term Care Insurance

When you buy life insurance, you’re paying for the death benefit. The difference between hybrid and traditional long-term care is the life insurance death benefit.

Hybrid long-term care insurance

Hybrid long-term care insurance policies are more recent on the market and steadily growing in popularity. Hybrid insurance blends life insurance coverage and annuity options with long-term care insurance. You pay premiums towards a death benefit but can “cash in” that benefit to pay for long-term care if you need it. This allows you to hedge your bets and guarantee that you’ll get at least some benefit out of your long-term care insurance.

Traditional long-term care insurance

Traditional long-term care insurance is the original type of coverage. It’s a stand-alone policy purchased and administered separately from other policies like life insurance. So it’s more straightforward than a hybrid policy, which makes it easier to understand and plan around. All you have to do is pay the policy's premiums and file a claim if you need to.

The downside of a traditional policy is that you may not ever use it, meaning you would have paid premiums for no cash benefit. But many folks find that the peace of mind this type of policy offers is beneficial enough on its own.

Which one is best?

It all depends on your needs and preferences. Hybrid policies offer flexibility, while traditional policies offer simplicity.

Hybrid long-term care insurance:

- Has a cash value and a death benefit

- Can be paid upfront (which is usually required)

- Allows you to get your premium back if you change your mind

- Typically not tax-deductible

Traditional long-term care policies:

- Offer pay-as-you-go premiums and are typically more cost-effective

- Don't offer a cash value option, and you don't get the premium back if your policy lapses

- Offer tax-qualified plans that can be tax-deductible over 10% of adjusted gross income and up to 100% for self-employed individuals

Long-term care insurance is an investment, so make sure you’re making a good one. Many independent insurance agents are also certified financial planners. They’re experts who are well-equipped to help you make these big decisions. Get started with an independent insurance agent today to find the right long-term care coverage for your needs.

How Much Long-Term Care Insurance Should I Buy?

It depends on your financial situation and on the cost of long-term care in your area.

The size of a long-term care insurance policy is measured in three ways:

- Daily benefit: The daily benefit is the amount of money the insurance company will pay per day of care. Long-term care is typically billed per day. This amount can range from $50 on the very low end to $300 or more on the high end.

- Maximum benefit: The total amount of money the insurance will pay, typically in the hundreds of thousands of dollars.

- Length of coverage: The amount of time your policy will cover, usually one to two years or more.

The more coverage you get, the higher your premiums will be. It’s important to evaluate your needs as accurately as possible.

First, research the cost of long-term care in your area. Look for the average “per day” cost. Then, determine how much you’ll be able to pay for yourself, drawing on savings and other investments. The shortfall is the size of the daily benefit you should purchase.

The maximum benefit and duration of benefits are a little more complicated to figure out. It’s impossible to predict just how much care you’ll need, but looking at your family’s medical history and talking with trusted friends, family, and financial advisors can help you decide.

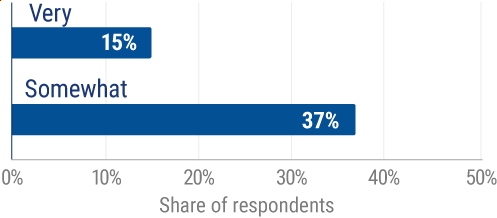

Retiree confidence about having enough money for long-term care in retirement in the United States

In recent years, only 52% of retirees ranked themselves as "very" or "somewhat" sure that they have enough money to cover their long-term care should they need it. Long-term care insurance is a great way to put yourself into the "very" category.

How To Buy Long-Term Care Insurance

You’re armed with knowledge, which means the hardest part of buying long-term care insurance is already over. But here’s how to actually purchase coverage, step by step:

- Research: Check out the “traditional vs. hybrid” and “how much” sections above for tips on how to decide which type of policy to buy and how much coverage you need.

- Contact an independent insurance agent: They’re experts who can shop around and find quotes that make the most sense for your situation.

- Fill out a medical history and get a medical exam: Your health status affects the cost of premiums, so the insurance company will need to verify it before giving you a quote. You may be able to get this exam at home. Your independent insurance agent will know.

- Get quotes and compare them: Your independent insurance agent will round up a number of quotes for you. The cheapest quote may not be the best one. Be sure to compare the size of the benefit and the years of coverage before choosing to make sure you’re getting enough bang for your buck.

- Sign on the dotted line: It’s that easy to buy long-term care insurance. Purchasing this coverage helps to secure your financial future, so your golden years can stay truly golden.

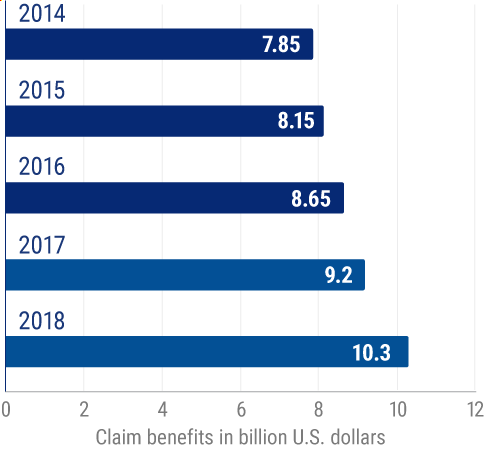

Amount paid in claims benefits to individuals by long-term care insurance companies in the United States (in billion US dollars)

Long-term care insurance companies paid out over $10 billion in benefits to their customers in 2018 alone, and that number is only trending up. Buying traditional long-term care insurance now secures you a piece of the pie, along with peace of mind.

Frequently Asked Questions about Long-Term Care Insurance Costs

Here are some of the most commonly asked questions about long-term care insurance costs:

Long-term care insurance rates can vary depending on a number of factors. So how much does long-term care insurance cost for you? It depends on your age, location, current health status, and more, but on average, a 55-year-old male can expect to pay about $1,700 annually, while a female of the same age can expect to pay about $2,675. An independent insurance agent can provide you with exact quotes to answer how much long-term care insurance per month would be for you.

Seniors in their 80s are most likely to file long-term care insurance claims. It's most cost-efficient to buy long-term care insurance between the age of 50 and 65. Buying coverage when you're younger and healthier can result in less expensive long-term care insurance costs because you're much less likely to file a claim.

A daily benefit amount as well as a maximum amount of coverage are included in a long-term care policy. Coverage can be used for the following:

- Services not covered by health insurance: This includes things like assistance around the house with eating, getting dressed, bathing, and other routine activities.

- Care for chronic health conditions: This can include cognitive disorders like Alzheimer's, cancer, and other chronic health conditions that require ongoing care and assistance.

Seniors in their 80s pay the most for long-term care and long-term care insurance alike. This age group is most likely to have chronic health issues, need assistance with daily activities, and file claims through their coverage.

Choosing an Independent Insurance Agent for Long-Term Care Insurance

Independent insurance agents are unique. While captive insurance agents can only sell insurance from one company, independent insurance agents can shop around among multiple companies to find the right deal for long-term care insurance, not just one company’s “best” deal.

With an independent insurance agent, you can be sure you’re talking to a real expert who knows traditional long-term care insurance inside and out. Good luck shopping for this critical coverage.

https://www.statista.com/statistics/310446/annual-median-rate-of-long-term-care-services-in-the-us/

https://www.aaltci.org/long-term-care-insurance-rates/

https://www.theseniorlist.com/nursing-homes/costs/#:~:text=How%20Much%20Do%20Nursing%20Homes,Care%20and%20Health%20Care%20Needs

https://www.schwab.com/learn/story/should-you-purchase-long-term-care-insurance#:~:text=Most%20LTC%20claims%20begin%20when,a%20longer%20period%20of%20time.