Workers' Comp Insurance FAQ

The big list of everything you ever wanted to know about workers' comp insurance.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Workers' compensation is an essential coverage for most types of businesses that rely on employees. But it can also be complex and confusing. That's why it's important to know the details about this insurance before you ever get a policy.

Whatever your industry, these common workers' comp questions can provide helpful guidance. An independent insurance agent can also answer your remaining questions and help you find the right workers' comp coverage for your business. But for starters, here's a big list of all the questions you might want answered about workers' comp.

What Is Workers' Compensation Insurance?

Workers' compensation insurance is a policy obtained by an employer to pay for medical expenses for employees that get injured or ill while working, or otherwise due to job-related activities. Most states make coverage mandatory if a business has a certain number of employees.

Workers' comp not only provides protection for employees on the job, but for the employer, too. If a business covers their workers with a workers' comp policy, their employees automatically forfeit the right to sue the business for a work-related incident in exchange for these benefits.

What Employers Need to Know about Workers' Compensation

Any employee who gets hurt or becomes ill on the job or as a result of doing work for your business can file a workers' compensation claim. An adjuster will then be assigned to check the validity of the claim and report back to the insurance company for a final decision.

A MOD, or an experience modifier, is basically a scorecard of the employer's frequency and payout of claims, and determines how high their premium will be. A MOD is typically assigned after three years of having a workers' comp policy with a premium of $5,000 or higher. Not all employers qualify for MODs. An independent insurance agent can help you determine if your business does.

As an employer, you're not required to pay an additional premium on your workers' comp policy for any hired subcontractors, as long as you collect the proper certificates of insurance. These documents show the insurance policies and limits of coverage that subcontractors have. Always ensure that any subcontractors you hire are equipped with their own workers' comp insurance.

The answer to this is a bit complicated. Workers' comp does not cover endemic disease, such as common colds or flu, even if they're spread through the workplace. But in general, whether illnesses or pandemics are covered by workers' comp depends on the specific state.

There are endorsements available for work-related travel, in case an employee gets an endemic disease in a foreign country. Also, if the nature of the work being performed makes workers more susceptible to getting a disease, even during a pandemic, then employees might be covered.

More than likely, an investigation will be performed after filing a workers' comp claim for a disease. An employee might be covered for catching an illness during a pandemic if their job's nature specifically put them at higher risk of contracting it. Ask your independent insurance agent for more details.

What Employees Need to Know about Workers' Compensation Insurance

As long as the employer carries a workers' compensation policy, an injured or ill employee can file a claim for a work-related incident. If the insurance adjuster approves the employee's claim, their medical expenses will be paid for or reimbursed by the policy.

It depends on your state's laws. Most states require businesses that have a certain number of employees to carry workers' comp. But there are certain exceptions, for example, agricultural businesses are sometimes exempt from being required to provide coverage. It's important to ask your independent insurance agent to help you review your state's laws about which businesses are required to have coverage.

Covered medical treatment for injured or ill employees lasts as long as necessary according to the claim's assigned physician.

This depends on the amount of the workers' comp payout and how long the employee's recovery will take. To find out for sure if an employee needs to use their sick time or vacation time to recover from work-related injuries while off work, review your policy with your independent insurance agent.

States and Workers' Compensation Insurance

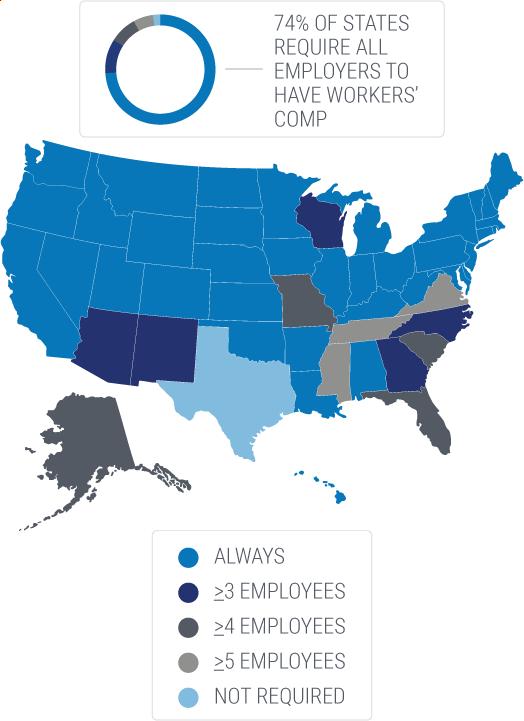

All states except for Texas have mandates about workers' comp. But every state has different requirements by business industry and the number of employees that make it necessary to obtain a policy.

Also, some states require businesses to obtain coverage after hiring their first employee, while others require it to be obtained when the business hires five or more employees. Check with your local independent insurance agent to be certain of your state's specific requirements for workers' comp.

Workers' comp laws vary from state to state, and it's crucial to be familiar with the requirements in yours. Your independent insurance agent can help you find more information about your state's workers' compensation laws if you're unsure, but you can also visit your state government's website.

Almost every state does require workers' compensation coverage for businesses that have employees. However, it's important to at least consider getting coverage even if your state doesn't mandate coverage for your specific business based on its industry or number of employees. Without coverage, you could face an employee lawsuit if there's an incident at work.

Why Are Independent Insurance Agents Awesome?

It’s simple. Independent insurance agents simplify the process by shopping and comparing workers' compensation insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print, so you know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best workers' comp coverage, accessibility, and competitive pricing while working for you.

https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-self-employed-or-employee