Long-Term Care Insurance Tax-Qualified vs. Non-Qualified

(What type of policy do you have?)

Are you struggling to know what Uncle Sam is entitled to when it comes to your long-term care insurance policy? That can be a scary thought, especially when you don’t know how much you will have left to care for you or your loved one.

It’s time to face your fears. Knowledge is power, and the more you know about how your long-term care operates can only be beneficial when you need it down the road. Read on and find out that ignorance isn’t so blissful, particularly when it comes to your money.

Our independent insurance agent matching tool will find you the best insurance solution in your area. Tell us what you're looking for and we'll recommend the best agents for you. Any information you provide will only be sent to the agent you pick.

What Is Long Term Care Insurance Anyhow?

Long-term care insurance in its simplest definition pays for your long-term care once you become critically ill or need additional assistance in everyday operations and functionalities. Some key areas where coverage would apply are as follows:

- In-home care

- Adult day service or daycare

- Hospice care

- Respite care

- Assisted living facilities (residential care or alternative care facilities)

- Alzheimer’s special care facilities

- Nursing homes

Now that you know what long-term care insurance covers, let’s dive into what you really want to know about — death and taxes. We are kidding about the death part, but you should really know about the taxes. So let’s continue.

What Is a Tax-Qualified Long-Term Care Policy?

A tax-qualified long-term care insurance policy is on a federal level. Tax-qualified is also often referred to as a qualified policy. These policies offer certain federal income tax advantages to the buyer.

For instance, if you have a tax-qualified long-term care policy and you are in the habit of itemizing your medical deductions, then you may be able to deduct the annual premium from your federal income tax return.

Let’s do a breakdown scenario on how this would come into play. Go ahead and add your deductible medical expenses to your annual long-term care policy premium. Got it thus far? Good, now stay with us.

You just calculated your total, now the fun part. Take that total for the year and if that's greater than 10% of your adjusted gross income, you may be able to deduct the excess amount on your federal income tax return.

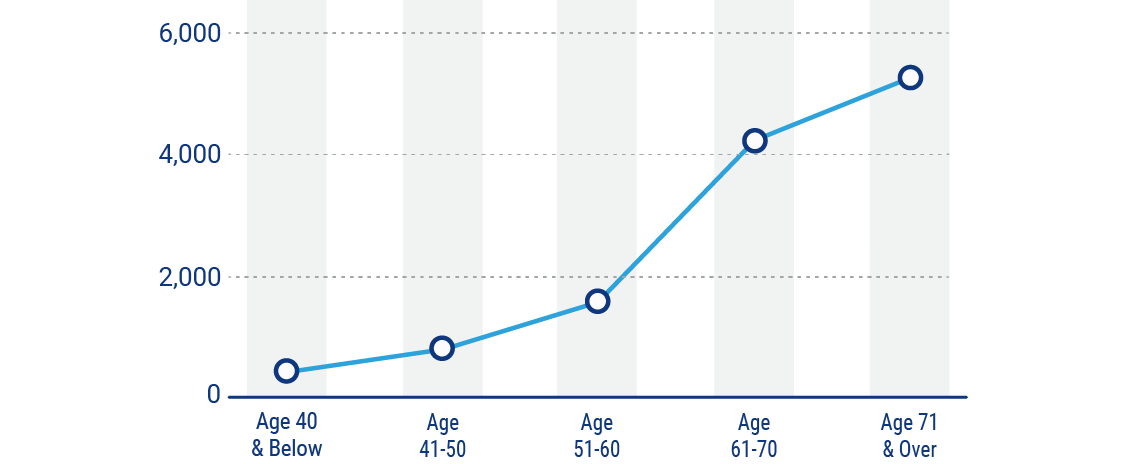

Last note on this mathematical equation — the maximum amount that you can claim as a deduction is dependent upon your age. Clear as mud? We thought so. Don’t worry too much about the math. As long as you have the right independent insurance agent, you will be golden.

In addition to premium deductibility, you will need to know if the benefits you are receiving under the policy coverages are taxable. A good rule of thumb is the benefits that are paid by a tax-qualified long-term care policy are usually not taxable as income to the recipient. On the contrary, the benefits paid from a long-term care policy that is non-tax-qualified may be taxable as income. Again, things to note.

This is where an independent insurance agent comes in handy. A good agent will know how to educate, do a breakdown, and have the most recent federal tax laws concerning long-term care.

If your independent insurance agent doesn’t know a piece of this puzzle when it comes to tax-qualified long-term care insurance, then they better know a person who does. We don’t know about you, but we would want to save as much money as we could for our aging care. It’s so important to have the right person in your corner.

What is a Non-Tax Qualified Long -Term Care Policy?

You should now have a pretty good grasp on what a tax-qualified long-term care policy is, so let’s talk about its not-so-identical twin, non-tax-qualified. A non-tax-qualified long-term care insurance policy means its benefits will not be taxed. No math problems to solve here, easy right? We thought you might like that.

A few other pieces of the puzzle are also worth mentioning. Like there are typically no caps or limitations on your long-term care benefits. Benefit triggers are more liberal, so to speak, and most of the time include “medical necessity” benefits.

A big selling point (if you were selling) is that patients whose time period of long-term care isn’t so “long-term” and lasts for less than 90 days can be eligible for benefit payout. Last, you do not need to itemize your tax return in this case which is a nice little task to remove from your to-do list.

Does Tax-Qualified and Non-Tax-Qualified Policies Vary from State to State?

Yes, each state is different and has different tax deduction laws and regulating factors. Most states encourage the purchase of a long-term care policy and in doing so offer deductions to assist in paying for the premium. See your local tax advisor and independent insurance agent for state specifics.

What Is an Independent Insurance Agent and Why You Need One

We are so glad you asked. It is probably one of the most important questions in knowing you are properly covered, and we’re going to make sure you know why.

Independent insurance agents aren’t just salespeople looking to make an easy buck. They are humans just like you and me working on your behalf. The independent agent has their client’s best interest in mind and works diligently to find not only the best price but also, the best coverage for their clients.

Let’s do a visionary exercise, imagine that you picked the wrong agent. You picked the first agent out of the phone book and went with the first long-term care policy they presented without any explanation of benefits.

Now, fast forward 50 years and the time has come to use that policy for an in-home nurse that will help with the day-to-day tasks that you can’t get done on your own any longer.

Oh, but wait, the policy that phone book agent sold to you has restrictions on in-home care. It also has restrictions on time periods, and you will likely have to fill the gap with your retirement.

Looks like phone book agent wasn’t the best choice. Now picture that same scenario except you did your due diligence and you went with an exceptional independent insurance agent. One that was truly knowledgeable. One that took the time to go over your coverages, had answers for all your questions, and even educated you on what you didn’t know you didn’t know.

The time still passed, and you still need that in-home care. Since you were informed enough to make the best decision, you have the proper coverage. You can use the benefits from your long-term care policy without dipping into your retirement. See, aren’t you glad you made the right choice? We sure are.

Where Can You Find An Independent Insurance Agent?

Right here, on TrustedChoice.com! We represent thousands of independent insurance agents across the country and have the best time helping you find one. It is our most important job aside from educational resources like this article. Just think, there is an independent agent equipped and ready to serve you right in your home town.

What are you waiting for?

Free Advice Legal. Tax-Qualified and Non-Tax-Qualified Long Term Care Insurance Policies. https://law.freeadvice.com/insurance_law/long_term_care/long-term-care-and-taxes.htm

American Association For Long-Term Care Insurance. November 17th, 2018. 2019 Tax-Deductible Limits For Long-Term Care Insurance Announced. http://www.aaltci.org/news/long-term-care-insurance-association-news/2019-tax-deductible-limits-for-long-term-care-insurance-announced