Standard Work Comp Policy Form

(And what it means for your business)

Workers' compensation insurance has a few different coverages involved, and knowing what the standards are is part of running a smooth operation. How a workers' compensation policy is supposed to look and what to watch for is only beneficial to your business.

An independent insurance agent is a key advisor for any employer when it comes to workers' compensation insurance and how coverage applies. Having the right person in your corner with the know-how is a pretty good place to start.

What Is Workers' Compensation Insurance?

First things first, you need to know what workers' compensation insurance is before you can know the laws that govern it. Workers' compensation insurance is an insurance policy taken out by an employer or independent contractor that will help pay for the medical expenses of an injury or illness that occurred while working or as a result of an employee's job.

This policy will also pay for partial wages, usually up to two-thirds, for any employee, included owners, or independent contractors while they're recovering. An independent insurance agent is the perfect resource to have when it comes to knowing the ins and outs of workers' compensation coverage.

What a Standard Workers' Compensation Policy Form Looks Like

A workers' compensation policy is pretty basic as far as coverages go. A standard policy form will have coverage limits for bodily injury, bodily injury by disease, and a policy limit for bodily injury by disease. The amounts you and your independent insurance agent choose for these coverages are dependent on your business risk factors, how many employees you have, how risky your business operations are, and what safety practices you have in place already.

The basics are like this for a workers' compensation policy:

- Coverage limit amount per occurrence for bodily injury

- Coverage limit amount per employee for bodily injury by disease

- Coverage limit amount policy limit for bodily injury by disease

Put it all together and it looks something like this: $100,000 per occurrence/$100,000 per employee/$500,000 policy limit

The $100,000/$100,000/$500,000 are the bare minimum basic statutory limits that are typically required by law for every employer or independent contractor to carry.

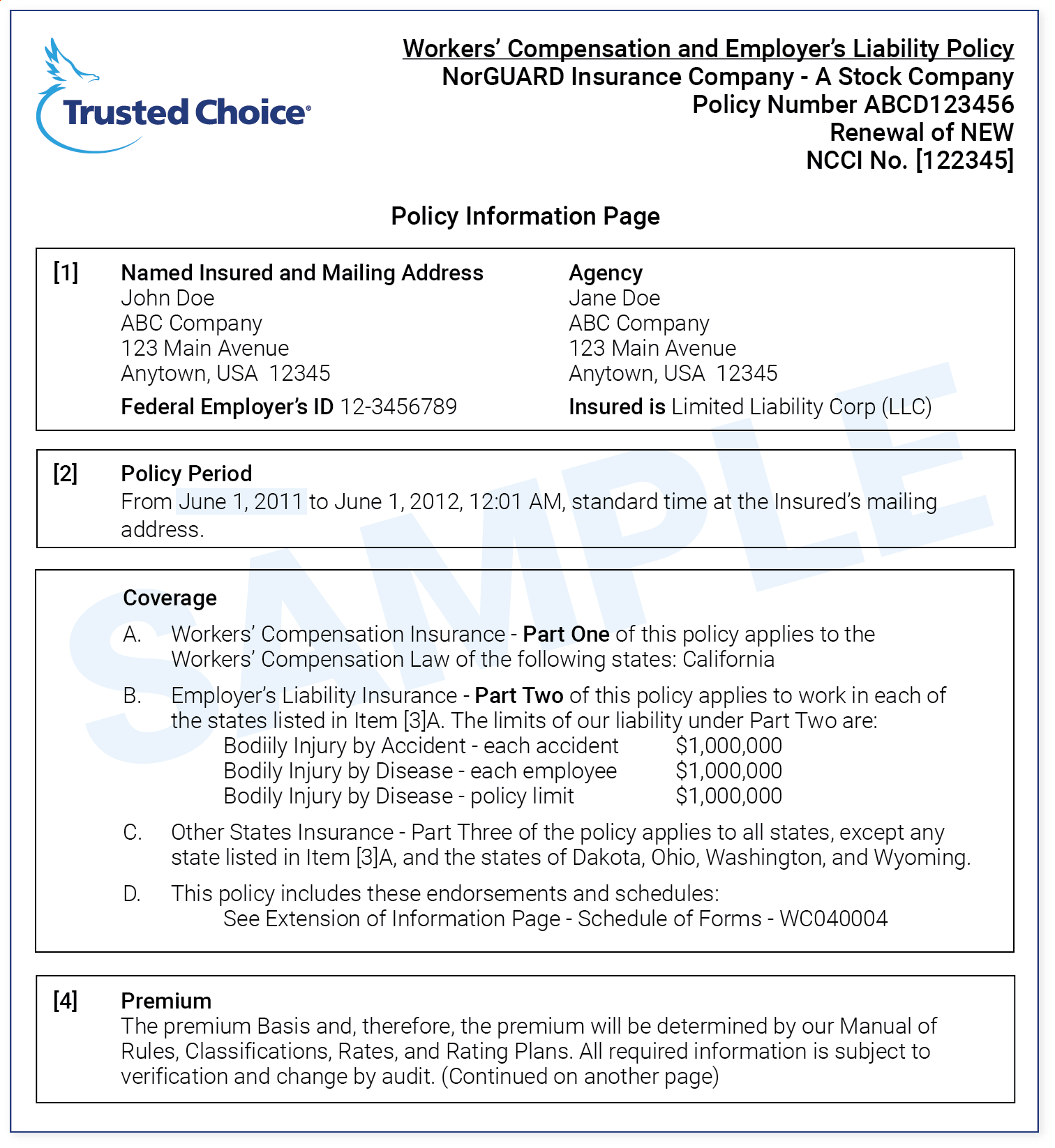

What Is a Workers' Compensation Standard Policy Form, Exactly?

Below you will find a sample declaration page of a workers' compensation policy standard form. Knowing what each item means is key to having a good grasp on your coverage and what kind of protection your business really has. This policy form will show you the key coverages that you will see on a standard policy declaration page so you know what to look out for.

The example above uses $1,000,000 per occurence/$1,000,000 per employee/$1,000,000 policy limit. Since coverage can be as low as the statutory state minimum requirements and even higher than the example, it's best to discuss what your business needs are coverage-wise with your independent insurance agent.

Other coverage options that could be added to a standard policy form is a waiver of subrogation endorsement. This is a popular policy endorsement and will only bar the subcontractor's workers' compensation company from initiating a lawsuit action or from enforcing its lien on a third-party claim.

All things need to be discussed with your trusted advisor because they are bound to come up in the land of workers' compensation insurance.

What Is Not Covered?

By now you should have a pretty good understanding of what goes into a standard workers' compensation policy form. But you should also know is what it's not going to cover.

What's not covered under a workers' compensation policy

- Full wages (this is lost income, and it will usually only cover up to two-thirds of regular pay)

- Non-work related injury or illness (this is crossing the line into insurance fraud which is discussed next)

- Coverage more than what is offered on the policy (once your policy limits are exhausted for any one claim, that's it. There is no more coverage and it has officially become a personal problem.)

Workers' Compensation Insurance Fraud Laws

Insurance fraud is a big deal. Filing a claim that isn't real or has been manipulated all in an effort to get a large payout from the insurance company should be taken very seriously mainly because it lacks integrity, but also because the consequences could be dire to you, your employee, and your business.

Some insurance fraud consequences:

- Penalties and fines ranging from hundreds to thousands of dollars

- Jail time from one year to thirty years

The result of filing a faulty workers' compensation claim and being caught isn't worth the risk. An employee can file a false claim wanting a payout for an injury or exaggerated illness. An employer can misclassify an employee to avoid them filing a claim in the first place, and a health care provider can extend the injury or illness to continue getting payment from an insurance company. As the employer, you set the stage. And by setting up proper safety practices and a clean claims reporting process, you can help curb the chances of false claims being filed.

Cost of Workers' Compensation Coverage

A standard workers' compensation policy form pricing is as unique as your business. Costs are as vast as the number of industries in the world. So the only true way to know is to have your agent run the numbers on your business and its specifics. While it's nearly impossible to know what your individual workers' compensation premium will be, here are some determining factors you can look out for.

Workers' compensation price-determining factors:

- Industry: This plays a big part in the cost of your workers' compensation premium. The riskier your business, the more your premiums will be.

- Number of employees: This determines how much your rates will increase. More people equal more money.

- Gross annual payroll per employee type: Each employee is given a classification code that classifies their job duties and then charges the premium according to how risky or not risky their tasks are. The amount of money you pay them will determine the amount of premium per classification code. The more payroll, the more premium you pay.

- Experience modification rating: If your business has had workers' compensation insurance for a total of three years or more, and you are paying over $5,000 in annual premium, then you'll be assigned an experience modification rating, aka "mod." This mod will adjust throughout the years depending on the number, length, and frequency of claims turned in. The better the mod, the better rate you will receive. It's kind of like a credit score for your workers' compensation policy.

What Is the Benefit of Having Enough Coverage?

The benefits of good coverage far outweigh the costs involved. A standard policy form for a workers' compensation policy may not be enough coverage. Not all businesses are the same and thus need to be individualized to really make sure coverage is accurate and sufficient.

Having a knowledgeable independent insurance agent who can properly advise on how much coverage you should obtain will determine how much coverage your injured employees can get and ultimately helps avoid hefty lawsuits. You don't know what you don't know, so shining a light on workers' compensation coverages and what goes into a policy will help you make a more educated decision when you're ready to buy.

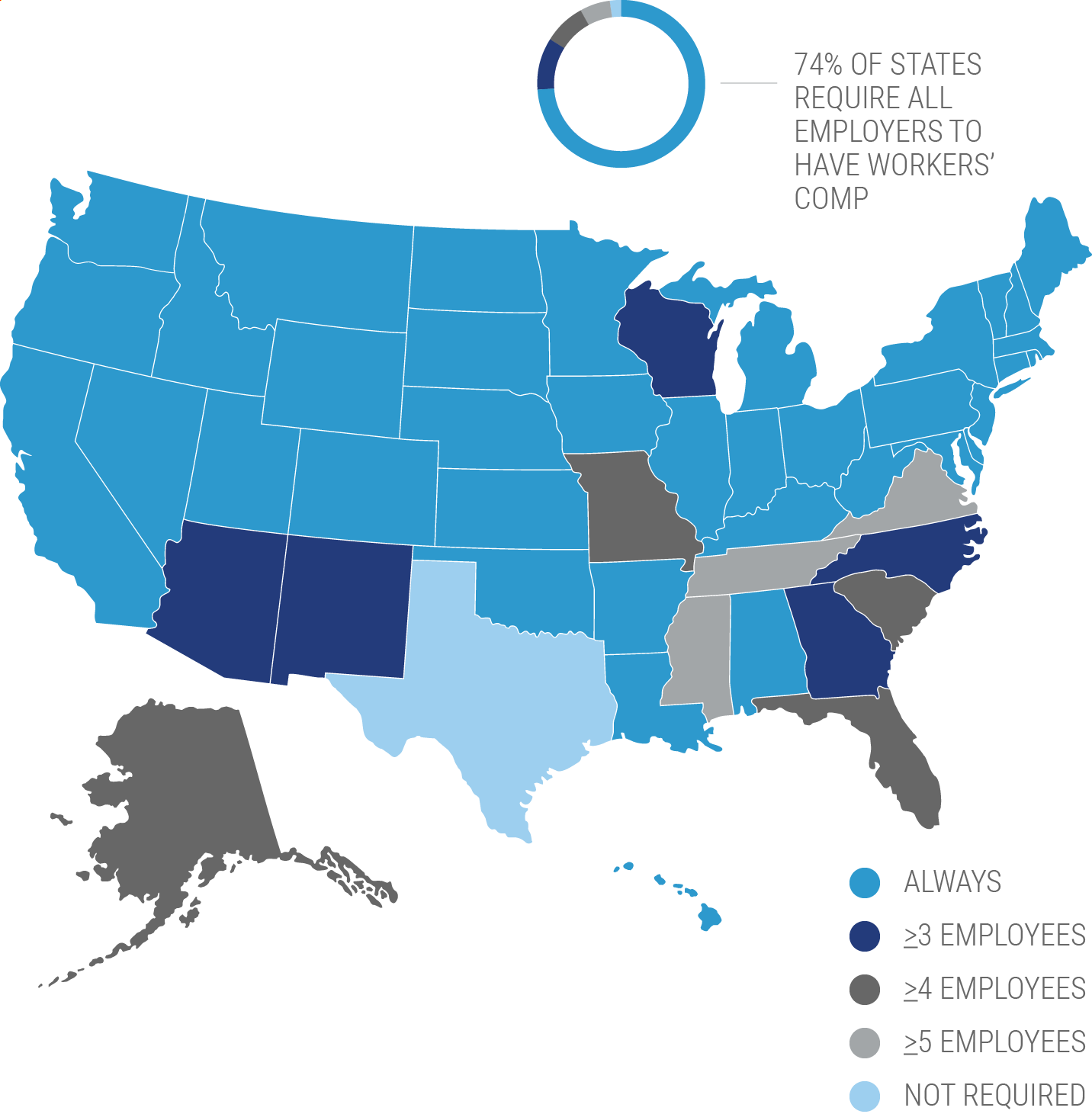

Is Workers' Compensation Insurance State-Specific?

Each state has its own rules when it comes to workers' compensation insurance because each state except for Texas has mandated workers' compensation coverage in some form or another. What's a standard policy form in Arkansas, may not be a standard policy form in Nebraska. There may be some separate workers' compensation forms that could apply to coverage specifics and depend on what state your business resides.

Knowing what your state specifics are concerning coverage types and different policy forms can be discussed with your local independent insurance agent. They have the knowledge to back up state regulations and policy forms when it comes to workers' compensation.

Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. And as your company grows and your needs change, they'll be there to help you adjust your coverage, up or down, to make sure you're properly protected without overpaying. Find an independent insurance agent in your community here.