Who Pays for My Damaged Boat at the Marina?

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

When you dock your boat at a marina, you're hoping it'll be safe after you leave. Unfortunately, this isn't always the case, and in many scenarios, the resulting damage isn't even technically your fault. But that's what makes having the right boat insurance key.

An independent insurance agent can help you find the right kind of boat insurance to help guard your vessel at the marina and other locations. A local agent can also help understand whose insurance pays for damages depending on how and where a boat is damaged when it's at a marina.

Who Pays for the Damage to My Boat at the Marina?

Understanding who'd be responsible for damage to your boat at the marina in many different scenarios can help put you on the fast track to reimbursement after an incident.

The answer depends on the exact situation and the cause of the damage to your boat. Because of this, let's walk through a few different marina incident scenarios and how the right coverage can protect you in each one.

Scenario 1: A Windstorm Blows My Boat into Someone Else's

Whose fault is this?

Storms are considered "Acts of God" by insurance companies, so you really can't be held responsible for the wind blowing your boat into someone else's in many cases. However, sometimes, marinas have rules in place for severe weather. If a storm is in the forecast, they might require boat owners to tie their boats more securely, and if they fail to do so, it's possible they could be held responsible for any resulting incidents, but this depends on the marina.

How will boat insurance handle this?

If the insurance company determined that the windstorm was an "Act of God" and no one was technically responsible, then each person with a damaged vessel would go through their own boat insurance policy to cover their own damage.

However, if the marina had required you to tie your boat down in a certain way and you failed to do so, then you might be held responsible for covering the damage to someone else's vessel. In that case, the property damage liability coverage in your boat insurance would help take care of that.

If the marina is somehow at fault for failing to require proper precautions or if the marina infrastructure hasn't been properly maintained to handle the local weather risks, the marina owner's marina insurance may have to pay for damages to any boats.

Scenario 2: A Marina Employee Moves My Boat from One Slip to Another and Causes Damage

Whose fault is this?

In this case, it's pretty clear that the person at fault for damage to your boat would be the marina's employee. Likewise, if another stranger moved your boat without your permission and caused damage to it or other property, it would be their responsibility.

How will boat insurance handle this?

The marina owner's marina insurance policy should pay to cover any physical damage to your boat or other property in this scenario. If the person who moved your boat wasn't a marina employee but just another third party, then their own boat insurance policy's property damage liability coverage should pay for the damage.

Scenario 3: Someone Is on My Docked Boat without Permission and Gets Injured

Whose fault is this?

Most likely, the person who was on your boat without your permission would be on their own to cover their injuries. However, according to insurance expert Paul Martin, this person could try to prove that your boat was unsafe and caused their injury. If they can successfully prove this, then you might be on the hook for their injury treatment costs.

How will insurance handle this?

If the person who was on your boat couldn't prove that your boat was unsafe, they'd be responsible for covering their own injuries with their health insurance. However, if they could prove it was your fault, your boat insurance's bodily injury liability section could reimburse them for the treatment of their injuries sustained on your boat.

Scenario 4: Someone Doesn’t Follow the Marina Signs and Rams into My Boat

Whose fault is this?

In this scenario, it's unquestionably the fault of the person who wasn't following the signs at the marina and caused the damage to your boat. Unless you also weren't following the marina's rules in some way, it's highly unlikely you'd ever be on the hook for this incident.

How will boat insurance handle this?

The person who was boating negligently through the marina would be responsible for going through their boat insurance policy's property damage liability coverage. Their boat insurance would reimburse you for the physical damage to your boat and property stored on or in it that was damaged by the negligent boater.

Scenario 5: My Boat Is Vandalized While Docked at a Marina

Whose fault is this?

Technically, it's the fault of the person who did the vandalizing. And if the marina failed to properly secure the facility or if the vandal is a marina employee, the marina itself could be at fault.

How will boat insurance handle this?

Boat insurance policies typically cover vandalism or malicious damage. Whether the marina owner's marina insurance comes into play depends on a variety of factors. You'll need to review your contract with the marina to determine if the marina can be held liable for any purposeful damage to your boat while it's docked.

What Does Boat Insurance Cover?

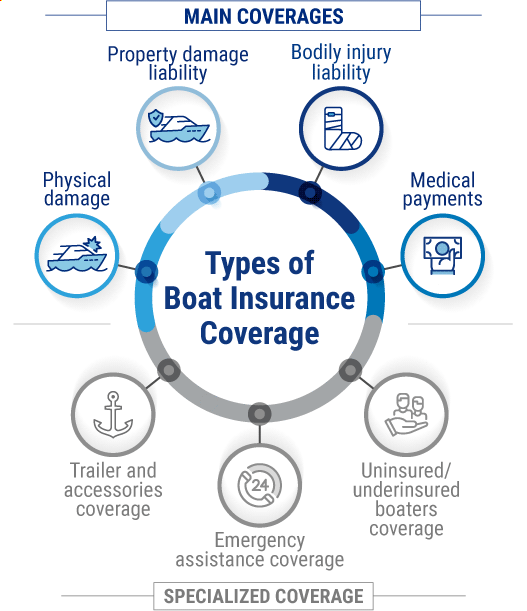

Proper boat insurance begins with a few key coverages and can then be built up to include even more optional add-ons that may be worth it, depending on your primary use of the boat.

Boat insurance often includes the following coverage types:

- Physical damage coverage: Reimburses for damage to your boat, including the hull, permanently attached equipment, machinery, etc., from many perils like animals, defective machinery, and insects.

- Property damage liability coverage: Reimburses property damage costs to others that were caused by your boat.

- Bodily injury liability coverage: Reimburses injury treatment costs to others who get physically harmed by your boat.

- Medical payments coverage: Reimburses for the treatment of injuries to you or your passengers who get hurt in some way by or on your boat.

You may also purchase specialized boating protections, such as:

- Trailer and accessories coverage: Your regular boat insurance policy might not include coverage for your trailer and other accessories, so you might have to purchase this additional protection for it.

- Emergency assistance coverage: Reimburses for towing and other emergency services if you get stranded in your boat or face other issues on the water.

- Uninsured/underinsured boaters coverage: Reimburses for expenses if another boater causes physical damage or injury to you or your passengers and doesn't carry any or enough insurance of their own.

An independent insurance agent can help you get set up with all the boat insurance you need. They'll help you choose any additional coverages that make the most sense for you.

How Can an Independent Insurance Agent Help You Find Boat Insurance?

An independent insurance agent simplifies the process by shopping and comparing insurance quotes for you. Not only that, they’ll also cut through the jargon and clarify the fine print so you'll know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best boat insurance coverage, accessibility, and competitive pricing while working for you.