Buying a Condo vs. Renting: What’s Right for You?

You're ready to get a condo, but you're not quite certain if you want to rent or buy. After all, there are pros and cons to both choices. The decision isn't one to be made without careful consideration.

But whether you rent or buy your condo, you'll need to ensure it's protected by the right type of coverage. An independent insurance agent in your area can help you find all the condo insurance you need. But first, here's a closer look at how to choose between renting vs. buying a condo and which choice is right for you.

Buying a Condo vs. Renting: Which Is Cheaper?

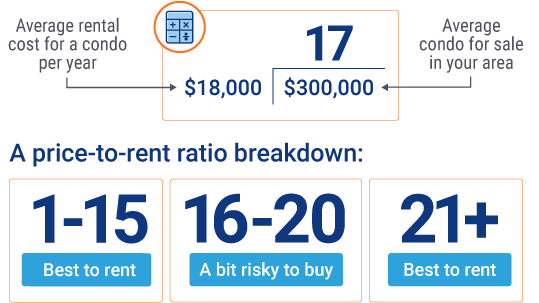

Though some agents insist that renting a condo is cheaper than buying, there’s a little trick called the “price-to-rent ratio" to consider first. It works like this: if the average rental cost for a condo in your area is $1,500 per month or $18,000 per year, and an average condo for sale in the same city is $300,000, you'd divide $300,000 by $18,000 to get 17. You'd then take that result and consider the following scale:

The price-to-rent ratio considers that when answers to these equations fall within the 1-15 range, it makes more sense financially to buy the condo instead of rent. In the next range of 16-20, it's considered a bit financially risky to buy. The final range of 21 and greater indicates a condo that would be most financially wise to rent.

While this isn’t a foolproof way to find your answer, it can give you a general idea. Then when budgeting, remember to consider any up-front costs of buying a condo vs. renting, and also future costs of renovations, utilities, etc.

Up-Front Costs with Buying or Renting a Condo

Your budget could dictate your decision between renting versus buying a condo. Buying comes with up-front expenses like closing costs, a down payment, and bank and title fees, which add up quickly.

If you don’t have enough money in savings to cover those costs, you might be better off postponing a purchase until you do. Consider that if you chose to rent a condo instead, you’d typically only be responsible for paying the first and last month's rent and, depending on the rental agreement, a security deposit.

Buy a Condo or Rent: Which Costs More Over Time?

The long-term cost of renting is basically your monthly rental price multiplied by the length of time you'll be staying in the same home. For many residents, it's still tough to determine whether it'll be more expensive in the long run to rent vs. buy a condo. Keep these key points in mind when weighing your options:

- Buying can be a bit more complicated because of unexpected costs like emergency repairs in addition to other expenses like taxes and insurance.

- Renting, on the other hand, means most of those extra costs, like maintenance and repairs, are not your responsibility.

It can still be tough to determine whether renting or buying a condo will cost you more over time. If you’re not prepared for the added and ongoing responsibilities of buying, renting might be worth the cost. But if you’re hoping to build equity and see a return on your investment, buying could be your best bet.

Consider the Added Responsibility of Owning a Condo

Most condo owners are only responsible for what’s inside their walls. The monthly association fees you pay will go towards fixing and maintaining everything else, including the exterior, entryways, and common areas. It’s less responsibility but more out-of-pocket costs.

While condo owners will most definitely have to pay any applicable HOA fees, renters may not have the same obligation. If renting, establish in the lease who's responsible for what fees and expenses and consider those costs before deciding.

Should You Buy or Rent a Condo If You Have Big Plans for the Future?

Future plans, or lack thereof, should be a major factor in your decision-making. If you’re considering a career change, going back to school, or maybe starting a family, renting can give you more freedom to move on to other things and places.

Owning a condo makes it more difficult to move whenever you like, and it can be costly. However, the benefit of owning is being able to stay put while having the freedom to make changes to your property, like adding another room or office.

The Pros of Renting a Condo

One method that can help you decide between renting vs. buying a condo more easily is considering the pros and cons of renting. Here are a few benefits that renting a condo can provide:

- You have more freedom to move to another location after your lease term is over, which is typically only a few months or a year

- Maintenance workers at a rented condo can help handle repairs for you

- You're not typically responsible for shoveling snow or mowing your lawn if you rent your home

- The landlord or property manager should handle routine maintenance costs

These benefits of renting a condo over buying sway many residents into renting. However, these reasons alone may not be enough to convince you not to buy a condo.

The Cons of Renting a Condo

When choosing whether to rent or buy a condo, you'll also want to weigh the cons of renting over buying. Here are some potential drawbacks to renting a condo instead of buying:

- The lease terms are outside of your control and may be changed when your contract renews

- Your rent will likely increase each time your lease renews, which may price you out of the area

- The landlord or property manager at your complex might not respond to maintenance requests and other matters in a timely manner

- There may be added HOA fees to your base rent cost

- Renters often have more limited access to community amenities like gyms and pools due to HOA rules

Considering the potential drawbacks of renting a condo instead of buying just might convince you to buy. Of course, beyond these pros and cons, you'll need to consider your financial situation and future life plans as well.

FAQs about Renting vs. Buying a Condo

Whether you buy a condo or rent one depends on your unique circumstances and needs. Consider your financial situation and whether you want to stay put in one area long term. You may have a lot of money put away in savings and have no plans to move, meaning buying a condo would make more sense for you. However, if the opposite applies, you may decide to rent.

There's no clear-cut answer on whether buying a condo is better than renting because it depends on your preferences. If you want to own your condo and know it's yours, you may decide it's better to buy than rent. However, if you want to keep the freedom to move as soon as your lease is up, you may decide it's better to rent than buy.

A few benefits of buying a condo instead of renting include the ability not to have to make monthly rent payments endlessly. You could pay for your condo upfront in one large payment if you wanted to. Also, when you buy your property, you have more freedom to make modifications, such as adding rooms or changing paint colors, which you don't have the ability to do if you rent.

You'll want to consider your plans and desires. If you'd like the freedom to modify your property in any way, you might want to choose to buy. But if you want to be able to switch homes once a lease is up, you might want to choose to rent. Also, factor in your budget and determine if you're more financially ready to make a big down payment and are prepared to pay maintenance costs or if you'd rather only be responsible for a monthly rent payment.

What Are the Benefits of Working with an Independent Insurance Agent?

If you're planning to get a condo in the near future, speak with an independent insurance agent before you start packing. They can help you assess your condo insurance coverage needs and can use their relationships with several insurance companies to find you a suitable policy at a competitive rate.

Your independent insurance agent can even find ways to save you money on your other insurance policies. Find a local independent agent in your neighborhood today who can provide the details you need to make an informed choice about condo insurance.

https://www.amfam.com/resources/articles/at-home/buying-condo-vs-renting

https://themortgagereports.com/37236/buying-a-condo-vs-renting

https://www.lahomes.com/blog/buying-vs-renting-a-condo/