Does Insurance Cover Car Damage to Property?

Responsible homeowners have to worry about what they can do to protect family members, guests, and strangers on their property and the damage others can cause to their homes. So what happens if someone crashes their car into your home or garage? Even worse, what if one of your own family members hits the house with your car?

You've got damage to your car and your home. You've got homeowners insurance and car insurance. Who's responsible, and which insurance policy pays for the damage?

Luckily, independent insurance agents are familiar with all kinds of scenarios. They can set you up with all the coverage you could need for incidents like these long before you'd ever need it.

Who Is Responsible for the Damage if a Car Hits My Home?

If a random driver hits your home or any other part of your property, like a garage or fence, that driver will likely be determined to be at fault and responsible for compensating you for the damage.

Most states require all drivers to have a minimum amount of property damage liability insurance to pay for any property damage they cause. In this case, the at-fault driver's liability insurance would pay for repairs to your home.

When might your homeowners insurance apply in this scenario? If the driver doesn't have enough auto liability insurance to cover your property damage, your home insurance will likely cover the damage costs beyond the vehicle owner's liability coverage limits. Vehicle damage is usually a covered peril under most home insurance policies.

What Happens If the Driver Who Hits My Home Is Uninsured?

If an uninsured driver hits and damages your home, your homeowners insurance will likely cover the cost of repairs. You will, however, need to pay your deductible before your coverage kicks in. Remember that if the repair costs are less than your deductible, your coverage won't apply, and it won't be worth filing a claim.

Your independent insurance agent can help guide you in these situations.

What If I Damage My Own Home With My Car?

Let's say you forget to open your garage door and back right into it on your way out. This happens more often than you would think, and it can cause significant damage to your garage door and even the structure of your garage.

In these cases, your auto insurance likely won't cover the repairs to your home (although your collision coverage, if you have it, may cover any damage to your car). If repairing the damage to the garage costs more than your homeowners insurance deductible, you can file a home insurance claim. Again, your independent agent can help you decide how to proceed.

How Would These Incidents Affect My Premiums?

Fortunately, single, relatively minor incidents are typically unlikely to affect your home or auto insurance premium. Insurance companies don't tend to punish policyholders for single or uncommon incidents.

However, suppose cars crashing into your home or hitting your garage door become a habit. In that case, your insurance company may decide to start hiking your premium or even choose not to renew your policy after its term is up.

What Are Some Other Common Home Risks?

Aside from these "car into house" scenarios, there are plenty of other ways for homeowners to sustain property damage or file a claim. Check out these stats regarding common home insurance claims.

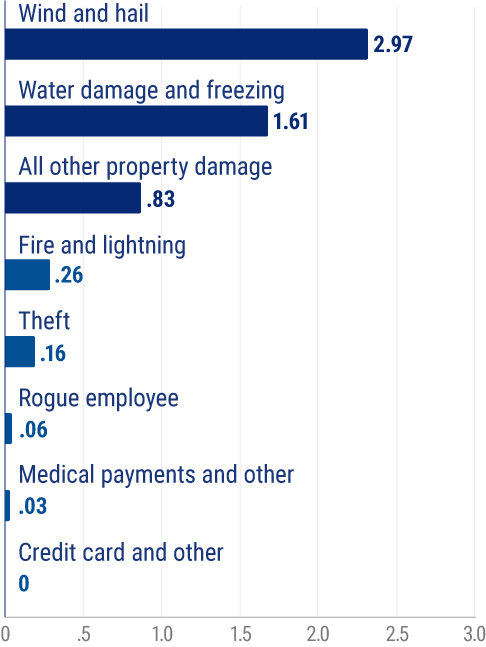

The most commonly submitted home insurance claims were due to wind and hail damage. Following those disasters were claims made due to water damage and freezing. Property damage, fire and lightning, and theft were also commonly reported, as were bodily injury claims, medical payments, and credit card misuse.

Talk with your insurance agent about covering your home from these common perils. Standard homeowners insurance policies usually cover water, fire, and wind/hail damage. You may, however, be concerned about your coverage limits.

Your independent insurance agent can ensure you walk away with all the protection you need to feel comfortable and secure.

What Are Some Other Common Auto Risks?

There are many common occurrences that all drivers should be aware of. How can your auto insurance help you in these scenarios?

- Damaged windshields: Windshields can be chipped or cracked by all kinds of things, including driving behind a truck on the freeway and getting hit by a rock. Having comprehensive coverage (an optional type of coverage) would protect you in this case.

- Hail damage: Hail can absolutely destroy vehicles in a severe storm. If you live in an area prone to hailstorms, you'll want comprehensive auto insurance to protect you.

- Vandalism: Cars can be vandalized in many ways, including being keyed, tagged, having the tires slashed, or getting broken into. Once again, the damage would be covered under comprehensive auto insurance.

- Theft: Your car can be stolen anytime, whether away from home or in your own driveway. Comprehensive auto insurance covers the theft of your vehicle.

Talk with your independent insurance agent about the common risks that all drivers face and any other concerns you may have about protecting your vehicle. Your local agent will ensure you get set up with the coverage you need.

How Can an Independent Insurance Agent Help?

An independent insurance agent can help you understand the personal risks you face and get the homeowners and auto insurance coverage you need to protect yourself. Whether your home is hit by a car or you take out your garage door with your own car, your agent can help you through the claims process and understand the coverage that applies to your situation.

A local agent is close if you're looking for home or auto insurance to protect your property. Contact an agent today to understand your risks and get covered.

https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance#:~:text=Homeowners%20Insurance%20Claims%20Frequency*&text=About%20one%20in%2035%20insured,related%20to%20fire%20and%20lightning.